Many employees want a net salary but we recommend agreeing a gross for numerous reasons. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee, such as a nanny or senior caregiver:

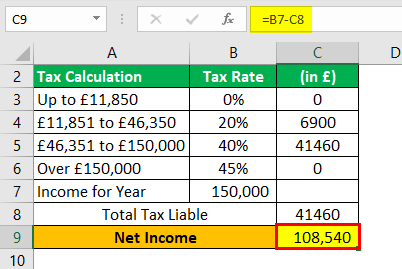

Corporate Tax Meaning Formula Examples Calculations

I feel good that we are paying taxes and above board;

Nanny tax calculator uk 2020. Gtm payroll services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not constitute the provision of tax or legal advice. You get £21.15 per week. However, please note that from december 2020 hmrc no longer allow claims to be made whilst employees are serving statutory or.

The table below shows the standard tax rates and thresholds for the 2021/2022 tax year for employees living in england, wales or northern ireland (slightly different rates apply in scotland). Or if you need more help talking it through, get a free phone consultation with one of our household experts: This is based on the 2021/2022 tax year using tax code 1257lx.

Workplace pension contributions are shown as. This time is also known as your basis period; Enter your caregiver's payment info.

Enter your employee’s information and click on the calculate button at the bottom of the nanny tax calculator. Nanny taxes are the employment taxes for those who hire household workers like nannies, housekeepers, and senior caregivers and pay them more than the nanny tax threshold (for 2021, this threshold is $2,300). 19.11.2021 analysis of claiming tax rebates via high volume agents;

“ with covid i had to hire a nanny for the first time, and one week into nest payroll i love it. At the time of writing tax related calculators are uk specific, however there. Table of income tax bands by tax year.

10.11.2021 tax year basis period for accounts from. Find out the total cost of employing any staff. Calculators.icu is the online home of calculators for any occasion.

The child benefit is simply a payment that the uk government can give to any parent who has children under the age of 16. Once that limit has been met, employer and employee shares of social security and medicare taxes must be remitted. Pay as you earn tax.

Nanny tax calculator cost calculator for nanny employers. The user assumes all responsibility and liability for its use. You can use the calculator to compare your salaries between 2017, 2018, 2019 and 2020.

Once you have discussed details and pricing with our support team, you can go to order page and fill all the requested fields regarding your order. This information is for guideline purposes only. Any employee pension payments will be deducted from the net pay you have supplied.

Latest business and tax news; Secondly, we have provided a whatsapp number to order quickly. Give me a second to calculate this.

And how much you earn: Usage of the payroll calculator. More than one job or nanny share?

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer, whether paying a nanny, a senior care worker, or other household employees.*. You must first decide if you are one employer or individual employers. Negotiate a gross salary with your employee.

This is a gross annual salary of £42,670 per year and a total cost to the employer of £48,438. The amount can be hourly, daily, weekly, monthly or even annual earnings. The figures above can be found at the staff tax webiste:

Nanny tax calculator homework solutions. All, they can contact our live customer support team which is available 24/7. Please note, if your nanny is leaving your employment but is currently furloughed, then we will process the final documentation as normal.

04.08.2020 eat out to help out calculator; I was a self employed nanny for 2020. The calculator is updated with the tax rates of all canadian provinces and territories.

Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees. Please note that the total cost includes tax and employee's national insurance as well as employer's national insurance contributions. Calculate pay and withholdings using the nanny tax company's hourly nanny tax calculator or salary calculator.

For tax year 2020, fica taxes will be applicable if a family paid you at least $2,200 in the year and unemployment insurance taxes will have to be paid for wages of more than $1,000 in a. If you choose individual employers, you should provide the shared tax code value in other, based on your. The tax calculation provided is for to establish the full cost including employer’s nic.

” — emkay 274, 09/16/2020, verified five star apple app store review If you earn over £50,000 this benefit is reduced. The pay statement gets emailed right to the nanny and i can venmo her in real time.

Your total cost will include your employee's gross wage, employer's ni, and possible pension contributions. This is 100% worth the cost. You can also print a pay stub once the pay has been calculated.

Your taxes are due on 31st january 2021; Our goal is to provide fast, and easy calculations for simple and complex subjects that would normally require an amount of research to understand. The standard tax code for this year is 1257l, this represents £12,570 tax free per annum.

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Progressive Tax Examples Top 4 Practical Examples With Calculation

How Much Does An Employee Cost In Spain Includes Calculator – Edco Business Consulting

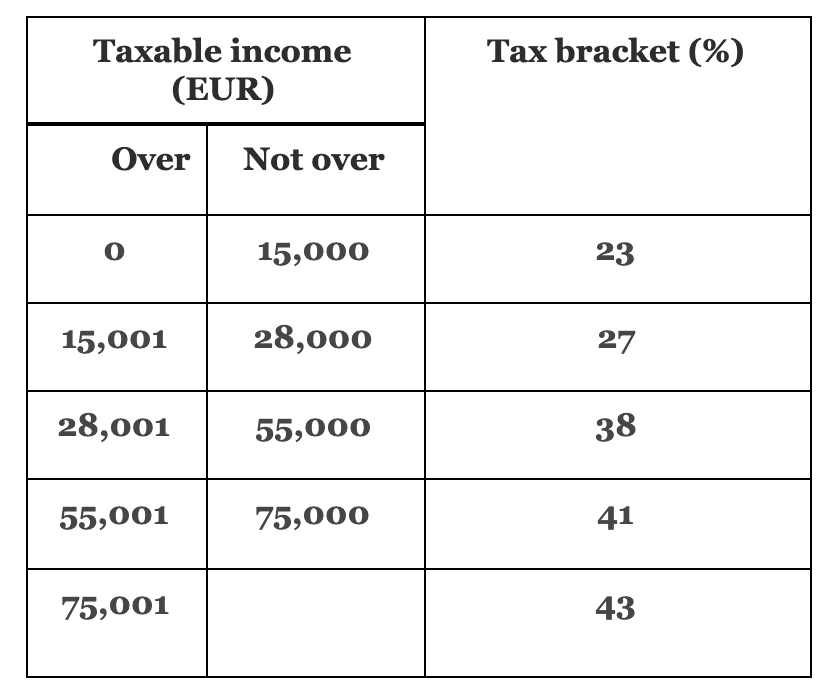

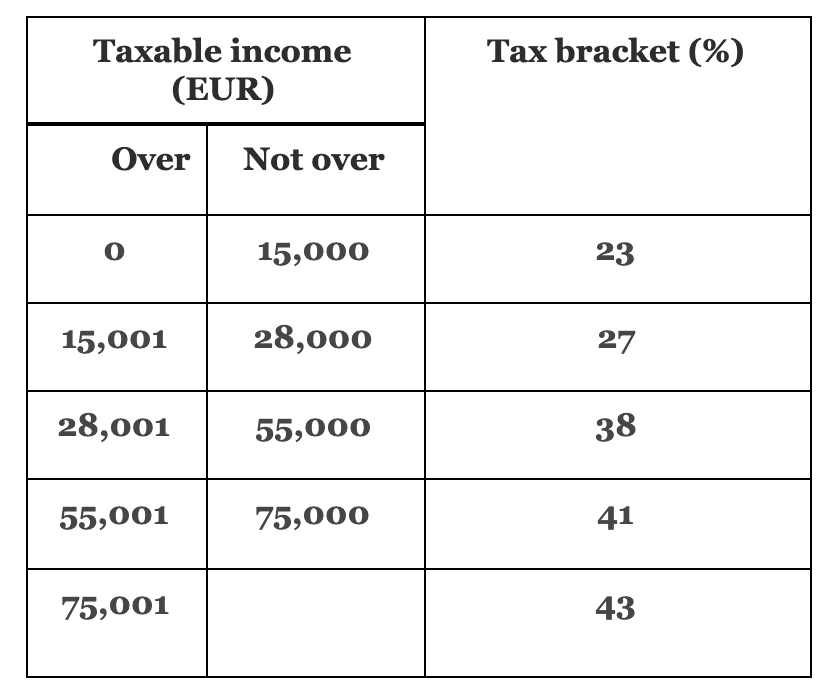

Income Tax Rate In Italy 2020 Guide For Foreigners – Accounting Bolla

No You Cant Deduct That 11 Tax Deductions That Can Get You In Trouble Inccom

42000 After Tax 2021 – Income Tax Uk

Dutch Income Tax Calculator I Expat Service

Provision For Income Tax Definition Formula Calculation Examples

New Tax Regime Tax Slabs Income Tax Income Tax

Financial Services Platform Monthly Salary Calculator

How Much Does An Employee Cost In Spain Includes Calculator – Edco Business Consulting

Provision For Income Tax Definition Formula Calculation Examples

Nanny Salary Pension Calculator – Gross To Net – Nannytax

Top 75 Similar Websites Like Netsalarycalculatorcouk And Alternatives

Nannytax Nanny Payroll Services For Uk Employers – Nannytax

42000 After Tax 2019

Nanny Tax National Insurance – Nanny Ni – Nannytax

Official Site Short Term Unsecured Loans Budgeting Budgeting Money Money Management

Corporate Tax Meaning Formula Examples Calculations