Tuesday, wednesday, thursday, and friday 8 a.m. To search by account id, enter account id.

Cities With The Lowest Tax Rates – Turbotax Tax Tips Videos

There is no city sale tax for new haven.

New haven mi taxes. The dmv's property tax section may be reached by mail at: On 5/8/1964, a category f4 (max. You may continue to pay them at the township until february 28 of the following year with penalties.

The new haven's tax rate may change depending of the type of purchase. Bs&a software provides bs&a online as a way for municipalities to display information online and is not responsible for the content or accuracy of the data herein. For mailed payments, please send to:

New haven township | shiawassee county | mi powered by as of january 1, 2022, the cost for individual record lookups will increase from $2 per record to $3 per record. If the tax forms are not available on the web site, you will need to contact the city in question and they will mail you the required forms. Estimated combined tax rate 6.00%, estimated county tax rate 0.00%, estimated city tax rate 0.00%, estimated special tax rate 0.00% and vendor discount 0.5% (n).

Property tax bills are sent out around january 1st. This is the total of state, county and city sales tax rates. To search by tax id, search by bill number by entering the grand list year, bill type and then tax id.

New haven, mi property records. You can also pay in person at the new haven township hall on these dates: Sales price ($200,000) / 2 = $100,000 x.0262004 = $2,629.04 per year for taxes.

Links to some michigan cities are available on this web site. To save township funds, i will mail a paid receipt only if you request it. Summer tax bills that were deferred are also due on this date.

The median property tax in michigan is $2,145.00 per year for a home worth the median value of $132,200.00. All due now balance due irs payment records for year 2020. The county sales tax rate is %.

New haven city rate(s) 6% is the smallest possible tax rate (48048, new haven, michigan) the average combined rate of every zip code in new haven, michigan is. In the town of new haven the town clerk is also the tax collector. Therefore, a property assessed at $10,000.

A mill rate of one mill means that owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 of assessed taxable property. Will pay a tax of $438.80. The tax collector collects the town and county property taxes.

The new haven sales tax rate is %. This value is converted into an assessment, which is one component in the computation of real property tax bills. The average household income in the new haven road area is $66,159.

Please refer to the michigan website for more sales taxes information. An alternative sales tax rate of 6% applies in the tax region macomb, which appertains to zip code 48050. Sales tax and use tax rate of zip code 48050 is located in new haven city, macomb county, michigan state.

Divide the sales price in half and multiply that amount by the correct rate below in the chart. Michigan is ranked number eighteen out of the fifty states, in order of the average amount of property taxes collected. School tax bills are sent out in september by the school district.

The average price for real estate on new haven road is $93,620. Link year, then link type and then link number. Directory listings of tax preparation locations in and near new haven, mi, along with hours and coupons.

The michigan sales tax rate is currently %. New haven rd, lenox, mi, 48048. Summer tax bills summer tax bills are mailed out on july 1st of each year and due by september 14 of each year.

Saturday, december 18, 2021—9 a.m. Please contact your local municipality if you believe there are errors in the data. This data is provided for reference only and without warranty of any kind, expressed or inferred.

We found 43 addresses and 46 properties on new haven road in lenox, mi. The mill rate for the 2020 grand list is 43.88. After february 28 all payments must be made at macomb county in mount clemens.

The assessor is a local government official who places a value on each parcel within the town. What is the sales tax rate in new haven, michigan? Counties in michigan collect an average of 1.62% of a property's assesed fair market value as property tax per year.

Find homes for sale in new haven, mi, or type an address below: New haven mi1st st (7) 26 mile rd (11) 27 mile rd (4) 28 mile rd (2) There is no special rate for new haven.

Taxable value ($125,000) times tax rate (37.3397) anchor bay pre rate divide by 1,000 = estimated yearly tax $125,000 x.0373397 = $4,667.46 (homestead rate) property tax estimator The average property tax on new haven road is $2,098/yr and the average house or building was built in 1970. School taxes are collected by the mexico academy and central school.

The new haven, michigan sales tax rate of 6% applies in the zip code 48048. The minimum combined 2021 sales tax rate for new haven, michigan is. [ 0 ] state sales tax is 6.00%.

There are approximately 5,809 people living in the new haven area.

Irs Refunds Will Start In May For 10200 Unemployment Tax Break

Irs Delays Tax Refunds Stimulus Checks Amid Identity Fraud Suspicion

Estimated Pricing Pulse4390520 Mo Payment 86954 Mo Includes Site Rent 95interest 993apr10down Property Property Tax Mortgage Loan Originator

Nothing Has Changed Over Time Crazy People Will Be Crazy Regardless Of The Laws On The Books On May 18 1927 45 People M History Interesting History Photo

Pin Auf Studyspo

How Parasites Poison Nyc Suburbs Property Tax System

Yellen Pushes Global Minimum Tax As White House Eyes New Spending Plan In 2021 How To Plan White House Tax

Michigan Property Tax Hr Block

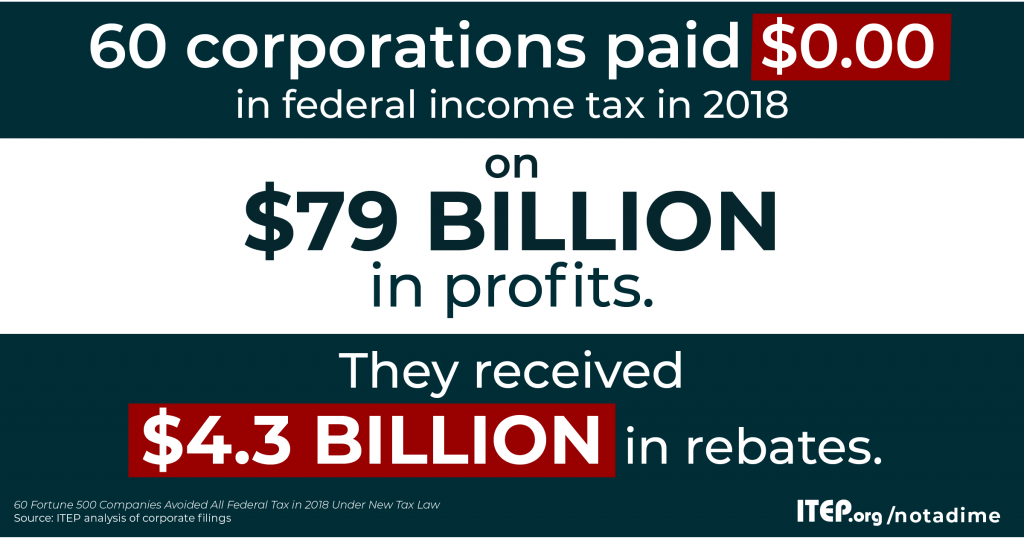

Corporate Tax Avoidance Remains Rampant Under New Tax Law Itep

Tax Dependents Accounting Humor Funny Friday Memes Taxes Humor

Detroit Before And After Detroit Michigan Flint Michigan Us Park

Pin On My New Book By Jeremy Mutz

Family Farms Wont Escape Bidens New Tax – Wsj

Up Up And Away 7 Homes With Private Helipads In 2021 New York Theme Legoland Colonial Style Homes

Detroit Files For Bankruptcy City City Photo Third World Countries

Catalpa Block Building Houses Elandts Tax Services Where My Parents Got Their Taxes Done At The Corner Of Catalpa And Main House Styles House Royal Oak

Rail Funding Real Property Tax Hike Weighed By Honolulu City Council In New Tax Bill

Pin On Offshore Banking Business

Take Advantage Of The New Tax Bracket Sweet Spots