On average, homeowners in new hampshire pay 2.05% of their home’s. The occupant, purchaser, or renter shall pay the tax to the operator.

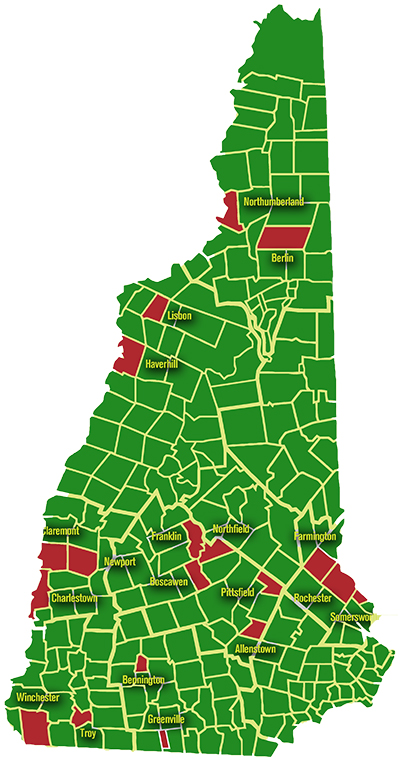

The Other New Hampshire – Nh Business Review

The 9 percent tax on meals and rooms is included for the costs of meals and lodging only. (b) the operator shall demand and collect the tax from the occupant, purchaser, or renter.

Nh meals tax payment. The tax is assessed upon patrons of hotels and restaurants, on certain rentals, and upon meals costing $.36 or more. Massachusetts meals tax vendors are responsible for: The new hampshire state sales tax rate is 0%, and the average nh sales tax after local surtaxes is 0%.

There are, however, several specific taxes levied on particular services or products. While new hampshire lacks a sales tax and personal income tax, it does have some of the highest property taxes in the country. Multiply this amount by.09 (9%) and enter the result on line 2.

In order to file, you’ll need to enter information on how much you charged for your rentals. Hotels, seasonal home rentals, campsites, restaurants and Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5%.

Office of the tax collector. A new hampshire meals tax / restaurant tax can only be obtained through an authorized government agency. Designed for mobile and desktop clients.

Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a new hampshire meals tax / restaurant tax. The state of new hampshire does not issue meals & rentals tax exempt certificates. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

Meals and rooms tax | where the money comers from | transparentnh. Exact tax amount may vary for different items. Actual cost of meals that aren’t considered lavish or extravagant.

The new hampshire department of revenue administration allows credit card payments, but you may be charged convenience fees for this type of payment. Pursuant to btla tax 203.02(d), the applicant(s) must sign the application. Collecting a 6.25% sales tax (and, where applicable, a.75% local option meals excise) on all taxable sales of meals.

*use this link to pay current property taxes only. Enter your total tax excluded receipts on line 1 (excluded means that the tax is separately stated on the customer receipt or check). A calculator to quickly and easily determine the tip, sales tax, and other details for a bill.

The tax must be separately stated and separately charged on all invoices, bills, displays or contracts except on those solely for alcoholic beverages. Use this app to split bills when dining with friends, or to verify costs of an individual purchase. Use this app to split bills when dining with friends, or to verify costs of an individual purchase.

Estimated tax payments are required if the estimated i&d tax is $500 or greater. You’ll also need to pay the tax amount due. If this continues please contact support.

In new hampshire, you can file returns online. Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5% Unlike the bpt and bet, the rooms and meals tax applies to the first dollar of rent.

New hampshire is one of the few states with no statewide sales tax. Subscribe to meals & rentals operators notifications, to receive nh dra announcements, guidance, and other helpful information. The meals and rentals tax is a tax imposed at a rate of 9% on taxable meals, occupancies and rentals of vehicles.

By signing below, the party(ies) by signing below, the party(ies) applying certifies (certify) and swear(s) under the penalties of rsa ch. 641 the application has a good faith basis, Last updated november 27, 2020

Registering with the dor to collect the sales tax on meals. Beginning august 9, 2021, real estate transfer. You can pay your taxes online.

File and pay your meals & rentals tax online at granite tax connect. There is also a 9% tax on car rentals. Paying the full amount of tax due with the appropriate massachusetts meals tax return on time, and.

New hampshire levies special taxes on electricity use ($0.00055 per kilowatt hour), communications services (7%), hotel rooms (9%) and restaurant meals (9%). It is assessed at a rate of 9 percent of gross rent collected, and on a monthly basis the payment and a tax return must be submitted to the state. Motor vehicle fees, other than the motor vehicle rental tax, are administered by the nh department of safety (rsa 261).

New hampshire's meals and rooms tax is a 8.5% tax on room rentals and prepared meals. The meals and rentals (m&r) tax was enacted in 1967 at a rate of 5%. Vendors must add a 6.25% sales tax to the selling price of every meal and collect it from the purchaser.

How Will State Tax Cuts Affect Education Funding In Nh New Hampshire Public Radio

2

2

The Juicery Portsmouth Nh The Juicery Is Located On 51 Hanover Street In Downtown Portsmouth New Hampshire Just Acro Organic Juice Juice Organic Juice Bar

The Basics Of Travel Therapy Pay Packages

How Will State Tax Cuts Affect Education Funding In Nh New Hampshire Public Radio

Elderly Services Town Of Plaistow Nh

State Senator Gary Daniels

Pin By Bellshomestead On Planning Our Homestead Food Protection Prepared Foods Things To Sell

Home – Mary For Derry

2

2

State Senator Gary Daniels

The Other New Hampshire – Nh Business Review

Home – Mary For Derry

Pay It Forward Give Meals To The New Hampshire Food Bank New Hampshire Public Radio

Sapporo Autumn Escape Sapporo Otaru Hakodate

Pin On Welcome New Neighbor Inc

School Voucher Program Added To Budget New Hampshire Bulletin