Under pa tax law, if you have at least $8,000 of income that isn’t subject to employer withholding for 2020, you may be required to make estimated payments or. The local earned income tax filing deadline.

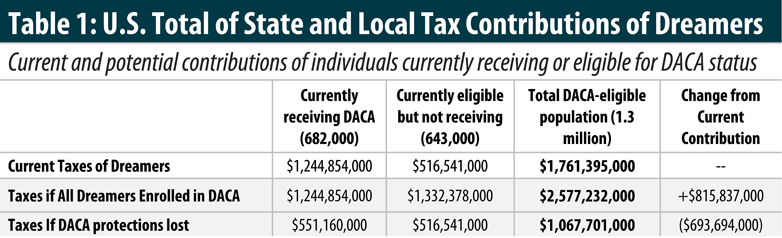

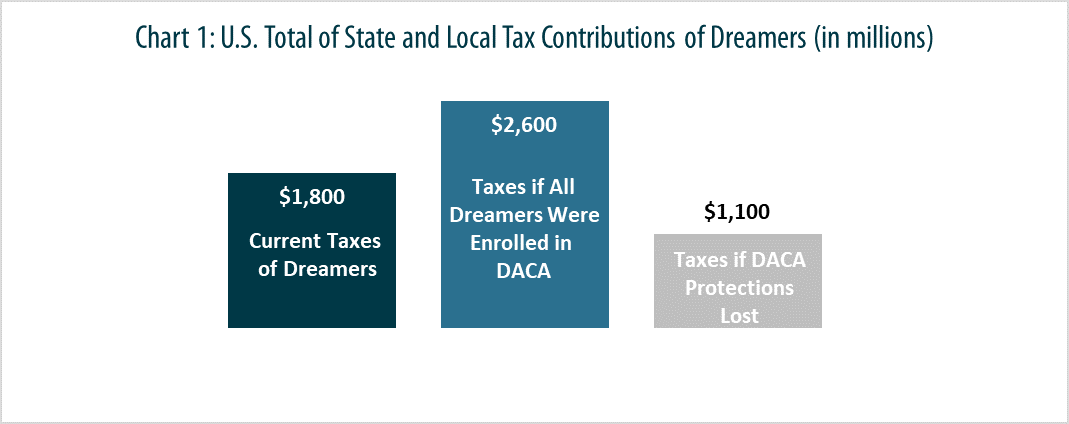

State Local Tax Contributions Of Young Undocumented Immigrants Itep

Of revenue (pdor) state law requires that the pa and federal tax due dates be tied together.

Pa state and local tax deadline 2021. State tax deadline extensions for 2021 anders state and local tax tax in response to the federal government’s deadline extensions for federal income tax filings and payments , many states are now extending deadlines for state taxes and payments. These rates are effective jan. According to the pa dept.

However, while taxpayers had until july 15, 2020 to file 2019 returns, this year’s deadline is only extended to may 17, 2021. The local earned income tax filing deadline is accordingly extended to match the state and federal date of may 17, 2021. Keystone collections said today, the local earned income tax filing deadline has not been extended beyond the april 15, 2021 due date.

The deadline for filing your local tax returns has not changed. Revenue department releases october 2021 collections. Pennsylvania law requires the deadline for filing state income.

Quarterly filings and remittances are due within 30 days after the end of each calendar quarter. This means taxpayers will have an additional month to file from the original deadline of april 15. Pennsylvanians should check with their local taxing authorities to determine whether an extension has been granted.

The final estimated payment for 2020 is due on jan. The federal and state government approved a delay for the filing and payment of 2020 income taxes, but without action from the pennsylvania general assembly, local tax returns are still due next week. Are you a pennsylvania resident who owes estimated personal income tax?

The irs announced extensions to the deadlines for filing and paying 2020 federal income tax returns. Pennsylvania is delaying the deadline to file state income taxes.the pennsylvania department of revenue announced thursday that the deadline for. This means taxpayers will have an additional month to file from the original deadline of april 15.

Harrisburg, pa — many pennsylvanians who may be eligible for a refund or reduction of their pennsylvania personal income taxes will be receiving lette. Adams, bucks, butler, cambria, chester, dauphin, erie, fayette, franklin, indiana, lackawanna, lancaster, lawrence, lehigh, luzerne, monroe, montgomery, northampton and. But it may not matter that much.

