To these ends, the compact created the appellee multistate tax commission. The multistate tax commission was enabled and its broad parameters for operation defi ned through creation of the compact (www.mtc.gov/compact/html).

Multistate Tax Commission – Home

Joe is the 2015 recipient of the paull mines award, the multistate tax commission’s award for significant contributions to state tax jurisprudence.

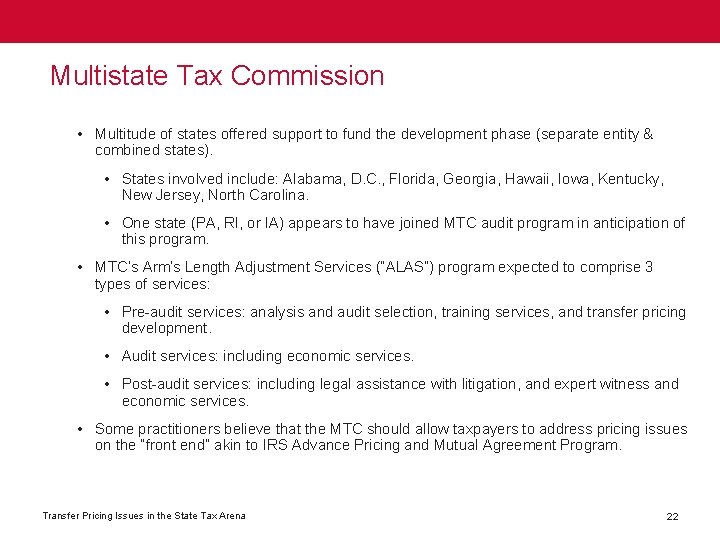

Multistate tax commission member states. The compact, in turn, created the multistate tax commission, and california is a member of the commission by virtue of its participation in the compact. This was entered into primarily to promote uniformity in state tax systems to facilitate the profit of termination of state and local tax liabilities. At the alabama department of revenue, joe led the state’s policy work addressing the.

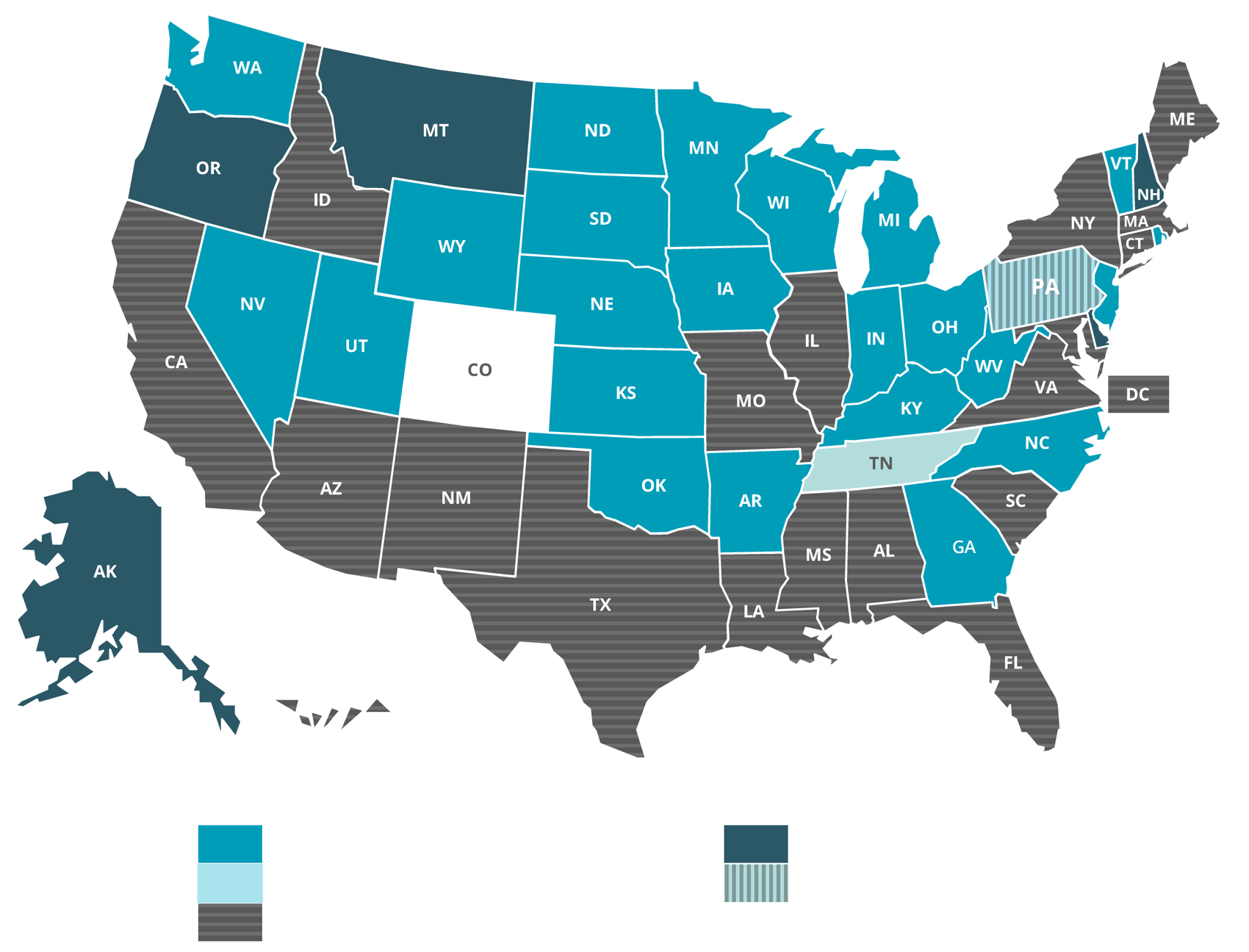

The intent of the compact is to Facilitate proper determination of state and local tax liability of multistate taxpayers, including the equitable apportionment of tax bases and settlement of apportionment disputes. Establishes a commission whose purposes are (1) to facilitate proper determination of state and local tax liability of multistate taxpayers, (2) to promote uniformi¬ty and compatibility in significant components of tax systems, (3) to facilitate taxpayer convenience and com¬pliance, (4) seeks to avoid duplicate taxation, (5) con¬ducts audits of major corporations on behalf of.

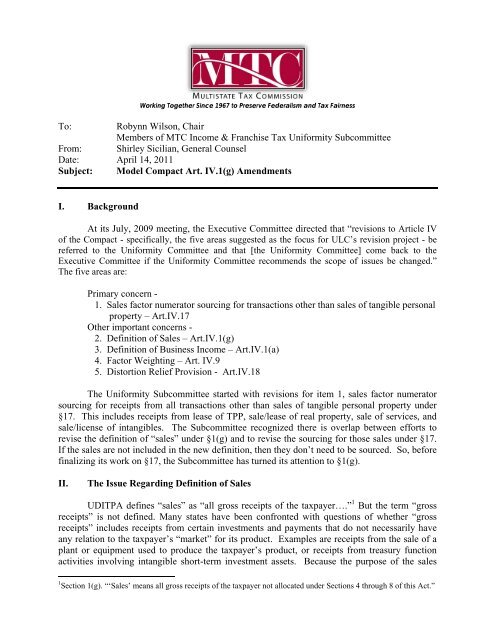

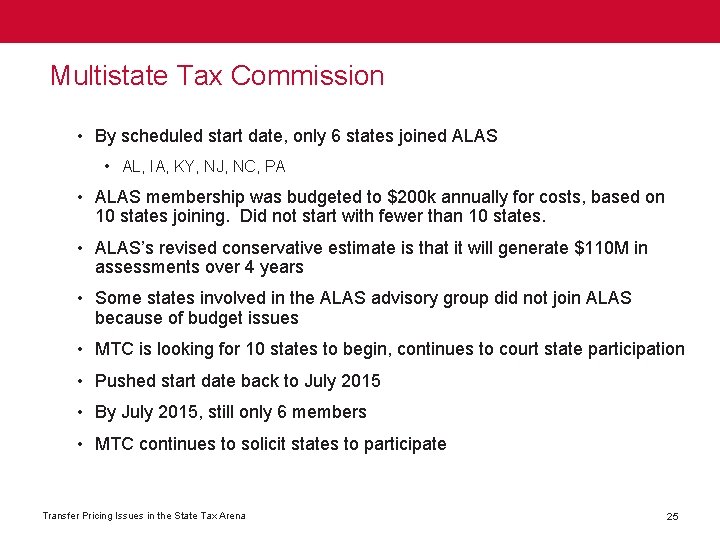

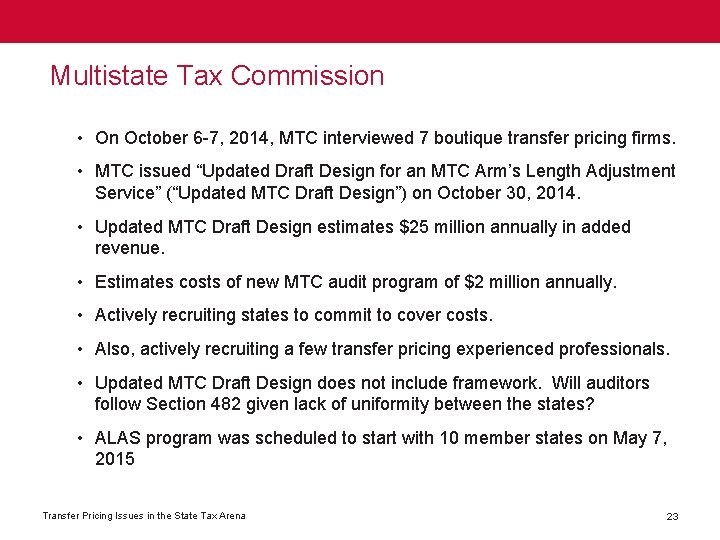

During the second portion of the meeting, ms. Supreme court decision in united states corp. Notably, 18% of the participating states responded that they currently utilize an advance pricing agreement (“apa”) process, whereby taxpayers currently under audit can agree with the state on a specific transfer pricing.

Below, we have summarized these changes and the state income tax nexus implications for taxpayers. Sovereignty members are states that support the purposes of the multistate tax compact through regular participation in, and financial support for, the general activities of the commission. Ends, the compact created the appellee multistate tax comminion.

He was also the state tax notes notable tax administrator of 2016 and featured in that publication’s “spotlight” article (september 2015). Each member state is authorized to request that the commission perform an audit on its behalf, and the commission may seek compulsory process in aid of its auditing power in the courts of any state specifically permitting such procedure. Joe is the 2015 recipient of the paull mines award, the multistate tax commission’s award for significant contributions to state tax jurisprudence.

The statement, which is an. It was established in 1967 as part of the multistate tax compact, an agreement formalized into law by many states in order to create more stability for interstate commerce. Multistate tax commission, which held that the compact:

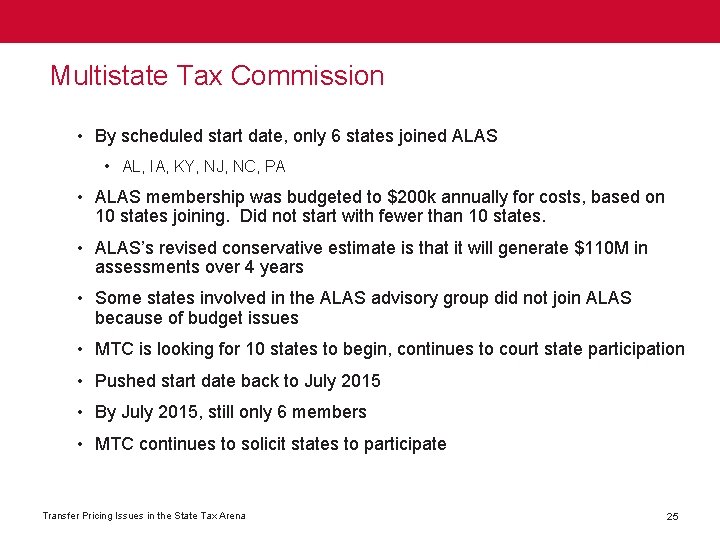

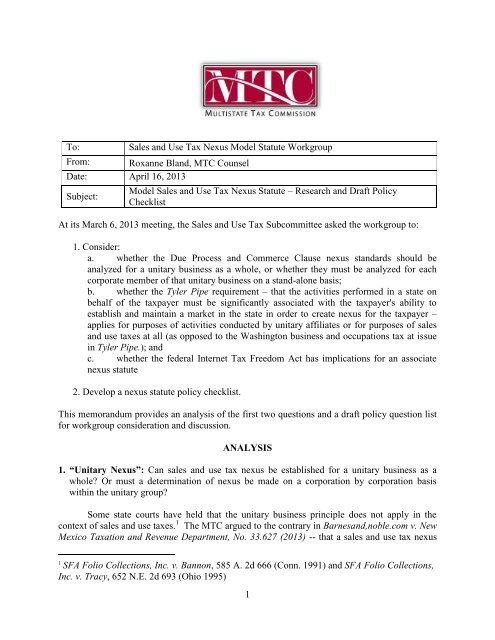

This brief is filed by the commission, not on behalf of any particular member state. The meeting is the annual event where full mtc member states approve model laws in their final version. Article vi establishes the multistate tax commission to accomplish those goals.5 the commission is composed of one member from each party state who is the head of the state agency charged with the administration of income or sales tax laws of the state, i.e., the tax commissioner, director of the department of revenue, or analogous officer.

Counsel for bothparties received timely notice of the 's intent to file this brief. These states join in shaping and supporting the commission’s efforts to preserve state taxing authority and improve state tax policy and administration. At the alabama department of revenue, joe led the state’s policy work addressing the state.

Does not purport to authorize the member states to exercise any powers they could not exercise in its absence. As part of the compact, a multistate tax commission (defendant) was created as well. The commission was created in 1967 as an effort by states to protect their tax authority in the face of previous proposals to transfer the.

Yesterday, the multistate tax commission (mtc) held its annual meeting in spokane, washington. He was also the state tax notes notable tax administrator of 2016 and featured in that publication’s “spotlight” article (september 2015). Multistate tax compact and commission the multistate tax compact is a model tax law that may be adopted by the states through discretionary legislative action.

The multistate tax commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws that apply to multistate and multinational enterprises. The tax commissioner of the department of taxation shall take such steps as are necessary for virginia to become an associate member of the multistate tax commission without payment of any membership fees, and shall participate in available multistate tax commission discussions and meetings concerning model legislation and uniform tax policies. The multistate tax commission is an intergovernmental state tax agency located at 444 north capitol street nw in washington, dc.

Supporting Transfer Pricing Positions And Preparing For Mtcs

Multistate Tax Commission – Home

Home

Multistate Tax Commission Discusses Standards For Income Tax On Business Travelers Tax Foundation

Ppt – Importance Of State And Local Tax Planning Powerpoint Presentation – Id3058059

Uniformity Committee Memo – Multistate Tax Commission

Exhibit A – Multistate Tax Commission

Supporting Transfer Pricing Positions And Preparing For Mtcs

Multistate Tax Commission – Home

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Materials – Multistate Tax Commission

Multistate Tax Commission – Home

Multistate Tax Commission – Home

Multistate Tax Commission – Home

Multistate Tax Commission – Home

Supporting Transfer Pricing Positions And Preparing For Mtcs

Why States Should Adopt The Mtc Model For Federal Partnership Audits

2

Multistate Tax Commission – Home