A typical partnership formed to. Transfers of property by gift are exempt from the pennsylvania property transfer tax (91 pa.c.s.

2

Transfer tax on the purchase of the replacement property is based on the $15,000 sales price paid to seller.

Philadelphia transfer tax regulations. Pennsylvania sales tax is due on the purchase price of the vehicle. The realty transfer tax applied not only to direct transfers of real estate, but also to transfers of 90% or more of the interests in a real estate company within a three year period. 567 (approved june 5, 1985) and bill no.

Because the transfer was from an entity, xyz general partnership, to its sole member, the llc, the document is subject to tax under § 91.154(a) (relating to documents involving corporations, partnerships, limited partnerships and other associations), and the exclusion under § 91.193(13) (relating to excluded transactions) does not exclude the. (2) under federal, state and city laws, corporations and associations are entities. If a document has been rejected, resubmit it with the document rejection notice.

As example, if a taxpayer is seeking an expedited ruling on the realty transfer tax, the combined fee would be $3,500. Realty transfer tax is imposed upon any document that effectuates or evidences the transfer of title to real estate located within the commonwealth, 72 p.s. The pennsylvania realty transfer tax provisions in act 52 take effect january 1, 2014.

The realty transfer tax is 3% of the total consideration for city taxes and 1% of the total consideration for state taxes. Payment of city transfer tax, state transfer tax, and recording fees must be made by separate checks. Consult a tax specialist with questions.

For example in michigan, state transfer taxes are levied at a rate of $3.75 for every $500 — which translates to an effective tax rate of 0.75% ($3.75 / $500 = 0.75%). Buyers and sellers of philadelphia real estate had to contend with a 4% realty transfer tax. City transfer tax—city of philadelphia, state transfer tax—commonwealth of pennsylvania, recording fees—department of records or city of.

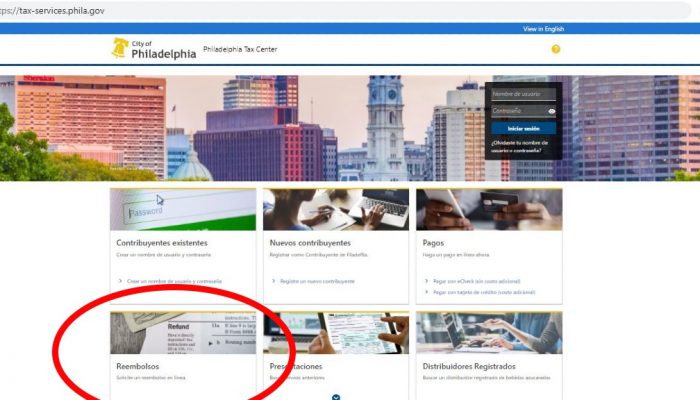

Department of commerce division of aviation regs. City of philadelphia real estate transfer tax regulations, author: The city of philadelphia imposes a realty transfer tax on the sale or transfer of real property located in philadelphia.

(1) there are business, economic and tax reasons for entities holding real estate to do business as corporations or associations. On date 2, x gives $5,000 to qi, and the qi pays $15,000 to seller to purchase the replacement property and directs seller to transfer title to the replacement property directly to x. The exact amount that you'll pay in transfer tax will depend on the county or city in which.

Expedited rulings are issued within 20 days of the receipt of a complete and proper request. 1259 (approved june 11, 1987.) these regulations have been 193), but are subject to the federal gift tax described above.

Department of commerce, division of aviation: These documents contain the full regulations for the realty transfer tax, as well as clarifications from technical staff on how the department of revenue interprets the law. The council of the city of philadelphia finds that:

Effective july 1, 2017, philadelphia law changed. If you would like to discuss how these changes may affect your business, or have any other tax or estate planning questions, please contact kevin koscil (215.864.6827/ koscilk@whiteandwilliams.com ), bill hussey (215.864.6257/ husseyw@whiteandwilliams.com. $2,000 additional for an expedited ruling.

$1,500 for any opinion on the realty transfer tax. Philadelphia real estate transfer tax certification complete each section and fi le in duplicate with recorder of deeds when (1) the full consideration/value is/is not set forth in the deed, (2) when the deed is with consideration, or by gift, or (3) a tax exemption is claimed. (no sales tax exemption is available for military personnel.) note:

Bellevue, in allegheny county, charges 1.5% in transfer taxes. This tax consisted of a 3% philadelphia tax and a 1% state tax. The tax reform code excludes from the imposition of tax certain transfers to trustees of living trusts.

The city of philadelphia imposes a realty transfer tax on the sale or transfer of real property located in philadelphia. In philadelphia, for example, 3.278% is paid to the city along with the 1% paid to the commonwealth. Each deed requires separate transfer tax checks.

The tax imposed by the local government and school district varies from place to place. The new regulations restrict the flexibility that buyers had in transactions that occurred. The grantor is responsible for paying the federal gift tax, and the grantee will be held liable if the grantor fails to do so [1].

Department of commerce division of aviation regs. City of philadelphia real estate transfer tax regulations, length: Both grantor and grantee are held jointly and severally liable for.

Note that transfer tax rates are often described in terms of the amount of tax charged per $500. The tax becomes payable when a property deed (or other document showing realty ownership) is filed with the records department. The correct payees for each are as follows:

The realty transfer tax applies to the sale or transfer of real estate located in philadelphia. If more space is needed, attach additional sheet(s).

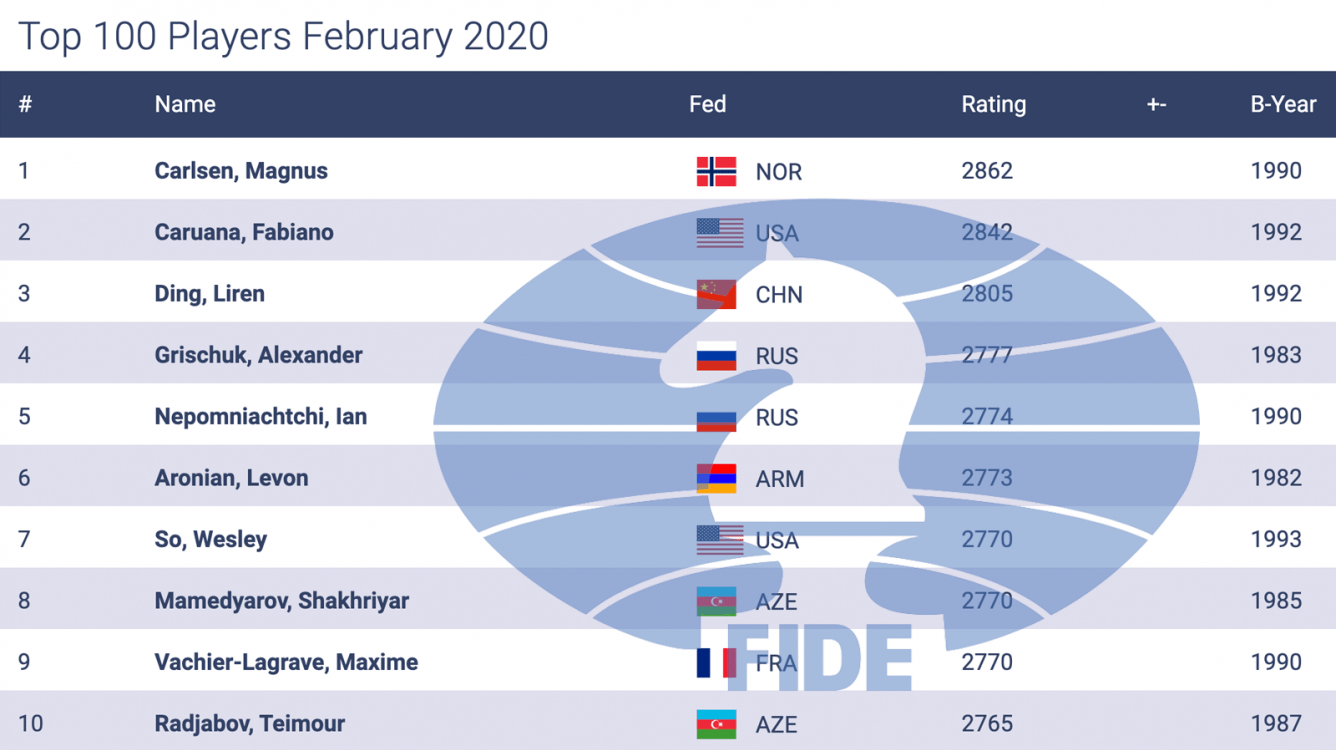

Caruana Closing In On Carlsen In Feb Ratings – Chesscom

Teacher Appointment Letter – School Teacher Appointment Letter Letter To Teacher Teacher Templates Letter School

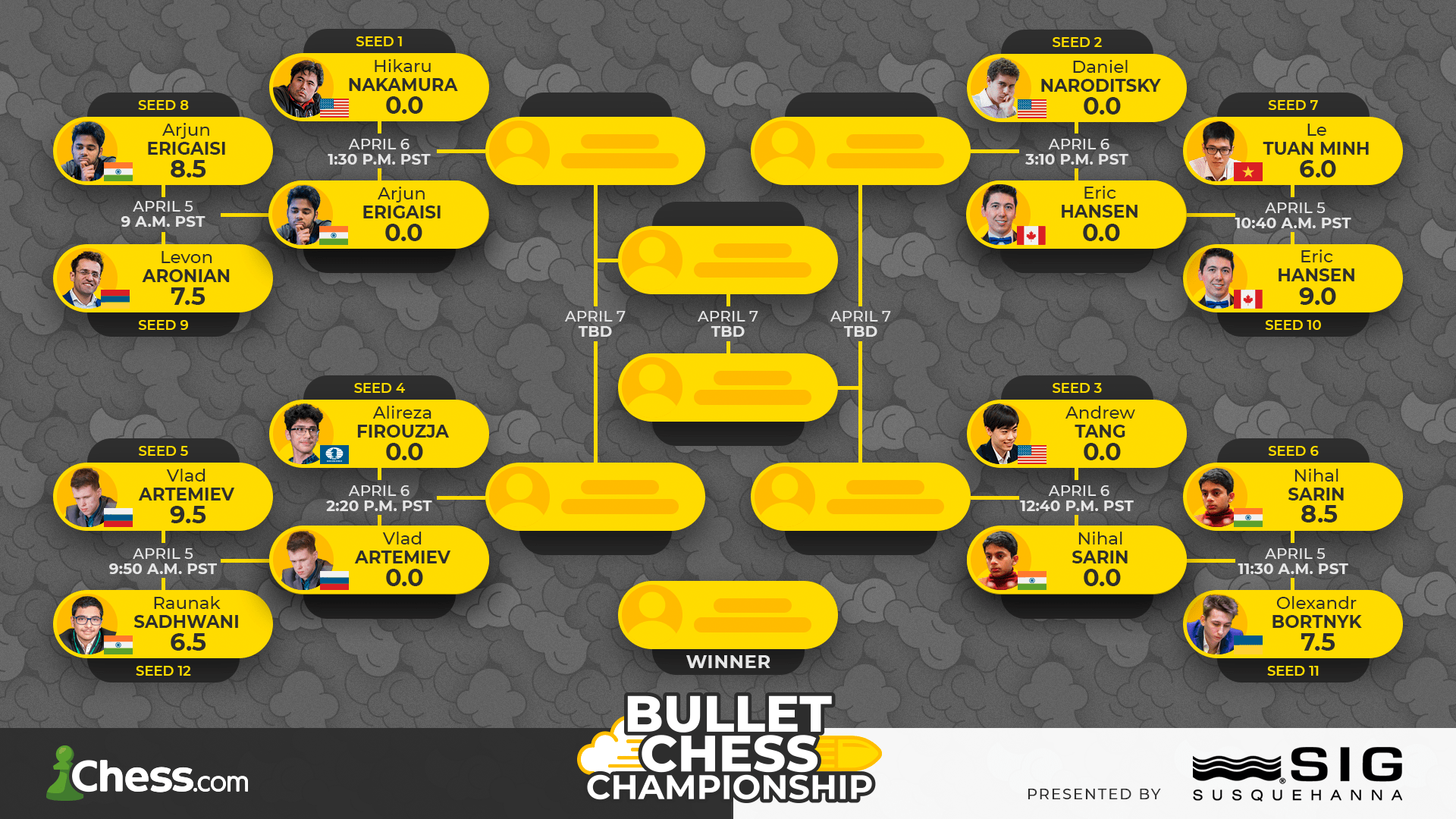

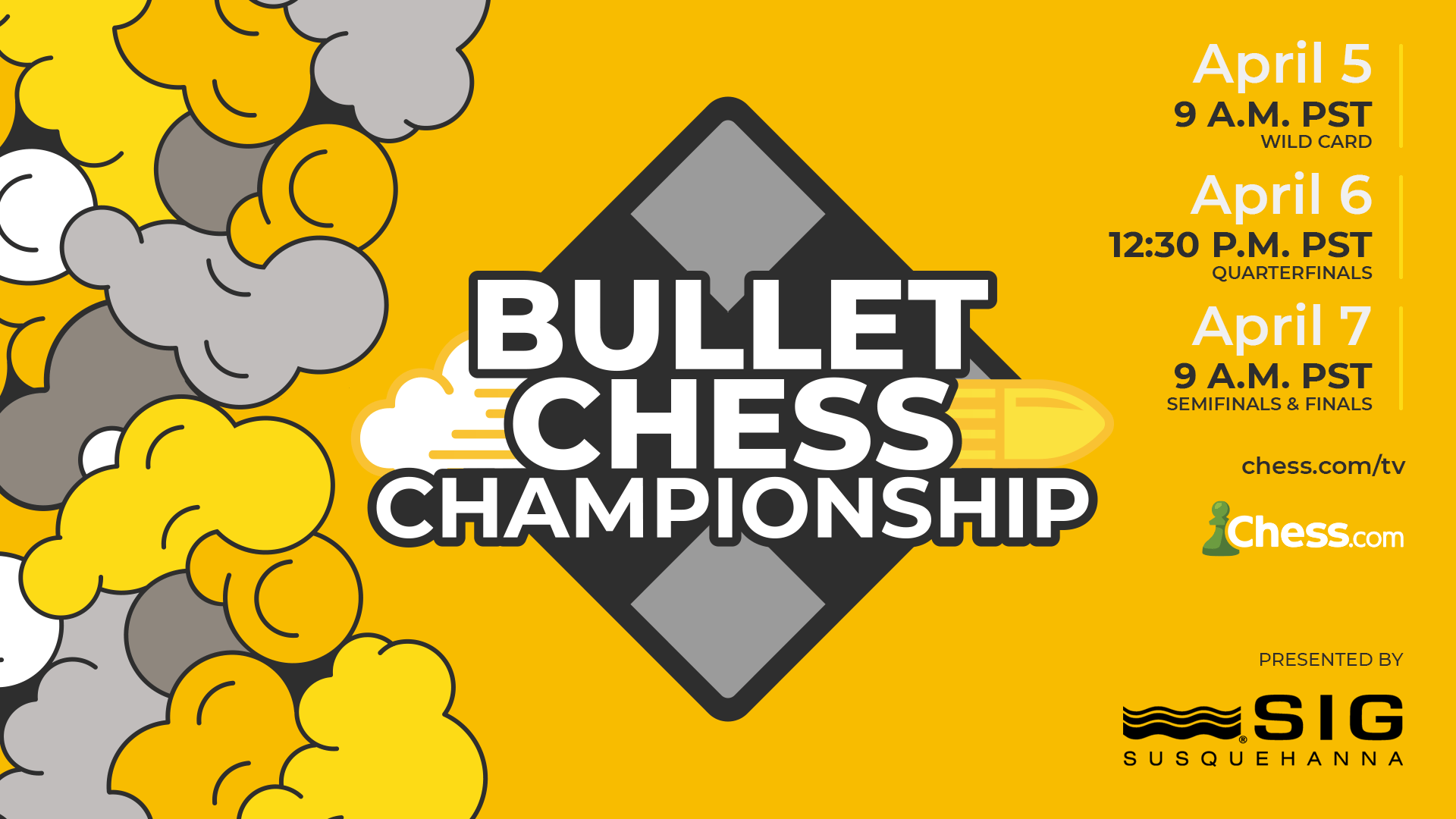

2021 Bullet Chess Championship Presented By Sig Erigaisi Artemiev Hansen Nihal Through – Chesscom

International Competition For The New Gangseo-gu Government Office Complex South Korea

Window Tax Vulcan And Exploding Signal Here Is Some More Interesting History That Took Place This Week In His Scary Facts Strange History Paranormal Activity

Ciyeryeycunh0m

Indonesian Navy Takes Delivery Of 1st Locally Built Submarine – Naval Today

Ancient Art In Indonesia – World Archaeology

Unmanned Aerial Vehicles Help Wheat Breeders Eurekalert

Pellet Accumulation As A Proxy For Herbivore Pressure In A Mediterranean Ecosystem – Sciencedirect

President Brou Reaffirms Commissions Cooperation With Ecowas Parliament To Advance The Cause Of Regional Integration Economic Community Of West African Statesecowas

Blame For The 737 Max – Flying Magazine

How Bidens Real Estate Tax Plan May Hit Smaller Property Investors

A Closer Look At 2021 Proposed Tax Changes – Charlotte Business Journal

Ciyeryeycunh0m

Smartagrihubs Begins Open Call For Digital Agriculture Innovation – The Cattle Site

Window Tax Vulcan And Exploding Signal Here Is Some More Interesting History That Took Place This Week In His Scary Facts Strange History Paranormal Activity

2021 Bullet Chess Championship Presented By Sig Erigaisi Artemiev Hansen Nihal Through – Chesscom

Pellet Accumulation As A Proxy For Herbivore Pressure In A Mediterranean Ecosystem – Sciencedirect