B c d e total f g deductions taxable gross receipts tax rate Expand the folders below to find what you are looking for.

X1kailne4g2xmm

Known as a crs identification number, it is used to report and pay tax collected on gross receipts from business conducted in new mexico.

New mexico gross receipts tax form. Other new mexico other forms: Click a form to download it. Granting a right to use a franchise employed in new mexico;

Denomination as gross receipts tax. Select the gross receipts tax rates link for additional tax rate information and schedules. Gross receipts are the total amount of money or value of other consideration received from:

In order of appearance announcements due dates Welcome to the taxation and revenue department’s forms & publications page. Originate and terminate within new mexico), are subject to “regular” gross receipts tax, just like any other general service performed in new mexico.

How to apply for a crs identification number Avalara will expire the nm srs1 long form (combined), and will update to the gross receipts tax return (form usnmtrd41413) with an effective date of 6/1/2021. Imposition and rate of tax;

Gross receipts tax taxation and revenue new mexico. You can print other new mexico tax forms here. Leasing or licensing property employed in new mexico;

The folders on this page contain everything from returns and instructions to payment vouchers for both income tax programs and business tax programs. Presence in new mexico with a total previous calendar year taxable gross receipts of at least $100,000 are considered to be engaging in business in new mexico. Taxpayers utilizing new mexico’s online taxpayer access point site should see these changes reflected in their account beginning july 6,.

707 15.707 1 hours ago businesses that do not have a physical presence in new mexico, including marketplace providers and sellers, also are subject to gross receipts tax if they have at least $100,000 of taxable gross receipts in the previous calendar year. The gross receipts tax rate varies throughout the state from 5% to 9% and frequently changes. You can also search for a file.

Anything over 5.125 percent represents local option rates imposed by counties and municipalities. * see instructions for column b. Selling property in new mexico;

More information on this standard is available. Leasing or licensing property employed in new mexico; By june 30, 2021, in avalara avatax, create a new filing request for the nm compensating tax return (form usnmtrd41412), effective 6/1/2021.

You may wish to register with the new mexico taxation and revenue department, which will prove helpful if you wish to apply for a gross receipts tax exemption (below). Gross receipts are the total amount of money or value of other consideration received from: Use this number to report and pay state and local option gross receipts tax, new mexico withholding tax and compensating tax under the combined reporting system (crs).

You can locate tax rates, tax authorizations, decisions and orders, and statutes & regulations. The gross receipts tax rate varies statewide from the state base of 5.125 percent to 8.8125 percent; Compensating tax is an excise tax imposed on persons using property or services in new mexico, also called “use tax” or “buyer pays.

How to register for a gross receipts tax permit in new mexico. The tax imposed by this section shall. Selling property in new mexico;

If your company reports consumer use tax: If applicable, you may also claim the refundable portion of approved tax credits using this schedule. Deductions require substantiation, either by a nontaxable transaction certificate or other valid proof.

After registering, the business will be issued a combined reporting system (crs) number, sometimes known as a new mexico tax identification number. Beginning july 1, 2021, new forms have been created to report gross receipts, compensating and withholding taxes separately. Cigarette, compensating, e911 service, gaming taxes, gasoline, gross receipts, special fuels, tobacco products, withholding, workers

Performing services in new mexico, and performing services outside of new mexico, the product of which is. Granting a right to use a franchise employed in new mexico; New mexico taxation and revenue department p.o.

(12) new mexico taxpayer bill of rights.

