Since taxes aren’t withheld from your postmates income, it’s possible you need to pay taxes quarterly. There’s one form that you must send to the irs to get a tax return.

5 Of The Cheapest Grocery Delivery Services Worth Ordering From Student Loan Hero

Depending on your situation you might fill out 1040, 1040a or 1040ez.

Postmates tax form online. Innovative features catering to you we consistently stay ahead of the curve creating new ways to help bring business to you—like seamless pos integrations, group ordering, and promotions that get you seen first by customers who are ready to make a purchase. Postmates tax deductionspostmates tax deductions miles driven with the delivery item in your car or between item pickups are tax deductible. Your tax information, including your 1099 for 2020, will still be available through your postmates delivery app.

Do not report this income on form 1040 line 21 as other income. It would be too much to try to cover that and the 1099 form, so we'll just settle on talking about the. You’re eligible for this form if the company doesn’t employ you, and instead, you work independently.

If you are expected to owe the irs $1000 or more when you file taxes then you need to make quarterly estimated income payments. It's the end of january. Even if you don’t earn that much, you’ll still be expected to pay the appropriate taxes.

Since we are now considered self employed contractors, we are now responsible for own taxes, including payroll deductions for social security and medicare. Freetaxusa is an online tax preparation software for federal and state returns. Fill out your part i (income) and part ii (expenses) for your delivery work with grubhub, uber eats, postmates, doordash or others.

Here is the link you'll need to request a 1099 from postmates: The card last 4 are the last 4 digits of your 16 digit card number. If you do decide to start delivering for postmates, be sure to hold back enough of your earnings to cover your estimated tax payments.

You are starting to get your 1099 forms from grubhub, doordash, postmates, and uber eats. I have yet to get my 1099 from postmates for doing deliveries for them last year. This gets covered in other articles in this series so i won't go into detail here.

Postmates drivers are independent contractors. You can file your self assessment tax return online if you: How you can get a postmates refund in just a few minutes postmates is a u.s.

No action is needed—you’re eligible to be added to the postmates app and shown where even more customers can find you. What expenses can i write off? 5 cents for every mile you drive.

Go to tax information and click send my 1099 form electronically when you have chosen to receive your tax forms electronically, you will be able to view and download your 1099 forms directly in the app, as soon as they get filed. This means you are responsible for claiming your earnings and paying taxes when you file each year. Your earnings exceed $600 in a year;

Before i go any further, let me make this clear. Need help contacting postmates for my 1099 to file my taxes. Postmates only sends 1099 forms to postmates who make $600 or more in the past year.

This form reports your earnings from the company. You should see a form prompting you to enter the last 4 digits of your card number and card identifier. 35% of your net profit greater than $400.

Now that i am thinking about it did move and they might not have my new address. Barney's beanery, west hollywood, ca. To fill this form out, you need information about your earnings.

Estimated quarterly taxes are due on: With postmates unlimited, you get free delivery with no blitz pricing or small cart fees—ever. If you didn't receive one, you can report your postmates income using your deposits records in your postmates app!

Taxes for uber, lyft, postmates, instacart, doordash and amazon flex drivers are handled differently than what most full time workers are used to. What happens to all my old postmates deliveries? When to file postmates 1099 taxes.

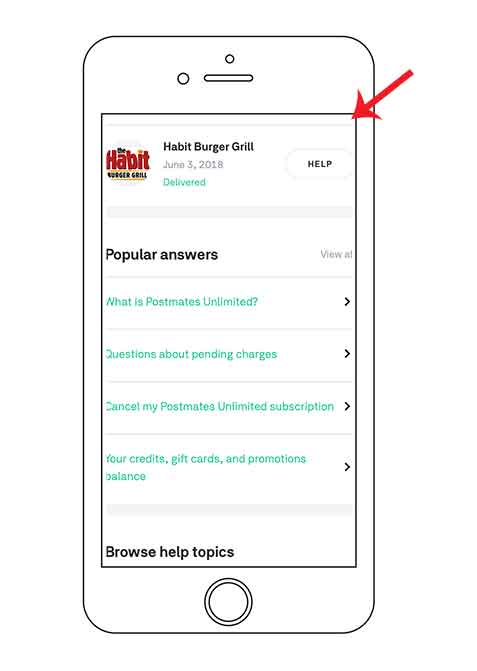

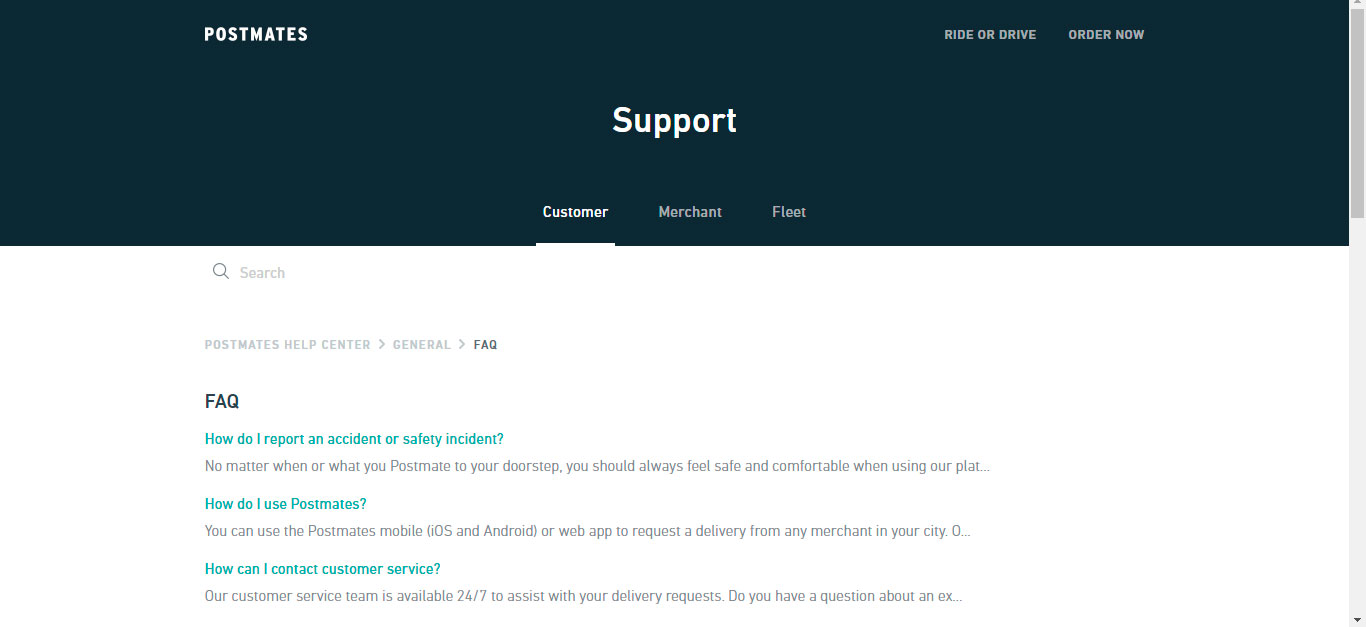

This information is sent to you by your employer. The postmates application can also be used to deliver groceries and alcohol from specific retailers. Who and how do i contact them to at least get an electronic copy of it so i can file my taxes?

Independent contractors must report all income as taxable, even if it is less than $600. It's tax time, isn't it? So let's talk about 1099's today.

One of the benefits of being an independent contractor is that you can deduct business expenses to pay less in taxes. It operates in over three thousand cities across america. Open the menu and go to personal info;

Misc stands for miscellaneous income that basically doesn't have an information return of its own. This is not meant to be a talk about taxes. To get your tax forms digitally:

That means you will need to estimate how much you will owe the government by four specific dates a year. The trip total in your uber profile will include the deliveries you previously completed on the postmates app.

How To Get Postmates Tax 1099 Forms – Youtube

Postmates For Android – Apk Download

How To Get Your 1099 Form From Postmates

The Ultimate Guide To Taxes For Postmates Stride Blog

4 Easy Ways To Contact Postmates Driver Customer Support

The Ultimate Guide To Taxes For Postmates Stride Blog

The Ultimate Guide To Taxes For Postmates Stride Blog

How To Earn More Driving For Postmates Tips Tricks Driver Job Driving Gas Buddy

Postmates Customer Service 3 Ways To Contact Postmates Support

Postmates Customer Service 3 Ways To Contact Postmates Support

Pin On Drive 4 Postmates

Delivering For Grubhub Vs Uber Eats Vs Doordash Vs Postmates – Youtube Postmates Doordash Grubhub

Web Design Trends To Try In 2018 – Designmodo Web Design Trends Web Design Quotes Web Development Design

Postmates Taxes 101 Filing Postmates Taxes For The End Of The Year – Youtube

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

Postmates Logo Postmates Coding Delivery Robot

Pin On Income

4 Easy Ways To Contact Postmates Driver Customer Support

Postmates 1099 Tax Filing The Complete Guide