Finally, gross receipts tax receipts tend to be less sensitive to the business cycle than a tax on goods alone would be. How to use the map.

New Mexico Clarifies Gross Receipts Tax On Food – Avalara

The business pays the total gross receipts tax to the state, which then.

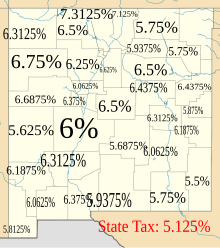

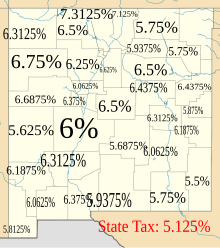

New mexico gross receipts tax rate. Generally, a business will pass that tax on to the consumer so that it resembles a sales tax. Gross receipts tax rate schedule. State of new mexico gross receipts tax rates.

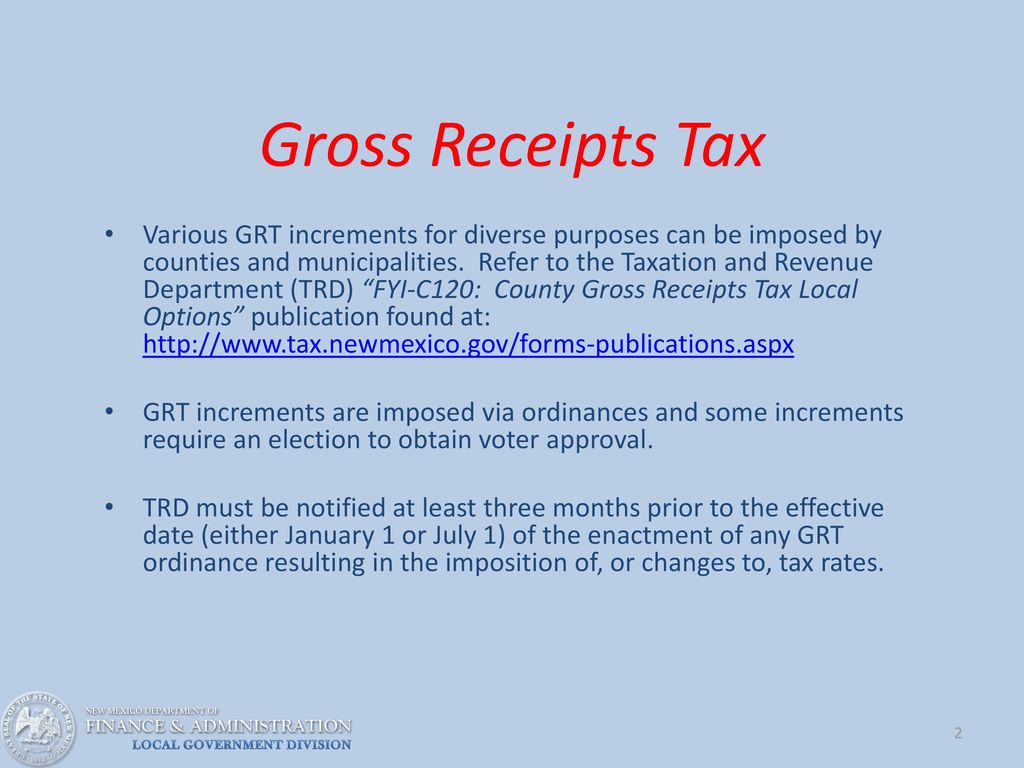

A space for the new mexico gross receipts tax location code has been added to nmar form 1106: The maximum local tax rate allowed by new mexico law is 7. This would be the first change in the statewide gross receipts tax rate since july of 2010, when the rate increased from 5 percent to its current 5.125 percent.

Pay parking citations, excavation & barricade permits, health permit renewal, & alarm fees. It varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located. According to the taxation and.

1 hours ago new mexico gross receipts tax rate schedule $0+ 4.800% $500,000+ 6.400% $1,000,000+ 7.600% new mexico collects a state corporate income tax at a maximum marginal tax rate of 7.600%, spread across three. Michelle lujan grisham on wednesday, speaking at an economic development event, announced that she will pursue a statewide cut in gross receipts taxes, the first in decades, as part of signature legislative agenda items for the upcoming 2022 session, a measure that will save new mexico families and. The gross receipts tax rate varies throughout the state from 5.125% to 8.6875% depending on the location of the business.

Liquor & pawnbroker license holders: This would be the first change in the statewide gross receipts tax rate since july of 2010, when. It varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located.

County regional spaceport gross receipts tax; Use a tax rate table State of new mexico new mexico counties new mexico municipalities.

Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. Legislative priority will save new mexicans $145 million annually. Currently, combined gross receipts tax rates in new mexico range from 5.125 percent to 9.0625 percent, depending on the location of the sale.

The gross receipts map below will operate directly from this web page but may also be launched from the department’s web map portal (portal link located below the map). There are a few ways to determine the proper location code: The total gross receipts tax is paid to the state, […]

Pawn, second hand, & precious metal dealers permits. New mexico gross receipts quick find is available. The gross receipts tax rate varies throughout the state from 5.125% to 8.8675%.

Since 2019, internet sales have been taxed using the statewide 5.125% rate. Within the city limits of hobbs, the effective rate is 6.8125%. The governor’s initiative will comprise a statewide 0.25 percent reduction in the gross receipts tax rate, lowering the statewide rate to 4.875 percent.

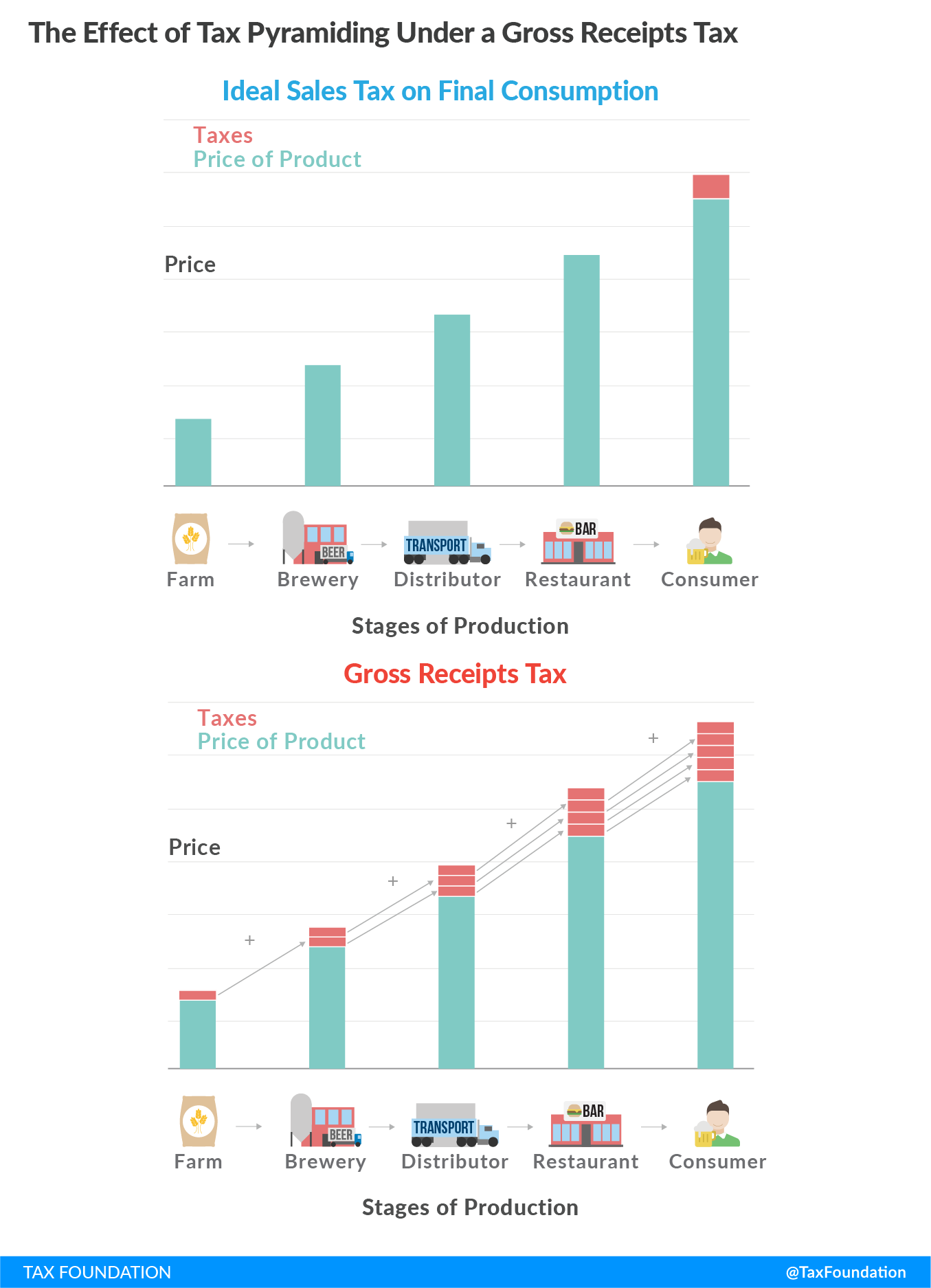

A gross receipts tax is a tax applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. The proposal would trim new mexico’s gross receipts tax rate by 0.25%, putting the rate at under 5%. For more details, read the new mexico gross receipts tax overview.

It varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located. View the current gross receipts tax rate schedule. On top of the state gross receipts tax, there may be one or more local taxes, as well as one or more special district taxes, each of which can range between 0 percent and 3.9375 percent.

Depending on local municipalities, the total tax rate can be as high as 9.0625%. New mexico has a gross receipts tax that is imposed on persons engaged in business in new mexico. One reason why the new mexico gross receipts share of.

The total rate is a combination of rates imposed by: New mexico gross receipts tax revenues grow at a rate nearly proportional to overall state economic growth. New mexico has a statewide gross receipts tax rate of 5.125%, which has been in place since 1933.

The gross receipts tax rate varies throughout the state from 5.125% to 8.6875% depending on the location of the business. The gross receipts tax rate varies throughout the state from 5.125% to 9.4375%. The governor’s initiative will comprise a statewide 0.25 percent reduction in the gross receipts tax rate, lowering the statewide rate to 4.875 percent.

The governor’s office said the proposed reduction would save new mexicans an. The business pays the total gross receipts tax to the state, which then distributes the counties’ and.

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry – New Mexico Oil Gas Association

A Guide To New Mexicos Tax System Executive Summary New Mexico Voices For Children

Gross Receipts And Property Tax – Ppt Download

Greater Gallup Economic Development Corporation Taxes

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap – Youtube

State Gross Receipts Tax Rates 2021 Tax Foundation

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

New Mexico Sales Tax – Small Business Guide Truic

States Latest Weapon In The Struggle For Tax Revenue Gross Receipts Taxes Accounting Today

Taxation In New Mexico – Wikipedia

A Graphic Explainer Of Problems With New Mexicos Gross Receipts Tax – Errors Of Enchantment

Tax Rates Climb Amid Debate Over Revising State Code – Albuquerque Journal

A Guide To New Mexicos Tax System New Mexico Voices For Children

States Gross Receipts Tax Its Complicated

2

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Gross Receipts Location Code And Tax Rate Map Governments