Regarding transfer taxes, most jurisdictions in maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, with a little foresight, it is possible for “refis” to be accomplished without payment of documentary stamp and nonrecurring intangible taxes on the amount being refinanced.

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

$500 *2 is $1000 and that would be what you owe in transfer taxes for the sale.

Refinance transfer taxes florida. The state transfer tax is $0.70 per $100. For transactions where title remains with the same parties such as a refinance transaction, no deed transfer taxes are due. There is a doc stamp of $3.50 per thousand and an intangible tax of $2.50 per thousand required on every refinance in florida.

There are not any additional transfer taxes for cash out, just use the new loan amount to calculate the doc stamps and intangible tax. In some states, the transfer tax is known by other names, including deed tax, mortgage registry tax or stamp tax. In other words, you can calculate the transfer tax in the following way:

It might also be added that apparently there is a transfer tax if you refinance and go from a title in a person's name to a title in that person's trust. (total price/$100) x.70 = doc stamps cost Cute way to tax people!

) please note, that the tax rate of.70. Florida mortgage refinance transfer taxes real estate. A transfer tax is the city, county or state's tax on any change in ownership of real estate.

Only documentary stamp tax will be due since there is no florida real property collateral. If a person is being added to the property deed at the time of refinancing, then the person will have to pay the transfer taxes. The rate is equal to 70 cents per $100 of the deed's consideration.

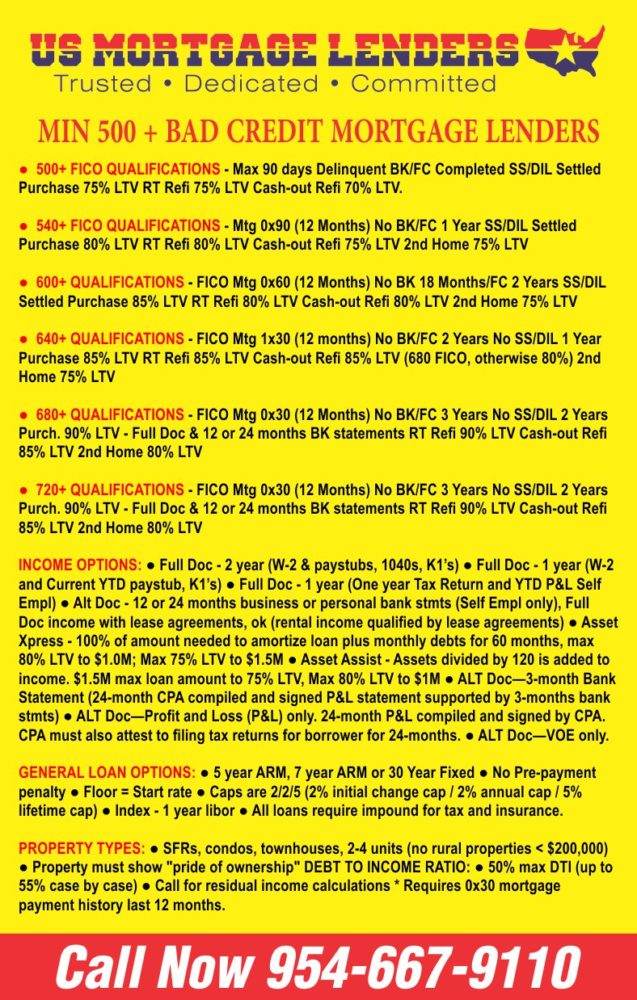

It is referred to as the 'mansion tax' and it is typically one percent of the sale price. However, in most jurisdictions, you must pay the state revenue stamps (this amount varies by county) on the new money being borrowed. The tax rate for documents that transfer an interest in real property is $.70 per $100 (or portion thereof) of the total consideration paid, or to be paid, for the transfer.

The title professionals at true title are waiting for your call to assist you with every step of this refinancing and property title transfer process. Some states will add an additional transfer tax if you sell a property for $1,000,000 or more. There are not any additional transfer taxes for cash out, just use the new loan amount to calculate the doc stamps and intangible tax.

The amount of the tax is equal to seventy cents ($.70) for each one hundred dollars ($100) of consideration.3 for example, if the purchase price for real property transferred is $250,000, then the documentary stamp tax imposed on the deed transferring the property is equal In other words, you will only be responsible for paying revenue. There is a doc stamp of $3.50 per thousand and an intangible tax of $2.50 per thousand required on every refinance in florida.

As described above, the documentary stamp tax will be an amount equal to 35 cents per $100.00 of the amount financed unless the loan amount is $700,000.00 or more, in which instance the maximum amount of tax payable is capped at $2,450.00. For example if a property is purchased for $200,000, first divide the sales price by $100, then multiply by.70 for a total of. Florida transfer taxes on refinance real estate.

For transactions where title is transferred such as a sales transaction, the documentary stamps in florida are calculated at a rate of 70 cents per $100.00 of the sales price rounded up to the nearest hundred. According to the documentary stamp tax, when transferring a property deed the florida transfer tax would be calculated by taking70 cents for each $100or fractional part. Florida real estate transfer taxes:

Calculating the florida transfer tax. Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. If you sold the property for $250,000 you would divide 250,000 by $500 which is 500.

