Tax revenue vs gdp per capita, 2020. Tax revenue (% of gdp) international monetary fund, government finance statistics yearbook and data files, and world bank and oecd gdp estimates.

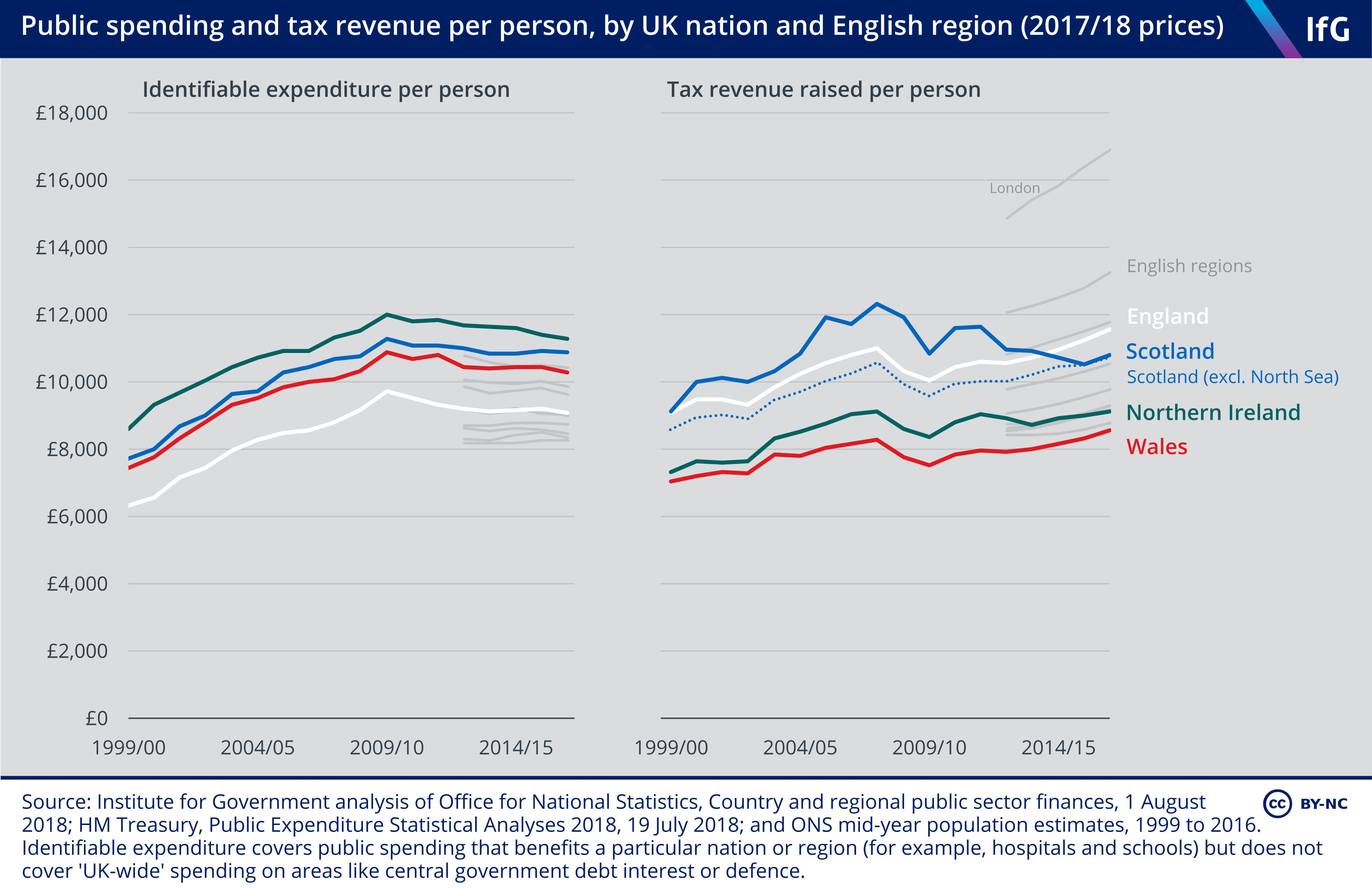

Public Spending And Taxation The Institute For Government

Statutory corporate income tax rates, 2000 vs 2018;

Per capita tax revenue. Municipalities and school districts were given the right to collect a $10.00 per capita tax under act 511, and school districts an additional $5.00. 187 rows tax revenue (% of gdp) gdp (billions, ppp) gov't expenditure (% of gdp(nominal)). Everyone benefits from programs funded by per capita fees.

1990 1995 2000 2005 2010 2015 % 13.0 13.5. And according to alachua county tax collector john power, they will generate a revenue of $393,460,611.67. In a sense, the figures show how effective and efficient the local government unit (lgu) is in producing income.

Empirical evidence from vietnam exceeds the tolerance of the people. Top marginal income tax rates (44.5 kb) august 26, 2021.

Rankings of state and local per capita general revenue | tax policy center. In massachusetts, cannabis tax revenue per capita was around 12.92 u.s. Tax revenue per capita in england, scotland, wales and northern ireland, 1999/00 to 2015/16

The department of revenue recently mailed livestock per capita fee bills and reminds livestock owners they must pay their 2021 per capita fees by may 31. The department of revenue (dor) 2020 florida county ad valorem tax profile ranks alachua county as 30th in the state for taxes levied per capita at $561. If both do so it is shared 50/50.

Tax revenue is defined as the revenues collected from taxes on income and profits, social security contributions, taxes levied on goods and services, payroll taxes, taxes on the ownership and transfer of property, and other taxes. What is difference between an act 511 and act 679 per capita tax? The five states with the lowest tax collections per capita are alabama ($3,206), tennessee ($3,322), south carolina ($3,435), oklahoma ($3,458), and florida ($3,478).

Tax revenue vs gdp per capita; This study used physical capital, human capital, population growth, tax revenue (gdp), personal income tax, corporate income tax, consumption tax and property tax as the variables. State and local tax revenue, per capita.

Taxes on goods and services; Tax revenue towards property taxes are associated with a higher level of income per capita in the long run. Tax reduction in income inequality;

Users should look at summary of tax burden measurement methods article for a. New jersey has the highest per capita state property tax revenue at $2,918, while arkansas has the lowest at $319 per capita. On average, state and local governments collected $1,556 per capita in property taxes nationwide in fy 2016, but collections vary widely from state to state.

Note, this data includes state taxes only.excluding local taxes can bias comparisons for some states. Taxes on goods and services; It's martin county that tops the ranking at $1,404 per capita and union county coming in 67th as the least.

Total tax revenue as a percentage of gdp indicates the share of a country's output that is collected by the government through taxes. Tax revenue as share of gdp; The per capita tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

It can be levied by a municipality and/or school district. Government spending per capita increased 65%. The highest state and local property tax collections per capita are found in the district of columbia ($3,535), followed by new jersey ($3,127), new hampshire ($3,115), connecticut ($2,927), new york ($2,782), and.

Top marginal income tax rate; Income per capita is a measure of the amount of money earned per person in a certain area. The five states with the highest tax collections per capita are new york ($8,957), connecticut ($7,220), new jersey ($6,709), north dakota ($6,630), and massachusetts ($6,469).

New york has the highest per capita local general revenue from its own sources at $5,463, while vermont has the lowest at $1,230 per capita; Taxes on incomes of individuals and corporations; The state of washington had the highest cannabis tax revenue per capita in 2019 at approximately 67.31 u.s.

Livestock owners can pay online at reportyourlivestock.mt.gov or by mail if they have not yet paid. Gross domestic product per capita and individual income tax revenue: To allow comparisons between countries, gdp per capita is adjusted for price differences.

An equal per capita redistribution of carbon tax revenues within countries — a relatively straightforward policy to implement — can increase wellbeing, reduce inequality and alleviate poverty. Per capita income refers to the total income earned divided by the city’s total population.

Chart Washington Dc Pays Most Per Capita Taxes In The United States Statista

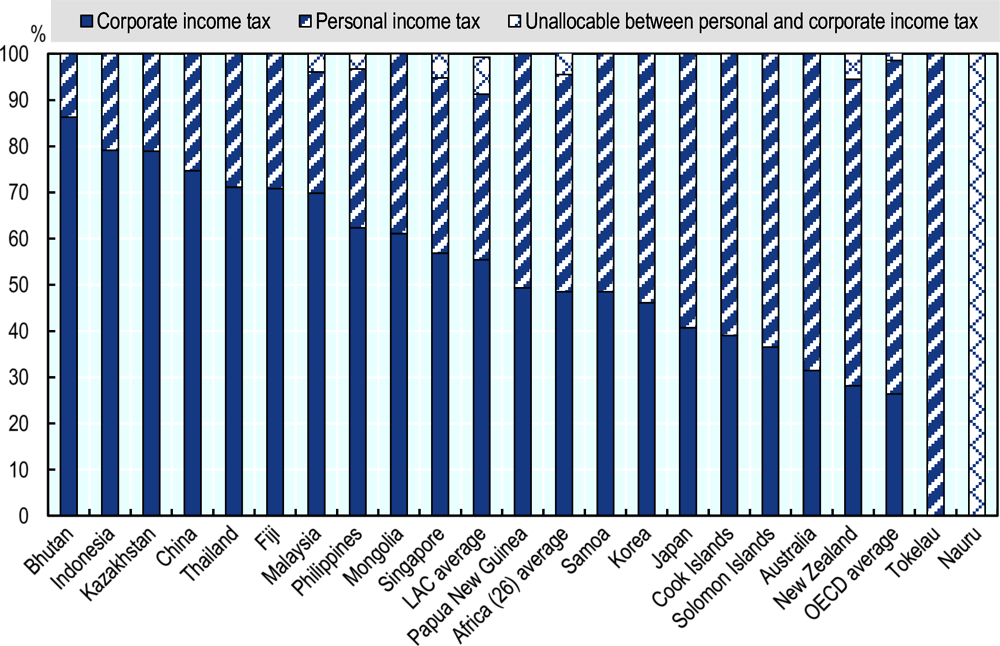

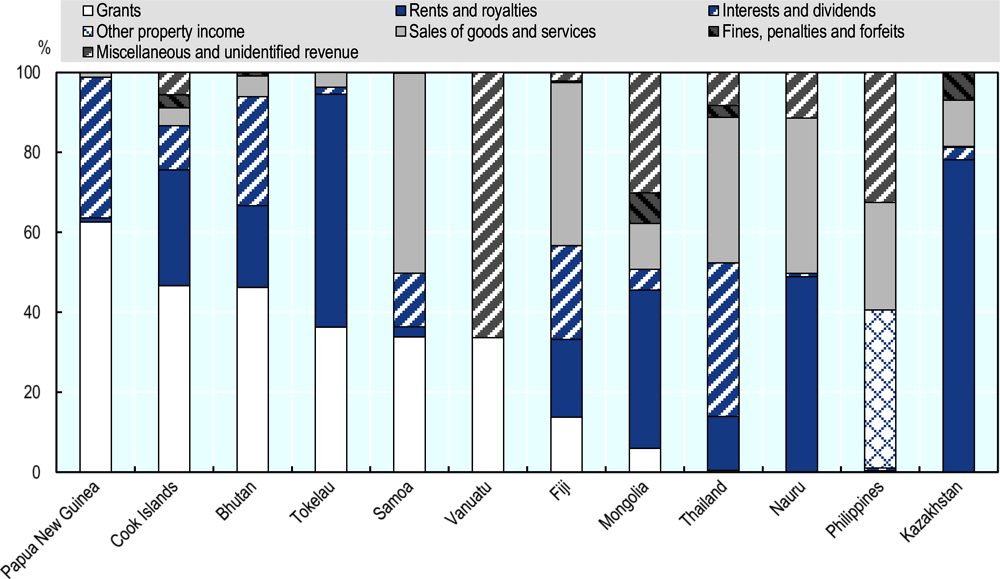

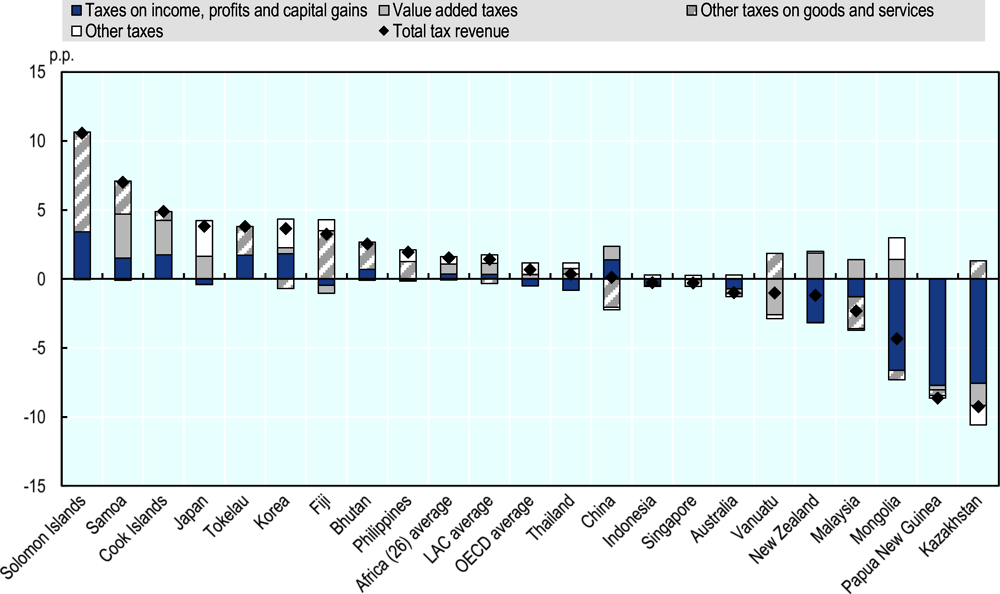

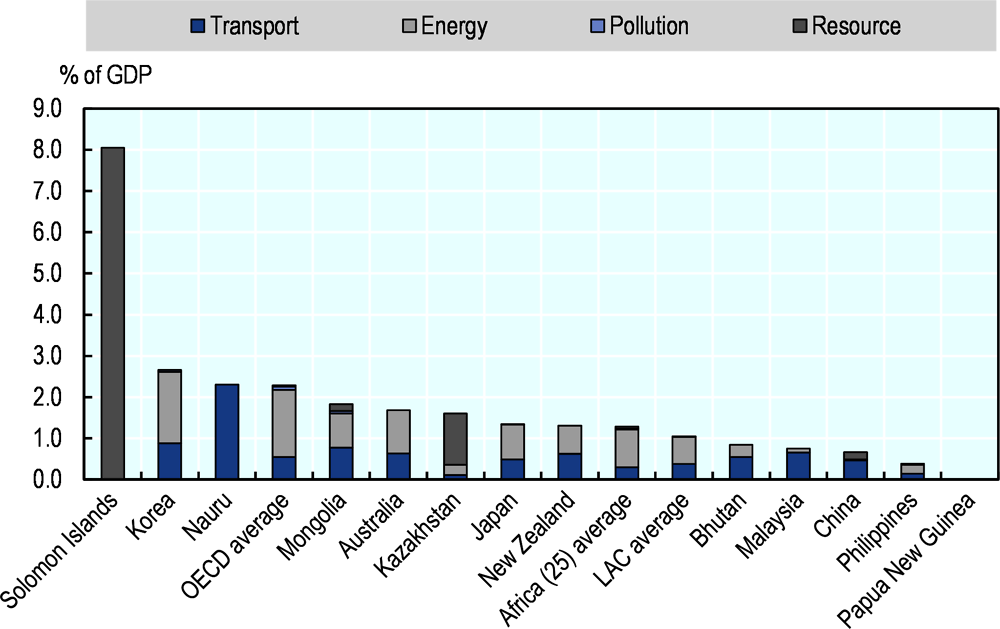

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Using The Tax Structure For State Economic Development Urban Institute

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Tax Return Income Tax

Per Capita Us State And Local Tax Revenue 1977-2018 Statista

Tax Capacity And Growth In Imf Working Papers Volume 2016 Issue 234 2016

Tax Revenue Vs Gdp Per Capita – Our World In Data

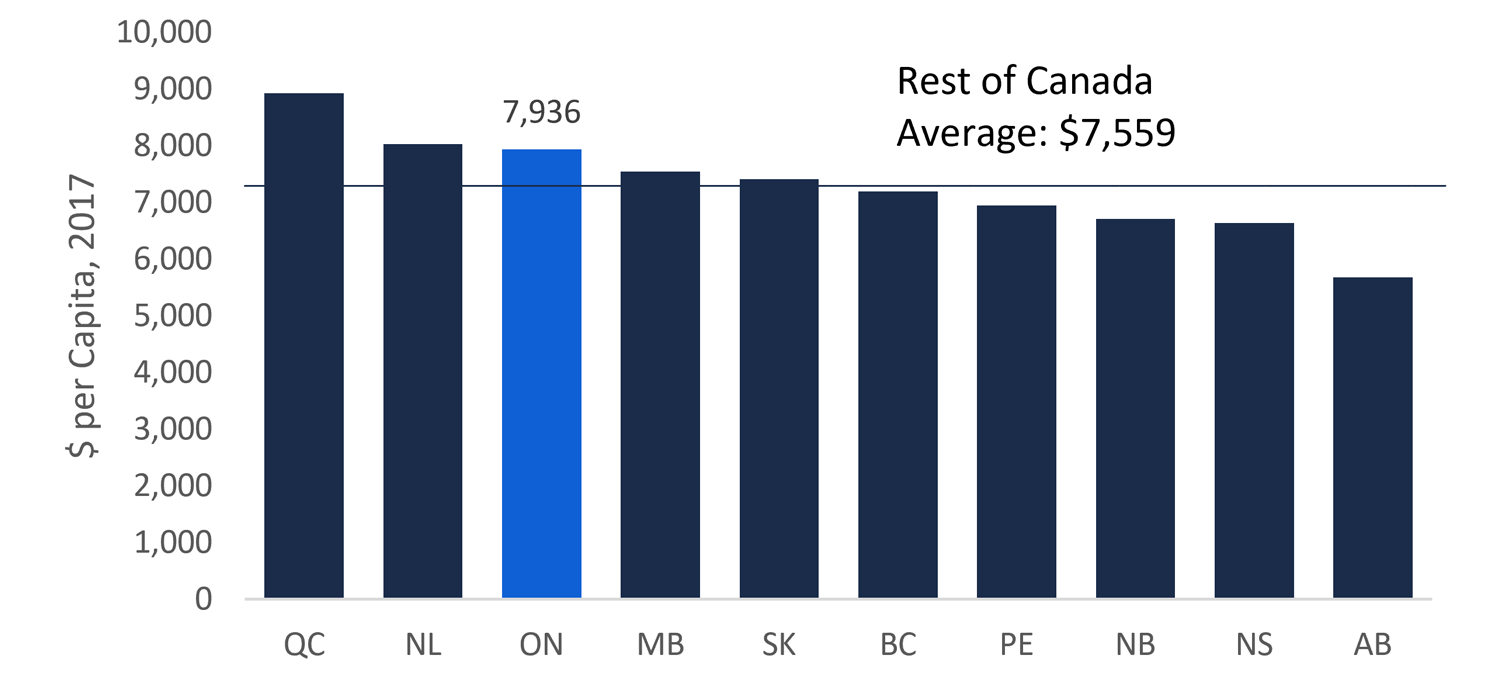

Comparing Ontarios Fiscal Position With Other Provinces

Indonesia Gdp Per Capita 2010 2021 Ceic Data

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Us – Income Tax Revenues And Forecast 2031 Statista

Azerbaijan Gdp Per Capita 1990 2021 Ceic Data

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Why Is Domestic Revenue Mobilization So Low In The Central African Republic And What Can Be Done About It

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

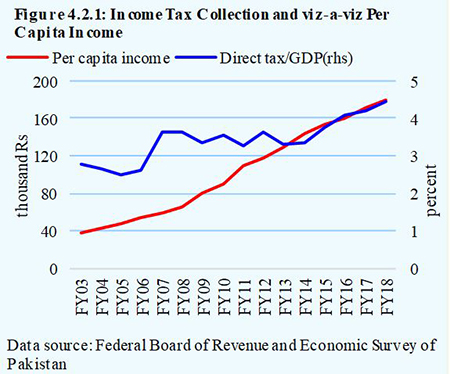

Exploiting Direct Tax Potential In Pakistan

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary