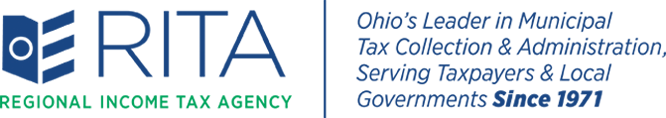

The city of elyria contracts with the regional income tax agency (r.i.t.a.) to process and collect payroll tax withholdings and estimated income tax payments required by ordinance and individual and corporate tax returns. Still, estimated quarterly payments can be paid to other taxing authorities such as cities or rita in ohio (regional income tax agency).

Here Are Key Tax Due Dates If You Are Self-employed Forbes Advisor

•check payment history and estimated payments including pending payments.

Regional income tax agency estimated payments. Make check payable to rita. One is cca (central collection agency) and the other, larger one, is rita (regional income tax agency). If your estimated tax payments are not 90 percent of the tax due or not equal to or greater than your prior year’s total tax liability, you may be subject to penalty and interest.

The ohio department of taxation has extended the deadline to file and pay ohio individual income tax for tax year 2020, from april 15th 2021 to may 17th 2021. •make payments by credit card (individual accounts only) or ach for all account types. For office locations and business hours.

There are 2 state wide agencies that help ohio cities collect city income taxes. •check refund status and whether or not the irs has levied a portion of the refund. From the regional income tax agency municipal income tax returns and payments for tax year 2019 deadline extended to july 15th 2020.

Rita offers comprehensive tax collection from registration through litigation. The regional income tax agency, known as “rita” was formed in 1971 to administer (1). From the regional income tax agency municipal income tax returns and payments for tax year 2020 deadline extended to may 17th 2021.

For tax year 2021 the due date for the 1st quarter estimate has not changed and is april 15th. There is a pull down list of cities, in turbo tax(tt), for both city tax forms (cca) & rita. You apparently live in a rita city.

The regional income tax agency (rita) for the most up to date list of municipalities that rita collects for and their tax rates please visit. If you do not have internet access you can contact our customer service department for this information at 1.800.860.7482 ext. Using our automated system 24 hours a day, you can verify the amount of estimated indicatetax payments and credits on your account or make a payment by calling 1.800.860.7482.

Regional income tax agency (rita) ritaohio.com. See below for mailing address. Form 27 net profit tax return.

If your estimated tax payments are not 90% of the tax due or not equal to or greater than your prior year’s total tax liability, you may be subject to penalty and interest. 2.2021 estimated tax payment (not less than 1/4 of total estimate) $.00 3.amount paid (add lines 1 and 2) $.00 (make check payable to rita see page 2 for mailing address) Estimated payment (not less than 1/4 of line 3) $.00 note:

The ohio tax commissioner has extended the due date for filing and payment of state income tax, which in turn has extended municipal income tax filings and payments. When a return is not required Forms may be mailed with payment to:

For tax assistance , contact our offices toll free at 1.800.860.7482 or for tdd: Line 1 must equal line 6 2.less prior year credit $.00 3. Download individual tax forms and instructions to file your taxes with rita if filing by mail.

If your estimated tax liability is $200 or more, you are required to make quarterly payments of the anticipated tax due. If your estimated tax liability is $200 or more, you are required to make quarterly payments of the anticipated tax due. All residents over 18 years of age must file a tax return with the city of elyria regardless of any tax due elyria.

Total estimated tax (distribute to each applicable municipality in line 5) $.00 note: Estimated income tax and/or extension of time to file, form. This article will primarily focus on payments owed to the irs (internal revenue service).

Total estimated tax due $.00 4.

![]()