Reducing Refinancing Expenses – The New York Times

Pay – Taxestalknet

Real Estate Transfer Taxes – Deedscom

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

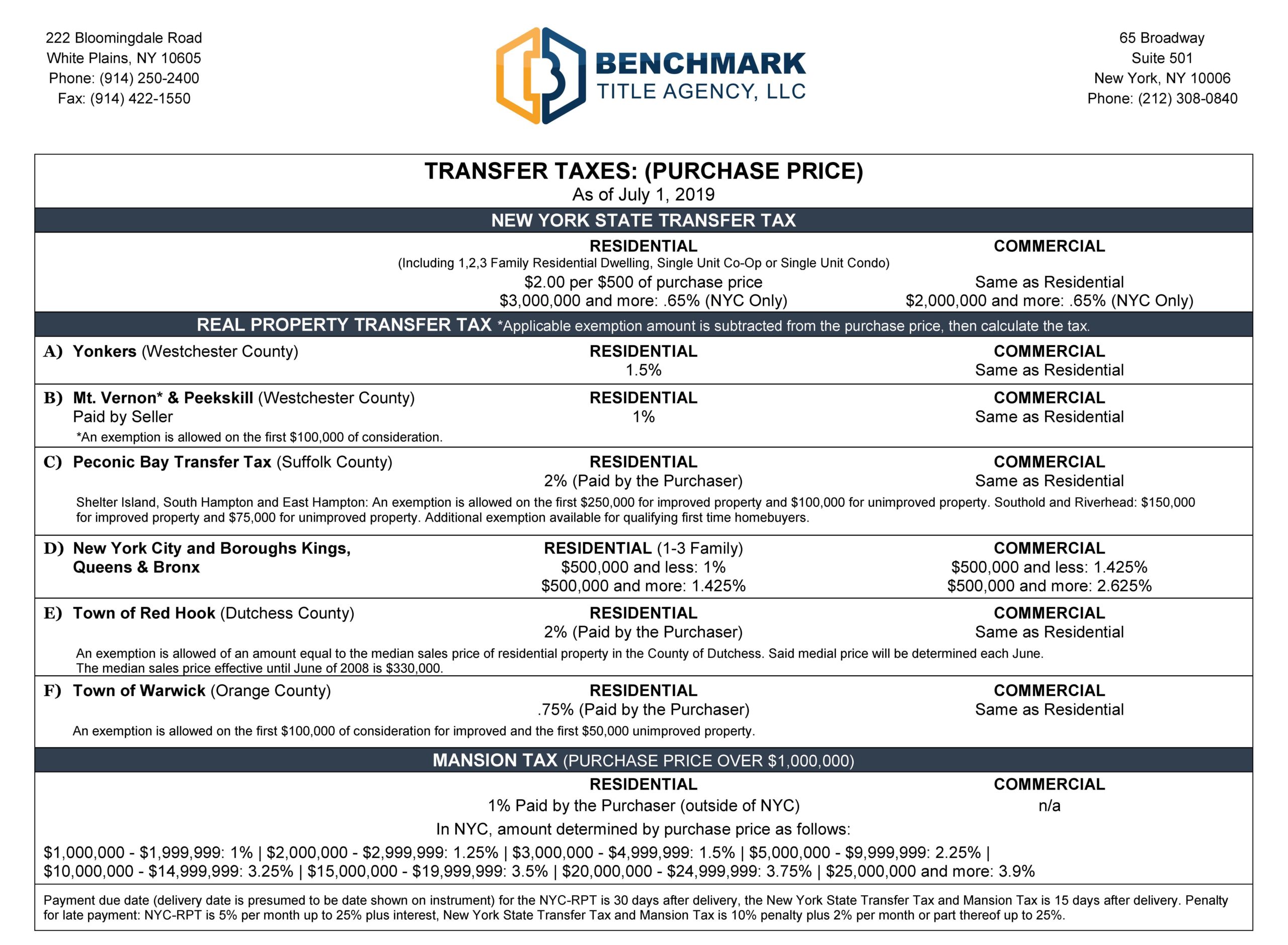

580ficomiami Florida Fha Mortgage Lenders

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Title Insurance Refinance Calculator – Benefit Title Services

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

Florida Mortgage Rates Todays Fl Mortgage Refinance Rates

What Are Real Estate Transfer Taxes Bankrate

![]()

Transfer Tax In A Refinance Transaction Property Legal Counsel

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Real Estate Transfer Taxes An In-depth Guide For 2021

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

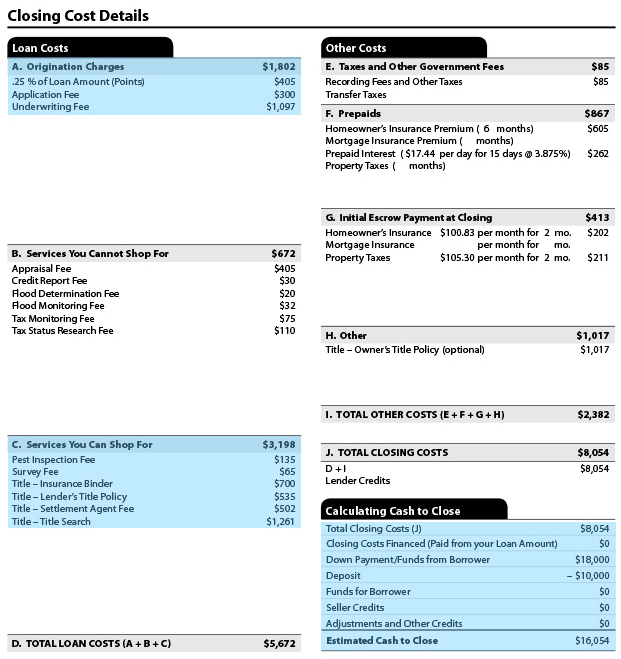

How To Read A Mortgage Loan Estimate Formerly A Good Faith Estimate Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Transfer Tax In A Refinance Transaction Property Legal Counsel

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro