Print, sign it, and send it to our office. This is referred to as “portability.”.

Florida Homestead Exemption Filing Explained – Bosshardt Title

A person moving during 2017 has until january 1st 2019 to qualify for a new exemption and “port” their benefits to a new homestead.

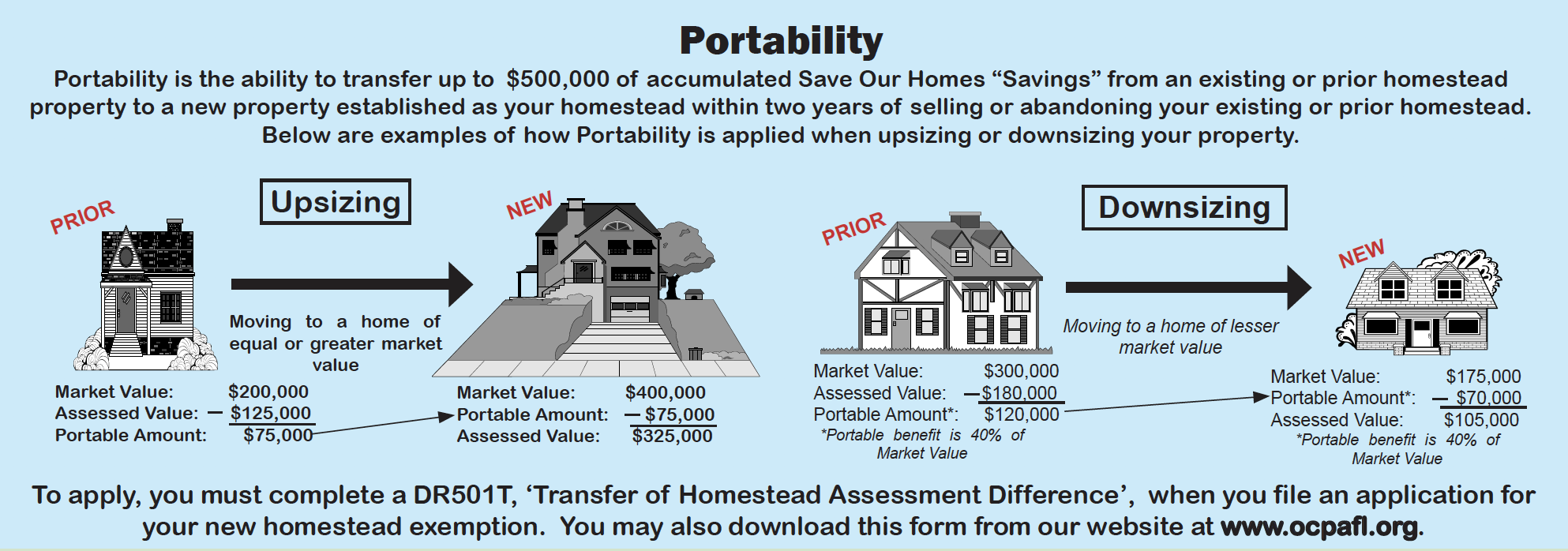

Portability real estate taxes florida. As it is now, florida homeowners have the ability to cap the assessment of their property at a 3 percent increase every year. You sell your current florida homestead that has an assessed value of $200,000 and a just (market) value of $350,000. This benefit first became available in 2008.

Homestead exemption requirements you must have homestead exemption on your new property within three (3) years of your last homestead exemption and all owners of a jointly owned previous homestead must abandon that homestead in order to port. Real estate tax portability in florida. $500,000 5 hours ago the portability amendment literally made that tax savings “portable” so you can now move up to $500,000 of your accrued save our homes assistance to your new home.

The portability amendment literally made that tax savings “portable” so you can now transfer up to $500,000 of your accrued save our homes benefit to your new home. Floridians amended the state constitution in january 2008 when they adopted a property tax amendment that, among other things, allowed for portability of benefits accrued under the save our homes. 2) to encourage the sale of residences for those who might otherwise find the realty taxes too high to acquire other residences.

The final millage rates are used to calculate the estimated property tax on the proposed property purchase. Complete the fillable portability application on the following page. Part 1 is on the new homestead property.

You sell your current florida homestead that has an assessed value of $200,000 and a just (market) value of $350,000. Essentially, a homeowner may “port” their save our homes tax benefits to their new home as long as they establish their new homestead within 2 years of abandoning their previous homestead. Houses (5 days ago) the portability amendment literally made that tax savings “portable” so you can now move up to $500,000 of your accrued save our homes assistance to your new home.

Through the introduction of amendment 1 on january 29, 2008, florida voters amended the state constitution to provide for transfer of a homestead assessment difference from one property to another. 1) to not penalize florida homeowners who leave their homestead residences by preserving the cap in moving to new homesteaded residences, and. The rules regarding portability are set forth in florida statute 193.155(8).

To transfer the soh benefit, you must establish a homestead exemption for the new home within three E file for portability when e filing for your. Portability benefits may be reduced if the benefit is split among multiple homestead owners and is limited to $500,000.

The estimated tax range reflects an estimate of taxes based on the information provided by the input values. Once the homeowner files these forms and if they are in fact eligible, portability will allow them to “transfer their soh benefit from their old homestead to a new homestead, lowering the tax assessment and, consequently, the taxes for the new homestead,” the florida department of revenue said. In florida, property tax portability refers to the ability to transfer up to $500,000 of accumulated save our homes cap “savings” from an existing or prior homestead exempt property to a new property established as your homestead within two tax years of selling or abandoning your existing or prior homestead.

The portability amendment literally made that tax savings “portable” so you can now transfer up to $500,000 of your accrued save our homes benefit to your new home.example: If you are eligible, portability allows most florida homestead owners to transfer their soh benefit from their old homestead to a new homestead, lowering the tax assessment and, consequently, the taxes for the new homestead. Part 2 is on the previous homestead property.

You will need the parcel id, pin It may be transferred to any property in florida and is commonly referred to as “portability.” back to top There are times when the portability benefit has to be split due to divorce or when an applicant had partial ownership interest in the prior home, has partial ownership interest in the new home, or had/has partial ownership interest in both the prior and new homes.

Portability’s purpose is basically twofold: It is equivalent to the difference between the just value and the assessed value. Florida’s save our homes (soh) provision allows you to transfer all or a significant portion of your tax benefit, up to $500,000, from a florida home with a homestead exemption to a new home within the state of florida that qualifies for a homestead exemption.

Portability florida real estate tax. The maximum portability benefit that can be.

Pin On All Home Decor

What Is Florida Homestead Portability – Epgd Business Law

3 Tax Mistakes Notaries Should Avoid Notary Notary Public Business Notary Signing Agent

Portability Dont Leave Part Of Your Homestead Tax Exemption On The Table – Brinkley Morgan Attorneys At Law

Highland Beach Fl Real Estate Overview – Truliacom Highland Beach South Florida Real Estate Highland Beach Florida

Tax Estimator Lee County Property Appraiser

324 Truman Avenue Florida Keys Real Estate Beautiful Homes Luxury Living

How To Applying For Net-banking Online Banking Or Net-banking Is The Internet Banking Service Which Provides You The Infor Banking Banking App What Is Internet

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida And Miami Real Estate Homestead Exemption Portability And Property Tax Savings Benefits Qa Condoblackbook Blog

File My Taxes Online Capital Gains Tax Tax Time Tax Season

2

Homestead Portability Transferring Your Florida Homestead Cap To Your New Home Infinity Realty Group

6 Steps To Purchasing A Home Curious Of The Home Buying Process Here Is An Overview Feel Free To Give Me C Home Buying Process Real Estate Tips Home Buying

How Florida Property Tax Valuation Works – Property Tax Adjustments Appeals Pa

Property Tax Portability – Jennifer Sego Llc

A Zoomed In Shot Of A Calculator Bookkeeping Bookkeeping Services Accounting

Florida Homestead Exemption Filing Explained – Bosshardt Title

What Is Tax Portability – Seller Central