Bureau of treasury click here to pay business personal property tax, or pay real estate tax. The us average is 4.6%.

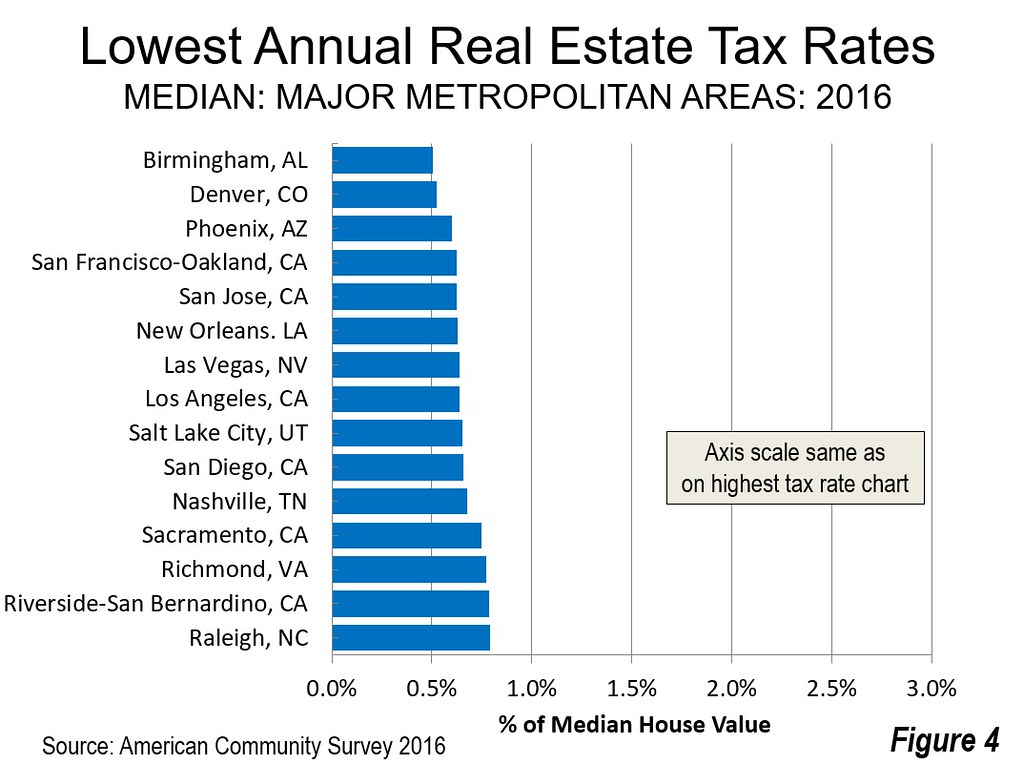

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Use the same method for determining additional use tax due on purchases at 4.5% (0.045.

New orleans sales tax rate. To compute the taxable amount for purchases, divide the $20.00 tax due by 5% (0.05), then enter the taxable amount of $400.00 on line s11 col a. Estimated combined tax rate 9.45%, estimated county tax rate 5.00%, estimated city tax rate 0.00%, estimated special tax rate 0.00% and vendor discount 0.0084. The 9.45% sales tax rate in new orleans consists of 4.45% louisiana state sales tax and 5% orleans parish sales tax.

The local sales tax rate in orleans parish is 4.75%, and the maximum rate (including louisiana and city sales taxes) is 9.45% as of november 2021. The louisiana sales tax rate is currently %. Find 667 listings related to louisiana sales tax rates in new orleans on yp.com.

Sales tax and use tax rate of zip code 70175 is located in new orleans city, orleans parish, louisiana state. 70175 zip code sales tax and use tax rate | new orleans {orleans parish} louisiana. Sales tax calculator | sales tax table the state sales tax rate in louisiana is 4.450%.

Income and salaries for new orleans.economynew orleans, louisianaunited statesincome per cap.$29,275$31,177household income$38,721$57,652. This is the total of state, parish and city sales tax rates. The new orleans sales tax.

