This statewide assistance program may allow up to one half of the annual property taxes to remain unpaid. The largest exemption available to florida homeowners is the state’s total homestead exemption program.

Florida Dept Of Revenue – Home

You can possibly reduce your property tax burden for your florida home if you meet one or more of the following requirements:

Property tax assistance program florida. Certain property tax benefits are available to persons 65 or older in florida. Some programs allow the creation of property tax installment plans for property owner(s) who are delinquent in paying taxes as a result of saying being unemployed for the last several months. The funds are available to applicants who live in apartments, houses, townhomes or mobile homes.

The amount may need to be paid if/when the home is ever sold in the future. Fewer than seven percent of all property owners ever attempt to seek a reduction in their property taxes. A board of county commissioners or the governing

Applications for property tax exemptions are typically filed with your local county tax office. Hptap provides an opportunity for homeowners to be exempt from their current year property taxes based on household income or circumstances. Help is only available for income qualified residents, and they need to contact their local assessor, department of revenue, or county treasurer.

Applying for a property tax exemption is never wholly straightforward, but donotpay can make the process easier. Florida’s homestead tax exemption programs offer many different types of homeowners the opportunities to reduce their annual real estate taxes. Skip to main content for questions about the program, call 833.493.0594, 7 days a week from 7 a.m.

Property owner must be 65 or older. Our app can check your location and give you customized advice on what exemptions are available in your area. Forms of property tax relief.

Information is available from the property appraiser’s office in the county where the applicant owns a homestead or other property. We would like to show you a description here but the site won’t allow us. The pay as you stay (pays) program is administered by the wayne county treasurer’s office and reduces back taxes owed by homeowners who have been granted a hope.

Eligibility for property tax exemptions depends on certain requirements. Once the homeowner assistance fund plan is approved, deo will implement the program. Property owners in florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

Check with your local government on the details, but good examples include homestead exemptions for primary residences, agricultural property tax exemptions, and disabled veteran exemptions. Longtime residents / seniors may qualify for an exemption if they have lived in florida for 25 years or more or are 65 years of age or older, and who meet certain income thresholds and have a home worth less than $250,000. Property tax exemptions are exactly what they sound like.

Please see specific program information at the palm beach county rental assistance website. An exemption reduces the property ' s assessed value and may be in the form of a percentage of that value or a reduction of that value. The florida department of economic opportunity (deo) has been designated to manage and operate the homeowner assistance fund on behalf of the state of.

Your local government has options for enforcing payment when you fall behind with your property taxes, such as the seizure and sale of your property through a tax foreclosure. A large percentage of property owners in florida are successful in obtaining substantial tax reductions through the value adjustment board petition process with assessment reductions in the millions annually. Florida housing finance corporation 227 n.

Aspire health partners is offering a dedicated telephone line to assist residents with mental health concerns. The homestead exemption and save our homes assessment limitation help thousands of florida homeowners save money on their property taxes every year. More than $676 million has been allocated to the state of florida through the homeowner assistance fund.

According to the rules of this program, qualified homeowners can receive a complete and total exemption. Bronough street, suite 5000 tallahassee, florida 32301 phone: Any negotiated program will be effective after the local government officials have thoroughly reviewed the owner’s ability to pay and the request from the homeowners.

Property tax exemptions and additional benefits. As mentioned above, property tax relief mechanisms generally provide relief by exempting a portion of a property ' s assessed value from taxation or abating the amount of taxes paid. While most states offer basic exemptions for.

Property owners can choose to pay 0% (full deferral), 25%, 50%, or 75% of the delinquent and future property taxes. The guide comes with two sections: Donotpay can help you apply for a property tax exemption for seniors in florida.

They alleviate the tax burden on homeowners for a variety of reasons.

28 Key Pros Cons Of Property Taxes – Ec

Disabled Veterans Property Tax Exemptions By State

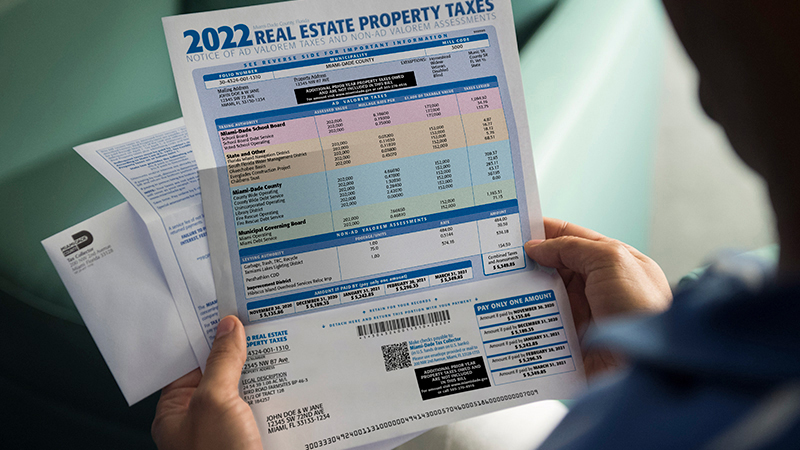

Last Day For Biggest Property Tax Bill Discount Nears

What Are The Different Types Of Real Estate Property Taxes

Florida Property Tax Hr Block

How To Save For Your First Home In 2021 Buying Your First Home Paying Off Credit Cards Lead Generation Real Estate

Secured Property Taxes Treasurer Tax Collector

20 Instant Download And Editable Buyer Seller Tips Etsy In 2021 Real Estate Marketing Quotes Real Estate Fun Real Estate Quotes

Real Property Tax Howard County

Soon After Taking The Oath Dehraduns New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Homeowners Property Taxes Grew Faster During Pandemic

Soaring Home Values Mean Higher Property Taxes

Best Real Estate Tax Tips

Deducting Property Taxes Hr Block

Are There Any States With No Property Tax In 2021 Free Investor Guide

Real Estate Legal Terms To Know Property Tax Tax Refund Types Of Taxes

Tennessee Property Tax Relief Program – Help4tn Blog – Help4tn

What Is Florida County Tangible Personal Property Tax

Image Result For Us National Map Of Property Taxes Property Tax History Lessons Historical Maps