• underpayment interest on estimated payments. 31 is deadline for 2016 virginia529 contributions.

Oregongov

To get started you can deposit $25 or set up a payroll deduction or automatic monthly plan.

Oregon 529 tax deduction 2019 deadline. Oregon exceptions to federal tax law: Single filers can deduct up to $2,435. Of course, your total amount in the plan can be higher as your investments group.

The oregon college savings plan’s carry forward option remained available to savers through december 31, 2019. If you currently take advantage of this option, you are able to carry forward your unused subtraction over the following four years. In the past, contributions to the oregon 529 plan were deductible on your oregon state income tax return, up to certain limits.

Oregon has a rolling tie to changes made to the definition of federal taxable income, with the exceptions noted below. Contributions must be made by december 31, 2016 to be deductible for the 2016 tax year. If you are an oregon resident and work for an employer outside of oregon, your employer isn't required to withhold the tax on your behalf but may choose to do so voluntarily.

If you currently take advantage of this option, you are able to carry forward your unused subtraction over the following four years. Contribution deadlines for state income tax benefits. The oregon college savings plan’s carry forward option remained available to savers through december 31, 2019.

In 2019, individual taxpayers were allowed to deduct up to $2,435 for contributions made to the oregon college savings plan, while those filing jointly could deduct $4,865. Oregon college savings plan gives $25 to kindergartners (08/02/2019) oregon college savings plan launches savings match plan (09/18/2019) oregon tax deduction to. In 2020 and beyond, there will be an oregon state income tax credit, instead of the deduction.

You get a tax deduction for every dollar you contribute up to the maximum deductible amount. Families can deduct up to $4,865 worth of these contributions from their state tax returns. The new tax credit would be in.

If you currently take advantage of this option, you are able to carry forward your unused subtraction over the following four years. 529 plan contributions are not deductible from federal income tax, but over 30 states offer a state income tax deduction or state income tax credit for 529 plan contributions.in most states the deadline to qualify for an annual state income tax benefit is december 31, but six states have contribution deadlines in april. Most states set a december 31 deadline, but georgia, mississippi, oklahoma, oregon, south carolina and wisconsin give you until april 15, 2019 (and iowa gives you until may 1,.

Currently, you can contribute until your account balance is $310,000 or higher in your oregon 529 plan. Contribution deadline for 2020 state income tax deduction. Your 2019 oregon tax is due july 15, 2020.

The credit replaces the current tax deduction on january 1, 2020. Currently, the deduction is based strictly on contributions: You may elect to carry forward a balance over the following four years for contributions made before the end of 2 019, in order to help distribute your tax deduction potential.

Most states have a december 31 deadline for 529 plan contributions to qualify for a tax benefit, but six states have april deadlines. For a short window of time, oregon taxpayers can qualify for both a deduction and a credit over the next four years. For all other purposes, oregon is tied to federal income tax laws as amended and in effect on december 31, 2018.

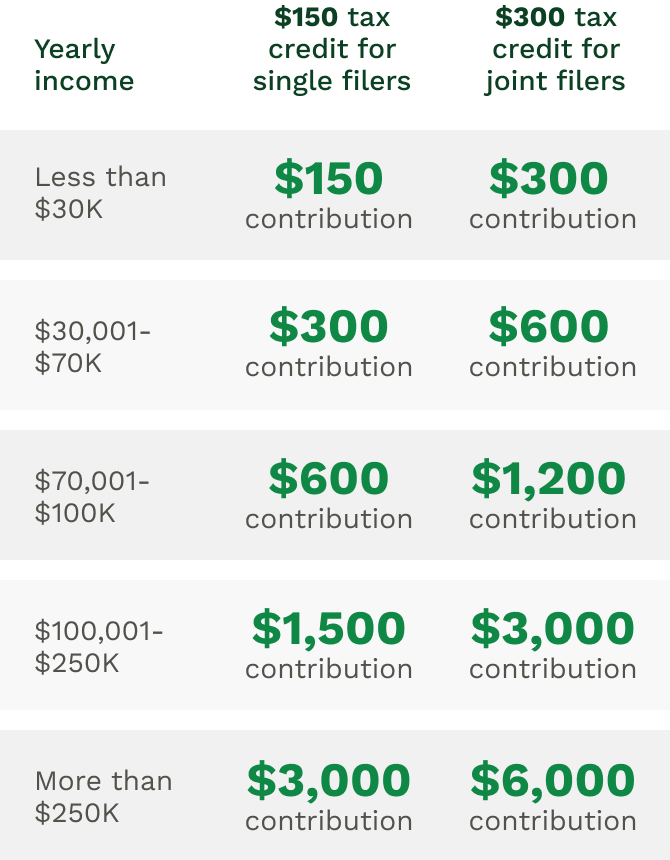

Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. If you are a resident of oregon, contributions made to any account in the oregon college savings plan are eligible to receive a state income tax credit up to $300 for joint filers and up to $150 for single filers. Federal deadline for payments and returns due after september 7, 2020 extended to january 15, 2021.

There is also an oregon income tax benefit. The oregon college savings plan is moving to a tax credit starting january 1, 2020. In 2020, contributions and the principal portion of rollover contributions of up to $3,340 per beneficiary per year ($1,670 for those married filing separately or divorced), are deductible from wisconsin state income tax.

And oregonians can still take advantage of this perk based on the contributions they made before december 31, 2019. Minimum contributions if you use payroll deduction are only $15. The new tax credit would be in addition to any carried forward deductions.

• penalty and interest upon request. The oregon college savings plan’s carry forward option remained available to savers through december 31, 2019. Contributions and rollover contributions up to $2,435 for a single return and up to $4,865 for a joint return are deductible in computing oregon taxable income.

But only on contributions made prior to december 31, 2019. The new tax credit would be in addition to any carried forward deductions. April 15, 2021 529 plan tax deduction:

Big Changes To Oregon 529 And Able Accounts – Jones Roth Cpas Business Advisors

Hfsplancom

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Deadlines 529 College-savings Plan Distributions Kiplinger

2019 Year-end Deadlines

Oregon College Savings Plan Changes Financial Freedom Wealth Management Group

Taxes Faqs Oregon College Savings Plan

Does Your State Offer A 529 Plan Contribution Tax Deduction

529 Plan Contribution Deadlines For State Tax Benefits

529 Plan Deductions And Credits By State Julie Jason

How Much Is Your States 529 Plan Tax Deduction Really Worth

The Or 529 Plan – No More Tax Deduction For Savers Springwater Wealth Management

Does Your State Offer A 529 Plan Contribution Tax Deduction

Tax Benefits Oregon College Savings Plan

How Much Can You Contribute To A 529 Plan In 2021

Oregongov

Big Changes To Oregon 529 And Able Accounts – Jones Roth Cpas Business Advisors

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Taxes Faqs Oregon College Savings Plan