This allows the rate to be reduced in 2020. For 2019, our analysts recommend lowering the assessment from 2.8 cents per hour worked in 2018 to 2.4 cents per hour worked in 2019.

Beware The State Of Your Workers Compensation Coverage – Psa Insurance And Financial Services

Note this assessment tax is different and in addition to the premiums you pay for workers’ comp coverage.

Oregon workers benefit fund tax rate. Effective jan.1, 2022, the department determined an assessment rate of 9.8 percent of direct earned premium is necessary for the department to carry out its statutory responsibility to regulate, administer, and enforce the workers’ compensation Employers and employees split this assessment, which employers collect through payroll. For calendar year 2016 the rate is 3.3 cents per hour (this rate has not changed for several years).

Www.oregon.gov/employ * base rates (medium density. 2.2 cents per hour worked. The announcement states, “despite facing the highest unemployment rate in oregon’s history, the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule, with an average rate of 2.26 percent on the.

.028 times number of hours worked. Departments through quarterly payroll tax reports, and the revenue is transferred to dcbs. For 2022, our analysts recommend no change in the current assessment, which means it would remain at 2.2 cents per hour worked.

Effective date of closure:_____ 2.still in business, but have no paid employees. The oregon employment department mails notifications to businesses regarding their individual tax rates and encourages employers to wait until they receive their individual notice before attempting to contact the department with questions. This tax rate is the same for all employers, and is normally calculated automatically in your payroll software.

2021 tax rates and breakdown of changes for oregon employers. Employers and employees split this assessment, which employers collect through payroll. General oregon payroll tax rate information.

The weekly benefit amount is 1.25% of the total base year wages but with a fixed lower limit of 15% and an upper limit of 64% of the state average weekly wage in covered employment. Workers’benefit fund (wbf) assessment this rate complies with the statutory requirement that dcbs maintain a fund balance sufficient to provide uninterrupted benefits and services to insured workers, despite revenue fluctuations that have occurred due to uncertain economic conditions. *virtual public hearing set for.

Tax rate increased more than 1.0 percentage point and not more than 1.5 percentage points will be eligible for 50 percent of their deferrable ui taxes forgiven; Tax rate increased 0.5 to 1.0 percentage point will be eligible for deferral only; The federal treasury direct website shows that despite having the highest ui benefit claims in oregon's history, oregon's ui trust fund balance was $3,781,391,672 as of january 31, 2021.

One half (.014) is withheld from the employee’s check and matched by employer contribution of (.014) times number of hours worked, deposited to state with. Benefit amounts are set by law as a percentage of the wages received during the base year. 1, 2021, this assessment will see no change, remaining at 2.2 cents per hour or partial hour worked by each person that an employer must cover or

Oregon workers benefit assessment tax: Employers can deduct 1.1 cents per hour from employees if they choose to have employees pay a portion of the 2.2 cents per hour employer tax. Ui trust fund fact sheet.

In 2021, this assessment is 2.2 cents per hour worked. Line 10 of the formula can be set up one of two ways, depending on how your company decides to. This allows the rate to be reduced in 2019.

You are responsible for any necessary changes to this rate. The rate is unchanged from 2021. For 2020, our analysts recommend lowering the assessment from 2.4 cents per hour worked in 2019 to 2.2 cents per hour worked in 2020.

This tax is paid directly to the state of oregon along with your state income, state. Do include clergy hours for the worker’s benefit fund assessment tax (see below). Employers and employees split the cost.

(oregon only) 2017 tax rate: Employers and employees split the cost. Workers' benefit fund (wbf) 2018 assessment rates:

The wbf is healthy, made so by a growing economy, which positively affects the assessment because it’s based on hours worked. •use this form to update your workers’ benefit fund assessment account* business name oregon business identification number (bin) changes in status (check and complete all that apply) 1.no longer in business. The purpose of the tax is to help fund programs in oregon to help injured workers and their families.

Departments through quarterly payroll tax reports, and the revenue is transferred to dcbs. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule, with an average rate of 1.97 percent on the first $47,700 paid to each employee. 2.8 cents per hour combined employer & employee rate 1.4 cents per hour employer rate, 1.4 cents per hour employee rate workers’ compensation effective 7/1/17 effective 7/1/18 agency websites dept.

Wbf assessment rate employer's portion worker's portion; Contact the ui tax division. If the oregon worker benefit fund (or wbf) tax rate is changing in january (any year.)

1, 2022, this assessment will see no change, remaining at 2.2 cents per hour or partial hour worked by each person an employer must cover or chooses Tax rate increased more than 1.5 percentage points and not more than 2.0 percentage points will be eligible for 75 percent of their deferrable ui taxes forgiven Departments through quarterly payroll tax reports, and the revenue is transferred to dcbs.

The wbf assessment rate (which varies from year to year) is x.xx cents for each hour or partial hour worked. Also, effective january 1, 2021, oregon’s unemployment taxable wage base will increase to $43,800, up from $42,100 in 2020. See the department's faqs and fact sheet for more information on the 2021 rate schedule projection and go here for general information on how oregon sui tax.

The wbf is healthy, made so by a growing economy, which positively affects the assessment because it’s based on hours worked. Ui trust fund and payroll taxes faq. For agency information, please see oregon workers' compensation division website.

2021 ui tax relief fact sheet.

Oregon Workers Benefit Fund Wbf Assessment

Carve-outs In Workers Compensation An Analysis Of Experience In The California Construction Industry

What Is Workers Compensation Fraud Fighting Fraudulent Claims

Quotes About Employee Compensation 38 Quotes

Permanent Disability Pay In California Workers Comp Cases 2021

Quotes About Employee Compensation 38 Quotes

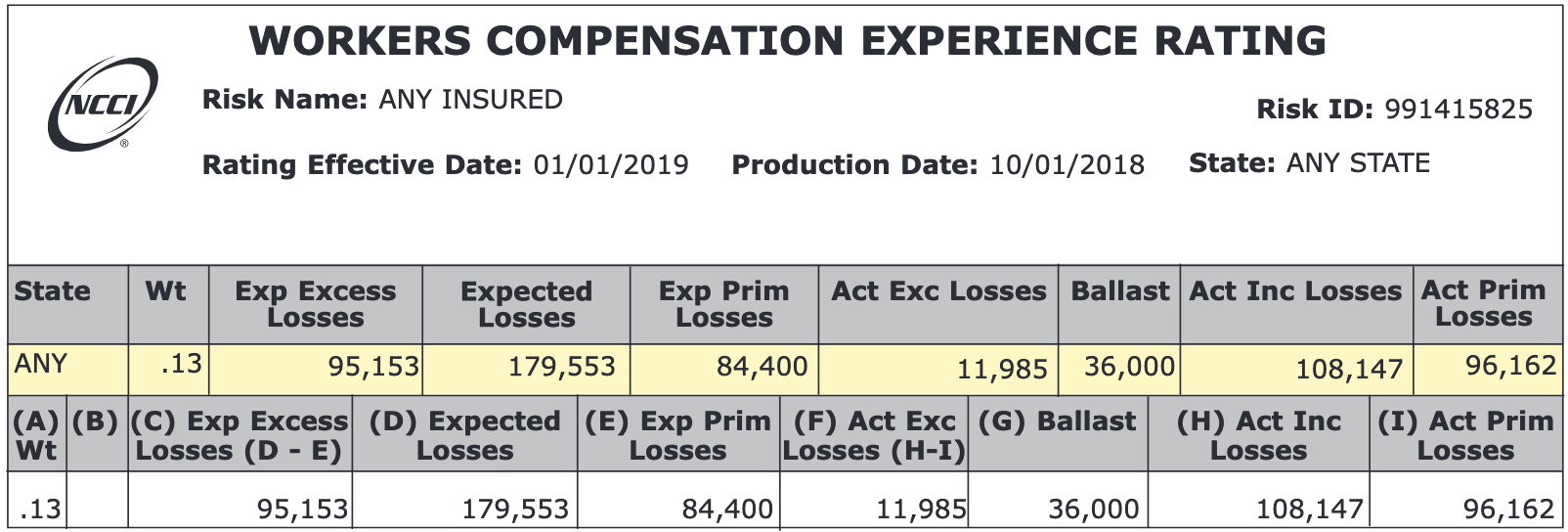

Understanding Your Workers Comp Ex-mod Factor – Payrollmedics Payroll Workers Compensation Hr Solutions

2

Terminating An Employee On Workers Compensation Nsw Owen Hodge Lawyers

Permanent Disability Pay In California Workers Comp Cases 2021

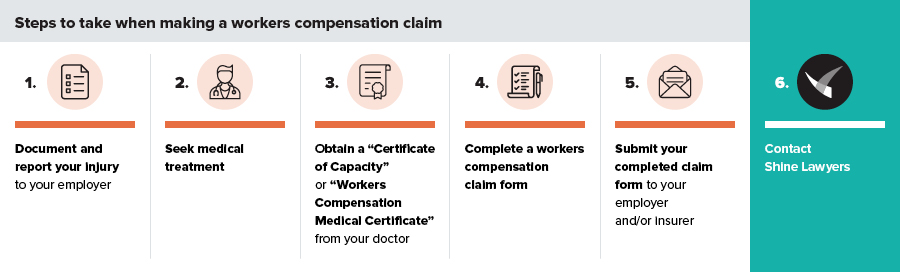

Workers Compensation Stress Claims No Win No Fee Shine Lawyers

Permanent Disability Pay In California Workers Comp Cases 2021

How Much Does Workers Comp Insurance Cost Calculator – Embroker

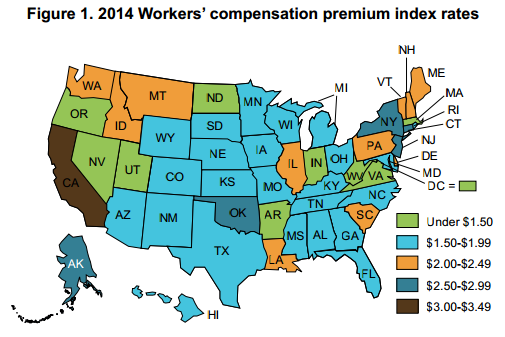

How States Rank High To Low In Workers Compensation Premiums

What Wages Are Subject To Workers Comp – Hourly Inc

Permanent Disability Pay In California Workers Comp Cases 2021

Do Sole Proprietors Need Workers Compensation Insurance Insureon

Workers Compensation Insurance Requirements Costs More

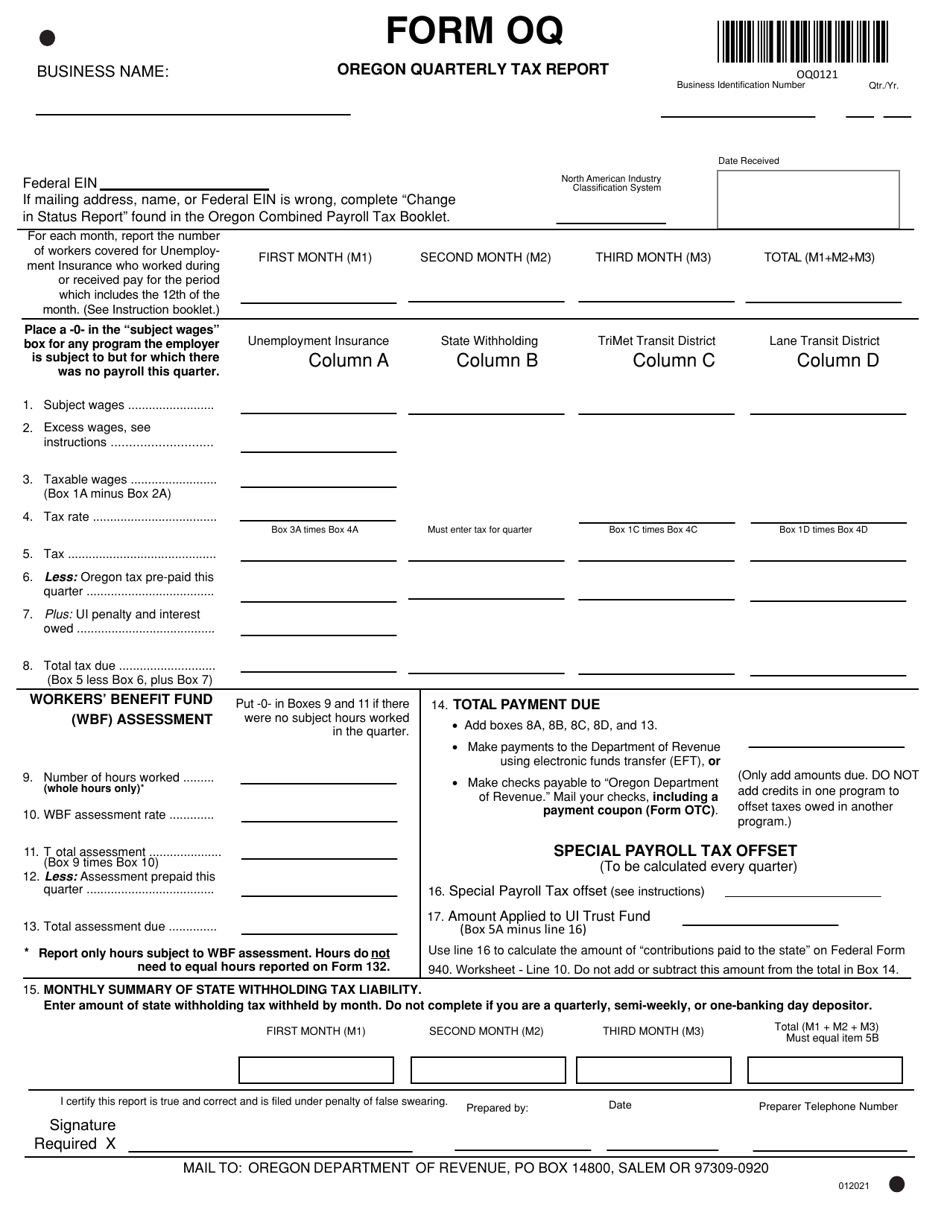

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller