Earthodyssey, llc, is a company in the business of innovation. Challenging or protesting tax rates is beyond the scope of your property tax grievance.

Make Sure That Nassau Countys Data On Your Property Agrees With Reality

The median property tax on a $487,900.00 house is $6,001.17 in new york.

Nassau county tax rate calculator. Look up the day count for the closing date. Nassau county has introduced an online school property tax calculator to help homeowners estimate their october tax bills in response to the sticker shock some residents experienced last year beca Rules of procedure (pdf) information for property owners.

The 2017/18 tax year will be used as a basis for any potential deferment. Us sales tax rates | ny rates | sales tax calculator | sales tax table. There is no city sale tax for nassau.

What is the nassau county tax year? 69 rows nassau county, new york sales tax rate 2021 up to 8.625%. However, effective tax rates in the county are actually somewhat lower than that.

The city of fernandina beach has provided a spreadsheet to assist in the tax calculation for interested residents. Assessment challenge forms & instructions. The nassau county sales tax rate is %.

In 2018, the average millage rate in the county was 26.4 mills, which would mean annual taxes of $7,920 on a $300,000 home. How to challenge your assessment. The median property tax on a $487,900.00 house is $8,733.41 in nassau county.

Assessed value (“av”) x tax rate = dollar amount of taxes. How 2021 sales taxes are calculated in nassau. Nassau county uses a simple formula to calculate your property taxes:

The nassau, new york, general sales tax rate is 4%.the sales tax rate is always 8% every 2021 combined rates mentioned above are the results of new york state rate (4%), the county rate (4%). Nassau county lies just east of new york city on long island. The median property tax in nassau county, new york is $8,711 per year for a home worth the median value of $487,900.

The document reflects the tentative operating millage rate (5.54683 mills.) instructions: Of course, you only pay taxes in a few of them, the exact number varies depending on where you live. Per new york state law, a home’s assessed value cannot be increased by more than 6% per year.nassau county will be overlooking this law during this reassessment period.

This form is applicable for city of fernandina beach residential properties with a taxable value of $100,000 or greater and with a qualifying homestead. This is the total of state and county sales tax rates. The minimum combined 2021 sales tax rate for nassau county, new york is.

$4.00 per $1000 of purchase price. The december 2020 total local sales tax rate was also 8.625%. You can find more tax rates and allowances for nassau county and florida in the 2022 florida tax tables.

Nassau county collects, on average, 1.79% of a property's assessed fair market value as property tax. How does sales tax in nassau county compare to the rest of florida? New york state transfer tax (as of 8.1.2006) residential rate.

The 2018 united states supreme court decision in south dakota v. Earthodyssey, llc has also developed a general purpose sales tax calculator for calculating new york state sales tax on any item for sale. Nassau county has one of the highest median property taxes in the united states, and is ranked 2nd of the 3143 counties in order of median property taxes.

The current total local sales tax rate in nassau county, ny is 8.625%. The median property tax on a $487,900.00 house is $5,122.95 in the united states. Has impacted many state nexus laws and sales tax.

Nassau county in florida has a tax rate of 7% for 2022, this includes the florida sales tax rate of 6% and local sales tax rates in nassau county totaling 1%. $4.00 per $1000 of purchase price. Nassau county tax lien sale.

The tax estimator allows you to calculate the estimated ad valorem taxes for a property located in nassau county. Calculate the daily tax rate by dividing the annual tax rate by the days in the year (365, or 366 for leap years). This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Earthodyssey, llc has developed a sales tax calculator to simplify the calculation of new york state sales tax on the earthodyssey pulling tool. The new york state sales tax rate is currently %. Nassau county's taxing jurisdictions range in size from the county itself to towns, cities, villages, local school districts, library districts and other special districts providing specific services to people in their boundaries.

Stephen Plolzs First Meeting As Bank Of Canada Governor – Leslie Blais – Mortgage Agent Canada Bank Mortgage

New Travel Services Transportation Services Service Trip Car

Co-op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Nyc Condo Buying A Condo Condo

Real-estate-agents-commission-rebates-in-nyc – Hauseit Real Estate Buyers Real Estate Buyers Agent Real Estate

Falcon Expenses Expense Report Template Expensive Expense Tracker Mobile Solutions

Golf Stat Tracker Spreadsheet In 2021 Spreadsheet Spreadsheet Template Excel Spreadsheets

When Applying For A Home Loan There Are Many Documents That You Will Need To Things To Sell Debt Relief Home Loans

Pin On Business Pinterest And Blogging

Robert Morris Architect Nassau Bay House Clear Lake Texas Photo By Cyndy Allard Special Design And Concr Custom Built Homes Houston Real Estate House Styles

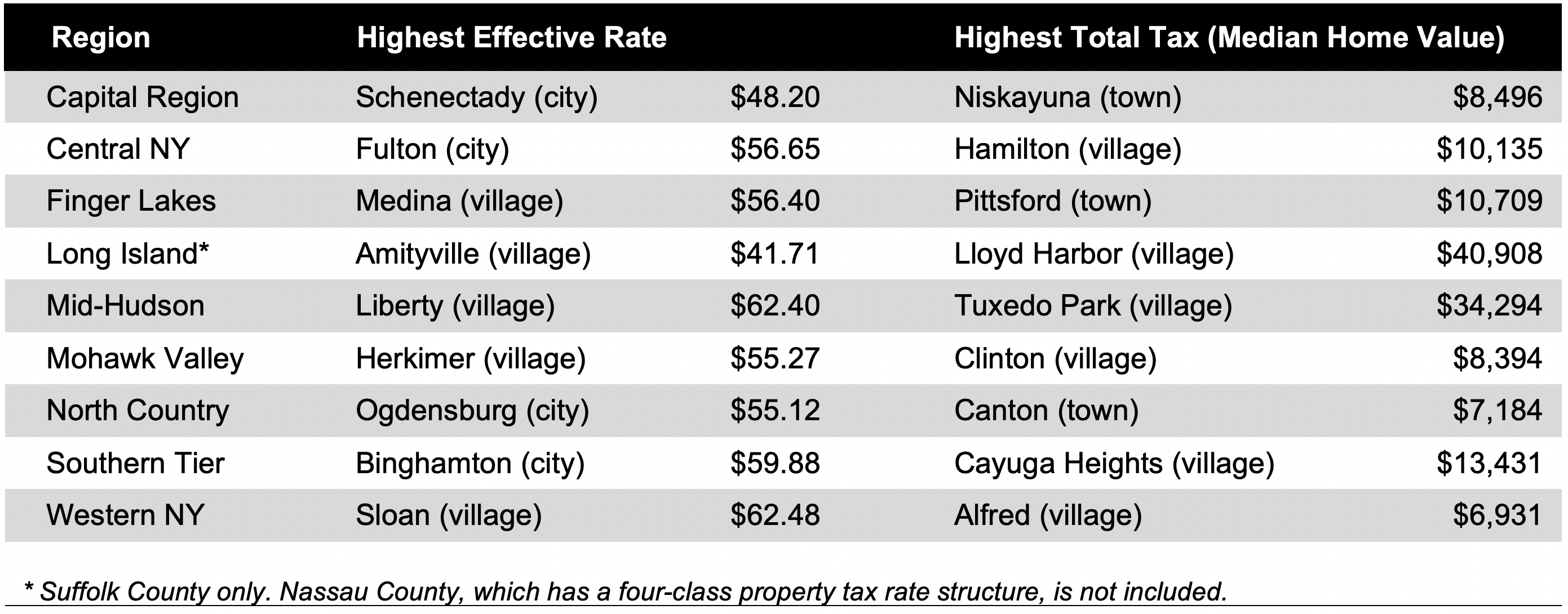

Local New York Property Taxes Ranked By Empire Center – Empire Center For Public Policy

Pin On Foreclosure Attorney In Beverly Hills

Not-having-a-buyers-agent-nyc – Hauseit Buyers Agent Nyc Buyers

New York Property Tax Calculator 2020 – Empire Center For Public Policy

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Property Tax Calculator – Smartasset

Nyc-real-estate-buyers-agent-duties – Hauseit Real Estate Buyers Agent Real Estate Buyers Nyc Real Estate

Ems Core Portal In 2021 Payroll Software Payroll Employee Engagement

How To File Previous Year Taxes Online Priortax Filing Taxes Previous Year Tax

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit