Purchase your silencer or sbr : 5103 raises the nfa tax to transfer silencers from $200 to $500.

How Do 500 Nfa Tax Stamps Sound Crusader Tactical

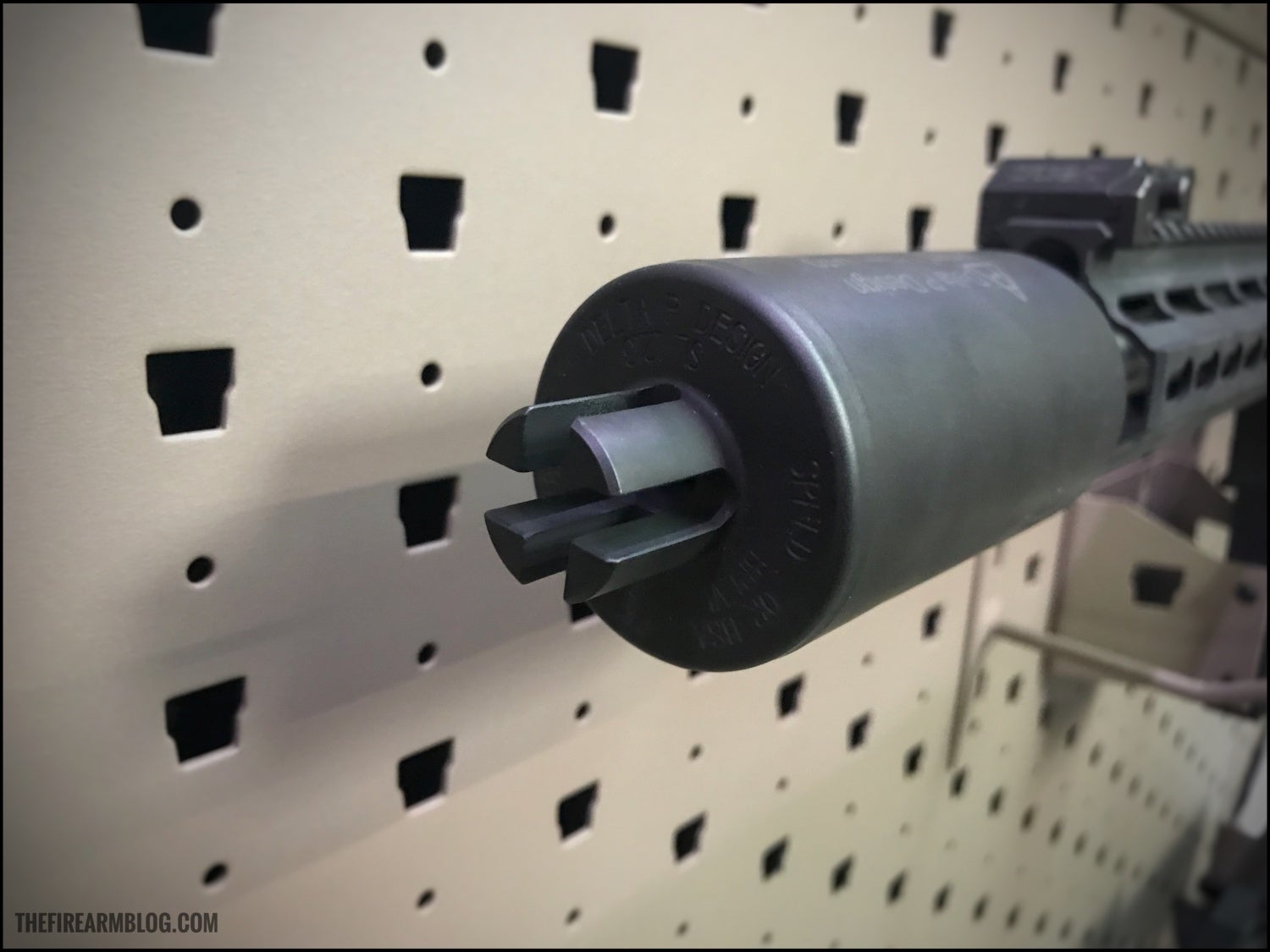

Moreover, it is compact (6.25”) and lightweight (12.9 ounces) build brings maneuverability to the equation.

Nfa tax stamp price rising to $500. Complete the background questionnaire for each responsible person. A licensed manufacturer under contract to make nfa firearms for the u.s. If you’d like to learn more about getting an ffl, check out our how to get an ffl guide.

The tax stamp is a $200 tax to that is paid to the atf when you want to make or purchase an already manufactured silencer or nfa firearm. Once you receive your tax stamp (approval to manufacture) from the atf, you can assemble all the parts & pieces of your nfa item. Silencer shop has said sales are hard because the cost just doesn't let them make much money.

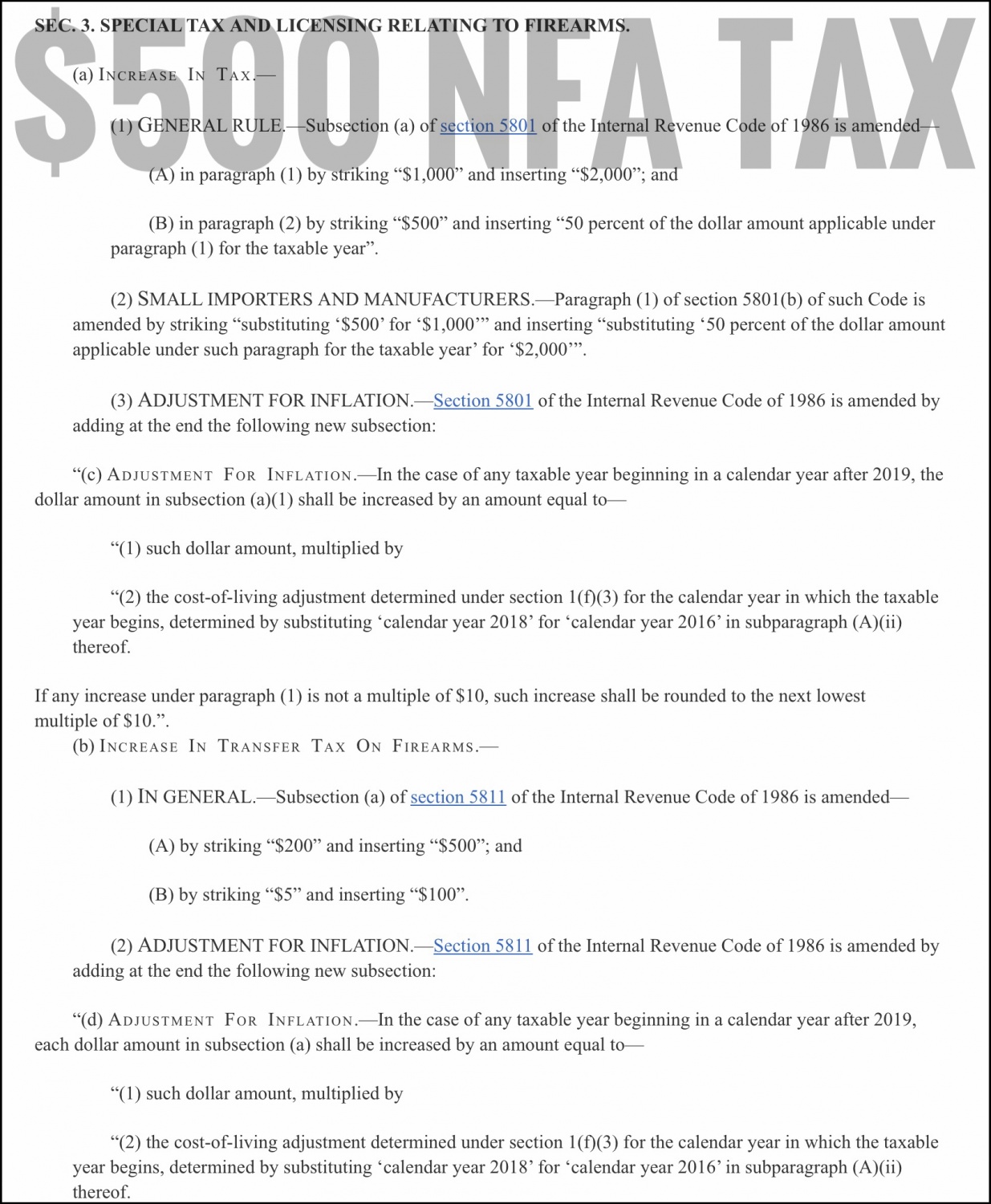

National firearms act (nfa) answers to some common questions related to what is the nation firearms act (nfa) including the definition, clarification and application of the act, as well as which form (s) to use in order to apply for a tax stamp. Among the increase in taxes on ammunition and firearms, and increases in sot and ffl licensing and fees, h.r. What you may have recently paid:

As a private actor, the range safety officer (rso) may ask you to produce proof of registration as a condition for use of the range. Fill out your part of the silencer or sbr application: The saddling of maxim's little harmless dime store tube with a big killer $200 federal stamp.

Please note that a tax stamp must accompany a silencer (or other nfa) purchase. They also want to tax firearms at 20% or 30% and ammunition at 50%. The hpa aims to take sound suppressors off the nfa and lump it in with common title one firearms such as rifles.

If adjusted for inflation, the $200 required in 1934 would be equivalent to $3,708.00 in 2017. You will use the atf form 1, atf eform 1, or atf form 4 to apply for your tax stamp. * reduced = rates which apply to certain taxpayers whose total gross receipts in the last taxable year are less than $500,000.

In this case, the death of one of the most onerous taxes of the 1930s: Take photographs of each responsible person: Have the seller fill out their portion of the application:

Here's some math on a new scary black rifle: Every item is $200 unless it’s an aow, and those are $5. There is one additional step, of course.

The $200 tax was quite prohibitive at the time, which was the goal of the national firearms act. Hr5103 increases taxes on firearms, nfa will now be $500 a new bill has been introduced that will raise firearm taxes across the board, including raise the tax stamp price to $500, increased taxes on imports, most prices of licensing will rise, among other. Among the increase in taxes on ammunition and firearms, and increases in sot and ffl licensing and fees, h.r.

Create your nfa gun trust: The atf must issue you a tax stamp after being approved by the nfa branch. 5103 raises the nfa tax to transfer silencers from $200 to $500.

The sot reduced rate applies to a business whose sales are less than $500,000 per year. There is nothing that requires a private range officer to check for a tax stamp. All silencers, or other nfa items, require a 'tax stamp'.

Taxing the transfer of nfa with what is essentially the total cost of an average suppressor will grind sales to a halt, force dealers and distributors to significantly reduce inventories and will crush. Democrats want to increase the tax stamp from $200 to $500 and peg it to inflation, so your $200 ought to be $500. The stamp itself costs $200.00 and the waiting process can take several months.

Taxing the transfer of nfa with what is essentially the total cost of an average suppressor will grind sales to a halt, force dealers and distributors to significantly reduce inventories and will. Once you’re an ffl/sot, you can pay $500 once a year as your sot registration, instead of $200 per nfa firearm for a tax stamp. However, the rso cannot compel you to produce the tax stamp.

The rso is not obligated to check for tax stamps. Due to california laws and regulations pertaining to firearms and firearms use, all roni pistol carbine conversion kit are not authorized for sale or use in the state of california. The rso may even prohibit you from using the range if you refuse.

But, the 1st thing you should do is create your gun trust. Hr5103 increases taxes on firearms, nfa will now be $500 a new bill has been introduced that will raise firearm taxes across the board, including raise the tax stamp price to $500, increased taxes on imports, most prices of licensing will rise, among other things. The national firearms act (nfa) introduced in 1934 requires nfa firearms to be registered and taxed.

You can check out the current nfa tax stamp wait times here. The 10 steps required for getting your tax stamp are: Government may be granted an exemption from payment of the special (occupational) tax as a manufacturer of nfa firearms and an exemption from all other nfa.

Until the tax stamp is received you won’t be able to possess the item you’ve purchased. Many of those are relatively simple compared to say welded baffle stacks of titanium. Yes it is common and probably will not result in a penalty, but unlike speeding, which is done regularly, the fines and potential penalties for transferring a firearm restricted by the.

You must first submit a form 1 (application to make and register a firearm) & $200 to the atf. After your tax stamp is approved, you will be able to make your silencer or pickup your purchased silencer from your local. Acrobat will populate the information you’ve input on the first three pages, into the remainder of the form including atf copy 2 (pages 7, 8 & 9) and the cleo copy (pages 10, 11 & 12) 1.

M4carbinenet Forums

How Do 500 Nfa Tax Stamps Sound Crusader Tactical

Federal Tax Stamp Silencer Central

Silencer Saturday 11 Do You Want 500 Nfa Tax Stamps -the Firearm Blog

Nfa Tax Stamp – Silencer Shop

How Do 500 Nfa Tax Stamps Sound Crusader Tactical

Silencer Saturday 11 Do You Want 500 Nfa Tax Stamps -the Firearm Blog

Asa Hearing Protection Act Suppressors For All -the Firearm Blog

Increase In Tax Stamps Being Introduced Defensive Carry

Silencer Saturday 11 Do You Want 500 Nfa Tax Stamps -the Firearm Blog

National Firearms Act – Wikiwand

Silencer Saturday 11 Do You Want 500 Nfa Tax Stamps -the Firearm Blog

Nfa Tax Stamps Explained Nfa Tax Stamp 2021 – Ffl License

National Firearms Act – Wikipedia

Nfa Tax Stamp – How To Get A Suppressor Or Sbr Tax Stamp 2021 – Rocketffl

How Do 500 Nfa Tax Stamps Sound Crusader Tactical

Silencer Saturday 11 Do You Want 500 Nfa Tax Stamps -the Firearm Blog

How Do 500 Nfa Tax Stamps Sound Crusader Tactical

What Happens When Suppressors Are No Longer Nfa Items – Gunsamerica Digest