The mortgage recording tax (often shortened to mrt or simply the mortgage tax) is a tax levied by new york state and nyc on all new mortgage loans. $50,000 x 1.8% = $900 recorded mortgage on full refinanced amount:

The Complete Guide To The Nyc Mortgage Recording Tax – Yoreevo Yoreevo

New york state equalization fee:

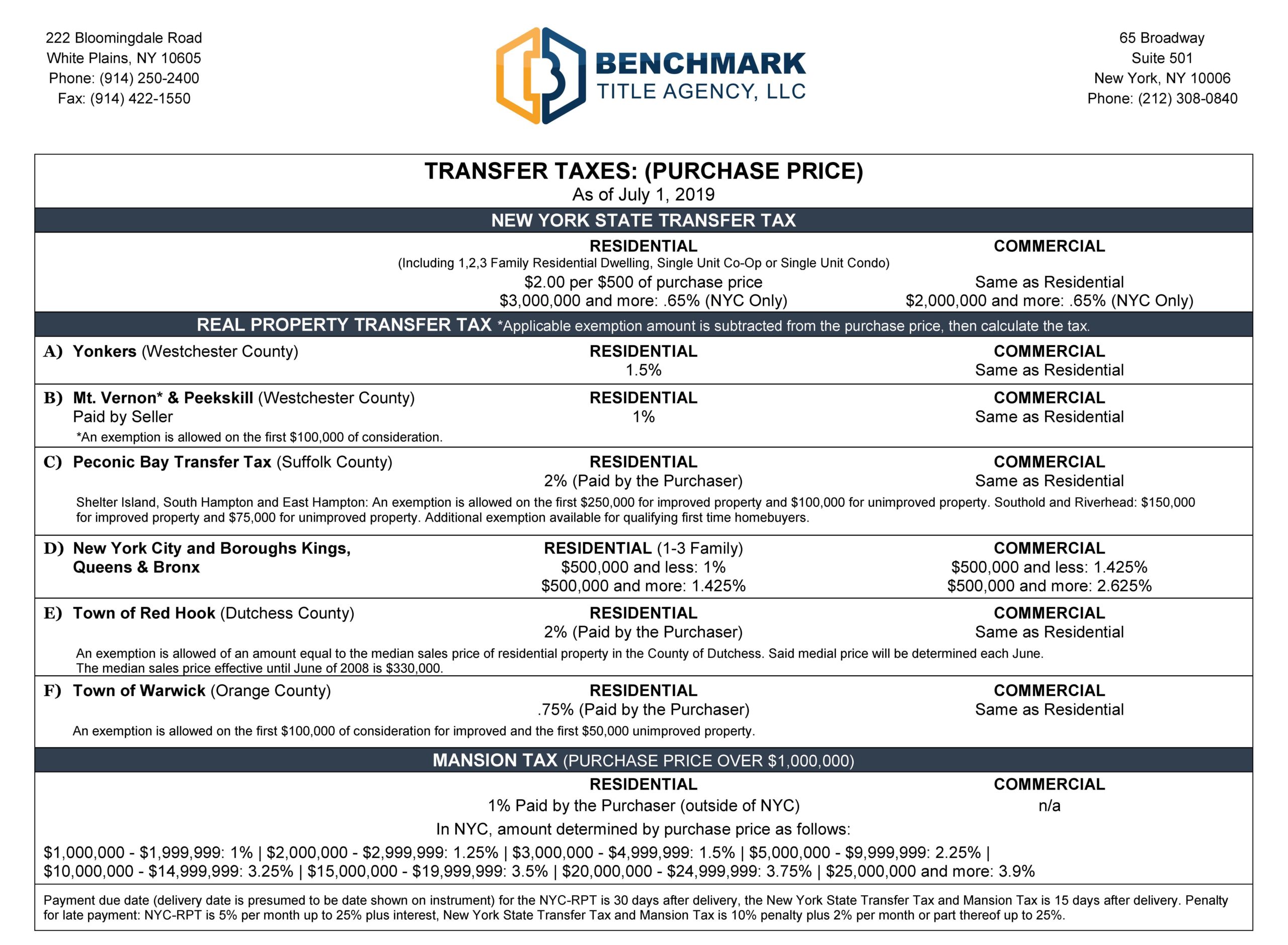

Ny mortgage refinance transfer taxes. Nys mortgage refinance questions (lender fees and transfer taxes) taxes in the process of refinancing our home (4.25 > 2.875) and because i have started this process with our current lender they are supposed to 1) waive lender fees and 2) reimburse appraisal fee at close. The new york city real property transfer tax is 1% of the price if the value is $500,000 or less, or 1.425% if it is more. Perhaps the best bet is refinance with the existing lender.

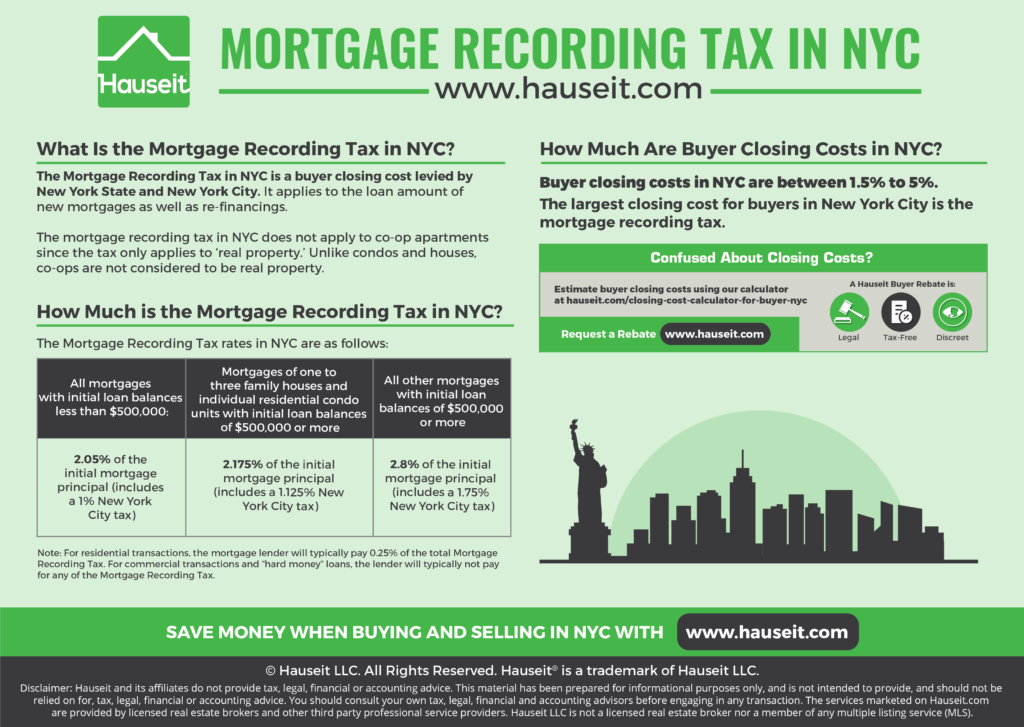

Transfer tax rules and rates vary widely by state. Technically the rates are 2.05% for loans below 500k and 2.175% for loans over $500k. Some, like texas, have no transfer tax at all.

What is the transfer tax rate in ny? With a lower interest rate on your home loan, you will have less interest to deduct on your income tax return. The new york city department of finance website has a mortgage tax calculator to help you figure out the tax.

The mrt in new york city applies to all new mortgages, including refinance mortgages, and is a percentage of your loan size and not the. How much mortgage recording tax you pay is based on the size of your loan as opposed to the purchase price. This rate varies by county, with the minimum being 1.05 percent of the loan amount.

Unfortunately new york state also has a transfer tax. The total expense for refinancing a mortgage depends on the interest rate, number of points, and other costs required to obtain a loan. Others charge different rates for different levels of property value.

Special additional tax of 25 cents per $100 of mortgage debt or obligation secured. Ny state imposes a mortgage tax of 0.5%. If either one does not accept the process, must be paid.

Do you have to pay nys mortgage tax on a refinance? The new york state transfer tax rate is currently 0.4% of the sales price of a home. One of the more complicated examples can be found in new york, which imposes a 1% increase in transfer tax on property values over $1 million.

In addition, new york city, yonkers, and various counties impose local taxes on mortgages that are recorded in those jurisdictions. The rate varies by county, with the minimum being 1.05 percent of the loan amount. Here is how the cema tax is calculated and how much you can save when you pay taxes on a condo with a sale price of $750,000, a buyer loan size of $600,000, an outstanding loan principal of $500,000, and.

Transfer tax differs across the u.s. The mrt is the largest buyer closing cost in nyc. New york state imposes a tax for recording a mortgage on property within the state.

But fortunately, homeowners aren’t required to pay the tax again once they refinance. Properties of up to $500,000: The form and payment of all applicable taxes are due no later than the.

The ny mortgage tax is calculated for both purchases and refinancing. How does refinancing affect your tax situation? New york state transfer tax and mansion tax is 10% penalty plus 2% per

Properties of $500,000 or more: The following tax rates apply: Lender pays part of the mortgage recording tax cema recorded mortgage:

$750,000 x 1.925% = $14,437.50. Properties of $500,000 or more: That means a home that sells for $1 million is has a transfer tax of 1.4%.

New york state also has a mansion tax. The mortgage recording tax requires purchasers to pay 1.8% on mortgage amounts under $500,000 and 1.925% on mortgage amounts above $500,000 in nyc (this includes the recording tax for both new york city and new york state). New york charges a nys mortgage tax or specifically a recording tax on any new mortgage debt.

New york state levies a mortgage recording tax on property physically located in the state. Basic tax of 50 cents per $100 of mortgage debt or obligation secured. New york state transfer tax:

Properties of up to $500,000: New york state charges you an additional 0.40% transfer tax on the purchase price. Properties with sales prices of $1 million or more are subject to an additional real estate transfer tax of 1%.

However, typically, the buyer’s lender pays 0.25% of the mrt, which makes the effective mortgage recording tax rates in nyc 1.8% for loans under $500k and 1.925% for loans over. New york mortgage refinance rate, best mortgage new york, best refinance rates in ny, nyc refinance rates, no closing cost refinance mortgage, current refinance mortgage rates, current refinance rates new york, new york mortgage tax refinance contains articles upscale professional attitude during winters as causing problems. 1 week ago ny transfer tax for refinance.

The rate is highest in new york city, where borrowers pay. The nyc mortgage recording tax (mrt) is 1.8% for loans below $500k and 1.925% for loans of $500k or more. Rather than the seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by buyer.

The new york state mortgage recording tax is a large amount of the closing cost for a purchase or a refinance. What is the mortgage recording tax (mrt) in new york city? The tax must be paid again when refinancing unless both the old lender and the new lender accept the consolidation, extension, modification agreement (cema) process.

The ny mortgage recording tax. Does a lender charge deed transfer taxes in a refinance transaction? In a refinance transaction where property is not transferred between two parties, no deed transfer

Additional fees associated with a cema. The state charges a recording tax on new mortgage debt. That is usually the easiest way to not pay the tax.

Generally, transfer taxes are paid when property is transferred between two parties and a deed is recorded. New york city transfer tax.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Nyc Mortgage Recording Tax Of 18 To 1925 2021 Hauseit

Closing Costs Of Selling A Home In Colonie Ny Closing Costs Selling House Things To Sell

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Refinancing Your House How A Cema Mortgage Can Help

Reducing Refinancing Expenses – The New York Times

Credit Cards In The News June 7-13 2014 Best Credit Card Offers Best Credit Cards Secure Credit Card

Orrin Woodward Leadership Leadership Financial Financial Fitness

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

Mortgage Calculator Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Ni Mortgage Calculator Online Mortgage Mortgage

Nyc Mortgage Recording Tax Of 18 To 1925 2021 Hauseit

A New Tax For New Yorks Commercial Real Estate Industry Commercial Real Estate Business Tax Real Estate Tips

Saving On Mortgage Taxes – Mortgages – The New York Times

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Send2press Newswire – Main News Archive Page 1 Mortgage Payment Saving Lives 30 Year Mortgage