The taxes paid totaled $30.00; 101 rows the 70119, new orleans, louisiana, general sales tax rate is 9.45%. General sales tax formally at 5% will, now be 5.2495% food for further consumption and prescribed medications (column b on the sales tax form) formally at 4.5% will now be 4.7495%

9.45% is the highest possible tax rate ( 70112, new orleans, louisiana) the average combined rate of every zip code in new orleans, louisiana is 9.261%. [ 2 ] state sales tax is 4.45%. Bureau of revenue click here to pay sales, parking, and occupational tax online.

The december 2020 total local sales tax rate was also 9.450%. Concerning local sales tax, occupational license, and other requirements. There is no applicable city tax or special tax.

This was envisioned as a temporary measure to boost the fledgling tourism industry in new orleans. What is the sales tax rate in new orleans, louisiana? Has impacted many state nexus laws and sales tax collection requirements.

The 2018 united states supreme court decision in south dakota v. This is the total of state, parish and city sales tax rates. The estimated 2021 sales tax rate for 70118 is.

Fast tax on read in new orleans. For tax rates in other cities, see louisiana sales taxes by city and county. With local taxes, the total sales tax rate is between 4.450% and 11.450%.

The federal government spent $14.5 billion on levees, pumps, seawalls, floodgates and drainage. Morial exhibition hall authority food and beverage tax. Combined local rate state rate total rate;

Therefore, the additional taxes due the city of new orleans would be 2% or $20.00. The us average is 7.3%. The louisiana sales tax rate is currently 4.45%.

New rate effective on all renewals on and after 12/1/2019:. Automating sales tax compliance can help your business keep compliant with changing sales. The new orleans sales tax rate is 0%.

Rate effective date required filing tax form; New orleans, la sales tax rate the current total local sales tax rate in new orleans, la is 9.450%. For more information about this tax,

That “temporary measure” is now nearly 53 years old. The parish sales tax rate is %. See reviews, photos, directions, phone numbers and more for louisiana sales tax rates locations in new orleans, la.

4% is the smallest possible tax rate ( 70140, new orleans, louisiana) 9.2% are all the other possible sales tax rates of new orleans area. The new orleans city council then suspended its 1 percent sales tax on hotel rooms as a temporary measure to limit the potential negative impact of hotel taxes and support the tourism industry. The minimum combined 2021 sales tax rate for new orleans, louisiana is.

11.75% (6.75% + 5%) 9/1/2020: You can print a 9.45% sales tax table here. [ 2 ] state sales tax is 4.45%.

What is the tax on food in new orleans? Sales tax and use tax rate of zip code 70112 is located in new orleans city, orleans parish, louisiana state.

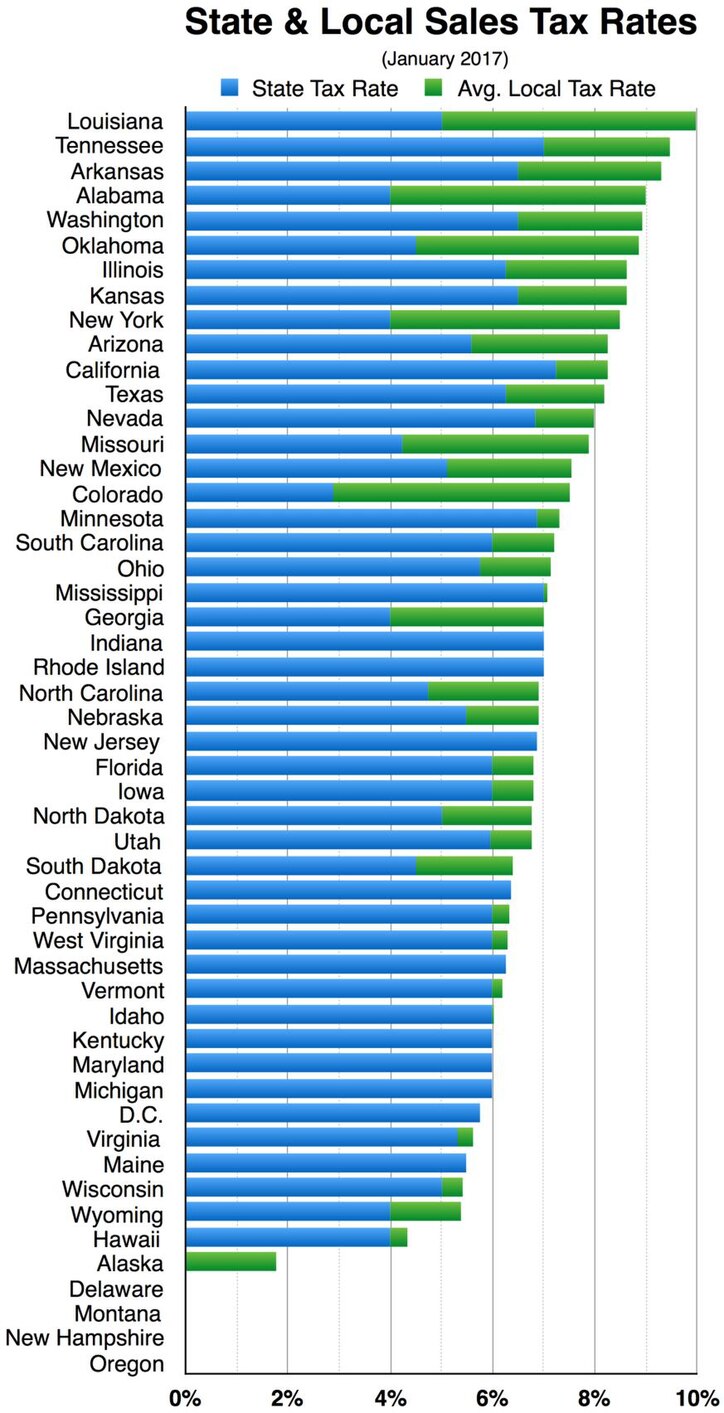

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

Analysis Shows Louisiana Has Highest Combined Sales Tax In Us – Biz New Orleans

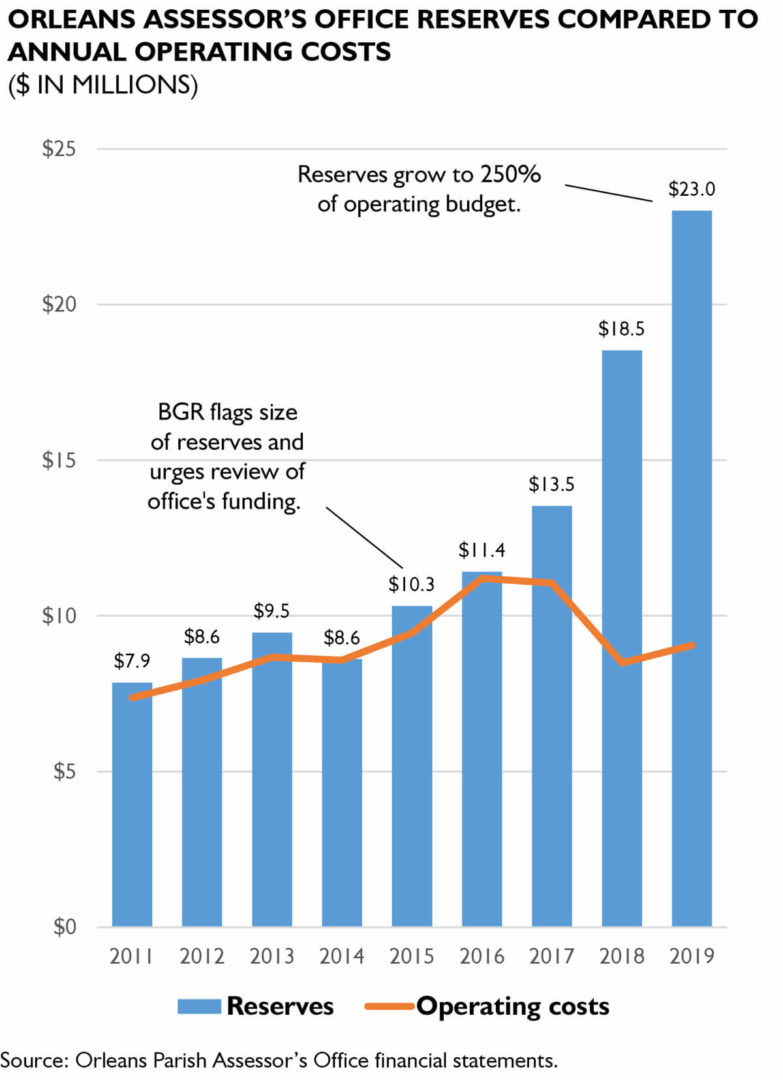

Policywatch Revisiting Assessment Issues In New Orleans

2

Louisiana Sales Tax – Small Business Guide Truic

2

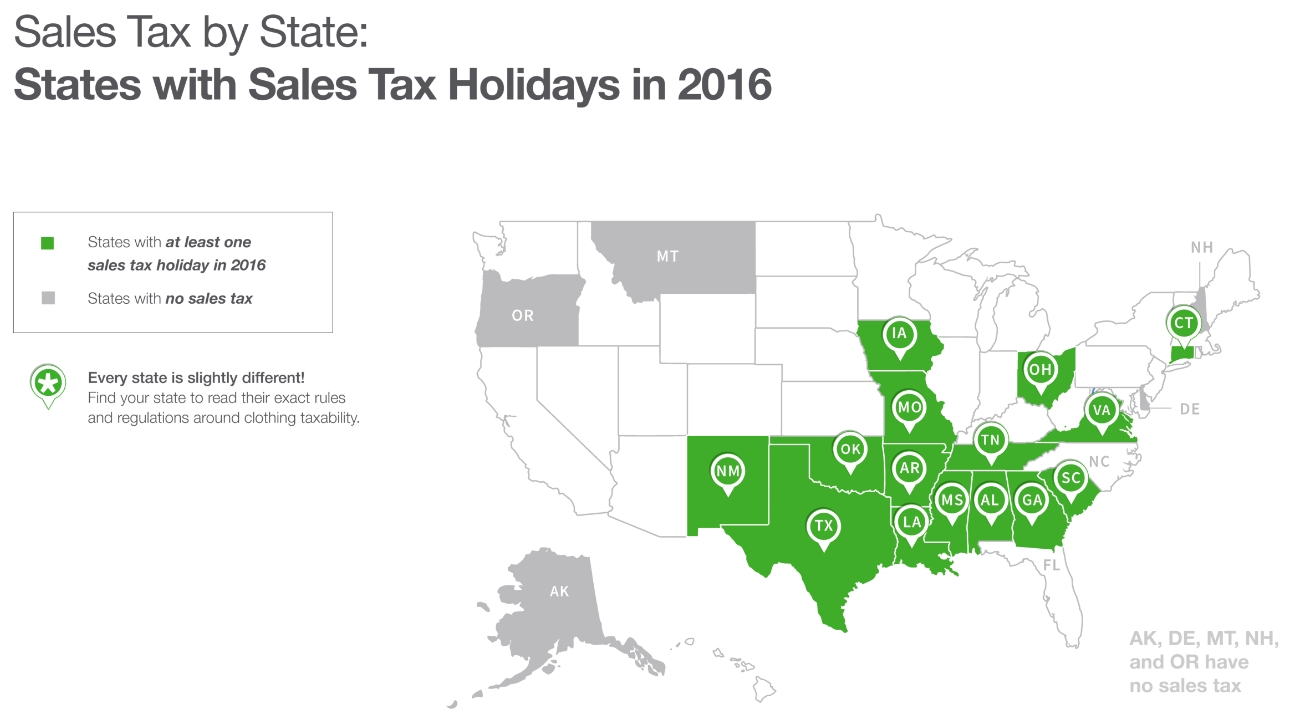

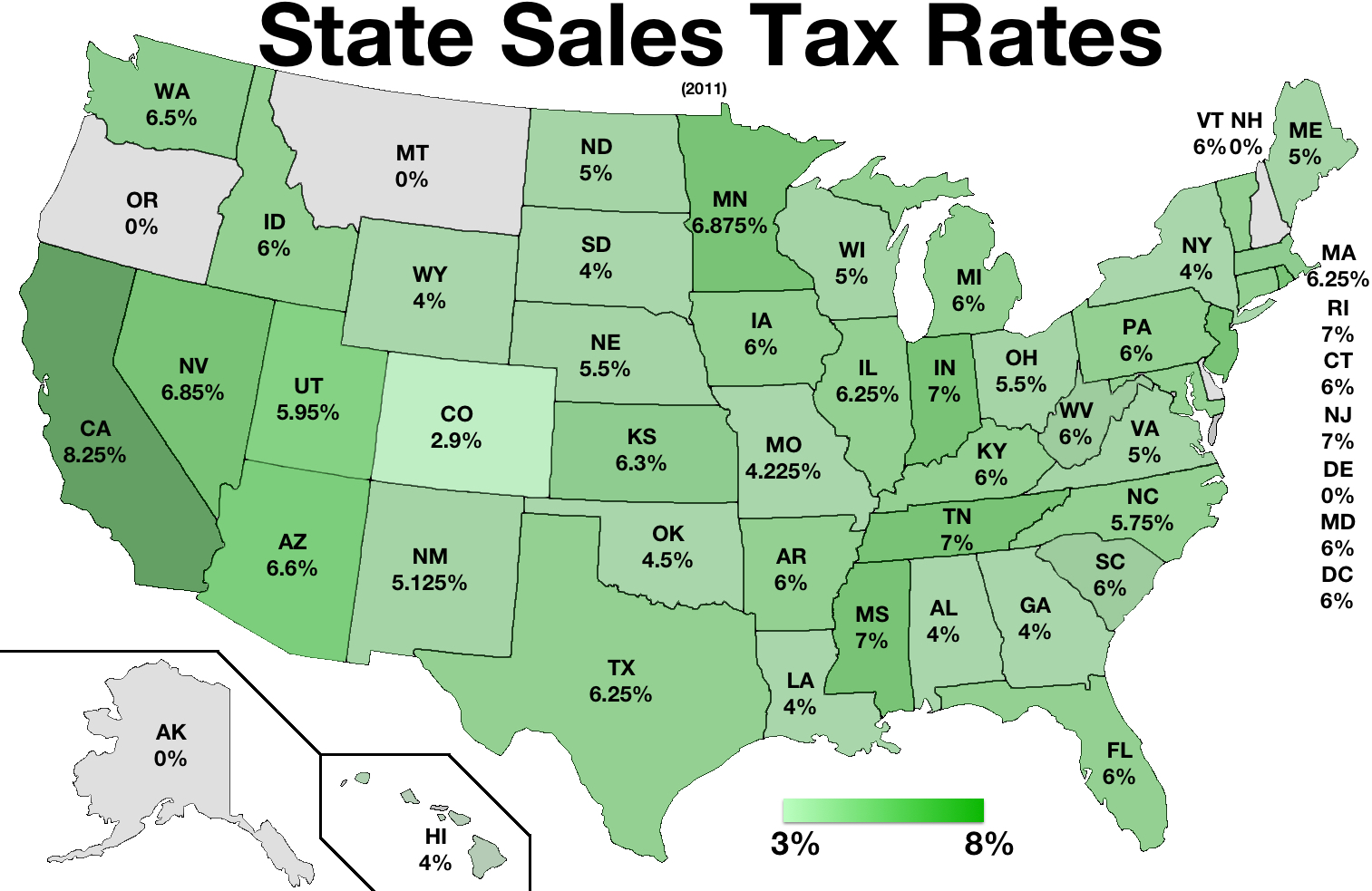

2017 Louisiana Sales Taxes

Sales Taxes In The United States – Wikiwand

2017 Louisiana Sales Taxes

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

After Overwhelming Defeat At Polls French Quarter Security Sales Tax Heading Back To The Ballot In April The Lens

Sales Taxes In The United States – Wikiwand

New Orleans Louisianas Sales Tax Rate Is 945

Hey Louisiana Were Number 1 In Highest State And Local Sales Taxes

Sales Taxes In The United States – Wikiwand

Sales Taxes In The United States – Wikiwand

Louisiana Has The Highest Sales Tax Rate In America Business News Nolacom

Louisiana Doesnt Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nolacom

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom