*for all due dates.if a due date or deadline falls on a saturday, sunday, or holiday, the due. Prince william county real estate taxes for the first half of 2020 are due on july 15, 2020.

Personal Property Taxes For Prince William Residents Due October 5

During the july 14 meeting, the prince william board of county supervisors voted to defer payments for the first half of the real estate taxes.

Prince william county real estate tax due dates. Prince william county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. You can pay your real estate taxes online using echeck at www.pwcgov.org/tax. Tax relief for the elderly and disabled mobile homes application due date.

Prince william 2020 real estate property tax. How will i recieve my pet's license and annual renewal notice? These records can include prince william county property tax assessments and assessment challenges, appraisals, and income taxes.

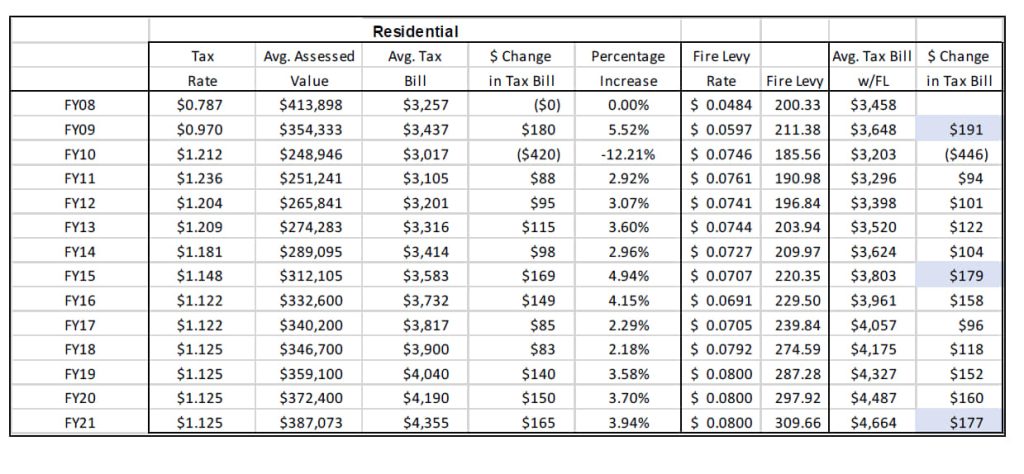

The median property tax in prince william county, virginia is $3,402 per year for a home worth the median value of $377,700. Prince william county government, virginia. Prince william county personal property taxes are due on friday, oct.

Tax relief for the elderly and disabled filing. The median property tax (also known as real estate tax) in prince william county is $3,402.00 per year, based on a median home value of $377,700.00 and a median effective property tax rate of 0.90% of property value. To pay by check, payments should be mailed in the remittance envelope included with the tax bill.

Board extends due date for real estate taxes. Business personal property filing deadline. The new due date is february 3.

Prince william county has one of the highest median property taxes in the united states, and is ranked 120th of the. The due date for 2nd half 2021 real estate taxes is december 6, 2021. The due date for 2nd half 2021 real estate taxes is december 6, 2021.

Personal property taxes and vehicle license fees due. Prince william county leaders are abandoning plans for a hefty real estate tax, while the coronavirus crisis continues, but are. The treasurer's office is working diligently to have bills mailed next week.

Prince william county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in prince william county, virginia. Provided by prince william county. Prince william county property taxes due oct.

The second half of real estate tax payments are still due on december 6, 2021. The due date for 2nd half 2021 real estate taxes is december 6, 2021. Prince william board of supervisors extends real estate tax payment due date to october 15.

Mailing of personal property tax bills has been delayed due to printing complications. Houses (2 days ago) prince william county is located on the potomac river in the commonwealth of virginia in the united states. Please note that the due date for personal property tax was recently changed to january 15, 2022.

The prince william board of county supervisors deferred the first half of the real estate tax due date for unpaid taxes to tomorrow, october 13. Payments must be postmarked by july 15 to avoid a late fee. During a meeting on nov.

Prince william supervisors extend deadline for real estate taxes to oct. Unfortunately, we have no information whether any exemptions currently apply to this property, therefore the taxable value is equal to the assessed value. Houses (2 days ago) prince william county is located on the potomac river in the commonwealth of virginia in the united states.

There are several convenient ways property owners may make payments: Dog licenses are no longer sold through the taxpayer portal. Several exemptions are available in the county of prince william like veteran exemptions or elderly exemptions that may lower the property's tax bill.

Starting november 1, 2020, prince william county dog licenses will be available online at www.petdata.com. Prince william county collects, on average, 0.9% of a property's assessed fair market value as property tax. By mail to po box 1600, merrifield, va 22116.

The due dates are july 28 and december 5 each year. If the real estate taxes aren't paid by february 3, residents and businesses must pay 10 percent interest. Pet owners can expect to receive an annual renewal notice from petdata in november/december.

Machinery & tools filing deadline.

Prince William County Data Center Site Sells For 745 Million – Dcd

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenovacom

Prince William County Va News Wtop News

Heres How Metro Would Change Prince William County Development With A Quantico Extension – Washington Business Journal

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

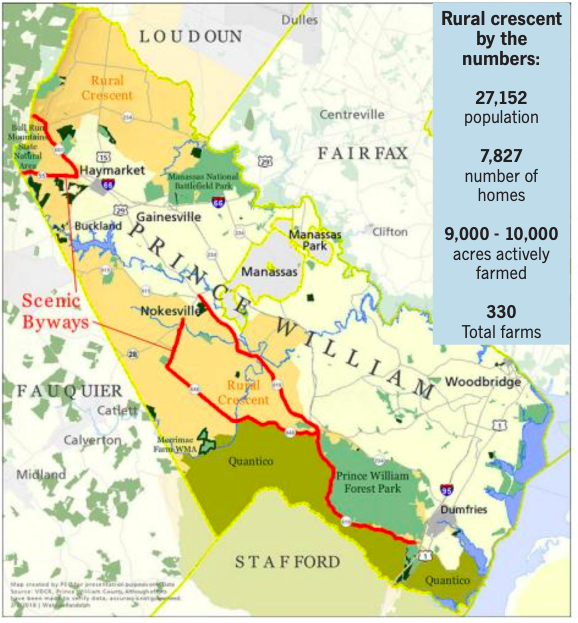

Democratic Supervisors Open To More Homes Industrial Uses In The Rural Crescent News Princewilliamtimescom

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Bocs Approves Land Purchase In Historic Thoroughfare Community Prince William Living

Profile Prince William County High Schools Manassas Virginia Public High School

2021 Best Places To Live In Prince William County Va – Niche

Heres How Metro Would Change Prince William County Development With A Quantico Extension – Washington Business Journal

Historic-preservation-coordinator Job Details Tab Career Pages

Best Of Prince William 2019 By Insidenova – Issuu

Prince William County Police Department – Home Facebook

A Message From The Chief

About Us

Rural Crescent In Prince William County

Rural Crescent In Prince William County

Whats So Great About Western Prince William County Manassas Va Patch