Oregon salary tax calculator for the tax year 2021/22. This change is effective for calendar year 2019.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

(b) $500,000 or more, but less than $1 million, the minimum tax is $500.

Oregon statewide transit tax import format. Less than $500,000, the minimum tax is $150. Even though such organizations may be exempt from paying income tax. Any individual or organization with employees working for pay is an employing unit.

The file types are efw2, fixed width, delimited, and excel. (d) $2 million or more, but less than $3 million, the minimum tax is $1,500. Select the states in which you do business.

Oregon tax prepaid this quarter. (c) $1 million or more, but less than $2 million, the minimum tax is $1,000. Taxpayers may also file these returns by paper or electronically via revenue online.

Finally, some countries provide export subsidies; These charges are not due until the goods are arriving at the destination country. Your browser appears to have cookies disabled.

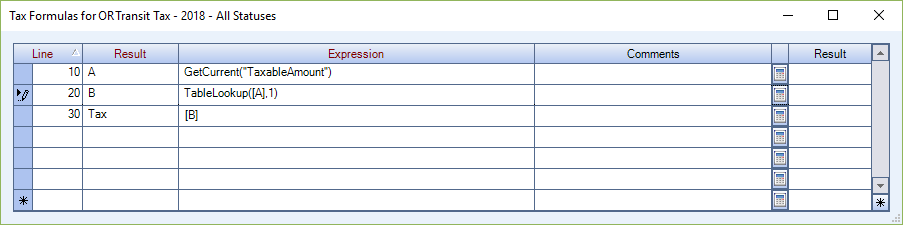

Oregon employers must withhold 0.1% (0.001) from each employee’s gross pay. At this time, the state wide transit tax will not be included in oprs. Find the average local tax rate in your area down to the zip code.

Employing units, which meet any of the following criteria, are employers for purposes of employment department law: Because oprs was already in development when the tax was introduced the department of revenue will continue to manage that tax. Withhold the state transit tax from oregon residents and nonresidents who perform services in oregon.

We publish tables based on our latest tax research, but downloaded tables become out of date as soon as state and local tax authorities make changes to tax laws and rules. Payment type code 04701, enter the amount for dealer vehicle use taxes followed by the terminator \ (backslash). Use this spreadsheet to import information.

Include any statewide transit tax credits used. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates. The returns supported for bulk filing are:

The oregon tax payment system uses the ach debit method to make an electronic funds transfer (eft) to the state of oregon for combined payroll taxes or corporation excise and income taxes. If you imported in otter, there is no need to change how your file is formatted. You are able to use our oregon state tax calculator to calculate your total tax costs in the tax year 2021/22.

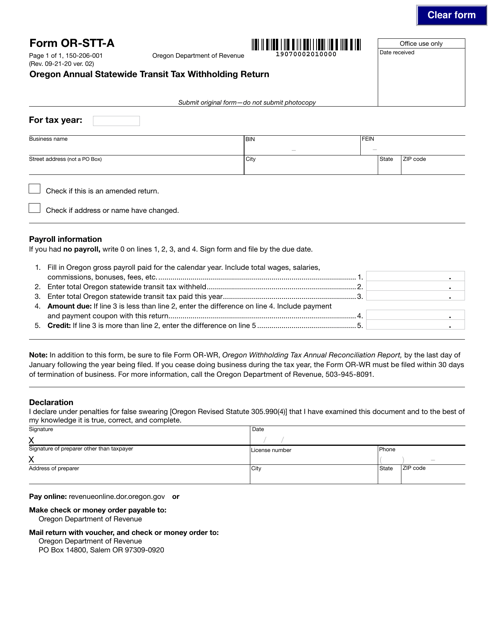

Blank fields do not qualify as a complete, filed form. File electronically using revenue online. Visit our forms page and search for stt. fill out the form and mail to:

Do not return the form with blank fields; However, that is not to say that it won’t ever be. Import subsidies are rarely… read more;

0 out of 1 found this helpful. A transit duty, or transit tax, is a tax levied on commodities passing through a customs area en route to another country. Payment type code 01113, enter the amount for statewide transit taxes followed by the terminator \ (backslash).

Cookies are required to use this site. (e) $3 million or more, but less than $5 million, the minimum tax is $2,000. Our calculator has been specially developed in order.

Similarly, an export duty, or export tax, is a tax imposed on commodities leaving a customs area. Statewide transit tax import template. Oregon employers are responsible for withholding the new statewide transit tax from employee wages.

What is the oregon transit tax? The oregon transit tax is a statewide payroll tax that employers withhold from employee wages. In oprs, you can import the same file formats that you previously used in otter.

Accept the default prompts that display in the excel format options window by clicking the ok button. Payment type code 01102, enter the amount for trimet transit taxes.

Oregon Statewide Transit Tax

How To Transfer Your Oregon Transit Tax Information From Sage 100 To The State

Ezpaycheck How To Handle Oregon Statewide Transit Tax

How To Transfer Your Oregon Transit Tax Information From Sage 100 To The State

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Form Or-stt-a 150-206-001 Download Fillable Pdf Or Fill Online Oregon Annual Statewide Transit Tax Withholding Return Oregon Templateroller

Oregon Statewide Transit Tax

How To Transfer Your Oregon Transit Tax Information From Sage 100 To The State

2

How To Transfer Your Oregon Transit Tax Information From Sage 100 To The State

2

Download Instructions For Form Or-stt-a 150-206-001 Oregon Annual Statewide Transit Tax Withholding Return Pdf Templateroller