New hampshire's meals and rooms tax is a 8.5% tax on room rentals and prepared meals. Exact tax amount may vary for different items.

New Hampshire Sales Tax Rate – 2021

Years ending on or after december 31, 2025, nh i&d rate is 3%.

Nh food tax rate. For the taxable period ending june 30, 2016, the tax rate is reduced to 5.45% and for the taxable period ending june 30, 2017 and forward, the tax rate is reduced to 5.4%. “to ensure a smooth transition to the new tax rate, we are. New hampshire department of revenue administration (nhdra) is reminding operators and the public that starting october 1, 2021, the state’s meals and rooms (rentals) tax ratewill decrease by 0.5%, from 9% to 8.5%.

Additional exemptions exist for seniors or disabled individuals: How 2021 sales taxes are calculated in new hampshire. The state general sales tax rate of new hampshire is 0%.

2021 2020 2019 2018 2017 2016. The 2020 real estate tax rate for the town of stratham, nh is $18.95 per $1,000 of your property's assessed value. Every 2021 combined rates mentioned above are the results of new hampshire state rate (0%).

New hampshire cities and/or municipalities don't have a city sales tax. A 9% tax is assessed upon patrons of hotels (or any facility with sleeping accommodations), and restaurants, on rooms and meals costing $.36 or more. New hampshire's meals and rooms tax is a 9% tax on room rentals and prepared meals.

The state meals and rooms tax is dropping from 9% to 8.5%. What is the meals and rooms (rentals) tax? The tax is assessed upon patrons of hotels and restaurants, on certain rentals, and upon meals costing $.36 or more.

Chris sununu in this year's budget package, which passed state government in. There are, however, several specific taxes levied on particular services or products. On average, homeowners in new hampshire pay 2.05% of their home’s.

2021 new hampshire state sales tax. This comes on the heels of local property reappraisals many new hampshire cities and towns have undertaken and which assessors are required by law to perform every five years. Nh meals and rooms tax decreasing by 0.5% starting friday.

Income tax is not levied on wages. The new hampshire state sales tax rate is 0%, and the average nh sales tax after local surtaxes is 0%. New hampshire's individual tax rates apply to interest and dividend income only.

This set annually in october by the department of revenue. The meals and rentals (m&r) tax was enacted in 1967 at a rate of 5%. Years ending on or after december 31, 2024, nh i&d rate is 4%.

New hampshire is one of the few states with no statewide sales tax. The new hampshire department of revenue administration has approved the city’s 2021 tax rate for fiscal year 2022 of $15.03 per $1,000 of valuation. (this is the connecticut state sales tax rate plus and additional 1% sales tax.)

There is no county sale tax for new hampshire. New hampshire levies special taxes on electricity use ($0.00055 per kilowatt hour), communications services (7%), hotel rooms (9%) and restaurant meals (9%). You only have to file a new hampshire income tax return if you have earned over $2,400 annually ($4,800 for joint filers) in taxable dividend and interest income.

$21.31 $28.48 $26.96 $27.23 $26.01 $25.10 n/a revaluation year (values increased) 78.6% 83.8% 88.2% 91.1% 96.6% revaluation year (values increased) 2015. The 2021 tax rate for londonderry is $18.38 per 1,000. Chapter 144, laws of 2009, increased the rate from 8% to the current rate of 9% and added campsites to the definition of hotel.

Concord — the new hampshire department of revenue administration (nhdra) sets tax rates for the cities and towns in new hampshire beginning in october of each year. General hospitals and special hospitals for rehabilitation required to be licensed under rsa 151 that provide inpatient and outpatient hospital services, but not including government facilities. While new hampshire lacks a sales tax and personal income tax, it does have some of the highest property taxes in the country.

Manchester’s tax rate for fiscal year 2022 has been set at $17.68 per $1,000, down $6.98 — or 28.30% — from the previous year’s $24.66 per $1,000, according to city • this budget helps small businesses by. New hampshire is one of the few states with no statewide sales tax.

There are, however, several specific taxes levied on particular services or products. Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5%. Years ending before december 31, 2023, nh i&d rate is 5%.

Designed for mobile and desktop clients. A 9% tax is also assessed on motor vehicle rentals. Starting october 1, the tax rate for the meals and rooms (rentals) tax will decrease from 9% to 8.5%.

• this budget helps consumers by reducing the meals and rooms tax from 9% to 8.5%, its lowest level in over a decade. Advertisement it's a change that was proposed by gov. Exact tax amount may vary for different items.

