The state of nevada does not participate in the administration of federal income tax nor does it levy a state personal, business or corporate income tax. As stated, nevada does not have an estate tax.

5 Ways To Get Approved For A Mortgage Without Tax Returns Tax Return Mortgage Home Loans

The date that the commerce tax year runs is july 1 to june 30.

Nevada estate tax return. However, if the settlor lives in a state that charges state income tax, the settlor will pay state income tax on profits the trust generates. The personal representative of every estate subject to the tax imposed by nrs 375a.100 who is required to file a federal estate tax return shall file with the department on or before the federal estate tax return is required to be filed, any documentation concerning the amount due which is required by the department. An executor or a survivor must, therefore, file a final federal income tax return (form 1040).

Some counties in nevada, such as washoe and churchill, add $0.10 to the rate. Inheritance and estate tax rate range. This helps reduce the erosion of trust assets by the tax rate.

The legislation requires “[e]ach business entity engaging in a business in [nevada] during a taxable year” to file a commerce tax return. Nevada filing is required in accordance with nevada law nrs 375.a for any decedent who has property located in nevada at the time of death, december 31, 2004 or prior, and whose estate value meets or exceeds the level requiring a federal estate tax return. Under the current federal tax code, on january 1, 2026, the bea—which is now $11.58 million—will revert or “sunset” back to $5 million as adjusted for inflation.

Currently, there is no separate form for the application of an extension request, but an extension for a time period of 30 days is available if filed with a written request. It is a very friendly taxing state and collects substantial income from the gambling industry. That’s because nevada has no state income tax of any kind.

As of 2019, if a person who dies leaves behind an estate that exceeds $11.4 million. The executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. The nevada department of taxation does not require informational copies of nevada residents’.

We always recommend checking with a licensed tax advisor to discuss your individual situation before utilizing information herein. Wages, capital gains, inheritances and, yes, winnings, are all devoid of state income taxes. Nevada has no state income tax.

Nevada has no personal income tax code. If the decedent’s assets (all separate property plus half of any community property) have a value greater than the exemption amount, a federal estate tax return (irs form 706) must be filed within nine months of the decedent’s death even though no estate tax is due. If an estate is worth $15 million, $3.6 million is taxed at 40 percent.

Whether you’re a teacher, a real estate mogul or a professional card shark, if you live in nevada you won’t need to pay any state taxes on your earnings. A corporation organized and domiciled in nevada can also significantly reduce its state tax burden by shifting its corporate level of activity to the state of nevada. Normally a federal estate tax return is only due if the gross estate plus the amount of any taxable gifts exceeds the applicable exclusion amount (up to $11.7 million in 2021).

Irrevocable trusts are taxed at the state level on where the trustee resides. Following the end of the tax year, returns are due for 45 days. It has been $14,000 since 2013).

Federal estate tax forms pertaining to the decedent’s estate may need to be filed (form 1041, form 706). Counties can also collect option taxes. As a result, they have large gambling tax receipts and they pass those savings down to.

Complex trusts) in which the trust pays income tax. It will increase to $11.40 million in 2019. A important recent legislative amendment:

Beginning on january 1, 2018, the bea was increased from $5 million to $10 million as adjusted for inflation. Who must file for estate taxes in nevada? Individuals who are considered domiciled in nevada generally escape taxation.

Nevada does not have an estate tax, but the federal government has an estate tax that may apply if your estate has sufficient value. The irs allows a generous annual exemption, currently $14,000, per donee. The nevada department of taxation receives an enormous number of inquiries regarding issues relating to federal income tax.

In practical terms, if you buy a home for $200,000, your real estate transfer taxes will only be $780. Nevada does not have a state or fiduciary income tax. Nevada's statewide real property transfer tax is $1.95 per $500 of value over $100.

The tax is collected by the county recorder. Estate tax return is required to be filed, the personal representative must file a report explaining to the court why the estate is not closed. When is the tax due for the nevada commerce tax?

Similarly, if the deceased individual had a sizable estate or assets that might generate income in the future, the estate may owe taxes. 143.037 except as otherwise provided in this section all estates must be closed within 18 months of the appointment of the. This can make the combined county/state sales tax rate as high as 8.10% in some areas.

Keep reading to find out more about nevada’ s tax rates and how they might affect you. 26 the tax therefore applies on a separate entity basis, and since the term “business entity” is defined to include entities that might be disregarded for federal income tax purposes (e.g., single member limited liability companies),. This means you may give up to $14,000 each year to an unlimited number of recipients without having to file a gift tax return.

(the amount was established at $10,000 and is increased periodically for inflation; Owning real estate in the state of nevada is key factor when considering such tax advantages. Of course, you must still.

If a client has a nevada trustee, the nevada trusts may avoid filing a state income tax return. Yes, nevada has no state income tax as of this writing. The federal estate tax exemption is $11.18 million for 2018.

Nevada has various sales tax rates based on county.

Million Dollar Estate Known As The Sierra Star In Incline Village Nv Incline Village Lake Tahoe Tahoe

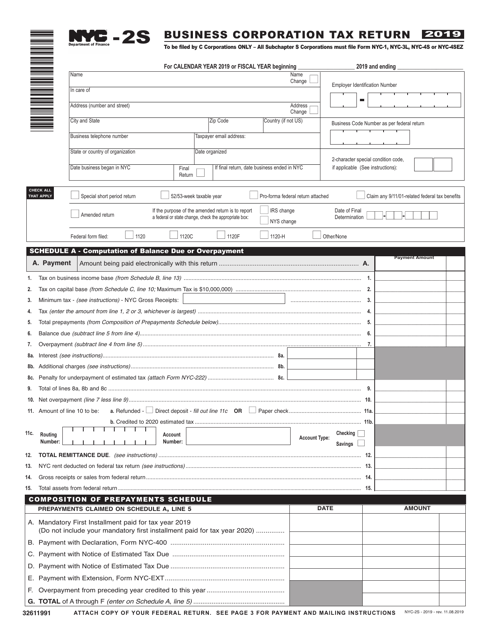

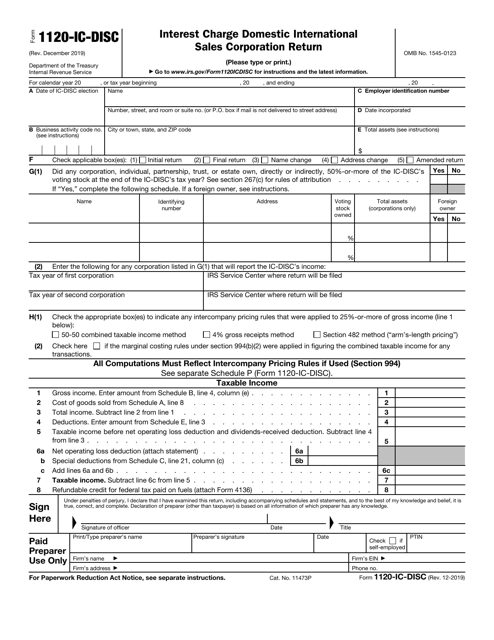

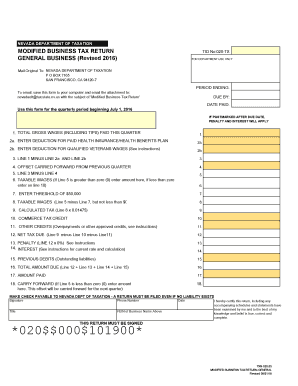

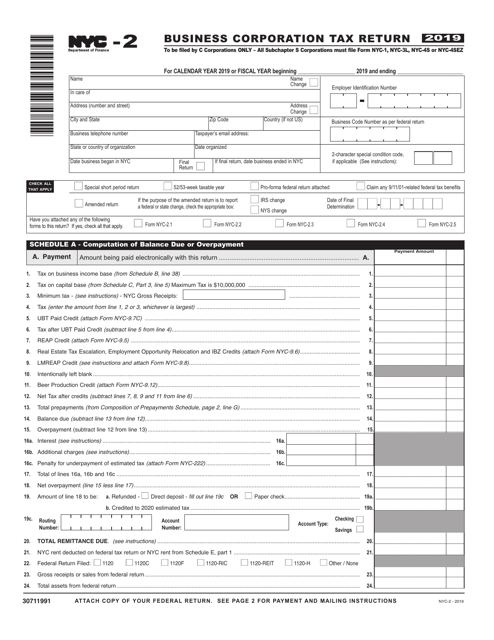

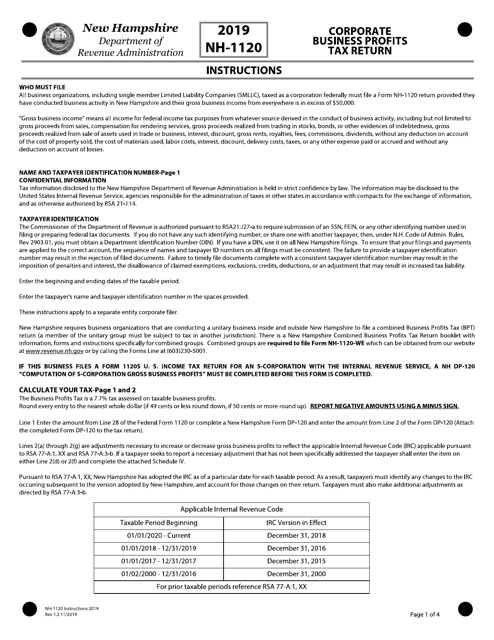

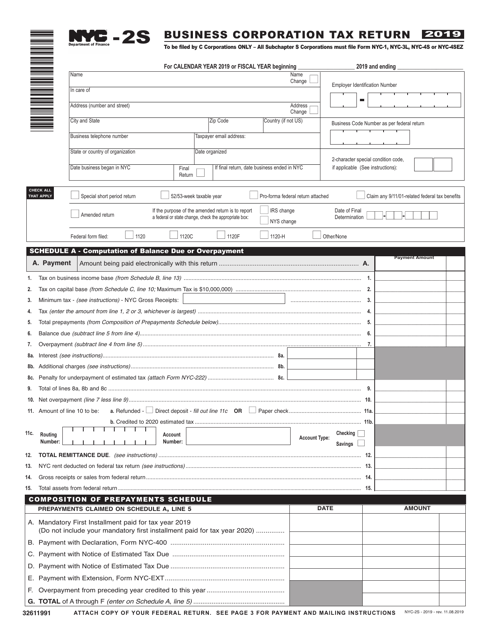

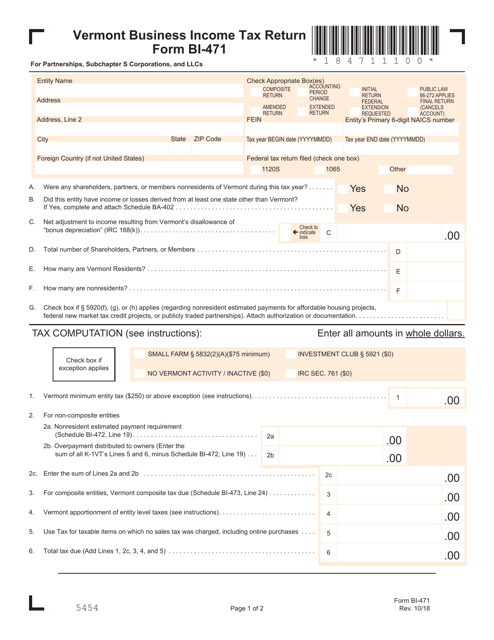

Corporate Tax Return Due Date 2019

Corporate Tax Return Due Date 2019

Corporate Tax Return Due Date 2019

Corporate Tax Return Due Date 2019

How To Fill Out Form 1040 Preparing Your Tax Return Oblivious Separation Agreement Template Estimated Tax Payments Tax Return

31114 Income Tax Returns For Estates And Trusts Forms 1041 1041-qft And 1041-n Internal Revenue Service

Massachusetts Tax Forms 2020 Printable State Ma Form 1 And Ma Form 1 Instructions

Corporate Tax Return Due Date 2019

Dua Kali Sp3 Kasus Hukum Sulit Dibuka Lagi Islam Hukum Pidana

Corporate Tax Return Due Date 2019

Filing Taxes For Deceased With No Estate Hr Block

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

Executor Of Estate Form New York Papers And Forms Legal Forms New York Papers Quitclaim Deed

New Jersey Tax Forms 2020 Printable State Nj-1040 Form And Nj-1040 Instructions

Worksheet For Completing The Sales And Use Tax Return Form 01-117

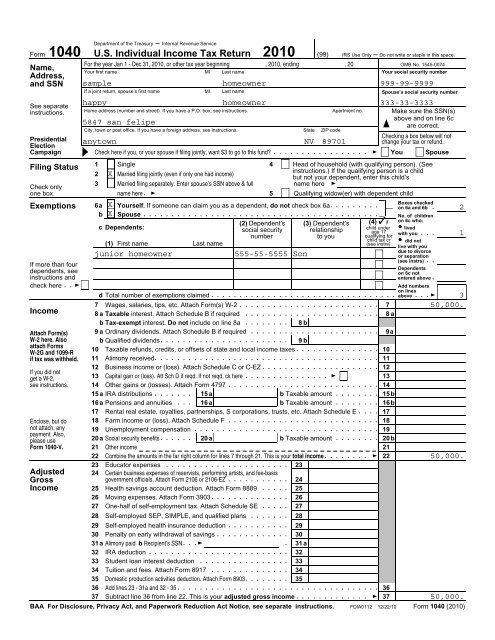

Sample 1040 Tax Return – Nevada Rural Housing Authority

Understanding The 1065 Form Scalefactor

2021 No Tax Return Mortgage Options – Easy Approval