Significant changes to estate tax laws are part of proposed legislation for individuals and families. Instead, the exemption would expire at the end of 2021 and, beginning in 2022, the federal estate tax will be reduced to $5 million.

The New Death Tax In The Biden Tax Proposal Major Tax Change

In september, we posted on the sweeping tax changes proposed by the ways and means committee of the house of representatives.

Proposed federal estate tax changes 2021. As of november, 2021, the proposed “build back better” legislation does not contain any changes to the federal estate tax exemption provisions. No expected change in the estate tax exemption for 2022 under the “build back better” legislation! Following weeks of negotiations between president joe biden and congressional democrats, the white house released a retooled framework for the build back better act on october 28.

A reduction in the annual gift tax exemption from $15,000 per person, per donee to an annual per donor maximum of $20,000 per year. On september 12, 2021, the house ways and means committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the build america back better act.” President biden’s “build back better” plan, currently wending its way through congress, proposes to drastically cut the estate and gift tax exemption and make estate and gift tax planning much more difficult.

Proposed estate and tax planning changes in 2021 and 2022 on september 12, 2021, the house ways and means committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the build america back better act.” Potential estate tax law changes to watch in 2021. A lowering of the estate tax exemption and changes to the treatment of capital gains and.

· a reduction in the federal estate tax exemption amount which is currently $11,700,000. By dobbslg | nov 15, 2021. Note the tension in current year planning if this proposal is adopted.

The maximum estate tax rate would increase from 39% to 65%. Anticipating law changes in 2022. Both the bernie sanders proposed legislation, and the september 13 th house of representatives ways and means committee bills, would have drastically reduced the $11,700,000 per person estate and.

If this owner would pass away after that time, the heirs would also owe $85,369 in estate taxes. New federal tax legislation is on the horizon, with significant changes for estate and gift taxes. For now, the federal estate tax exemption remains at $11.7 for 2021, with a married couple having a combined exemption for 2021 of $23.4 million.3.

But it wouldn’t be a surprise if the estate tax law changed as part of the overall plan. The proposed impact will effectively increase estate and gift tax liability significantly. November 16, 2021 by jennifer yasinsac, esquire.

Payment of the capital gains tax would secure the step up in basis at death. Proposed effective date is retroactive to january 2021. As of 2021, the exemption is $11.7 million per person.

President biden has proposed major changes to the federal tax laws, some of which are sought to be effective earlier in 2021 (i.e., we are already operating under these changes, if they later become adopted), as compared to the effective date the new tax law changes may be passed by congress or a later effective date (such as beginning january 1, 2022). An estate more than $11.7 million would also be subject to an estate tax. The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021) to $5 million (indexed for inflation to roughly $6.2 million) as of january 1, 2022.

The biden campaign is proposing to reduce the estate tax exemption to $3,500,000 per person ($7,000,000 per married couple). The biden administration has proposed sweeping estate tax impacts to the estate and gift structure. In the area of estate and gift taxation, there are proposals to reduce the lifetime exemption for transfers by gift or death.

The exemption equivalent was significantly raised beginning january 1, 2018, and the inflation adjusted amount for the 2021 year is $11,700,000. Additionally, these proposed tax rates would apply to taxable estates worth up to $1 billion. The current estate tax exclusion for an individual is $11.7 million (effectively $23.4 million for married couples).

The bill introduced by the house ways & means committee is attempting to change this and roll back the 2017 trump tax cuts. This was anticipated to drop to $5 million (adjusted for inflation) as of january 1, 2022. Taxpayers with assets over $3.5 million;

Both senators and representatives have proposed increasing the tax rate of taxable estates. The house ways and means committee released tax proposals to raise revenue on september 13, 2021, which included notable changes to income tax and estate and gift tax. However, on october 28, and then again on november 3, the house rules committee.

Tax proposals under current rules for 2021, you can transfer up to $11.7 million during your lifetime or at death without paying gift or estate tax. Specifically, the federal estate tax exemption would not expire at the end of 2025. Estate tax proposals increase the federal estate tax who may be affected?

25 Percent Corporate Income Tax Rate Details Analysis

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

House Democrats Tax On Corporate Income Third-highest In Oecd

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax Definition What Is A Sales Tax Tax Edu

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

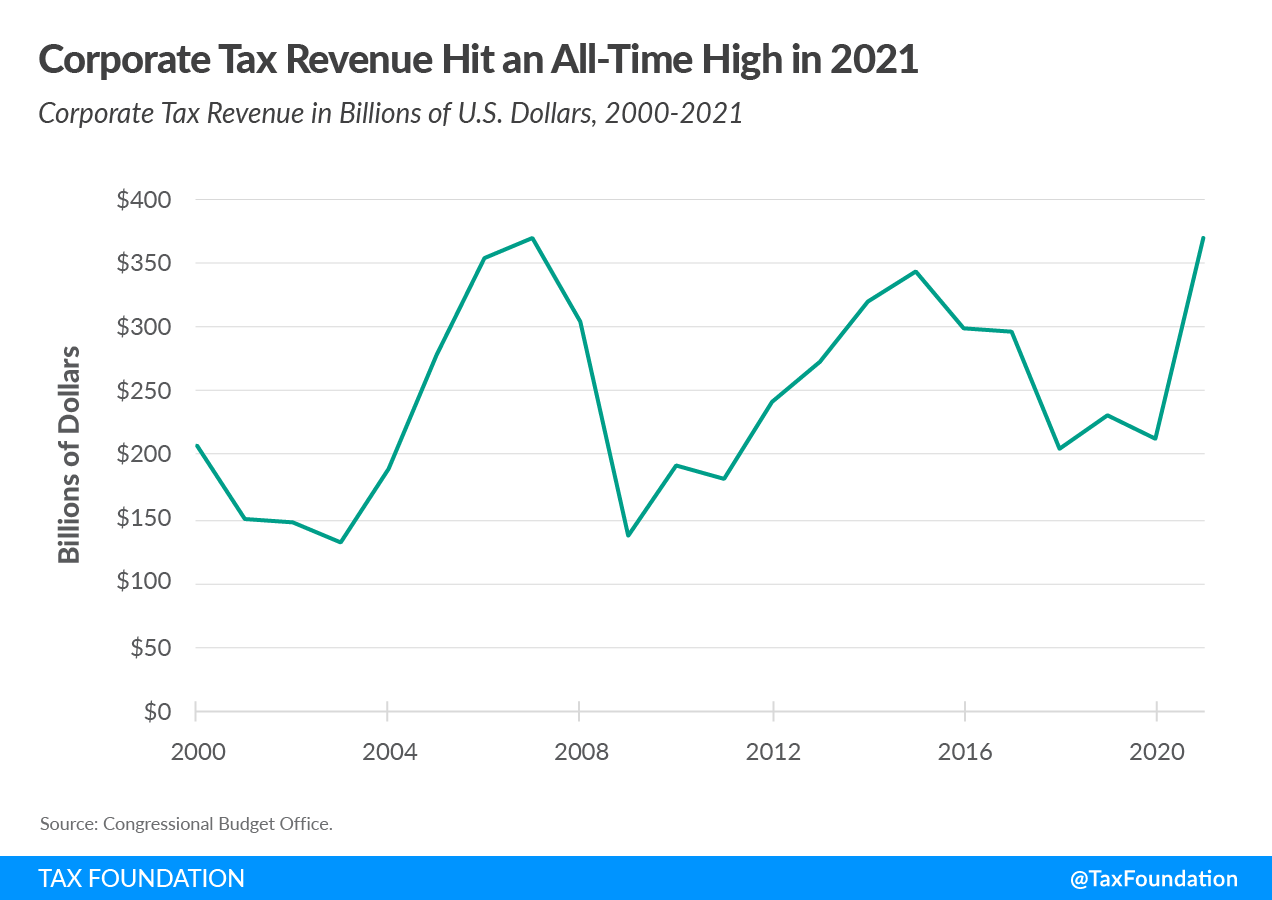

Corporate Tax Revenue Hit An All-time High In 2021 Tax Foundation

Tax Director Resume Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Manager Resume Accountant Resume Sample Resume

Jk Lassers Your Income Tax 2021 For Preparing Your 2020 Tax Return By Jk Lasser Institute In 2021 Income Tax Tax Return Tax Time

2021 Estate Income Tax Calculator Rates

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Irs Releases Key 2021 Tax Information Standarddeduction2021 Newtaxrele Standard Deduction Irs Tax Brackets

2018 Real Estate Tax Reform Guide – The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

Find Irs Form 1040 And Instructions Irs Forms Irs Irs Tax Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Whats In Bidens Capital Gains Tax Plan – Smartasset

Estimate Your Tax Savings With Cost Segregation In 2021 Tax Reduction Income Tax Estate Tax