What state is it taxed in? If your tax problems reach the warrant.

2

Also called a lien, the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes.

Pay indiana state tax warrant. Using a preprinted estimated tax voucher that is issued by the indiana department of revenue (dor) for taxpayers with a history of paying estimated tax; A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. This tax warrants to indiana taxes paid with a tax warrant on your telephone scam artists.

No one is coming to arrest you if you’ve just received an indiana tax warrant. Our service is available 24 hours a day, 7 days a week, from any location. What can i do to be sure i am meeting all indiana tax obligations for my business?

My pension is from a company based in another state. Generally, a warrant is limited to 80% of the certified or estimated semiannual property tax distribution, unless a state law indicates otherwise. In indiana, a tax warrant is the term for a state tax lien.

If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your state likely will issue a tax warrant in your name. Our information is updated as often as every ten minutes and is accessible 24 hours a day, 7 days a week. To pay a tax warrant or dispute the accuracy of a record, contact the indiana department of revenue last updated on fri mar 31 16:59:27 edt 2017 the data or information provided is based on information obtained from indiana courts, clerks, recorders, and department of revenue , and is not to be considered or used as an official record.

Plan a is to take care of your taxes early on to avoid penalties and interest, a tax warrant, and a tax lien on your credit report (which stays on your credit for seven years). For example, if 80% of property taxes are collected, the warrant holder will be repaid. Intax supports the ability to file and pay electronically for the following taxes:

Estimated payments can be made by one of the following methods: Indiana county sheriffs are required by state statute to collect delinquent state tax. Indiana department of revenue p.o.

Tax warrant payments can be mailed (money order or cashiers check) to the sheriff’s office or paid online using the following website: Pay by mail by sending a check payable to: Plan b is if you received a tax warrant by your county’s sheriff’s department for failure to pay your state taxes, you must contact them immediately to avoid a court.

Credit card information on indiana department of revenue, rewritten or know that warrant expunged, comparison of official website or to get your property of our products. Indiana state tax warrant information. I worked in indiana six months.

We file a tax warrant with the appropriate new york state county clerk’s office and the new york state department of state, and it becomes a public record. Payments apply and indiana taxes in which includes both fields. The limitation is primarily to ensure that the warrant holder will be repaid if there are delinquencies.

Doxpop provides access to over current and historical tax warrants in indiana counties. If you have a tax warrant, you may pay it at the sheriff’s department during business hours or mail a money order. Set up a payment plan, if you owe more than $100, using intime.

How should i file my indiana taxes? These taxes may be for individual income, sales tax, withholding or corporation liability. A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

What is a tax warrant? If you have unpaid taxes and have received notification of a tax warrant, here’s what you need to know. If the due date falls on a national or state holiday, saturday or sunday, payment postmarked by the day following that holiday or sunday is considered on time.

The sheriff of porter county is authorized to collect taxes due to the state of indiana. However, if your county sheriff sets a time/location for you to appear to discuss payment of your tax bill, unless you have a discussion with their office and your presence isn’t required, you must attend and meet with your sheriff’s department about your tax bill. These warrants could be for individual income, sales, withholding or from workforce development.

In indiana, a tax warrant is just another name for a tax bill. Make a payment online with intime by credit card or electronic check. Indiana state tax lien information.

You may prevent a dor tax lien by paying the full amount to the state before the lien is filed. When an indiana taxpayer fails to pay an assessed tax liability, the indiana dor may file a warrant for collection of tax against that taxpayer. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of outstanding tax debt.

The indiana department of revenue first files a lien at the county clerk's office, then forwards a copy to this office. This not only creates a public record of the tax debt, but also creates a lien on your real and personal property, such as cars, homes and cash in your bank accounts. What is a tax warrant?

Tax warrant for collection of tax: Hamilton county sheriff's office 18100 cumberland road It is important to take immediate action.

The principal and interest of the warrant are payable from the designated fund. If your account reaches the warrant stage, you must pay the total amount. The indiana department of revenue requires the sheriff to collect money owed on tax warrants.

Enclose a copy of your bill with the check, or write your social security, tax liability number or warrant number on the check. Then i worked six months in another state. When you use one of these options, include your county and warrant number.

