What proposed changes to the capital gains tax affect estate planning? 2021 federal income tax brackets

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Under this proposed tax, combined federal and state taxes on capital gains would average 48 percent (itself a 66 percent increase over current law), exceed 50 percent in thirteen states and the district of columbia, and reach 58.2 percent in new york city.[12] the combined average federal and state capital gains would surpass denmark, chile, and france to become.

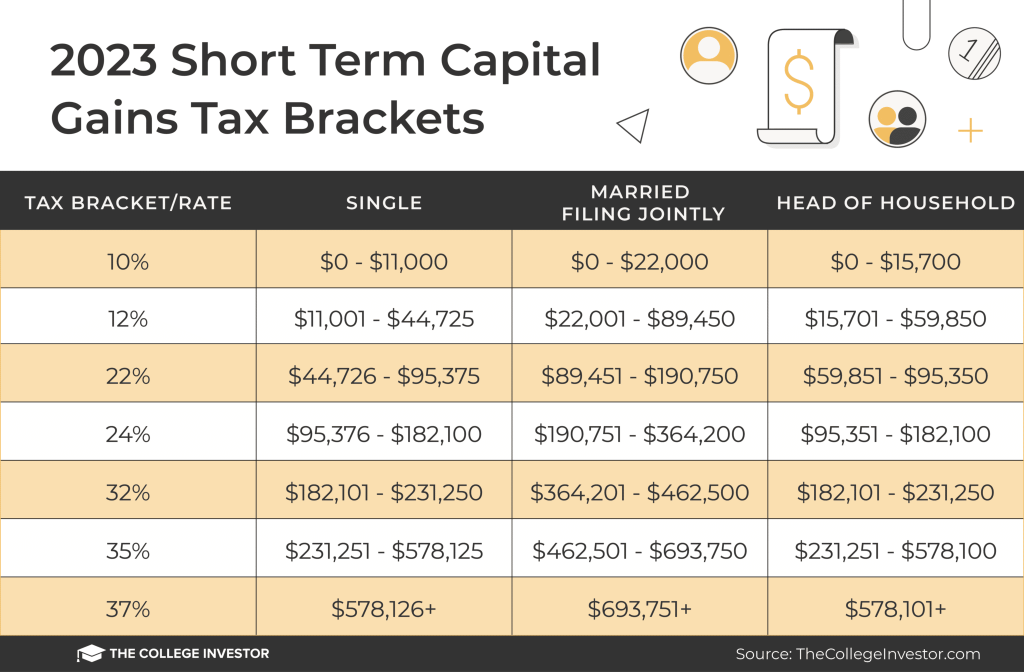

New short term capital gains tax proposal. The impacted assets include stocks, bonds, real estate, and art. That means you could pay up to 37% income tax, depending on your federal income tax bracket. (nii includes, among other things, taxable interest, dividends, gains.

House democrats on monday proposed raising the top tax rate on capital gains and qualified dividends to 28.8%, one of several tax reforms aimed. The tax would apply to people who make more than us$ 100 million a year for three years in a row or if one makes us$ 1 billion in annual income. It’s important to note that biden is also proposing a tax hike that will raise the top income tax bracket from 37% to 39.6%.

This proposed change says all gains, long and short will be taxed at the higer rate for anyone who makes over $1million income. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. The white house plan would instead tax capital gains as ordinary income, at a top proposed rate of 39.6%.

There's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax. In his april 28th speech introducing the proposal, president biden explained, “ending the practice of ‘stepping up’ the. Short term and long term, with short term being taxed much higher and long term taxed within your applicable tax bracket.

At the tax foundation, we find that biden’s capital gains proposal would raise $213 billion over 10 years, compared to. Economy would be smaller, american incomes would be reduced, and federal revenue would also drop due to fewer capital gains realizations. Currently, taxes on gains fall into 2 classifications.

It would apply to those with more than $1 million in annual income, according to bloomberg. Under biden’s proposal for capital gains, the u.s. The biden proposal would raise the capital gains tax rate on those earning more than $1 million.

Proposed capital gains tax under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. The build back better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross income (magi) above $25 million, including on capital gains income. Including a 3.8% medicare surtax on high earners, the top capital gains rate would be 28.8%, taking effect in tax years ending after sept.

Mutual Funds Capital Gains Taxation Rules Fy 2018-19 Ay 2019-20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Whats In Bidens Capital Gains Tax Plan – Smartasset

Capital Loss Set-off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Budgeting Fund

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

How To Set-off Short Term Long Term Capital Losses On Stocks Mfs

Capital Gains Tax 101

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What You Need To Know About Capital Gains Tax

Rethinking How We Score Capital Gains Tax Reform Bfi

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

What You Need To Know About Capital Gains Tax

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Pin On Tax Consultant

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others