After two (2) to six (6) months after submitting the income tax return, the tax office will send you a tax assessment (steuerbescheid). Taxpayers can bring their account up to date.

Publication 908 022021 Bankruptcy Tax Guide Internal Revenue Service

Granholm july 12, 2007, imposes a 4.95% business income tax and a modified gross receipts tax at the rate of 0.8%.

Modified business tax refund. If you are afraid of a smaller tax refund this year, there’s still time to opt out of receiving the last of the advance ctc payments. 15 payment (but be aware that both parents must opt out of the payment). The irs uses your magi to determine your eligibility for certain deductions, credits and retirement plans.

For tax year 2021, the standard mileage rate is 56 cents per mile. The credit is phased out for individual filers with a modified adjusted gross income between $80,000 and $90,000, or $160,000 and $180,000 for joint filers. A tax refund calculator can be a good step so that there are no surprises as you prepare your tax return.

Exceptions to this are employers of exempt organizations and employers with household employees only. The mbt rates have remained the same (1.475% on taxable wages exceeding $50,000 annually for most businesses, 2% for financial institutions and mining companies) and were not reduced to 1.378% and 1.853%, respectively. The michigan business tax (mbt), which was signed into law by governor jennifer m.

The dot has been ordered to refund to businesses the excess tax collected, plus interest from the date of collection. Effective july 1, 2019 the tax rate changes to 1.853% from 2.0%. Had any tax taken out (withheld) from income you receive;

According to the treasury report , about 7.3 million tax returns processed by the irs in early. There are a number of reasons you may need to lodge a tax return. Any unused credit may not be carried forward beyond the fourth calendar quarter immediately following the end of the taxable year for which the commerce tax was paid.

For more information about these reasons, go to work out if you. The modified business tax covers total gross wages less employee health care benefits paid by the employer. Had $1 or more of foreign income;

This is the latest round of refunds being issued to many who filed their taxes before an abrupt change in. And ordered the department of taxation to refund any overpayment of the modified business tax plus interest. Processing it can take up to 16 weeks.

The actual expenses method is more complicated, but it is also more precise, and it can yield a larger deduction in some cases. Modified adjusted gross income (magi) in the simplest terms is your adjusted gross income (agi) plus a few items — like exempt or excluded income and certain deductions. The mbt replaces the single business tax, effective january 1, 2008.

What to do if you are afraid of a smaller refund or larger tax bill. No refunds will be issued to taxpayers with a delinquent return. Magi can vary depending on the tax benefit.

Taxpayers whose modified adjusted gross income was less than $150,000 qualify for the tax break. Are leaving australia and have a study or training support loan. What is the modified business tax?

You drive 10,000 miles for your startup business. There is no refund to the taxpayer for any unused credit. Using this information, 2020 tax calculator will give you an estimate of how much of a refund to expect from the irs or how much of.

Tax calculated for modified business tax for that quarter. Sb483, 2015 legislative session, effective 7/1/2015 Additionally, the modified business tax.

Insurance companies and financial institutions pay alternate taxes (see below). Filed your tax return for 2020? Are a liable or recipient parent under a child support assessment;

Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. Had business or investment income; Visit the ctc update portal by november 29, 2021 to opt out of the dec.

The department is developing a plan to reduce the modified business tax rate for quarters ending september 31, 2019 through march 31, 2021, for general businesses, financial institutions and mining, and will soon announce when the refunds will be issued. You can deduct $5,600 (10,000 x $.56 = $5,600). The refunds will put more than $510 million into wallets now — averaging $1,189 each.

If you are eligible for a refund, this will be paid directly into your bank account. In addition to the change to the financial institution definition and the deduction for qualified veteran wages pursuant to ab71, the 78 th (2015) legislative session also enacted ab165, sb412, and sb507 that created certain credits a taxpayer may be able to take against their modified business tax. The 2020 tax refund calculator asks you a few questions regarding your personal situation, income, and expenses during 2020.

If you own money to the tax authorities, you will generally have four (4) weeks to pay the outstanding balance. Individual income tax return, for this year and up to three prior years. Your amended return will take up to 3 weeks after you mailed it to show up on our system.

Corporate Tax 2021 Laws And Regulations Indonesia Iclg

Legstatenvus

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Taxnvgov

Publication 908 022021 Bankruptcy Tax Guide Internal Revenue Service

How To Manage Value-added Tax Refunds In Imf How To Notes Volume 2021 Issue 004 2021

Publication 970 2018 Tax Benefits For Education Internal Revenue Service Cover Pics Education Film Structure

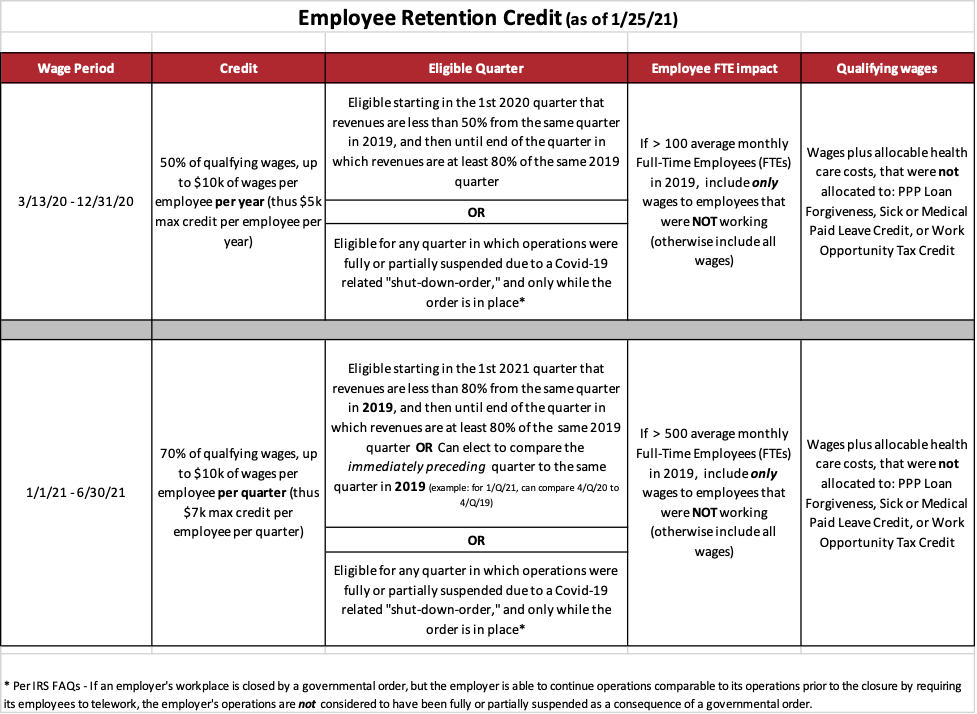

Employee Retention Tax Credit Significantly Modified And Expanded For Businesses Shindelrock

Taxnvgov

Taxnvgov

Taxnvgov

Taxnvgov

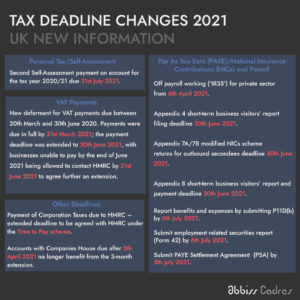

Hmrc 2021 Uk Tax Deadline Changes Amid Covid-19 – Abbiss Cadres

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Publication 908 022021 Bankruptcy Tax Guide Internal Revenue Service

Taxnvgov

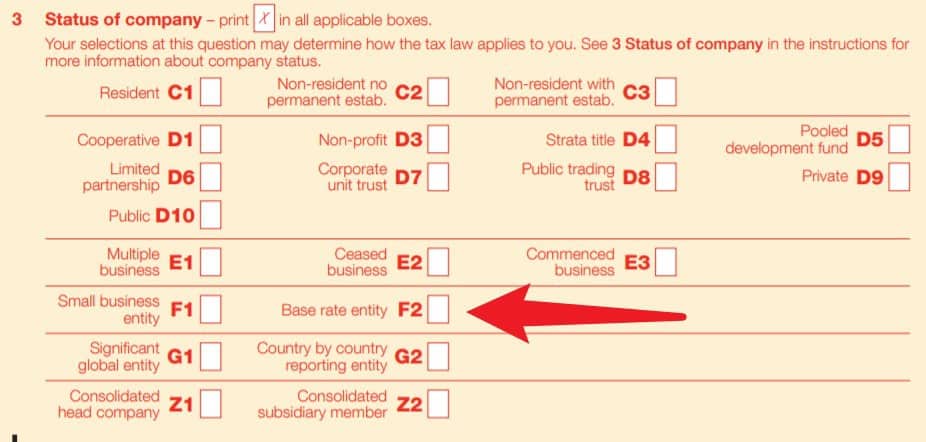

Company Tax Rates 2021 – Atotaxratesinfo

How To Manage Value-added Tax Refunds In Imf How To Notes Volume 2021 Issue 004 2021

Taxnvgov