The oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1000 or fraction thereof on the amount of capital allocated or employed in oklahoma. The maximum amount of franchise tax that a corporation may pay is $20,000.00.

Should The Wealthy Pay More Income Taxes Debate Divides Maryland Democrats Wamu

Further, similar to the income tax, the filing extension does not extend the due date for payment of the franchise tax.

Oklahoma franchise tax payment. Until processed by the oklahoma tax commission (otc). Determine the amount of franchise tax due. Typically, businesses must pay franchise tax annually.

Penalties can vary from state to state. Employees pay federal and state income taxes on their earnings. The tax rate is $1.25 for every $1000 of capital invested or used in oklahoma.

Corporations reporting zero franchise tax liability must still file an annual return. The report and tax will be delinquent if not paid on or before september 15. Oklahoma department of revenue, oklahoma tax oklahoma business corporate tax, oklahoma personal income tax, oklahoma sales tax rates what is the oklahoma corporate net income tax rate?

And interest for late payments of franchise tax, 100% of the franchise tax liability must be paid with the extension. How is franchise tax calculated? Oklahoma’s franchise tax is a tax on corporations for the privilege of doing business in the state.

Failure to pay privilege taxes to the state can result in a company becoming disqualified from doing business in the state and other penalties. Plus the oklahoma franchise tax of $1.25 for every $1000 of assets in oklahoma. The franchise tax is assessed at the rate of $1.25 per $1,000 or fraction thereof on the amount of capital allocated, invested, or employed in oklahoma, with a $250 minimum tax and $20,000 maximum tax.

The return status will remain as pending. If filing a consolidated franchise tax return for oklahoma, the oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Fiscal year and short period returns

The franchise tax payment is due at the same time as the corporate income tax. Visit tax.ok.gov to learn more about paying accounts online. If your state has franchise tax, you must pay it.

The franchise tax is calculated at the rate of $1.25 for each $1,000.00 of capital employed in or apportioned to oklahoma. Employers pay payroll tax on any wages paid to employees. You will be directed to the ok.gov quicktax payments screen and can make a payment for your return.

Some llcs pay oklahoma sales tax on products. Cash payment incentives the oklahoma quality jobs program (68 o.s. Foreign corporations are not obliged to pay the oklahoma franchise tax but are still liable for the $100 registered agent fee.

Pay your continuing education fees today! In oklahoma, the maximum amount of franchise tax a corporation can pay is $20,000. What are the oklahoma personal net income tax rates?

You will be directed to a confirmation screen and can make a payment by clicking the schedule payment button. When is my oklahoma franchise tax return due? The oklahoma insurance department accepts payments for:

We would like to show you a description here but the site won’t allow us. What is oklahoma’s franchise tax? The report and tax will be delinquent if not paid on or before september 15.

An alternative to paying by check or money order is to make an online payment. Only those corporations with capital of $201,000.00 or more are required to remit the franchise tax. § 3601) the oklahoma quality jobs program serves as an incentive for companies to expand or relocate jobs to oklahoma by providing a rebate of a portion of newly created payroll in the state.

Any taxpayer with an oklahoma franchise tax liability due and payable on or before july 1, 2021 will be granted a waiver of any penalties and/or interest for returns filed by august 1, 2021, provided payment is received by september 15, 2021. All agents/producers, csrs and adjusters are required to complete continuing education in order to renew their license through the oklahoma insurance department (oid). A submitted return may be withdrawn if it has not yet.

No Receipts No Problem Free Quotes Work On Yourself Receipts

California Ftb Rjs Law Tax Attorney San Diego

What Happens When You Dont Pay Your Franchise Tax Harvard Business Services

Franchise Tax Board Homepage Tax Franchising California State

1 New Message

Godzilla – Monsters Inc By Roflo-felorezdeviantartcom On Deviantart Godzilla Funny Godzilla Godzilla Franchise

Trifold Brochure For Two Men And A Truck Trifold Brochure Did Brochure

Consumer Reports Used Car Checklist Car Checklist Used Cars Mini Van

California Tax Forms Hr Block

Youve Ever Had To Deal With Delinquent Taxes And The Internal Revenue Service Then You Will Be A Bit Familiar Wit Tax Attorney Legal Services Tax Lawyer

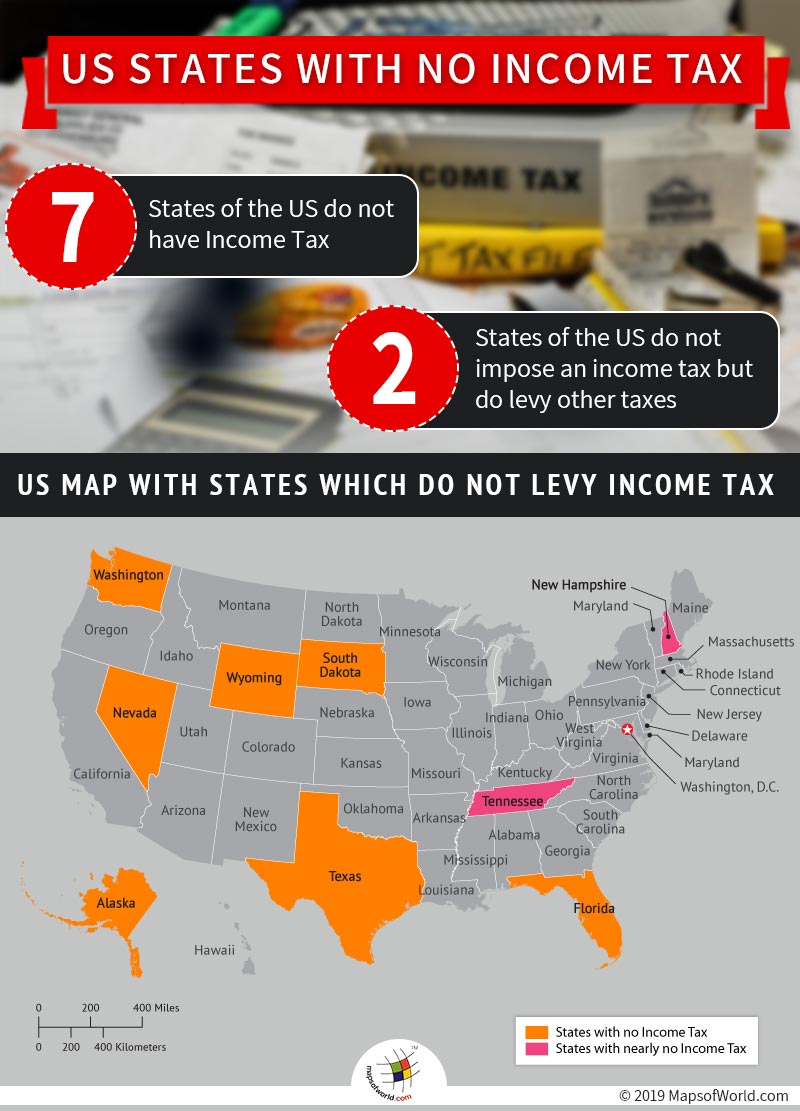

Which Us State Has No Income Tax – Answers

Franchise Tax What Is It – Fundsnet

What Is Franchise Tax Overview Who Pays It More

Lenfer Aucune Fureur Comme Hath Celle De Lirs Par The_gamerwithin Pokemon Drole Memes Droles Jeu Lol

California Tax Forms 2020 Printable State Ca 540 Form And Ca 540 Instructions

2

Will I Get Audited If I File An Amended Return Hr Block

Who Qualifies For The 600 California Payment Cbs8com

Franchise Tax Board Phone Number