Here are the special tax benefits and considerations for using. Most states offer some form of state income tax.

529 Plans Which States Reward College Savers – Adviser Investments

But of course, when choosing a 529 plan when your child is young, you have no idea what schools your future.

Nj 529 plan tax benefits. 5% tax credit on contributions up to $5,000 for joint accounts. 10% tax credit on contributions up to $2,500 for individuals. Thankfully, nj residents can open an account in any other state that lets them.

5% tax credit on contributions up to $2,040 for individuals. The new jersey college affordability act allows for new jersey taxpayers, with gross income of $200,000 or less, to qualify for a state income tax deduction for contributions into an njbest plan of up to $10,000 per taxpayer, per year, beginning with contributions made in tax year 2022. Choose a plan associated with vanguard and compare it with other 529 savings plans.

Also, the first $25,000 in savings will be excluded from the criteria used to. A 529 plan is designed to help save for college. New jersey no yes beginning with the 2022 tax year, maximum deduction of $10,000 per taxpayer per year for taxpayers with gross incomes of $200,000 or less that contribute to new jersey’s 529 plan (contributions made before 2022 tax year are not deductible) new mexico no yes contributions to new mexico 529 plans are fully deductible

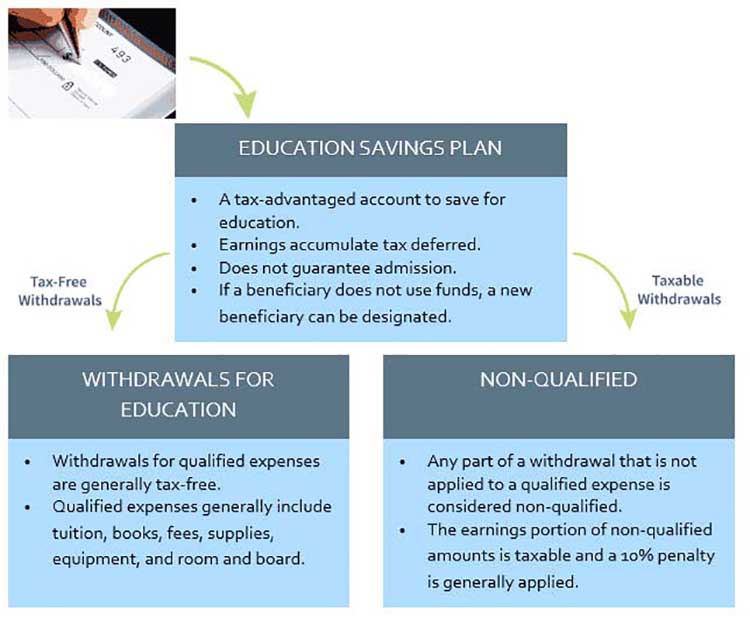

The budget deal creates new tax deductions for contributions of up to $10,000 into an nj better education savings trust 529 account for households earning up to $200,000. Many 529 savings plans feature vanguard funds and/or investment management. Tax savings is one of the big benefits of using a 529 plan to save for college.

This state does not offer any tax benefits for contributing to a 529 plan. This state offers no tax deduction for 529 plans. The longer your money is invested, the more time it has to grow and the greater your tax benefits.

Njbest is the new jersey 529 plan, but parents can invest in the plan of any state for their future students. The easiest way to enroll. 1) favorable treatment when you apply for financial aid from the state of new jersey.

A 529 plan, technically known as a “qualified tuition program” under section 529 of the internal revenue code, is an education savings plan that provides major tax advantages, said gene mcgovern of mcgovern financial advisors in westfield. Learn about your investment options & how to open an account. The new jersey college affordability act allows taxpayers with household adjusted gross income between $0 and.

How do i enroll in new jersey’s 529 college savings plan? 5% tax credit on contributions up to $4,080 for joint accounts. The benefit would only be available to households with an annual income of $200,000 or less.

It rewards you for simply opening a nj 529 plan and saving. You will lose some of these potential benefits if you withdraw money from a 529 plan account within a short period of time after it is contributed. New jersey does not offer any state tax benefits for opening a nj 529 plan.

*either the child or the account owner must be a nj resident. He said the plans are generally established by individual states, and they come in two different versions. As of january 2019 there are no tax deduction benefits when making a contribution to a 529 plan in new jersey, however you do have the ability to take advantage of up to a $1,500 maximum.

New jersey 529 plan tax information. Because new jersey law incorporates the provisions of irc section 529, new jersey follows the federal expansion and considers a withdrawal from an irc section 529 savings plan used for tuition at private, religious, elementary, and secondary schools a qualified higher education expense for new jersey gross income tax purposes. A key benefit of both nj 529 plans is the njbest scholarship.

You can contribute as much as you want, as often as you want. The proposal includes a provision to allow new jersey taxpayers to deduct 529 plan contributions of up to $10,000 per year from state taxable income. 529 plans typically increase the contribution limit over time, so you may be able to contribute more.

Njbest is a 529 college savings plan for new jersey families trying to save for future education costs. Using a 529 plan to fund college education costs provides a variety of state and federal tax benefits. 529 tax benefits for new jersey residents.

Unfortunately new jersey does not offer any tax benefits for socking away funds in a 529 account for your child. But it does offer these two key benefits: New jersey offers tax benefits and deductions when savings are put into your child's 529 savings plan.

Pennsylvania 529 Plans Learn The Basics Get 30 Free For College

New Jersey 529 Plans Learn The Basics Get 30 Free For College

529 Plan What You Need To Know Understanding Tax Benefits – Sbnri

2

Vermont 529 Plans Learn The Basics Get 30 Free For College Savings

529 Accounts In The States The Heritage Foundation

Does Your State Offer A 529 Plan Contribution Tax Deduction

New York 529 Plans Learn The Basics Get 30 Free For College Savings

How A 529 Plan Works – State Farm

Tax Deduction Rules For 529 Plans What Families Need To Know – College Finance

How Much Is Your States 529 Plan Tax Deduction Really Worth

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

How Much Can You Contribute To A 529 Plan In 2021

529 Plans Which States Reward College Savers – Adviser Investments

10 Things Parents Should Know About College Savings –

Njbest 529 College Savings Plan New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 College Savings Plan Options Broken Down By State

Usa 529 Plan Tax Savings 2019 How To Plan Tax Credits Tax Deductions