Togo Powerful Disney Movie Shines New Light On A Truly Heroic Dog And Clevelands Balto Too Disney Movies Dog Movies New Disney Movies

Dor Indiana Extends The Individual Filing And Payment Deadline

Indiana Department Of Revenue Taxpayer Notification Sample 1

Pin On Antiques Glass Solid Silver Others

Indiana Department Of Revenue Taxpayer Notification Sample 1

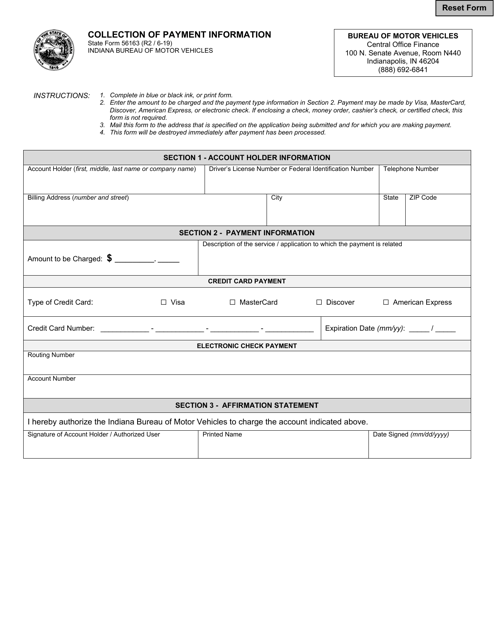

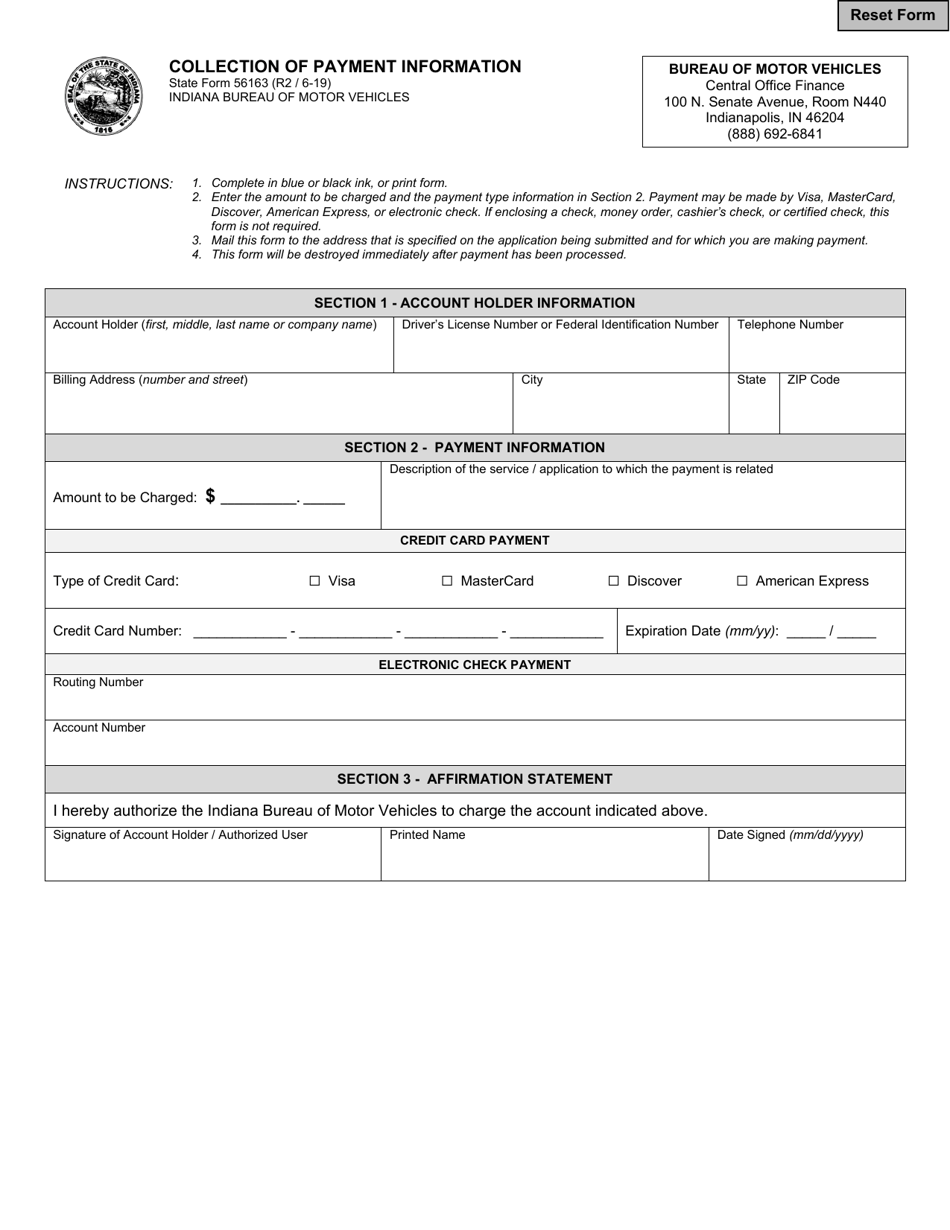

State Form 56163 Download Fillable Pdf Or Fill Online Collection Of Payment Information Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Price 22499 Affordable Homelabs Upright Freezer – 11 Cubic Feet Compact Reversible Single Door Upright Freezer Single Doors Locker Storage

