The municipality will issue a tax sale certificate to the purchaser, who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to filing suit to foreclose the lien. Municipal charges include but are not limited to:

Capemaycountynjgov

Post tax sale • creation and issuance of tax sale certificates within 10 days (day of sale is 1st day) • lienholder must record the certificate(s) within 90 days of sale or may be deemed void.

Nj tax sale certificate. If a bid made at the tax sale meets the legal requirements of the tax sale law, the municipality must either sell the lien or outbid the bidder. New jersey is a good state for tax lien certificate sales. The tax sale includes delinquent taxes as well as other delinquent municipal charges as dictated by new jersey statutes.

New jersey property tax sale certificates and foreclosures. At the conclusion of the sale, the highest bidder pays. When a property is in the sale.

If playback doesn't begin shortly, try restarting your device. Business tax clearance certification required for receiving state grants, incentives. By posting this notice, the state of new jersey neither recommends nor discourages investment in tax sale certificates, and makes no guarantee of profit or positive result from such investment.

Interest rates at the auctions start at 24% and can eventually be bid down to zero. By selling off these tax liens, municipalities generate revenue. The municipalities sell the tax liens to obtain the tax revenue which they should have been paid by the property owner.

Seller/consultant receives the electronic tax certificate from the authority and forwards it to the seller and buyer for execution and copies nolclosingservices@njeda.com and taxincentives.olad@treas.nj.gov on every email containing/transmitting the electronic tax certificate. Anyone wishing to bid must register preceeding the tax sale. Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale.

The holder of a new jersey tax sale certificate does not own the property. The packet containing your certificate of authority will also contain your assigned new jersey tax identification number, which is usually based on your federal employer. In new jersey, every municipality is required by law to hold sales of unpaid property taxes at least once each year.

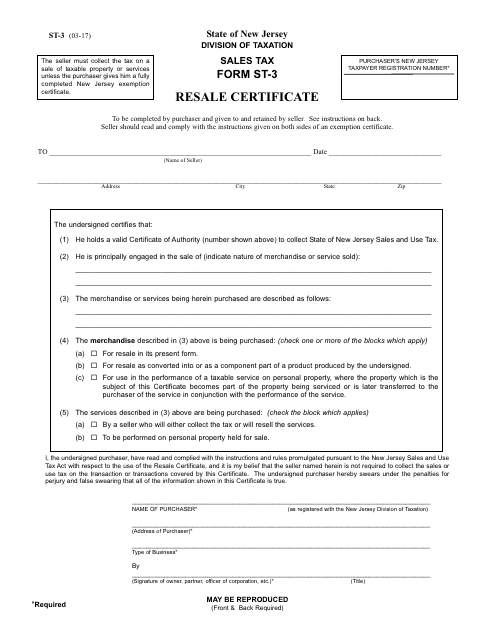

Purchasers of tax sale certificates, liens; This certificate will furnish your business with a unique sales tax number (nj sales tax id number). What is sold is a tax sale certificate, a lien on the property for delinquent outstanding municipal charges due.

Register for a nj certificate of authority online by filling out and submitting the “state sales tax registration” form. The tax sale can be held at any time after april 1st. • all subsequent payments that become due and remain dlq may be paid by the

In new jersey tax lien certificates are sold at each of the 566 municipal tax sales. Sale must be completed within ten (10) business days of receipt by seller of the electronic tax. This certificate is your authorization from the state of new jersey to collect sales tax and to issue or accept exemption certificates.

Copy of the recorded certificate shall be forwarded to the tax collector. Disable tooltips just for this page. New jersey assesses a 6.625% sales tax on sales of most tangible personal property, specified digital products, and certain services unless specifically exempt under new jersey law.

Third parties and the municipality bid on the tax sale certificates (“tsc”). A tax sale is the sale of tax liens for delinquent municipal charges on a property. New jersey tax lien certificates.

When a property is included in the tax sale, a lien is sold for the amount of the eligible municipal charges together with interest to the date of the tax sale and costs of sale. The delinquencies will be subject to interest and charges as set forth by the state of new jersey. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality.

All municipalities in new jersey are required by statute to hold annual sales of unpaid real estate taxes. Tax liens are also referred to as tax sale certificates. The new jersey business tax identification number allows for the registration of a new jersey sales tax certificate, which is sometimes referred to as a certificate of authority, seller’s permit, sales tax registration number, or sales tax license.

