The house ways and means committee advanced its portion of the proposed act on september 15, 2021, which addresses numerous fiscal issues, including many tax increases. On monday, september 13, 2021, the house ways and means committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the build back better act (the “act”).

Irs Releases Key 2021 Tax Information Standarddeduction2021 Newtaxrele Standard Deduction Irs Tax Brackets

Proposed estate and gift tax changes.

.png?sfvrsn=34046ffe_3)

Proposed estate tax changes september 2021. Here’s what you need to know. The biden administration has proposed sweeping estate tax impacts to the estate and gift structure. House democrats recently released additional legislative proposals that, if passed, would affect several commonly used estate planning techniques.

The bill introduced by the house ways & means committee is attempting to change this and roll back the 2017 trump tax cuts. Previously, this reduction was not scheduled to take place until january 1, 2026. The proposed impact will effectively increase estate and gift tax liability significantly.

September 29, 2021 article 3 min read. The new exemption amount would be $5 million, indexed for inflation dating back to 2010. On september 13, the ways and means committee of the house of representatives released sweeping tax proposals affecting both businesses and individuals.

Some of these proposals would have a significant impact on estate tax planning. Tax proposal could bring sweeping changes to estate planning. President biden’s proposed build back better act includes major changes to estate and gift taxes to fund the social and education spending plan.

Among those proposals are three that would significantly impact some of the more common wealth transfer strategies. On september 13, 2021, democrats in the house of representatives released a new $3.5 trillion proposed spending plan that includes a wide array of changes to federal tax laws. The new tax plan, part of president biden and congressional democrats’ $3.5.

The house ways and means committee released their first draft of proposed tax changes on september 14, 2021, as part of their efforts to fund the biden administration’s build back better program. Proposed estate and tax planning changes in 2021 and 2022 on september 12, 2021, the house ways and means committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the build america back better act.” Three estate planning proposals to watch.

No changes to the current gift and estate exemption provisions until 2025. On sunday, september 12, 2021, the house ways and means committee released a first draft of proposed tax legislation, including several provisions that could significantly impact the estate planning environment. Proposed tax law changes impacting estate and gift taxes (september 23, 2021) september 26, 2021 september 28, 2021 ~ anthony tran david bussolotta of pullman & comley, llc , has made available for download his article, “proposed tax law changes impacting estate and gift taxes,” published on jdsupra.

The significant changes still need to undergo rigorous negotiations in the house and senate before being sent to the president for his signature. Proposed tax changes affecting estate planning are moving through congress. This was anticipated to drop to $5 million (adjusted for.

On september 12, 2021, the house ways and means committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the build america back better act.” Instead, the exemption would expire at the end of 2021 and, beginning in 2022, the federal estate tax will be reduced to $5 million. The biden campaign is proposing to reduce the estate tax exemption to $3,500,000 per person.

The $11.7m per person gift and estate tax exemption will remain in place, and will be increased annually for inflation until it’s already scheduled to sunset at the end of 2025. On september 13, 2021, the chairman of the house ways and means committee released the proposed “build back better act” (the “proposed act”). This alert will provide a brief […]

Both the bernie sanders proposed legislation, and the september 13 th house of representatives ways and means committee bills, would have drastically reduced the $11,700,000 per person estate and. Specifically, the federal estate tax exemption would not expire at the end of 2025. The exemption will increase with inflation to approximately $12,060,000 per person in 2022.

· a reduction in the federal estate tax exemption amount which is currently $11,700,000. As many people are aware, congress is considering changes to the federal tax code to support president biden’s build back better spending plan.

.png?sfvrsn=34046ffe_3)

Iras Tax Season 2021 – All You Need To Know

How Build Back Better Act Gives High Earners A One-year Reduction In Taxes

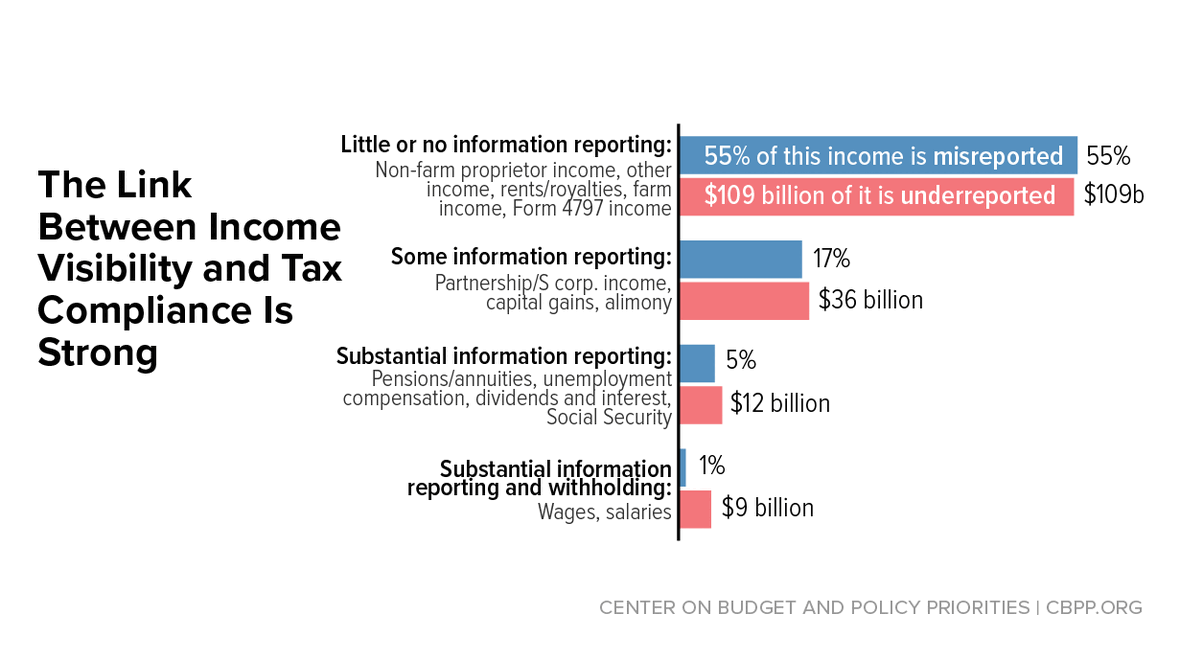

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

-01n0wgz0jantm

Uae Visa Rules And New Legal Updates In The Middle East Uae Long-term Visa Cost Announced Job Advice Visa Career Advice

Oyo Os – Hotel Management System In 2021 Hotel Management Management Staff Training

Build Back Better 20 Still Raises Taxes For High Income Households And Reduces Them For Others

Whats In Bidens Capital Gains Tax Plan – Smartasset

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

Taxtipsca – Business – 2020 Corporate Income Tax Rates

Ultimate Home Money Makeover Checklist In 2021 Money Makeover Financial Checklist Checklist

Happy New Year Law Firm Litigation Business Law

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

State Corporate Income Tax Rates And Brackets Tax Foundation

Latest Income Tax Slab Rates For Fy 2021-22 Ay 2022-23 Budget 2021 Key Highlights – Basunivesh

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow