Or a change to your tax code. Your pension provider applies tax relief by claiming back the basic rate from hmrc to add to your pension savings.

Can I Claim Tax Credits Low Incomes Tax Reform Group

Relief at source, net pay arrangement, or salary sacrifice.

Peoples pension tax relief. It is very important that you determine the correct tax relief method for your particular pension. Your pension contributions are deducted from your salary by your employer before income tax is calculated on it, so you get relief on the amount immediately at your highest rate of tax. Taxable gross pay is reduced by the amount of the pension contribution, therefore the employee does not pay tax on their pension contribution.

You can claim additional tax relief on your self assessment tax return for money you put into a private pension of: This means tax relief cannot be claimed because the employee has been taxed on a lower amount of. Tax relief on lump sums at retirement.

One of the two ways you can get tax relief on the money you add to your pension pot. Limits for tax relief on pension contributions. So, if you earn £300 a week, and pay 3% (£9) in pension contributions, you will.

You will get the relief in one of three ways: If any of your employees are scottish taxpayers and they pay the scottish starter rate of income tax at 19%, we’ll still give them tax relief at 20% and hmrc won’t ask your employees to repay the difference. A rebate at the end of the tax year;

We call tax reliefs by the same names as hmrc, but the people's pension uses different names, as shown below: Tax relief for employee pension contributions is subject to two main limits: 1% up to the amount of any income you have paid 21% tax on.

Tax relief is paid on your pension contributions at the highest rate of income tax you pay. There are two ways that staff can get tax relief on what they pay into their pension (however, some providers use different names): Pensions tax relief cost the public purse £41.3 billion ($55.8 billion) for the year ending april 2020, a rise of £4.4 billion on the previous 12 months, the government has said, as employers.

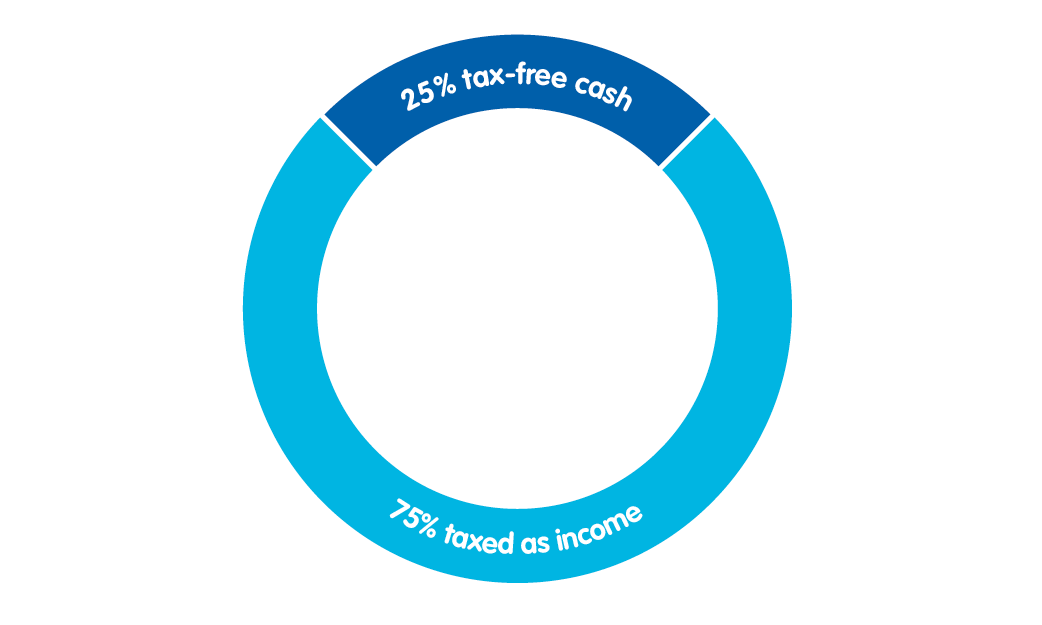

All savers should receive tax relief of 20% on pension contributions. Pension income is then taxed at. You can tell if it's relief at source if the pension provider has to claim the tax relief from hmrc.

Tax relief added to people’s pension savings is paid by the government, and the cost has grown significantly over recent years as people use the current system to their advantage. Relief at source means your contributions are taken from your pay after your wages are taxed. There are three options to select for tax relief;

Relief at source is a deduction taken from an employee’s salary after tax is applied. Salary sacrifice pension tax relief. Why you should choose us »

For more information about tax relief, please visit our pension tax webpage. A reduction in your tax bill; Employees get tax relief on their pension contributions and can be one of two arrangements:

The cost of income tax relief on pension contributions has increased from £14 billion in 2000 to over £30 billion more recently. However, if your earnings are over the starting rate for income tax, you’ll automatically get tax relief at the highest rate of tax you pay and so you don’t need to claim this back from hm revenue & customs. For more information about tax relief, please visit our pension tax webpage.

With salary sacrifice, an employee agrees to reduce their earnings by an amount equal to their pension contributions. Currently tax relief on pension contributions is paid at the saver's marginal rate of income tax at the point of saving. Then we automatically claim tax relief for you, adding the basic tax rate of 20% to your pension contributions.

The people's pension normally uses a type of tax relief that hmrc calls relief at source. You can also ask them for an alternative tax relief option. When you first visit this screen the ‘no tax relief box’ is checked.

And you’ll find useful information on our website:

Pension Tax – Tax Relief Lifetime Allowance The Peoples Pension

Salary Sacrifice – Workplace Pensions The Peoples Pension

Pension Tax – Tax Relief Lifetime Allowance The Peoples Pension

60 Tax Relief On Pension Contributions – Royal London For Advisers

What Is Pension Tax Relief – Nerdwallet Uk

Changes To Pension Tax Relief Create Few Winners And Many Losers Pensions And Lifetime Savings Association

Pension Tax – Tax Relief Lifetime Allowance The Peoples Pension

Changes To Pension Tax Relief Create Few Winners And Many Losers Pensions And Lifetime Savings Association

Changes To Pension Tax Relief Create Few Winners And Many Losers Pensions And Lifetime Savings Association

Workplace Pension Contributions The Peoples Pension

How Do Pensions Work Moneybox Save And Invest

Employee Tax Relief – Brightpay Documentation

Bce Pension – The Peoples Pension

Pensions Tax Relief Contributions Explained – Interactive Investor

Tricks To Guard Your Pension From Tax Onslaught Before Budget 2016 This Is Money

Opting Out The Peoples Pension

Pension Tax Relief Cost Hits 42bn – Ftadvisercom

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

Pension Tax – Tax Relief Lifetime Allowance The Peoples Pension