New jersey tax lien auctions. Interest rates for liens sold may be as high as 18%. After july 1, 2017, any applicant for certification that can’t obtain a premier business.

What is a tax sale? If you are already familiar with our system, you may disable tooltips. Depending on the amount of the lien.

Tax sale certificate basics •in order to enable municipalities to return property to the paying tax rolls, they must sell or assign the liens •new jersey law requires all 565 municipalities to hold at least one tax sale per year, if the municipality has delinquent property taxes and/or municipal charges. Dates of sales vary, depending on the municipality. Instead, the winner of the tax sale certificate now has a lien against the property in the amount paid for the tax sale certificate plus interest and penalties which will continue to accrue.

New jersey offers grants, incentives, and rebates to businesses, and every recipient must obtain a business assistance tax clearance certificate from the division of taxation. Tax sales are conducted by the tax collector; Sale of certificate of tax sale, liens by municipality.

Here is a summary of information for tax sales in new jersey. Sales subject to current taxes; At a tax sale, title to the delinquent property itself is not sold.

New jersey tax sale law gives purchaser of a tax sale certificate a tax lien on the underlying property. Tax sale certificates require “active” follow up and management by the investor. 18% or more depending on penalties.

Any municipal taxes or charges, such as sewer service charges, that are delinquent from the prior year will be subject to tax sale in the current year. Videos you watch may be added to the tv's watch history and influence tv. The court found that as a matter of legislative intent, a tax sale certificate secures the obligation to pay municipal taxes, thus creating a tax lien.

Foreclosure, right of redemption, recording of final judgment;

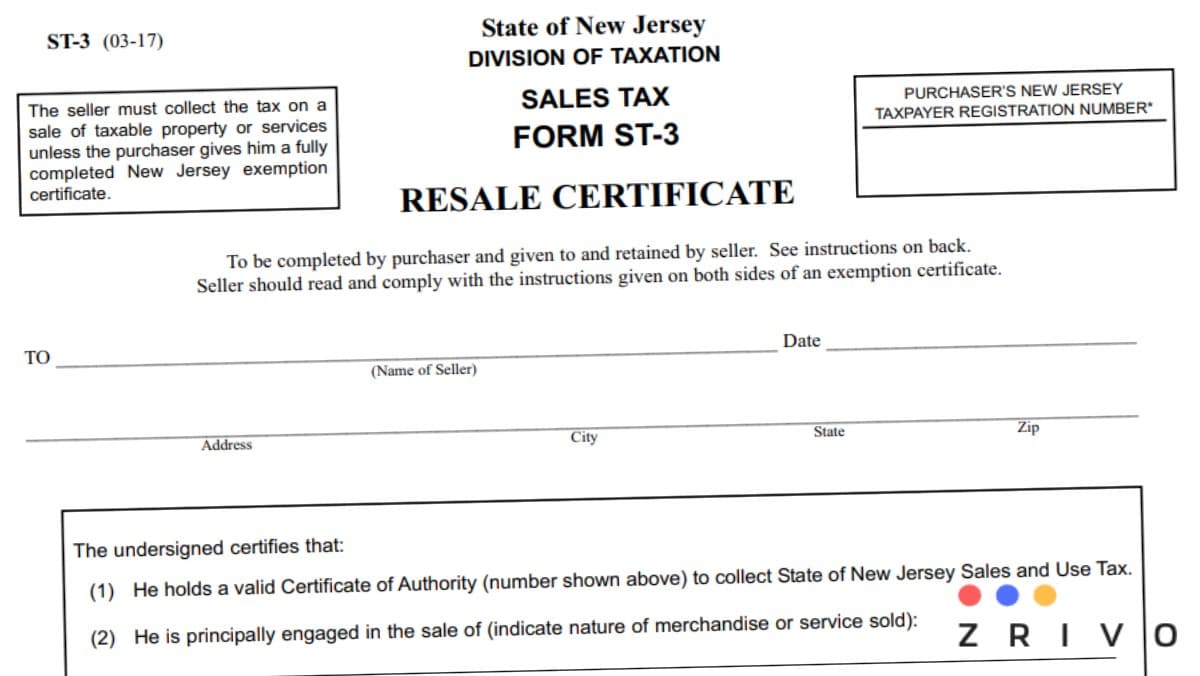

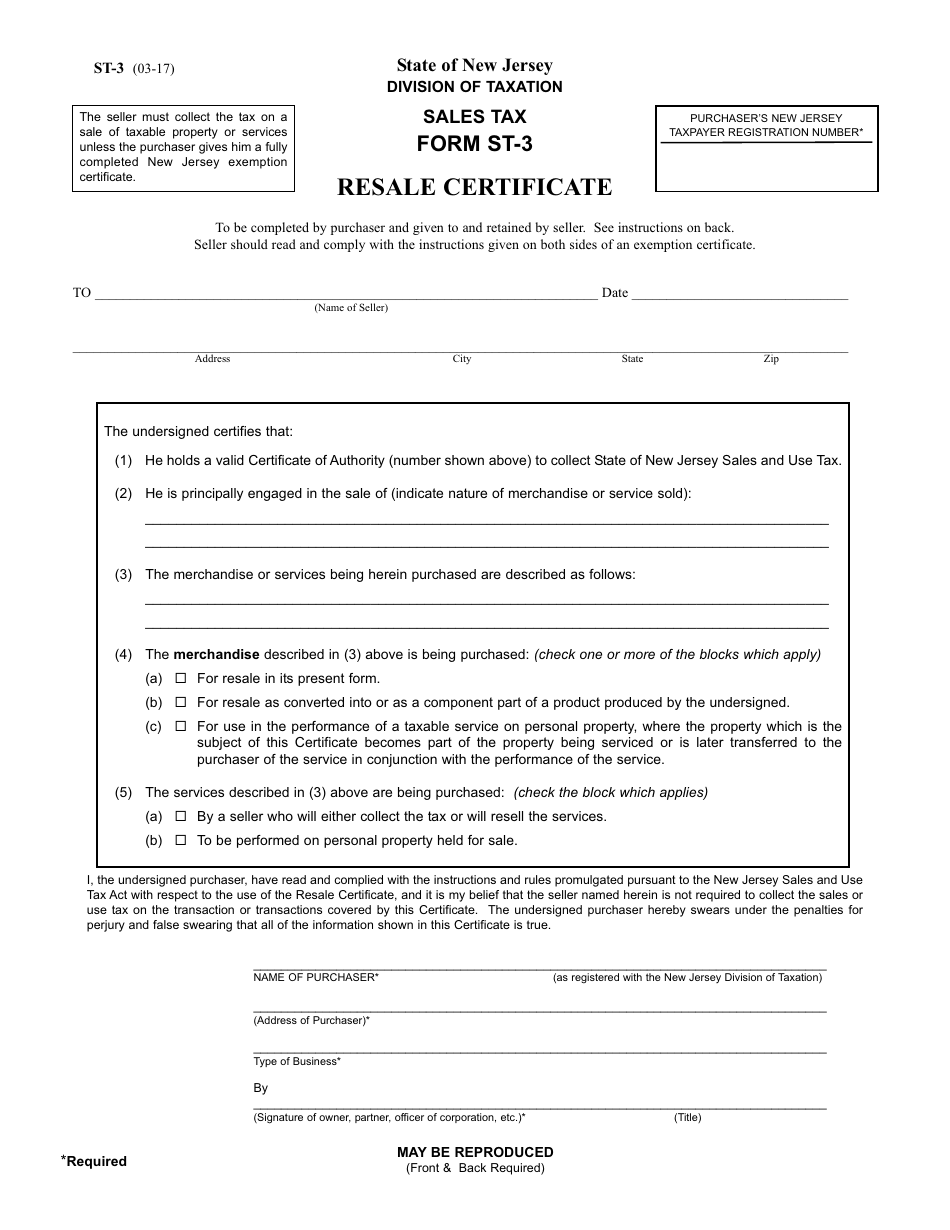

How To Get A Resale Certificate In New Jersey – Startingyourbusinesscom

Frankfordtownshiporg

Esfedu

Newprovorg

Statenjus

St3 Form Nj 2021 – Sales Tax – Zrivo

Nj Resale Certificate – Fill Out And Sign Printable Pdf Template Signnow

New Jersey Resale Certificate Trivantage

Form St-8 Fillable Certificate Of Exempt Capital Improvement

Form St-3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Nj Resale Certificate

Form St-3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Cranfordnjorg

Statenjus

Form St-3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Councilsvinelandcityorg

Capemaycountynjgov

Do I Need A Sales Tax Certificate Of Authority – Tax Walls

Nj Resale Certificate Online – Fill Online Printable Fillable Blank Pdffiller