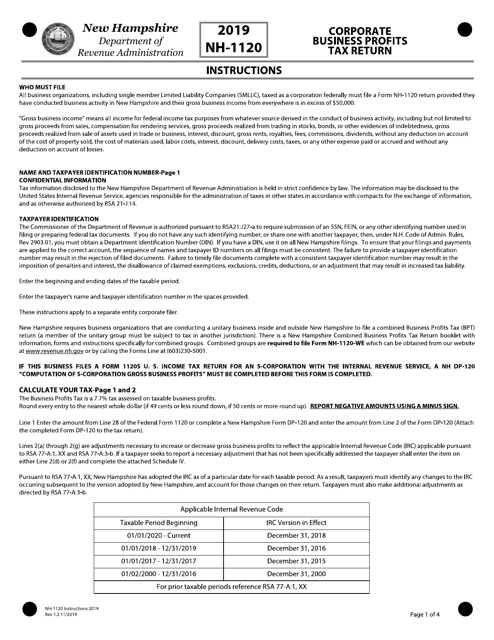

How to lodge your tax return. Unitary business group (ubg) instructions for form 4567 michigan business tax (mbt) annual return purpose to calculate the modifiedgross receipts tax and business income tax for standard taxpayers.

File Paye Summary And Td4 – Belize Tax Services

Purpose of form form 500 is used by a corporation and certain

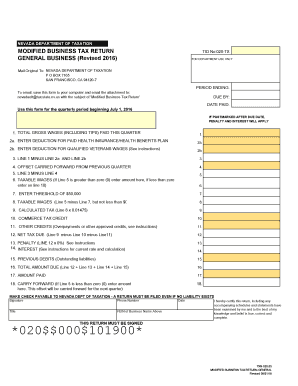

Modified business tax return instructions. Lodge a prior year tax return; How you can complete the nevada modified business tax return form on the web: The nevada modified business return is an easy form to complete.

Exceptions to this are employers of exempt organizations and employers with household employees only. Granholm july 12, 2007, imposes a 4.95% business income tax and a modified gross receipts tax at the rate of 0.8%. However, individual taxpayers, estates, and accountants can also fill out the form.

Additionally, the modified business tax has two classifications, each of. A business’s duty regarding modified business tax abatement. The mbt replaces the single business tax, effective january 1, 2008.

Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. The deduction has two components. Amortization of costs that begins during the 2020 tax year.

This component of the deduction equals 20 percent of qbi from a domestic business operated as a sole proprietorship or through a partnership, s corporation, trust or estate. Form 500 must be filed electronically if the corporation plans. Employer paid health care costs, paid this calendar quarter.

Eligible taxpayers can claim it for the first time on the 2018 federal income tax return they file in 2019. Insurance companies should filethe mbt insurance company annual return for michigan business and retaliatory taxes (form 4588) and Hit done and save the filled out document to your computer.

On who is eligible for the premium tax credit, see the instructions for form 8962. The instructions are revised to clarify that if modified agi is $1,000,000 or more and net business income is $1,000,000 or more, nol deduction is suspended. General instructions filing form 500.

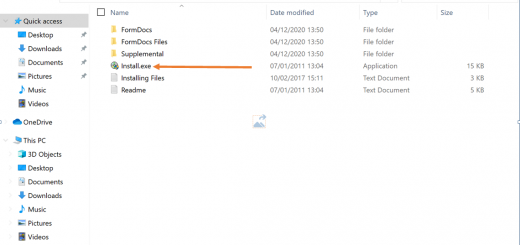

If a business does not comply with this requirement, abatement could be voidable. This is the standard quarterly return for reporting the modified business tax for general businesses. To get started on the blank, use the fill & sign online button or tick the preview image of the blank.

The michigan business tax (mbt), which was signed into law by governor jennifer m. Lodge your tax return from outside australia; Gross wages, payments made, and individual employee information.

There are no changes to the threshold of the sum of all taxable wages after deductions, currently. Look through the entire document to make certain you have filled in everything and no corrections are needed. All businesses are required to register under the applicable state and county laws and to obtain all licenses and other permits required.

Business tax (general business) returns are due by the last day of the month following the calendar quarter in which the employer is required to pay unemployment If you don’t, however, have this information readily available, this simple form can end up taking hours to complete. They will be sent to you at the same address you have registered with the employment security division.

In most cases, business owners will fill out form 3115 to request a change in their accounting method. The modified business tax covers total gross wages less employee health care benefits paid by the employer. Lodging your first tax return;

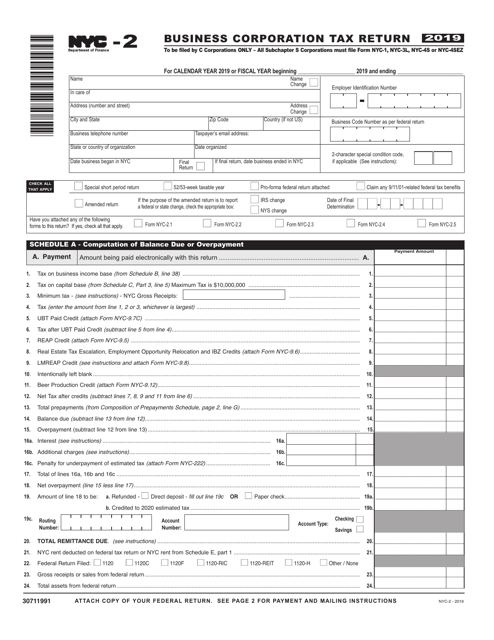

When you register with the nevada employment security division (esd) for unemployment compensation for your employees you are automatically registered with the department of taxation for modified business tax. Lodge a paper tax return; Corporation income tax form 2019 return instructions.

To claim a business income tax credit from form 500cr or the heritage structure rehabilitation tax credit from form 502s. Lodge your tax return online with mytax. You will start receiving tax returns from the department of taxation.

100 booklet, california corporation tax booklet: Insurance companies and financial institutions pay alternate taxes (see below). Lodge your tax return with a registered tax agent;

They are also required to maintain the business in nevada for a period of five years. Lodge your tax return before leaving australia; Send your modified business tax return general businesses form in a digital.

The irs defines a tax form 3115 filer as the “person or entity required to file form 3115, whether on its own behalf or on behalf of another entity.”. Effective july 1, 2019 the tax rate changes to 1.378% from 1.475%.

2

2

Corporate Tax Return Due Date 2019

2

2

Comtaxregistrationfaqs

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Corporate Tax Return Due Date 2019

Instructions For Form 5471 012021 Internal Revenue Service

2

2

Corporate Tax Return Due Date 2019

2

2

2

Publication 908 022021 Bankruptcy Tax Guide Internal Revenue Service

2

2

2