Tax is $500 or greater. Motor vehicle fees, other than the motor vehicle rental tax, are administered by the nh department of safety.

Pin On Features

Exact tax amount may vary for different items.

Nh meals tax change. Hotels, seasonal home rentals, campsites, restaurants and vehicle rental agencies are required to register with and obtain a license from the department of. A 9% tax is also assessed on motor vehicle rentals. Serving new hampshire and new england.

The state's meals and rooms tax will drop from 9% to 8.5%. Currently, new hampshire restaurants keep 3% of the state’s rooms and meals tax as a commission for collecting it. To learn more, see a full list.

Governor mills considering conformity legislation in response to recent federal tax law changes july (pdf) maine revenue services (mrs) issues guidance relative to nonconformity with recent federal tax law changes for tax years 2018 and 2019; While new hampshire lacks a sales tax and personal income tax, it does have some of the highest property taxes in the country. The meals and rentals (m&r) tax was enacted in 1967 at a rate of 5%.

Pricing is valid through june 30, 2018. There are, however, several specific taxes levied on particular services or products. Nh meals and rooms tax decreasing by 0.5% starting friday.

Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5%. View current and past tax rates. New hampshire is one of the few states with no statewide sales tax.

This page describes the taxability of food and meals in maine, including catering and grocery food. Bill supporters say it will level the playing field with “brick and motor” establishments that collect the levy and remit it to the state. A bit of that money goes toward school building loans and tourism promotion.

While maine's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. Voted best accounting firm in new hampshire for the ninth straight year in 2019, wipfli is also one of the largest accounting firms in new hampshire with offices in bedford and portsmouth, and one of the top 20 accounting firms in the united states.our focus on our company culture, community involvement and professional. The budget also assumes the exclusion of forgiven amounts on federal loans received via the paycheck protection program from state.

Expect more from your accountant. The tax is collected by hotels, restaurants, caterers, and other businesses. The budget cuts the 5% interest and dividends tax by one percent a year, starting in 2023 and eliminating it by 2027, so that really doesn’t affect this budget much.

New hampshire levies special taxes on electricity use ($0.00055 per kilowatt hour), communications services (7%), hotel rooms (9%) and restaurant meals (9%). New hampshire department of revenue administration (nhdra) is reminding operators and the public that starting october 1, 2021, the state’s meals and rooms (rentals) tax ratewill decrease by 0.5%, from 9% to 8.5%. On average, homeowners in new hampshire pay 2.05% of their home’s.

The tax is assessed upon patrons of hotels and restaurants, on certain rentals, and upon meals costing $.36 or more. They send the money to the state. Locate the group rate section and select add.

Beginning august 9, 2021, real estate transfer tax, utility property tax, tobacco tax, railroad tax, and private car tax will also be available through gtc. Concord city hall 41 green street concord, nh 03301 phone: View only access remains available for the following tax types:

Chapter 144, laws of 2009, increased the rate from 8% to the current rate of 9% and added campsites to the definition of hotel. The house approved a bill that extends the rooms and meals tax to online platforms that coordinate private auto and short term rentals. Starting on october 1, 2021, the meals and rooms tax rate was decreased from 9% to 8.5%.

• this budget helps small businesses by. Menus are subject to change. For more information on motor vehicle fees, please contact the nh department of safety, division of motor vehicles, 23 hazen.

The meals and rentals tax is a tax imposed at a rate of 9% on taxable meals, occupancies and rentals of vehicles. • this budget helps consumers by reducing the meals and rooms tax from 9% to 8.5%, its lowest level in over a decade. Speaking of the rooms and meals tax, the budget would cut that rate from 9% 8.5% starting in january.

Enter the group name as meals and entertainment, m & e, or meals. The new hampshire state sales tax rate is 0%, and the average nh sales tax after local surtaxes is 0%. Menu pricing is subject to 9% nh meal tax & 19% service charge.

2021 new hampshire state sales tax. During the last four months of the fiscal year — march, april, may and june — the state had expected to collect $795.6 million in general fund tax revenue from its three largest taxes — business profits tax, business enterprise tax and rooms and meals tax, or about 30% of the $2.6 billion collected by the state in annual general taxes.

Pin On Welcome New Neighbor Inc

These 10 Restaurants In Alabama Have The Best Seafood Ever Orange Beach Alabama Orange Beach Al Gulf Shores Alabama Vacation

New Hampshire Meals And Rooms Tax Rate Cut Begins

Why Cash Is Not King Budgeting Cash Flow King Queen

Notaries247-map Loan Signing Notary Service Reverse Mortgage

Tips To Review Or Create A Business Continuity And Disaster Preparedness Plan For Your Small Business Ensur Business Continuity Financial Strategies Disasters

Donor Towns Tax Cuts And The Elusive Education Funding Solution New Hampshire Bulletin

Beacon – Vigo County In City Of Terre Haute Vigo County Vigo County

Cut To Meals And Rooms Tax Takes Effect – Nh Business Review

Organic Bytes 624 Two Billion Dollars – 051619 Byte Bomb Making Eating Organic

If Youve Been Thinking About Becoming A Thirty-one Consultant Now Is The Perfect Time For A Limited Time Thirty One Gifts Thirty One Thirty One Consultant

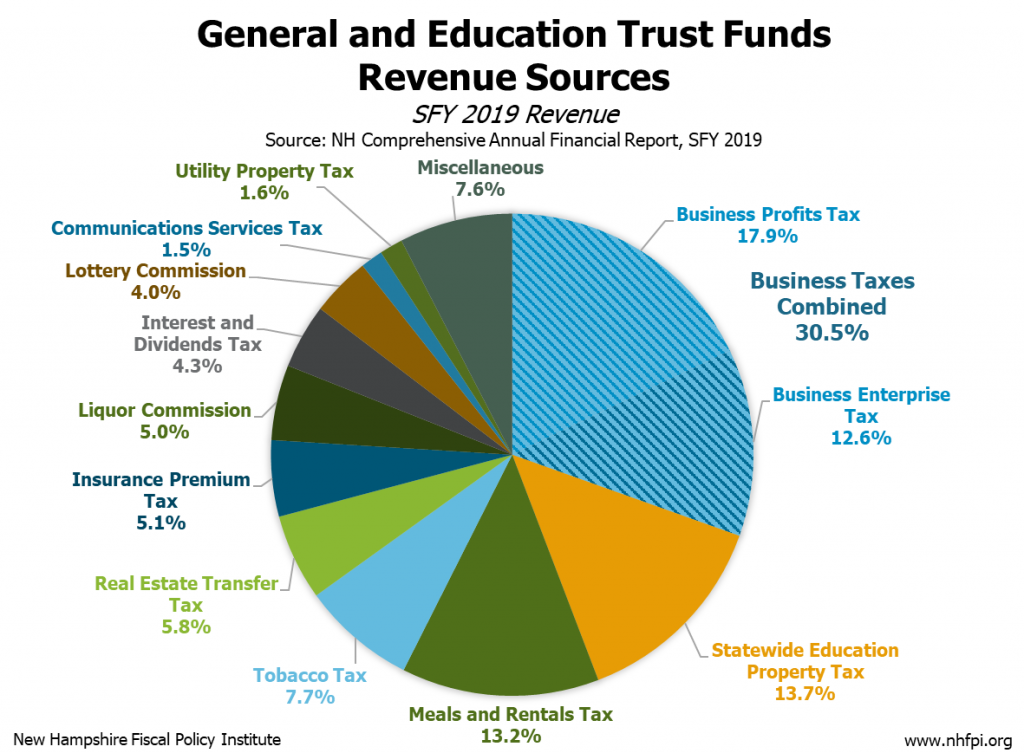

Statewide Education Property Tax Change Provides Less Targeted Relief – New Hampshire Fiscal Policy Institute

Aging On Nautilus Why You Cant Help But Act Your Age Act Your Age Acting Aging

Courtyard Nashua Courtyard Marriott Courtyard Hotel Marriott

Chat Game Logo Template Psd Vector Eps Ai Illustrator Tech Logos Logo Design Template Social Media Design Graphics

Early Impacts Of The Covid-19 Crisis On State Revenues – New Hampshire Fiscal Policy Institute

Nh Meals And Rooms Tax Decreasing By 05 Starting Friday Manchester Ink Link

Prep Sheets – Kitchen Forms – Chefs Resources Weekly Meal Planner Template Prep Kitchen Menu Planning Template

Pin By Pamela Mcdormand On Biology Pollination Nectar Sound