The Regional Council Of Governments – Regional Income Tax Agency

Finance City Of Strongsville

A Guide To Paying Taxes In Spain For Expats

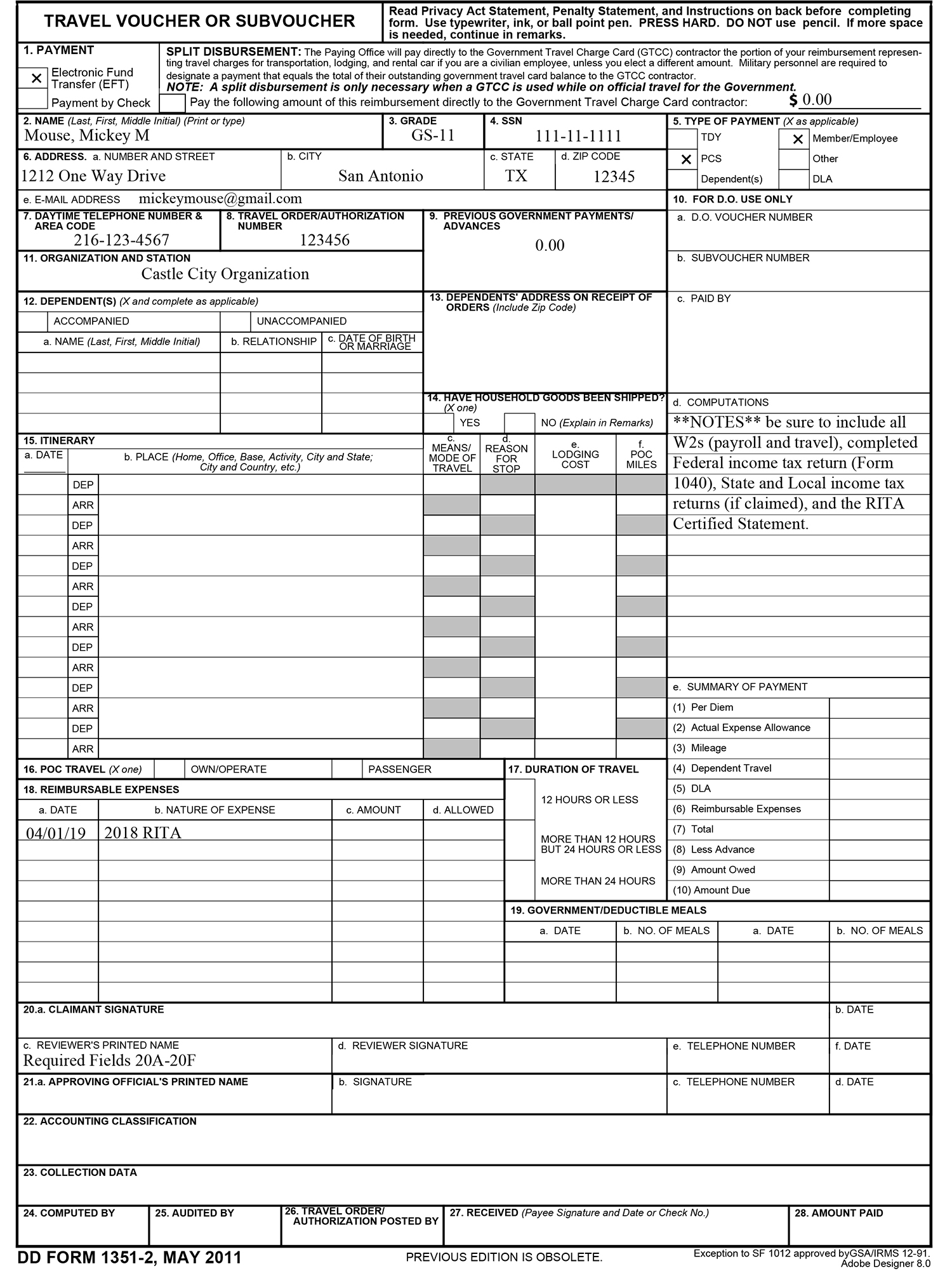

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

A Guide To Paying Taxes In Spain For Expats

Check Out How Income Tax Is Calculated On Business Income – Abc Of Money

Www2deloittecom

Ohio Regional Income Tax Return Rita Support

![]()

The Regional Council Of Governments – Regional Income Tax Agency

![]()

Individuals – Estimated Tax Payments – Regional Income Tax Agency

Individuals – Filing Due Dates – Regional Income Tax Agency

The Complete Guide To Income Tax In Sri Lanka-simplebooks

![]()

The Regional Council Of Governments – Regional Income Tax Agency

The Lakefront City – City Of Euclid

Rita Map – Regional Income Tax Agency

Income Tax City Of Gahanna Ohio

Individuals – Filing Due Dates – Regional Income Tax Agency

Income Tax City Of Gahanna Ohio

Pin On Taxes