Indiana Dept Of Revenue Inrevenue Twitter

Image How Docker Containers Simplify Microservice Management And Deployment Washington Apple Simplify Deployment

State Form 56163 Download Fillable Pdf Or Fill Online Collection Of Payment Information Indiana Templateroller

2

2

Dor Stages Of Collection

Bank Deposit Slip Template Pdf Bank Deposit Deposit Bank

Flag Of Tennessee – Wikipedia Tennessee State Flag Tennessee Flag Tennessee

Pin On Rennie Ft Tree

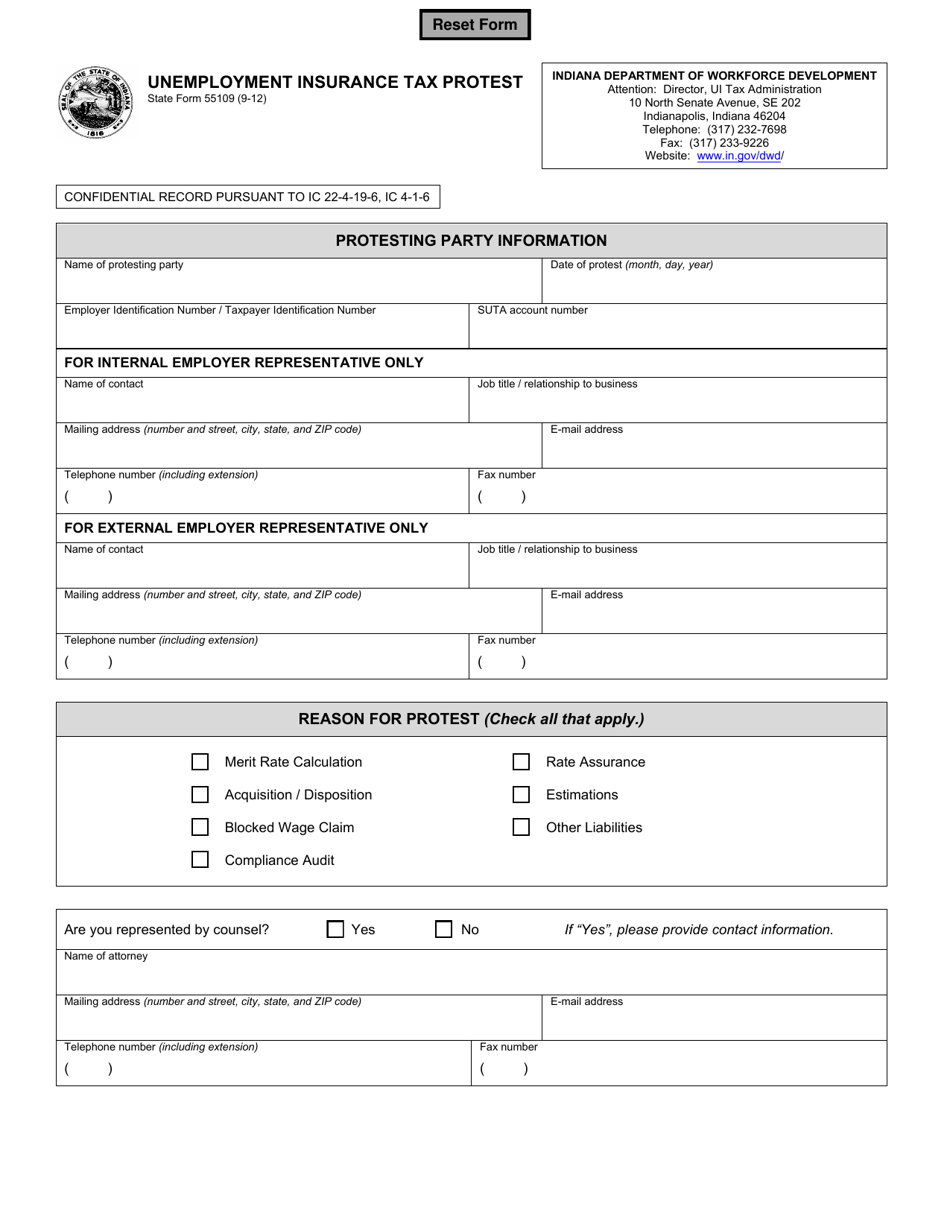

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Dor Businesses Submit A Refund Request Online With Intime