A business paying taxes in pennsylvania can receive up to a. The amount of tax credits available under the ostc program increases to $55 million.

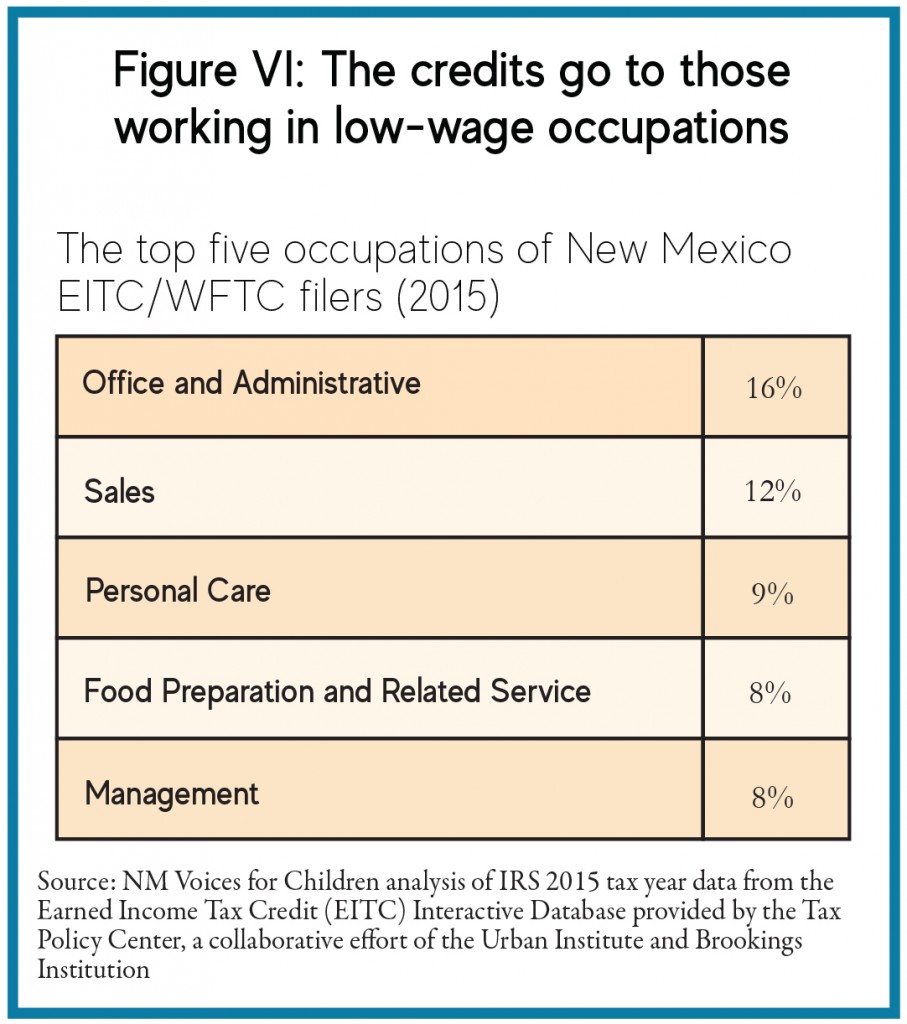

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

1520 locust st., suite 901:

Pa educational improvement tax credit application. College settlement is an educational improvement organization (eio) approved by the commonwealth of pennsylvania’s department of community and. An application must be submitted to the pa department of community and economic development. Eligible companies may take up to $750,000 in tax credits per fiscal year.

Joining an spe enables pennsylvania taxpayers the ability to receive a credit up to 90% of the. Businesses pennsylvania businesses can begin applying for opportunity scholarship tax credits through dced’s electronic single application system. If additional lines are needed, make a copy of this schedule to ensure all required information is provided.

Do not use the single application. The pennsylvania department of community and economic development (dced) has approved the foundation for free enterprise education as an educational improvement organization (eio) under the educational improvement tax credit (eitc) program. The business application guide explains the process of applying.

To shareholders, members or partners. Pennsylvania educational improvement tax credits. Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made.

All applications received on a specific day will be processed on a random basis before moving on to the next day’s applications. Applicants can contact the tax credit division at 717.787.7120 to be connected to their assigned project analyst. Pennsylvania's educational improvement tax credit (eitc) apply for pa tax credits available to eligible businesses contributing to scholarship organizations such as ceo america the children's educational opportunity fund.

That allowance has nearly quintupled since the eitc program began in 2001. If applicant is a business: Enter the applicant's name as registered under the federal employer identification number or social security number.

Dced will no longer require applicants to mail the signed signature page. Tax credit applications will be processed on a first. Individuals may now join a special purpose entity (spe) that allows personal tax liabilities to flow through it, allowing them to participate.

The additional $5 million must be used to provide tax credits for contributions from business firms to increase the scholarship amount to students attending an economically disadvantaged school by up to $1,000 more than the amount provided during the immediately. Name and address of each owner having an interest in the entity. Irrevocable election to pass educational improvement tax credit (eitc)/opportunity scholarship tax credit (ostc) through.

How does a pass through entity that is granted an educational improvement tax credit make an election to pass through the credit to the owners? Pennsylvania businesses can apply for eitc credits through the pa department of community & economic development’s electronic single application system which can be accessed by clicking here. The business application guide explains the process of applying.

Pittston area educational improvement organization: Tax credit cannot be switched to the more popular education improvement (ei) tax credit in. Eitc provides companies with a 75% tax credit for donations to approved nonprofit educational improvement organizations (such as community giving foundation).

Key features of the eitc: A separate election must be submitted for each year an eitc/ostc is awarded. Applications will be approved until the amount of.