The pennsylvania department of revenue alerts taxpayers that the filing and payment due dates for 2020 pennsylvania personal income tax returns have been extended to may 17, 2021. The department of revenue has announced the deadline for taxpayers to file their 2020 pennsylvania personal income tax returns and make final 2020 income tax payments is extended to may 17. The pa department of revenue and the irs announced that the income tax filing deadline for the final annual return (2020) is extended to may 17, 2021.

In addition, the deadline for filing local tax returns and making local income tax payments may still be today, april 15, 2021. The annual assessment appeal deadline of august 1, 2021 for assessed values effective for tax year january 1, 2022 is quickly approaching for the following pennsylvania counties: Pennsylvania has extended its personal income tax deadline, to may 17, 2021 to coordinate with the extended federal tax return deadline.

While this extends the deadline for the 2020 individual income tax returns, the first. Tax filing deadlines extended to may 17, 2021. Pennsylvania extends personal income tax filing deadline to may 17, 2021.

Harrisburg, pa — the department of revenue today announced the deadline for taxpayers to file their 2020 pennsylvania personal income tax returns and make final 2020 income tax payments is extended to may 17, 2021. Internal revenue service, irs, pennsylvania department of. Keep in mind that your state income tax filing due date may be different than the federal deadline.

While the pa department of revenue and the irs announced. Irs and pennsylvania have recently announced an extension to the 2020 individual income tax filing deadline from april 15, 2021 to may 17, 2021. Withhold and remit local income taxes if applicable, provide your local tax id number to your payroll service provider.

Harrisburg, pa — the department of revenue today announced the deadline for taxpayers to file their 2020 pennsylvania personal income tax returns and make final 2020 income tax payments is extended to may 17, 2021. The pa department of revenue and the irs announced that the income tax filing deadline for the final annual return (2020) is extended to may 17, 2021. The pandemic changed a lot of things, including the tax deadline which would normally be april 15.

March 18, 2021 at 12:59 pm. This means taxpayers will have an additional month to file from the original.

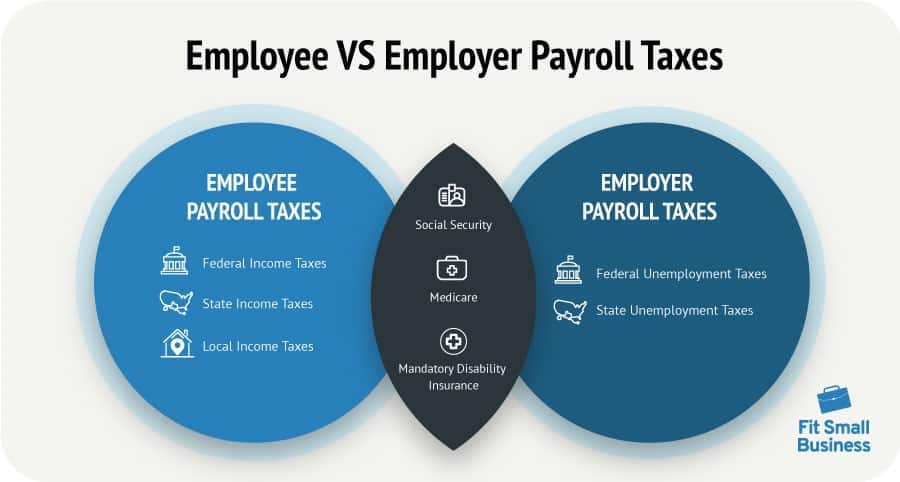

2021 Federal State Payroll Tax Rates For Employers

Floridas State And Local Taxes Rank 48th For Fairness

Pennsylvania Tax Rate Hr Block

State Income Tax – Wikiwand

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

State Income Tax – Wikiwand

Here Are Key Tax Due Dates If You Are Self-employed Forbes Advisor

Pennsylvania Sales Tax – Small Business Guide Truic

Us State And Local Tax Changes Due To Covid-19 – Our Commercial Real Estate Services Altus Group

Borough Of Avalon Tax Office

Pennsylvania Property Tax Calculator Smartassetcom Tax Refund Calculator Income Tax Property Tax

State Local Tax Contributions Of Young Undocumented Immigrants Itep

State Income Tax – Wikiwand

I Forgot To File My Taxes – Now What Community Tax

Pennsylvania State Tax Refund – Pa State Tax Brackets Taxact Blog

York Adams Tax Bureau – Pennsylvania Municipal Taxes

State Income Tax – Wikiwand

Taxes Warwick Township Bucks County

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center