Lottery number selectors, converters and calculators below is a list of calculators and selector programs available for use in picking lottery numbers for various national, regional and state lotteries. The nebraska lottery started in 1993, making it the us' 37th state lottery.

Lottery Tax Calculator – How Lottery Winnings Are Taxed Taxact

By law, nebraska lottery will withhold 24% of winnings for federal taxes and 5.0% for state income taxes.

Nebraska lottery tax calculator. Also, check out our powerball payout and tax calculator to figure out how much taxes you will owe on your lottery winnings and also your payout for both cash and. Additional tax withheld, dependent on the state. They are for reference only, and should not be used for form substitution purposes.

22 infographics ideas romney infographic obama. Nebraska judicial branch internet payment system top www.nebraska.gov. Form 1040xn, 2020 amended nebraska individual income tax return.

All calculated figures are based on a sole prize winner and factor in an initial 24% federal tax withholding. Entries received after this date and time are ineligible for the drawing and will be destroyed. The nebraska lottery will not accept entries at any of their claim centers.

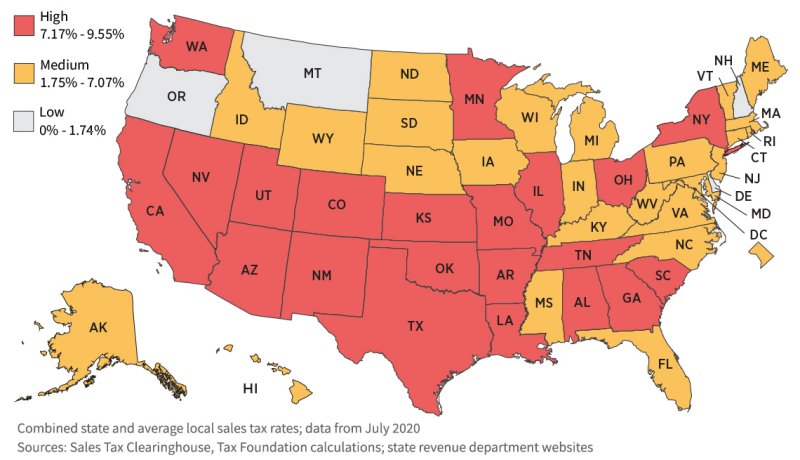

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Nebraska has a 5.5% statewide sales tax rate, but also has 295 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.547% on top of the state tax.this means that, depending on your location within nebraska, the total tax you pay can be significantly. 2010 = $311,221 2011 = $332,793 2012 = $389,088 2013 = $394,829 2014 = $350,223 2015 = $369,911 what is the projected additional revenue that will be generated from this tax, if alcohol is included?

All entries must be received no later than 5:00 p.m. With mega millions fever sweeping the country, today we released a short report on state lottery withholding taxes. Substitute forms submitted for approval based on these drafts will not be accepted.

Since then, it has raised more than $717 million for the state's educational and environmental programs. The nebraska state sales and use tax rate is 5.5% (.055). Capitol tour nebraska blue book.

Nebraska lottery proceeds received by the state fair, to the nebraska state fair support and improvement cash fund. Jump to nebraska lottery dashboard. Five numbered balls are drawn from 1.

The total payment covers the amount you owe as well as the operating costs, incurred by the nebraska.gov network manager, nebraska interactive, llc contracted by the nebraska state records board (nsrb) to provide online services for nebraska government agencies, including the state's portal (www.nebraska.gov). Please note, the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the lottery every year. (c.t.), on thursday, december 29, 2011.

The retailer is required to calculate the occupation tax on the meal charge and then use this “subtotal” to calculate the state and local sales tax. A portion of this information has been provided by usamega.com, and all figures are subject to fluctuation resulting from (but not limited to) changes in tax requirements, lottery rules, payout structures, personal expenditures, etc. This varies across states, and can range from 0% to more than 8%.

How to win the 2020 and 2022 nylon nba lottery: For contracts above $10,000, the bond must be 10% of the contract amount for the first $100,000, and. Form cdn, 2020 nebraska community development assistance act credit computation.

$1,000 for contracts between $2,500 and $10,000; All lottery winnings count toward your taxable income at the end of every year. Our tax calculator can be accessed and used free in any state and is great to use in the more popular gambling states like nj, nv, mi, pa, in.

By law, nebraska lottery will withhold 24% of winnings for federal taxes and 5.0% for state income taxes. We have written and provided these for your use and convenience, and hopefully some luck. Attention these are draft forms for tax year 2021.

In this example, the business is not allowed to add the tax rates together and charge 9.5% (one flat rate). Other lottery calculators and tools. Drawings are held at 10:00 pm ct every tuesday and friday.

What is nebraska mega millions? This can range from 24% to 37% of your winnings. Lottery winnings of $600 or less are not reported to the irs;

The taxes you will have to pay in order to receive. Lottery tax rates vary greatly by state. Your tax bracket may also go up when winning a large amount.

Winnings in excess of $5,000 are subject to a. Form 4797n, 2020 special capital gains election and computation. The table below shows the payout schedule for a jackpot of $243,400,000 for a ticket purchased in nebraska, including taxes withheld.

Terms base year base year means the tax year preceding the year of application eligible employee eligible employee means a nebraska employee subject to nebraska income tax withholding on compensation received from the applicant or an employee of a qualified employee leasing company which employs all of the applicant's employees. Nebraska lottery schools tax information unclaimed property. Draw sales end at 9:00 pm ct on the day of a drawing.

An applicant under the nebraska advantage rural. Here's everything you need to know about the nebraska lottery such as results, winning numbers, and draws. 201.01 these regulations govern the practice and procedure before the nebraska department of revenue or the division of the nebraska department of revenue arising from and as required by the state lottery act, and constitute a separate practice and procedure system from that governing other revenue and gaming laws administered by the nebraska.

For postsecondary education private career schools nebraska college fund school closings state colleges university of nebraska. Income tax withheld by the us government, including income from lottery prize money. The odds of winning a $10 million prize in the 2020 nba lottery are 1 in 4.1 million, according to….

States With Highest And Lowest Sales Tax Rates

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Powerball How Much Youll Pay In Taxes If You Win Money

Powerball Tax Calculator Payout Calculator

Powerball Tax Calculator Payout Calculator

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Usa Lottery Tax Calculators Comparethelottocom

Lottery Tax Calculator Updated 2021 – Lottery N Go

Usa Lottery Tax Calculators Comparethelottocom

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Usa Lottery Tax Calculators Comparethelottocom

How Long After Winning The Lottery Do You Get The Money

Usa Lottery Tax Calculators Comparethelottocom

Lottery Tax Rates Vary Greatly By State

:max_bytes(150000):strip_icc()/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

State Taxes

Mega Millions Payout Calculator After Tax Jan 22 Heavycom

Michigan Lottery Tax Calculator Comparethelottocom

Lottery Tax Calculator Updated 2021 – Lottery N Go

Maryland Gambling Winnings Tax Calculator Marylandbetscom