The $105 million that philadelphia expects to repay nonresidents represents just 6.2% of the $1.59 billion in wage tax revenue the city collected in the last fiscal year. Workers can change their tax status and be exempt from the city of philadelphia’s city wage tax of 3.4481% until june 30, 2020 and 3.5019% beginning july 1, 2020.

Theres A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Go back to hr resources more in taxes and deductions.

Philadelphia wage tax refund. During 1939, philadelphia became the first municipal government to levy an income tax, successfully implementing a 1.5% tax on income from wages and salaries. For the first time, the city of philadelphia department of revenue. A philadelphia resident, regardless of where you work, or;

Over 80 years later, the wage tax. Percentage of time worked outside of philadelphia. Complete a refund petition form.

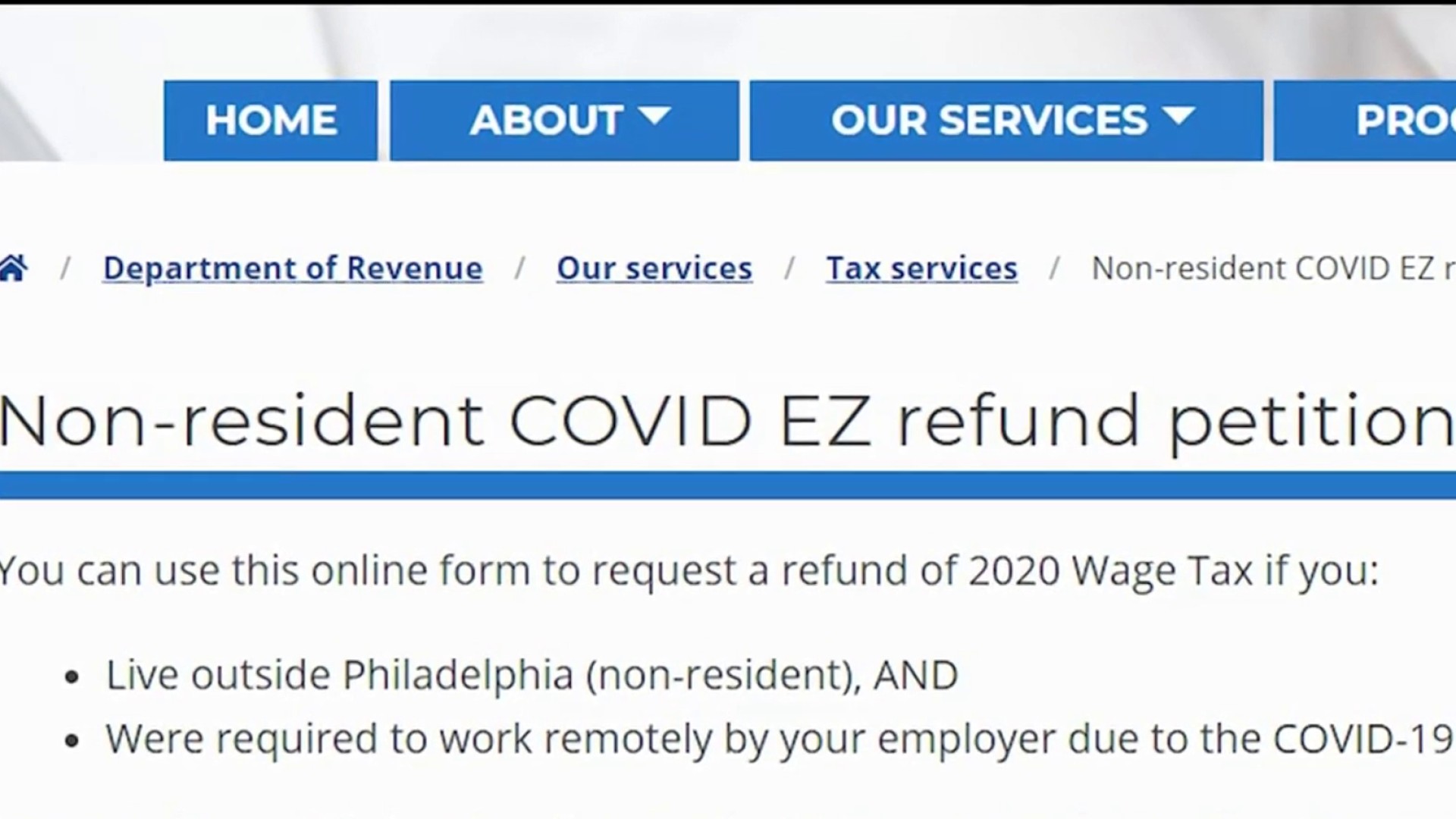

Historically, employees have been responsible for applying for wage tax refunds. Unprecedented times call for unprecedented measures. “if you’re a nonresident, and your employer.

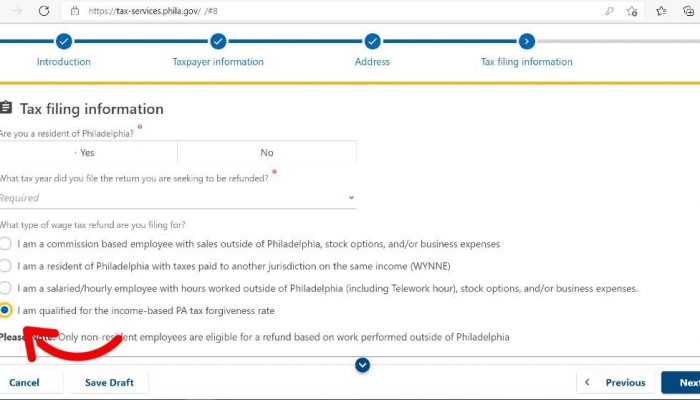

A new year, a new philadelphia wage tax refund option. 9 rows wage tax refund form (salaried employees) salaried employees can use this. Starting in november 2021, wage tax refund requests must be submitted through the philadelphia tax center.

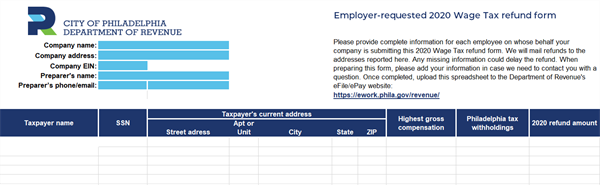

The business must provide for each employee: Philadelphia’s wage tax is a tax on salaries, wages, commissions, and other compensation. Missing information could delay the refund.

Phila.'s 2020 wage tax refund process: The city will refund wage tax that was withheld by the employer above the 1.5% discounted rate. Divide line 2d by line 2c.and round the resulting percentage to 4 decimal places.

Percentage of time worked outside of philadelphia. But this year’s refunds still account for much more money than in years past, due to the pandemic. You must pay this tax if you are:

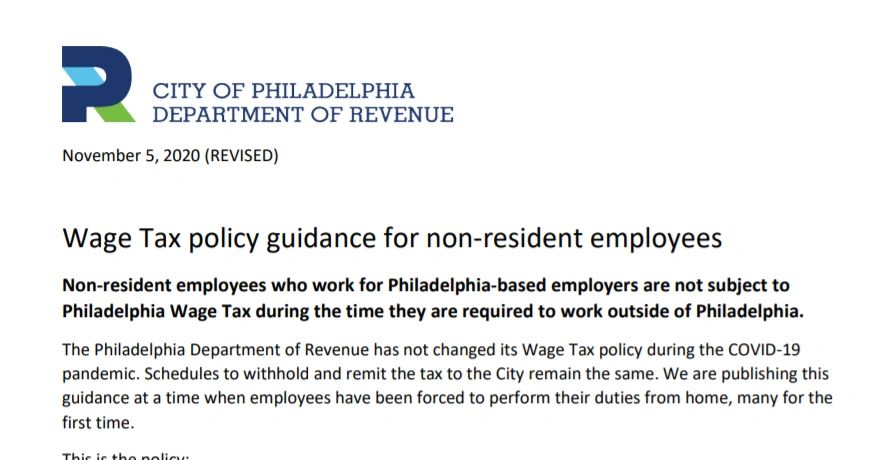

The coronavirus pandemic has caused unprecedented disruption to businesses and employees. Refunds only apply for days that employees were required to perform their work duties remotely outside of. Your employer should withhold and remit the wage tax to the city on your behalf.

Suburban lawmakers are also upset that, during the pandemic, philadelphia raised the wage tax on suburban commuters but not city residents. Can i get a wage tax refund? A philadelphia city wage tax credit for 2016 can be claimed by filing an annual reconciliation of employee earning tax return with the city of philadelphia by april 18 and reporting the allowable credit on line 17.

We will mail refunds to the addresses reported here. The city has approved about 32,000 applications for 2020 thus far, lessard said, compared with 5,000 by the same date last. Divide line 2d by line 2c.and round the resulting percentage to 4 decimal places.

To request a refund for tax years 2013 through 2015, eligible philadelphians must: How do i change my city wage tax status in philadelphia? We are writing to provide important updates about 2020 wage tax refunds in philadelphia.

As long as companies are requiring employees to work from home, they are exempt from the 3.4481% nonresident tax.

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

Working From Home For A Philadelphia-based Employer

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Tax Advice For Single Moms What You Can Do To Increase Your Tax Refund Tax Refund Payroll Taxes Income Tax

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia

Wage Garnishments Can Leave You Struggling To Pay The Essential Living Expenses Wage Garnishment Irs Taxes Tax Help

We Help Taxpayers Get Relief From Irs Backtaxes Do You Qualify For Irs Back Tax Relief Get A Free Review Free On Business Tax Deductions Tax Help Tax Time

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Tax Risk For Middle Class Americans Increased Audits And Amt Irs Taxes Tax Attorney Debt Relief Programs

N_hncjndq1jjgm

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JJVOE3MU7BD5XHJ3LOWCOOJTVU.jpg)

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

2015 Irs W9 Form Top 22 W 9 Form Templates Free To In Pdf Format Fillable Forms Form Blank Form

W9 Form Download Fillable Form W 9 Request For Taxpayer Identification Fillable Forms Form Blank Form

Struggling With Tax Debt Here Are Some Tips Finance Flirting Tax Debt

Limits Of Salary Deductions Surcharges And Salary Advances Wage Garnishment Wage Tax Debt

Your Guide To Wage Tax Refunds Nbc10 Philadelphia

If You Are Suffering From Dwi Charges Near Long Island And Want A Best Lawyer Who Make You Risk Free From These Charges Attorney At Law Good Lawyers Attorneys