Improvement or opportunity scholarship tax. Application information from the pennsylvania department of community and economic development. Businesses making an eio donation may be eligible to receive a tax credit of 75% for a one year commitment or 90% for a two year commitment.

This tax credit increases to 90% if a company commits and is approved to making the same donation for two consecutive years. Here is the link to their website: 90% tax credit for donors with 2 year commitment.

In the educational improvement tax credit (eitc) and opportunity scholarship tax credit (ostc) programs. The average scholarship size is about $2,000, which is only about 13 percent of the average expenditure per student at pennsylvania’s district schools.

Ratios Analysis Financial Statement Analysis Financial Statement Financial Ratio

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Eitcostc Program – Aim Academy

Defaulted Student Loans – Help With Defaulted Student Loans Get Help With Defaulted Student Loans In Student Loan Default Student Loans Student Loan Help

Return On Net Assets Formula Examples How To Calculate Rona Accounting And Finance Valuing A Business Time Value Of Money

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

The Diploma In Accounting Is A 2 12 Year Programme That Provides Students With Knowledge And Skills In Financial Acc Accounting Financial Accounting Economics

Western Pennsylvania Montessori School

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Five Ways To Save For A Home Loan Visually Home Loans Home Improvement Loans Loan

New Mexicos Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

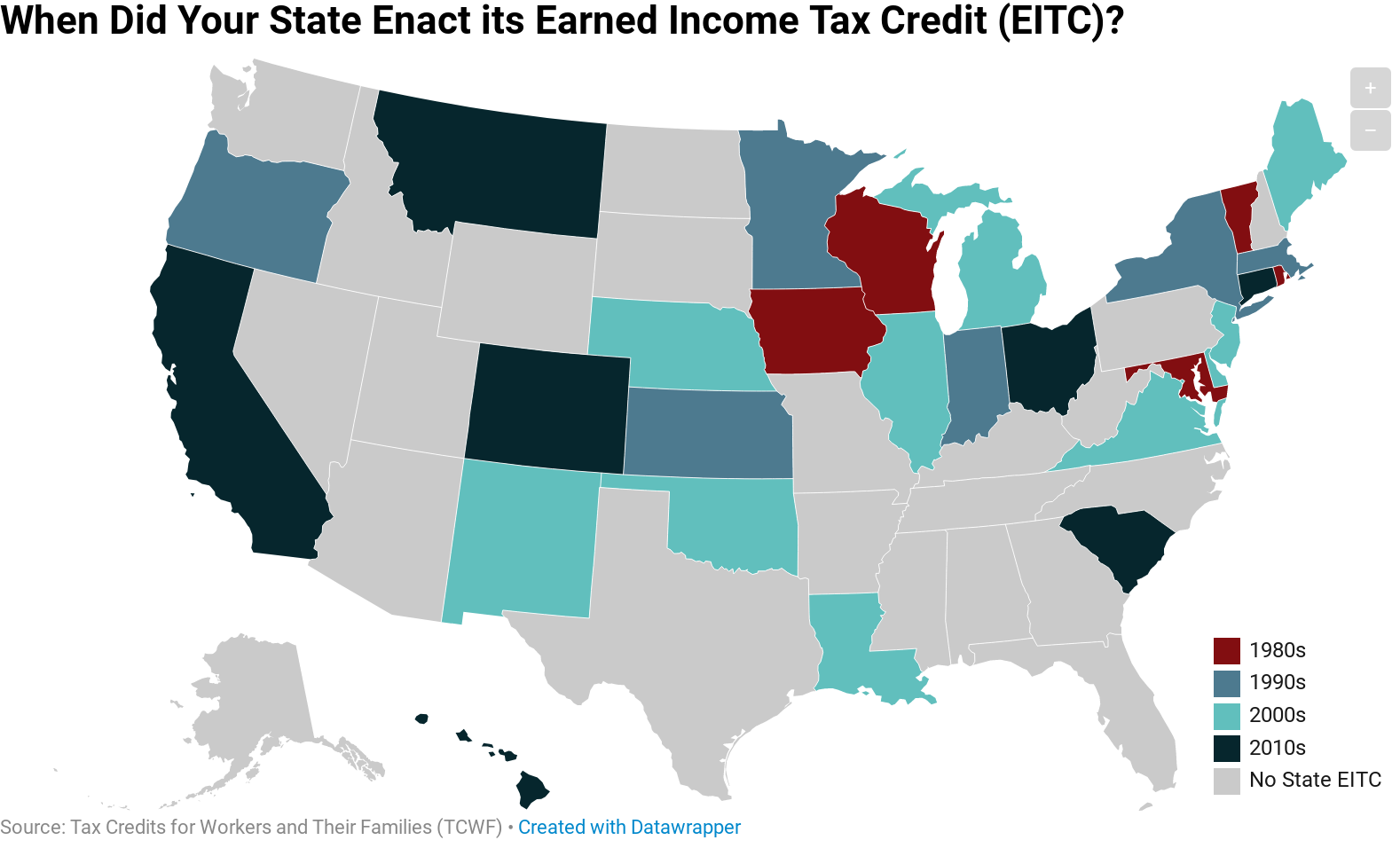

When Did Your State Enact Its Eitc Itep

Redesign Slated For Loan Forms – Real Estate Agent And Sales In Pa Loan Application Lettering Application

Quidco Business Model Canvas In 2021 Business Model Canvas Business Model Canvas Examples Business Canvas

Controller Business Manager Resume Sample Free Resume Sample Manager Resume Resume Resume Template Examples

Browse Through A Comprehensive Range Of Savings Accounts With High Interest Rates That Are Offered By Yes Bank Savings Account Saving Bank Account Accounting

Eitcostc Program – Aim Academy