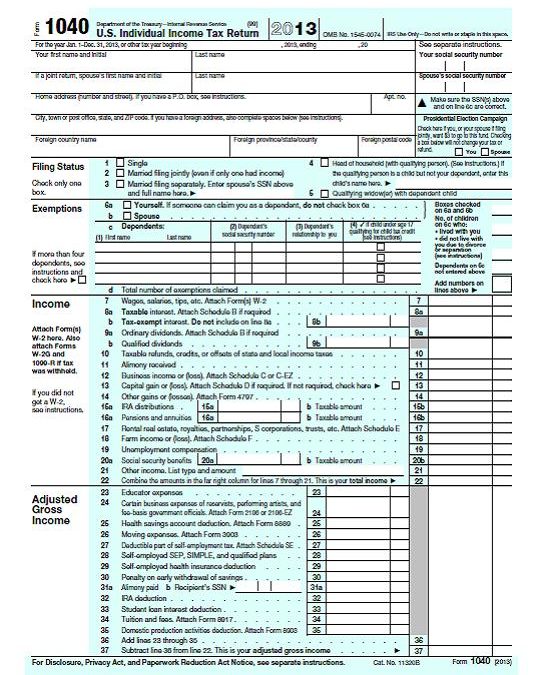

Americas First Income Tax Form Tax Foundation

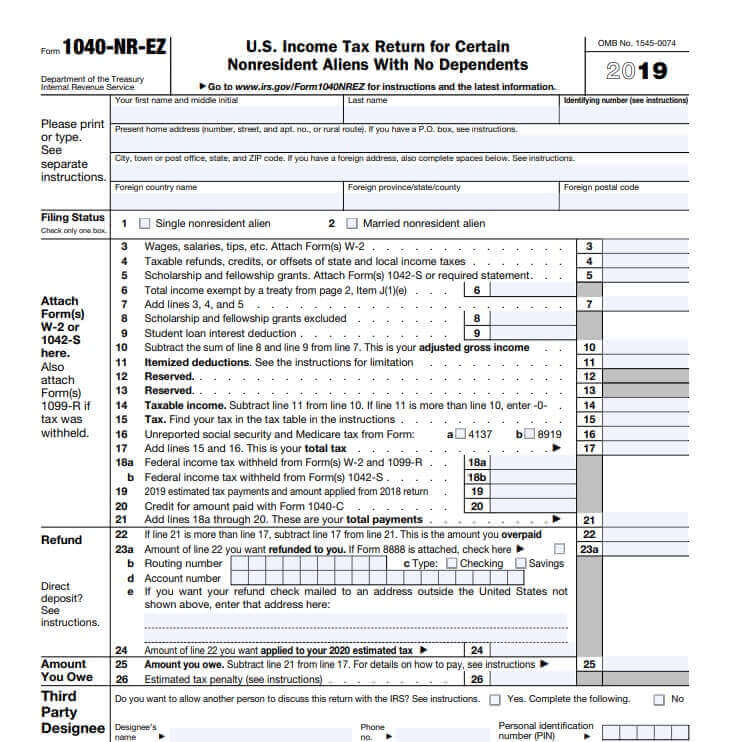

Us Tax For Nonresidents Explained – What You Need To Know

Form Crs-1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Georgia Tax Forms 2020 Printable State Ga Form 500 And Ga Form 500 Instructions

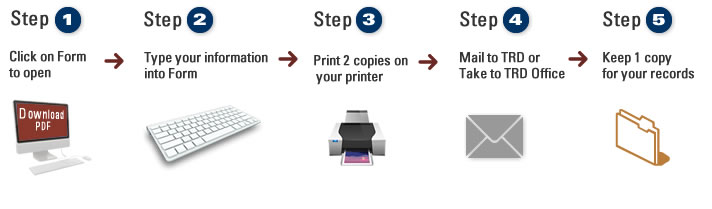

Fill Print Go Taxation And Revenue New Mexico

How To Pay Taxes On Sports Betting Winnings Bookiescom

Understanding The 1065 Form Scalefactor

How To Get A Non-taxable Transaction Certificate In New Mexico – Startingyourbusinesscom

Connecticut Tax Forms And Instructions For 2020 Ct-1040

Wisconsin Tax Forms And Instructions For 2020 Form 1

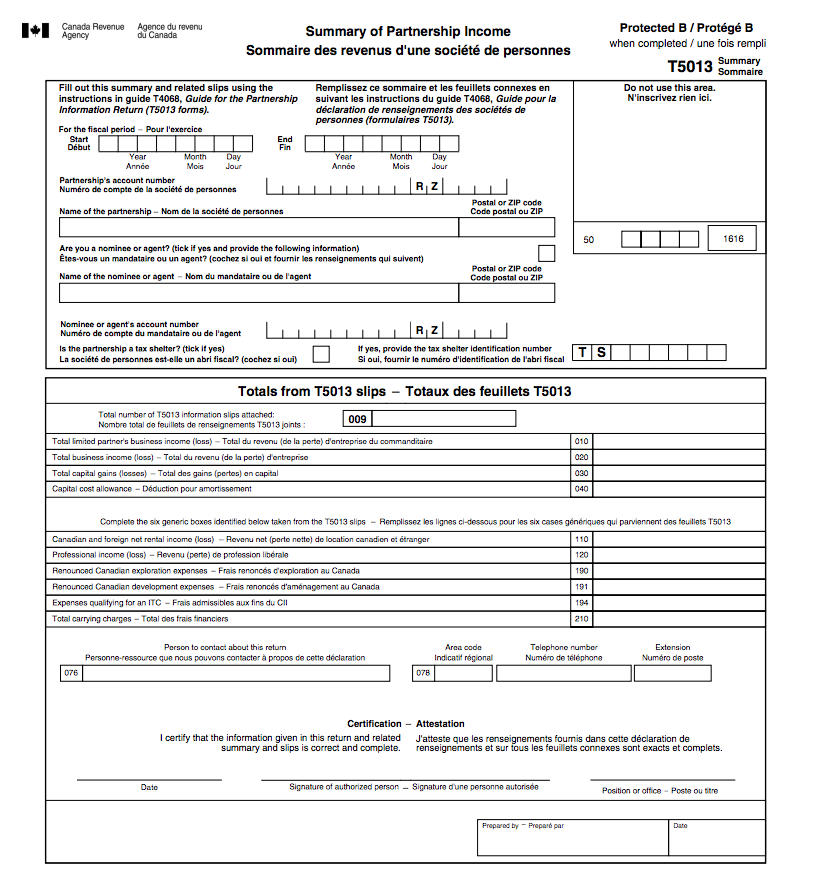

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Mississippi Tax Forms And Instructions For 2020 Form 80-105

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Alabama Tax Forms And Instructions For 2020 Form 40

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

2

Oregon Tax Forms 2020 Printable State Form Or-40 And Form Or-40 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Irs Boosts 2022 Standard Deductions For Inflation Relief Ktla