Download forms and instructions to use when filing city tax returns. When you complete a sale or transfer of real estate that is located in philadelphia, you must file and pay the realty transfer tax.

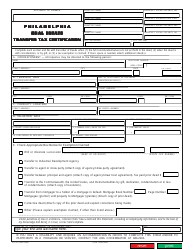

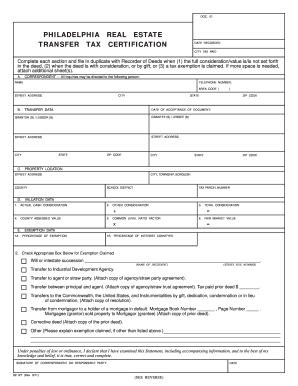

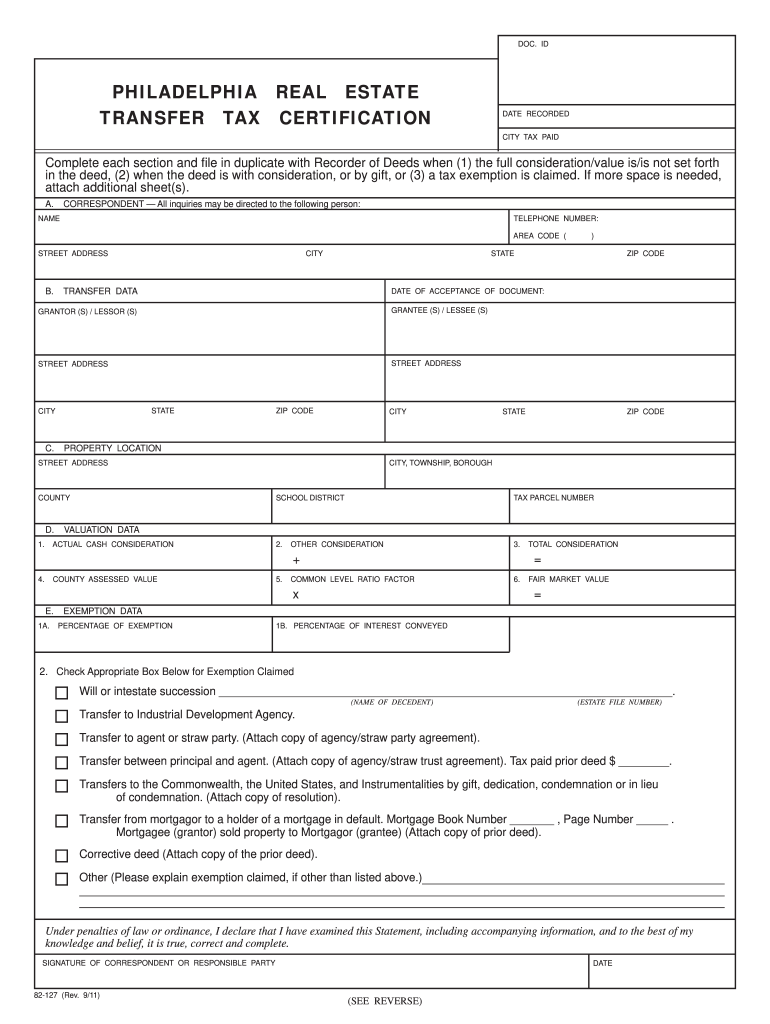

Form 82-127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

(1) the full value/consideration is not set forth in the deed, (2) the deed is without consideration or by gift, or.

Philadelphia transfer tax form. The tax becomes payable when a property deed (or other document showing realty ownership) is filed with the records department. Rate free philadelphia transfer tax form. Copies of recorded instruments are $2, and certified copies are an additional $2.

Both grantor and grantee are held jointly and severally liable for payment of the tax. 2 hours ago the current rates for the realty transfer tax are: Instructions for completing philadelphia real estate transfer tax certification section a correspondent:

Instructions for completing philadelphia real estate transfer tax certification section a correspondent: Enter the date on which the deed or other document was accepted by the party(ies). Enter the name, address and telephone number of party completing this form.

2 hours ago philadelphia has raised its transfer tax from 3% to 3.1%, for a current total effective combined rate of 4.1% as of january 1, 2017. City of philadelphia an official website of the city of philadelphia government here's how you know This is a statewide form required in every county where applicable.

(3) a tax exemption is claimed. Fill in the appropriate oval. Philadelphia real estate transfer tax exemptions 1 hours ago rslawgroup.com get all effective october 1, 2018, the transfer tax for the city of philadelphia is 3.278%, with an additional state of pennsylvania tax of 1%, for a total of 4.278%.

Forms include supplementary schedules & worksheets going back to 2009. (3 days ago) guide to: Available for pc, ios and android.

This transfer tax is traditionally split between the buyer and the seller (with each party paying half) and becomes payable when the property deed or another document showing ownership is. Deed transfers and entity transfers have their own, unique forms. Enter the date on which the deed or other document was accepted by the party(ies).

Philadelphia real estate transfer tax certification. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Effective october 1, 2018, the transfer tax for the city of philadelphia is 3.278%, with an additional state of pennsylvania tax of 1%, for a total of 4.278%.

The form is digitized and comes with instructions. This statement must be signed by a responsible person connected with the. Instructions for completing philadelphia real estate transfer tax certification section a correspondent:

Transfer tax certification this form is specific to philadelphia county and is required instead of the statewide form. Philadelphia real estate transfer tax form. Enter the name, address and telephone number of party completing this form.section b transfer data:

Pa realty transfer tax exemptions real estate transfer tax exemptions property transfer tax family exemption pa realty transfer tax statute of limitations. Pa realty transfer tax and new home construction. Enter the name, address and telephone number of party completing this form.

The realty transfer tax is 3% of the total. Complete the correct certificate and submit it when you record the deed or mail in your realty transfer tax. Complete each section and file in duplicate with recorder of deeds when:

Section iii valuation data 2. A collection of all the forms and documents you need to file and pay your city taxes and receive assistance, discounts, or refunds. This is a continuation of the blog post from june 22nd, which you can read about here.in that post, i highlighted how the pennsylvania transfer tax system works generally, and how the taxes in certain counties (like philadelphia) are substantially.

Enter the date on which the deed. From there, choose cocosign reader to open the document. Exception for deceased spouse deed:

A statewide list of the factors is available at the recorder of deeds office in each county. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Keywords relevant to philadelphia transfer tax 2020 form.

Failure to complete this form properly or attach requested documentation may result in the recorder’s refusal to record the deed. Fill philadelphia transfer tax form, edit online. The realty transfer tax applies to the sale or transfer of real estate located in philadelphia.

As a reaction to the substantial tax on the transfer of real estate, philadelphia real estate attorneys have always searched for creative ways to avoid paying the tax.

Self Employment Income Statement Template Inspirational 9 Sample Profit And Loss Forms Statement Template Profit And Loss Statement Income Statement

What Is A Medical Certificate For Truck Drivers Doc In 2021 Medical School Application Doctors Note

New Hire Forms Template Beautiful 99 New Employee Wel E Packet Template Sample Resume Free Brochure Template Preschool Lesson Plan Template

Pin By Colleen Mcclain On Passport Tax Refund Money Template Payroll Template

Medical Records Form Template Beautiful Sample Hipaa Pliant Release Form 8 Examples In Word Pdf Personal Health Information Templates Teacher Templates

2 Trillion Stimulus Deal Reached – 19 Things You Need To Know About Your Check Money Template Ways To Get Money Payroll Template

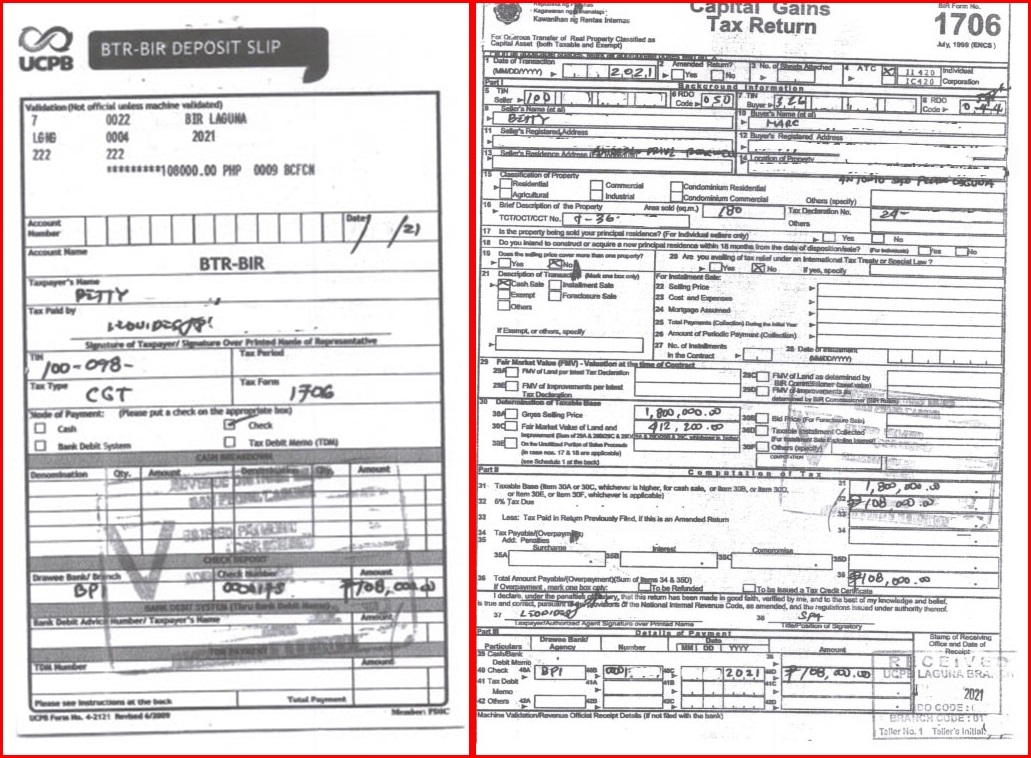

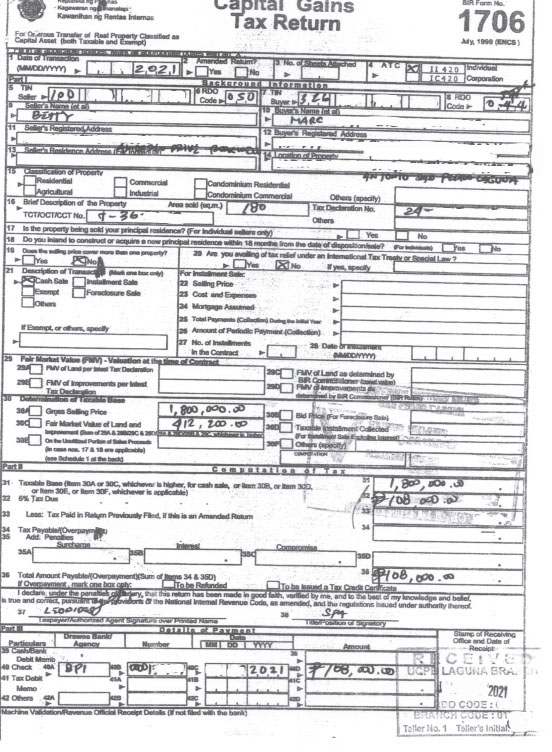

Taxes And Title Transfer Process Of Real Estate Properties This 2021

Form 82-127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Medical Record Forms Template Inspirational Generic Release Forms Medical Records Editable Lesson Plan Template Job Application Cover Letter

2

2011-2021 Form Pa 82-127 – Philadelphia Fill Online Printable Fillable Blank – Pdffiller

Taxes And Title Transfer Process Of Real Estate Properties This 2021

2011-2021 Form Pa 82-127 – Philadelphia Fill Online Printable Fillable Blank – Pdffiller

2

311154 Unemployment Tax Returns Internal Revenue Service

31116 Corporate Income Tax Returns Internal Revenue Service

Pa 82-127 – Philadelphia 2011-2021 – Fill Out Tax Template Online Us Legal Forms

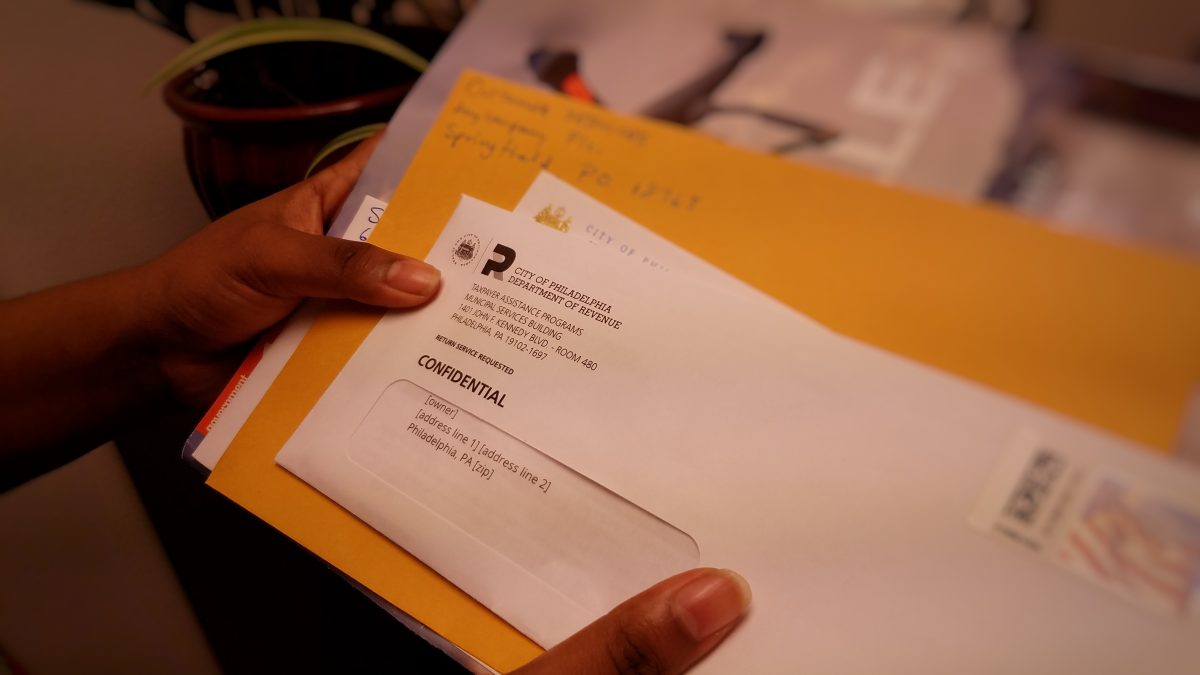

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia