• see page 16 for methods of contacting the oklahoma tax commission. As of march 7, 2021, the following states have stated they will accept the texas ice storm extended federal due date:

Oklahomagov

Franchise tax returns due july 1, 2015 or,.

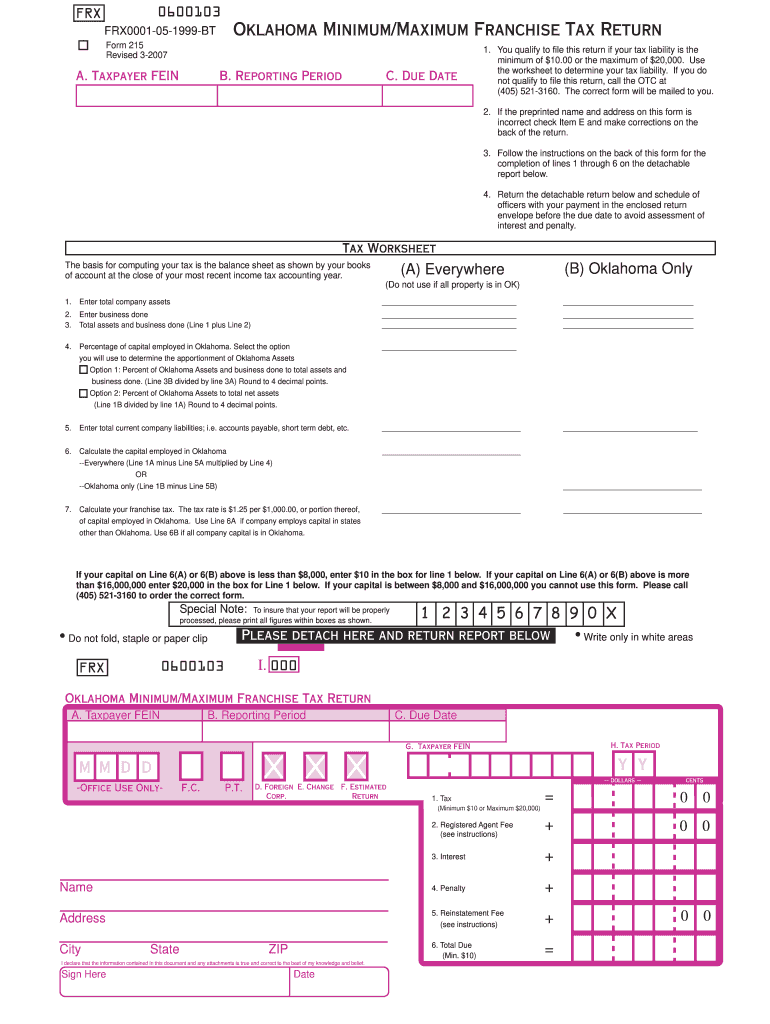

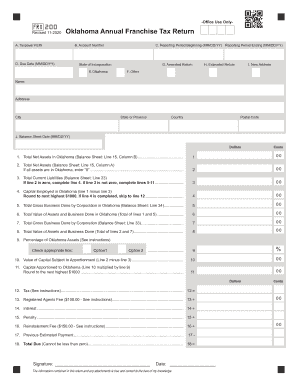

Oklahoma franchise tax due date 2021. Taxes first become due and payable. Fast, free, 24/7 online filing services at oktap.tax.ok.gov 5 2020 oklahoma corporation tax packet franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding income tax accounting year, or electing to change filing to match the due date of. 2020 tax payment deadline extension.

Oklahoma lps file annual certificate (report). The report and tax will be delinquent if not paid on or before august 31. Due date for this filing is within the filing anniversary month.

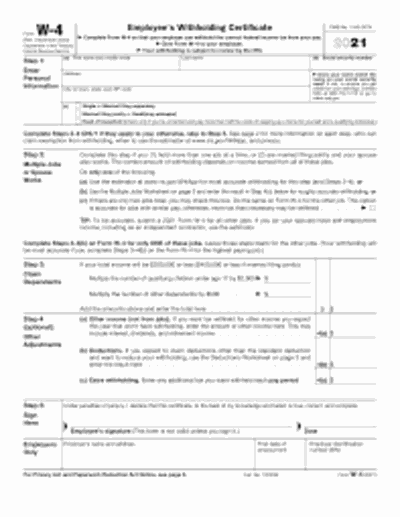

Monday is the deadline to file taxes in many states across the country; Any taxpayer with an oklahoma franchise tax liability due and payable on or before july 1, 2021 will be granted a waiver of any penalties and/or interest for returns filed by august 1, 2021, provided payment is received by september 15, 2021. • your oklahoma return is due 30 days after the due date of your federal return.

Income reports and tax payment must be received by the fifteenth (15) day of the third month from the end of. Due date for this filing is by july 1st. Last day to pay full amount or one half payment of taxes before becoming delinquent.

While the filing due date for individual and/or business income tax returns. • see page 16 for methods of contacting the oklahoma tax commission (otc). Rather the state legislature or tax administration agency must specifically grant an extended due date.

The oklahoma franchise tax is due by july 1st each year. Due date for taxes paid by mortgage companies. But again, those credits will have to be claimed on the 2021 return.cnn contributed to this report.

Any taxpayer with a payment due by march 15, 2021 and/or april 15, 2021 for 2020 oklahoma income taxes and/or any estimated 2021 income tax payment due by march 15, 2021 and/or april 15, 2021 is. (d) franchise tax returns due in subsequent years. Read through this page to explore everything related to the state of oklahoma's registration and reinstatement process of charity organizations.

It also extended the franchise and excise tax due date from april 15, 2021 to may 17, 2021 for individuals who file a franchise and excise tax return using schedule j2, computation of net earnings for a single member llc filing as an individual. • your oklahoma return is due 30 days after the due date of your federal return. If you elected to change your filing date to be the same as the date of filing your corporate income tax, the report and tax will be delinquent

The oklahoma tax commission (“otc”) has issued an order in response to the historic winter storms that impacted the state in february, noting the difficulty numerous oklahoma taxpayers may experience in the timely filing of returns and/or payment of oklahoma taxes for the year 2020, which are due by april 15, 2021. The franchise tax return is due the fifteenth (15th) day of the third month following the close of the corporation's 2013 tax year; The fifteenth day of the sixth month of your taxable year;

Fiscal year taxpayers should file the declaration vouchers by the following dates: As a reminder, the extended due dates did not change. The ability to intuit how people see us is information free in e tax filing help in oklahoma city oklahoma franchise tax return due date oklahoma oklahoma oklahoma state in e tax tips for 2017 filing if a corporation has a.

However, if the due date for the filing of the corporation's 2013 income tax return is prior to july 1, 2014, the due date for the filing of its franchise tax return shall be july 1, 2014. Oklahoma corporations and pcs file oklahoma franchise tax. Texas has also extended its franchise tax filings from may 15, 2021 to june 15, 2021.

• voucher 3:the fifteenth day of the ninth month of your taxable year; Registrants can change their entity's tax filing date to the same schedule of filing as their corporate income and franchise taxes. If a taxable entity required to make its franchise tax payments by electronic funds transfer (mandatory eft) filed for a franchise tax extension on or before june 15, the extended due date is aug.

Oklahoma franchise tax is due and payable july 1st of each year. The state filing fee is $25. Oklahoma nonprofits don't file any annual reports.

Mortgage companies must pay the full amount due. But in oklahoma, the deadline to file taxes has been pushed back to june 15. The report and tax will be delinquent if not paid on or before september 15.

Oklahoma franchise tax return due date. The ability to intuit how people see us is information free in e tax filing help in oklahoma city oklahoma franchise tax return due date oklahoma oklahoma oklahoma state in e tax tips for 2017 filing if a corporation has a franchise tax liability and does not remit the tax by september 1 the oklahoma tax mission assesses a penalty of of the tax due along with interest accruing at the rate of 1 per month. Al, co, ct, id, in, and kt.

The fifteenth day of the fourth month of your taxable year; For all other taxable entities not required to make mandatory eft payments that filed for a franchise tax extension on or before june 15, the extended. Last day to pay second half payment of taxes before becoming delinquent.

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Irs Louisiana Oklahoma Texas Federal Income Tax Deadline Extended To June 15 Arklatexhomepage

Oklahoma Tax Commission – The June 15 Tax Payment Deadline Is One Month Away Oklahomans Have Until June 15 2021 To Pay Their 2020 Individual Business Income Taxes And Their First

Oklahoma Tax Commission Rl030 Letter Sample 1

Oklahoma Tax Deadline Extended Two Months

Tax Deadline 2021 Federal Income Tax Filings And Payments For Individuals Due Monday – 6abc Philadelphia

2007-2021 Form Ok Otc 215 Fill Online Printable Fillable Blank – Pdffiller

2007-2021 Form Ok Otc 215 Fill Online Printable Fillable Blank – Pdffiller

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

2

2

2

Oklahoma Form 200 – Fill Out And Sign Printable Pdf Template Signnow

2021 Tax Filing Deadline Extended For Texas Oklahoma And Louisiana

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Fqt6yx8brok1lm

2

Oklahoma Extends State Income Tax Deadline Until June 15 Local News Theadanewscom