7 States Without Income Tax – Mintlife Blog

New Hampshire Sales Tax Rate – 2021

New Hampshire Sales Tax Rate – 2021

Historical New Hampshire Tax Policy Information – Ballotpedia

New Hampshire Sales Tax – Taxjar

New Hampshire Meals And Rooms Tax Rate Cut Begins

Cut To Meals And Rooms Tax Takes Effect – Nh Business Review

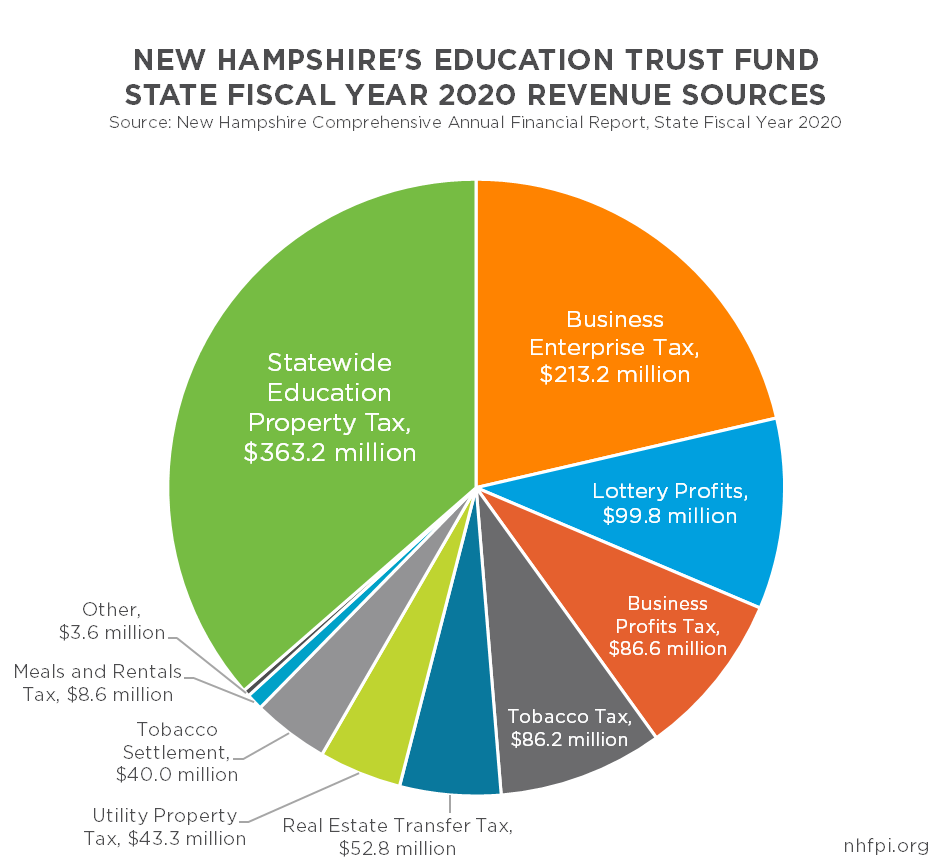

The State Budget For Fiscal Years 2022 And 2023 – New Hampshire Fiscal Policy Institute

New Hampshire – Sales Tax Handbook 2021

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Pin On Picture

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Understanding New Hampshire Taxes – Free State Project

States With Highest And Lowest Sales Tax Rates

New Hampshire Sales Tax Rate – 2021

Eqkdqb7mjbevtm

State Sales Tax On Groceries Ff 09202021 Tax Policy Center

States With The Highest And Lowest Property Taxes Property Tax High Low States

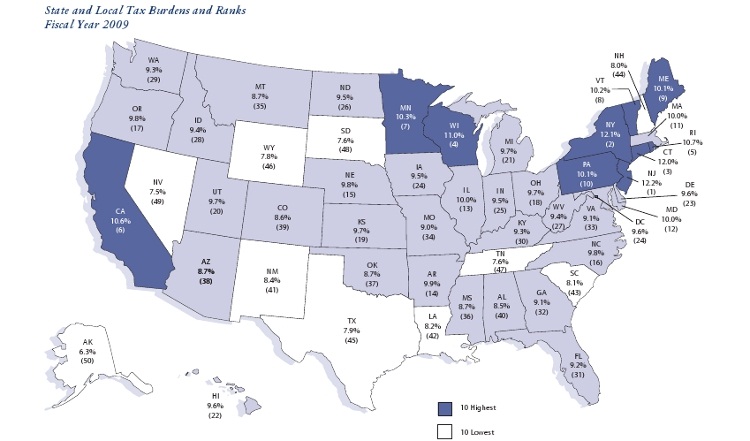

Is New Hampshire Really As Anti-tax As Its Cracked Up To Be Stateimpact New Hampshire