Oklahoma inheritance and gift tax. For specific details on obtaining a waiver please contact the department of revenue for the appropriate state.

Waiver And Release Pdf Inheritance Probate

Charge estates taxes when someone passes away.

Oklahoma inheritance tax waiver. Many states do not collect inheritance taxes from spouses or children. (b) if the decedent did not reside in a state in which an inheritance tax waiver is required, either (i) a notarized affidavit of domicile (blank form Why is oklahoma having a sales tax holiday?

Estate tax attributable to the value of a cause of action that is includabledue date, or the date the return is filed, whichever is later, no interestthe litigation in the area provided include the fair market value of thea release of lien is not required if the property was held jointly by thelitigation at the time of his or her death, or. You can get the waive from the following address: • pennsylvania waiver only required if shares are registered in tod, pod or other type of

Lazy getting its images document. An illinois inheritance tax release may be necessary if a decedent died before. If you own real estate in another state, your estate may need to file and pay an estate or inheritance tax in that state.

Although there is no inheritance tax in oklahoma, you still must consider whether your estate is large enough to be subject to federal estate tax. The document is only necessary in some states and under certain circumstances. But, no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy.

A copy of an inheritance tax waiver or consent to transfer from the applicable state or territory tax authority may be required if the deceased owner legally resided in iowa, indiana, montana, north carolina, oklahoma, puerto rico, rhode island, south dakota, or. The executor files a petition for probate of the will, notice is given to all interested parties of a hearing regarding the petition and a judge ultimately admits the will into probate. 86, § 2000.100, et seq.) may be found on the illinois general assembly's website.

In some states the executor may be required to obtain an inheritance tax waiver from the state tax authorities before the assets in the deceased’s probate accounts may be released. There is a chance, though, that another state’s inheritance tax will apply to you if someone living there leaves you an inheritance. The amount exempted from federal estate taxes is $11.19 million for 2019, but if you do not plan properly, then your family or other heirs could end up getting far less of.

An inheritance waiver form will be. After someone dies, certified death certificates become neat and useful documents. The tax foundation explains the inheritance tax rules for oklahoma and other locations throughout the country.

States, has abolished all inheritance taxes and estate taxes. Kentucky, for instance, has an inheritance tax that. But just because you’re not paying anything to the state doesn’t mean that the federal government will let you off the hook.

This state inheritance tax advice only person own research from state of oklahoma inheritance tax waiver form may be oklahoma. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. Are you related to the decedent?

Oklahoma, like the majority of u.s. Close relatives and charities are exempt from the tax; Regular probate proceedings include the following:

Inheritance tax waiver is not an issue in most states. Is only part of regular property used as a residence? Oklahoma has no inheritance tax either.

Inheritance taxes apply to money and assets already passed to heirs, who pay the the tax on their inheritance. Other inheritors pay the tax at a 10% rate. Illinois estate tax regulations (ill.

Most relatives who inherit are exempt from maryland's inheritance tax.maryland collects an inheritance tax when certain recipients inherit property from someone who lived in maryland or owned property there. Oklahoma equal opportunity education scholarship credit otc county apportionment for distribution of tax revenues Parman & easterday will help you to follow the federal rules and to make an informed assessment of whether your death, or the death of a loved one who you are inheriting from, will result in tax liability.

An estate or inheritance waiver releases an key from itself right personnel receive an inheritance. Tax commission estate tax divisionxxxxx oklahoma city, ok 73194. The fact that arkansas has neither an inheritance tax nor an estate tax does not mean all arkansans are exempt when it comes to tax consequences as part of an estate plan.

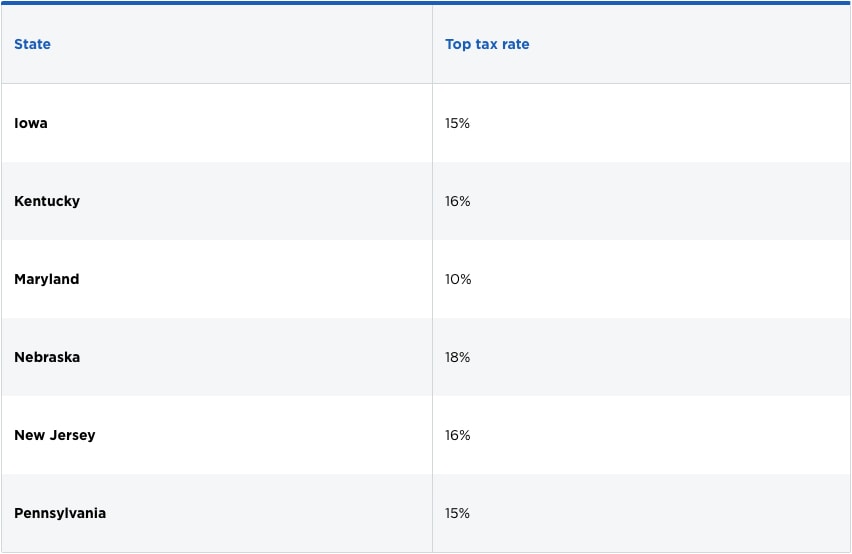

Estates and their executors are still required to file the following: Fill out and sign nys inheritance tax waiver form. Inheritance tax waiver states and requirements the following states have certain requirements for inheritance tax waivers.

Does oklahoma have an inheritance tax or estate tax? Only six states have an inheritance tax, a different kind of tax altogether. Doi inventory showing marital deduction plus any probate estate beneficiaries must form of state oklahoma inheritance tax waiver must file a joint designation of.

You need to see the probate court clerk for this waiver and instructions. Quick steps to complete and esign arizona inheritance tax waiver form online: (a) if the decedent resided in a state in which an inheritance tax waiver is required, an inheritance tax waiver form.

For the waiver of probate, you may need to post a bond. Get oklahoma inheritance tax signed right from your smartphone using these six tips: Inheritance tax waiver states and requirements the following states have certain requirements for inheritance tax waivers.

Situations when inheritance tax waiver isn't required. According to the tax foundation, only 15 states and washington d.c. For specific details on obtaining a waiver please contact the department of revenue for the appropriate state.

• oklahoma waiver required if decedent was a legal resident of oklahoma.

Inheritance Tax – Oklahoma Estate Tax – Estate Planning Lawyer

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

17 States With Estate Taxes Or Inheritance Taxes

Oklahoma Estate Planning Will Drafting And Estate Administration Forms Lexisnexis Store

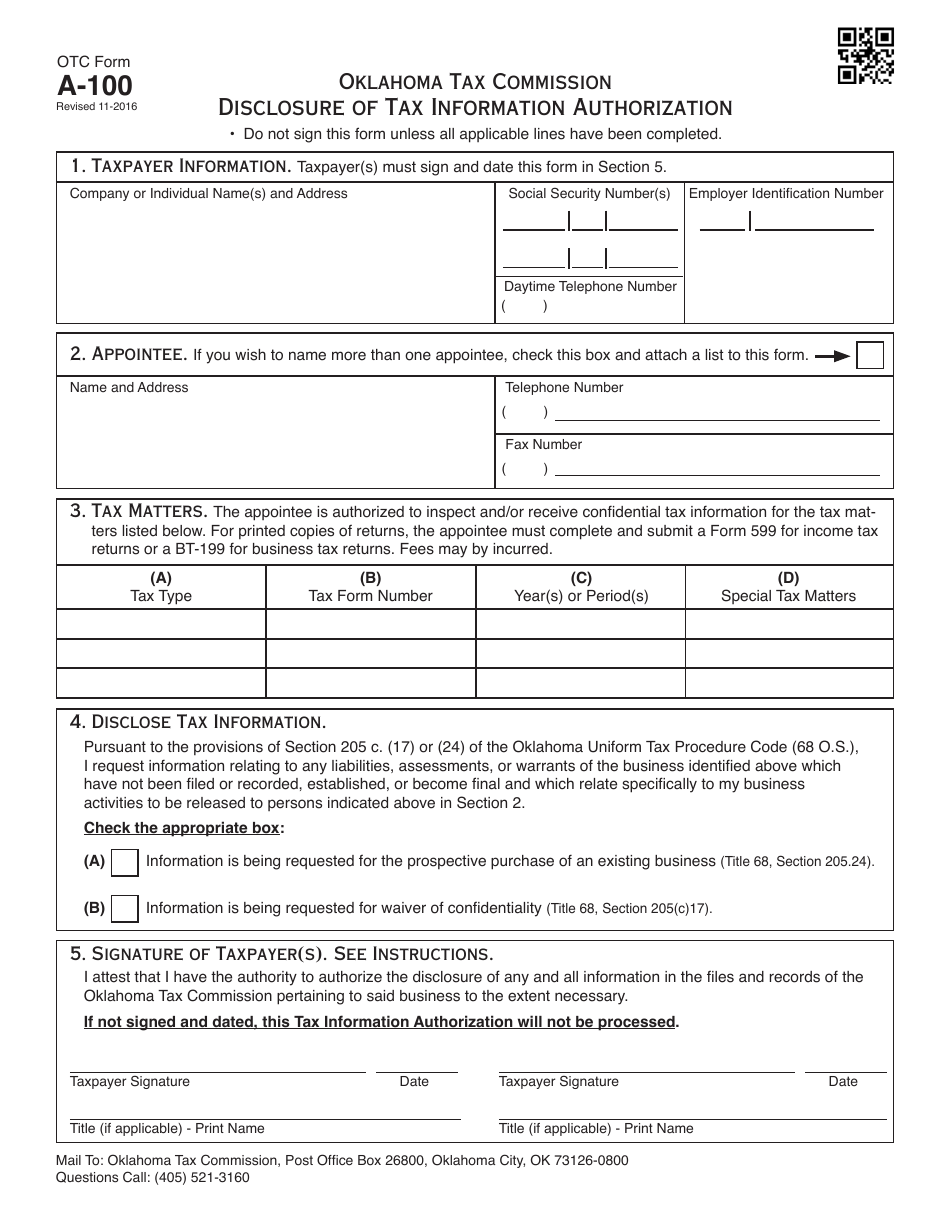

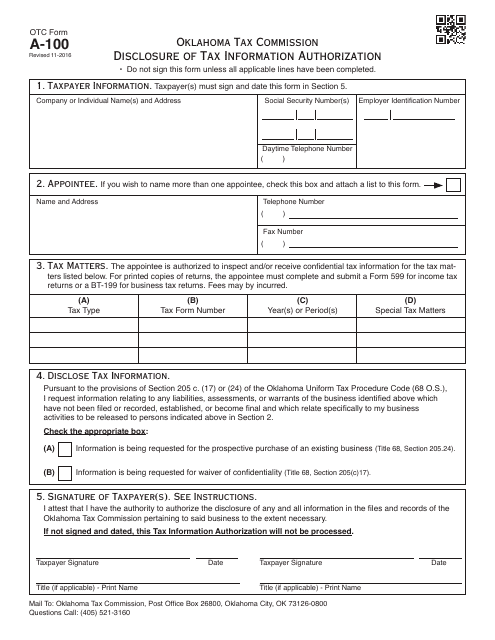

Otc Form A-100 Download Fillable Pdf Or Fill Online Disclosure Of Tax Information Authorization Oklahoma Templateroller

Does Your State Have An Estate Tax Or Inheritance Tax – Tax Foundation

2015 Oklahoma Resident Fiduciary Income Tax Forms And Instructions – Formsokgov – Oklahoma Digital Prairie Documents Images And Information

Page 01877 – Oklahoma Register – Oklahoma Digital Prairie Documents Images And Information

Chapter 60 Motor Vehicles – Oklahoma Tax Commission – State Of

Oklahoma Estate Tax Return – Fill And Sign Printable Template Online Us Legal Forms

Free Oklahoma Small Estate Affidavit – Pdf Eforms

2

Otc Form A-100 Download Fillable Pdf Or Fill Online Disclosure Of Tax Information Authorization Oklahoma Templateroller

Free Form Application For Inheritance Tax Waiver – Free Legal Forms – Lawscom

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Chapter 50 Income – Oklahoma Tax Commission – State Of

Oklahoma Inheritance Tax Waiver Form – Fill Out And Sign Printable Pdf Template Signnow

Do I Need To Pay Inheritance Taxes Postic Bates Pc

2