States that does not impose a state income tax on business income. After you log in, click the profile option located in the upper right hand corner of the page.

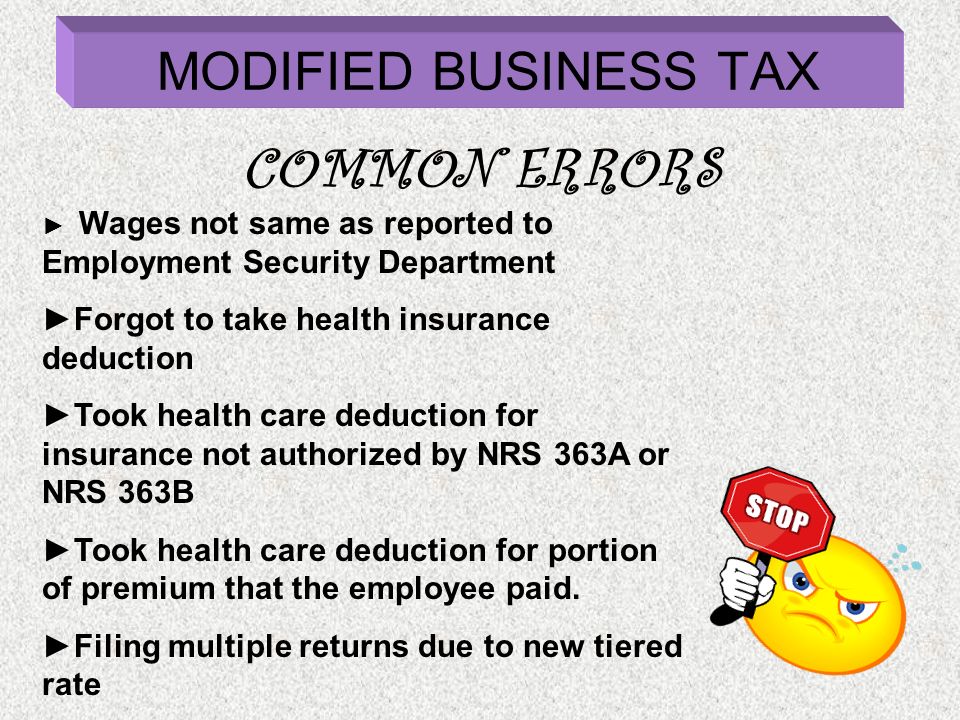

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation – Ppt Download

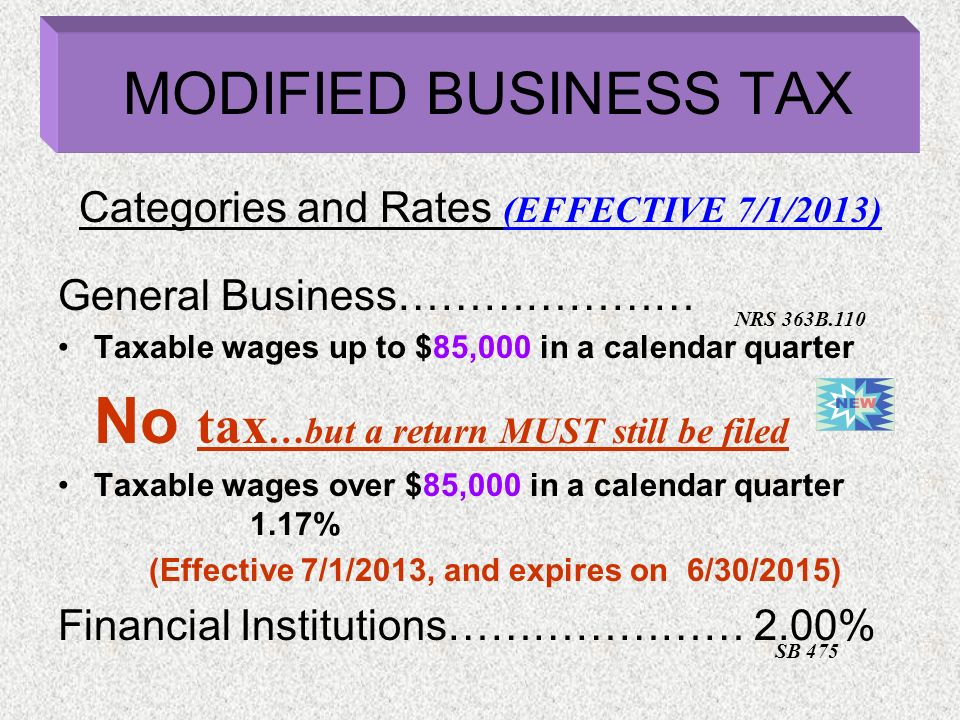

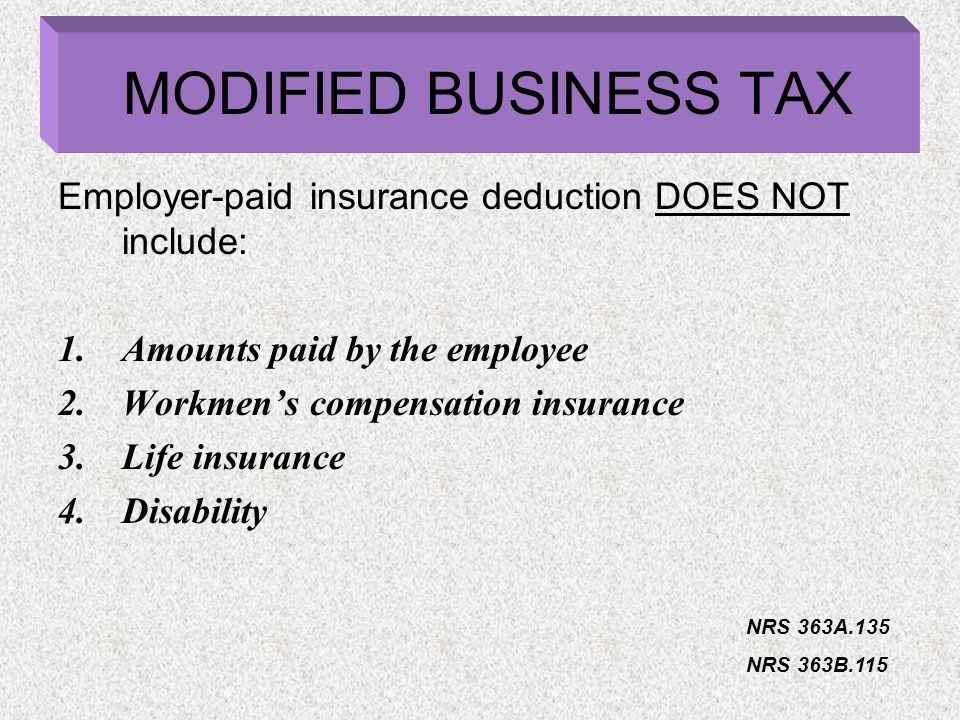

If your nevada llc will have employees (and is subject to nevada’s unemployment compensation laws), you’re also responsible for paying a modified business tax

Modified business tax nevada due date. Due date extended due date ; When is the tax due? 25 thus, the due date for all business entities would appear to.

$1.50 for each $1,000 or major fraction thereof up to $300,000 of capital employed in louisiana, and $3 for each $1,000 or major fraction thereof in excess of $300,000 of capital employed in louisiana. If the business ceased to exist before the end of the taxable year, a short year return may be filed. Similar to the personal income tax, businesses must file a yearly tax.

A modified business tax (mbt) is a tax for employers who are also liable to pay contributions under the nevada unemployment compensation law. This tax is paid to the department of taxation. The nevada corporate income tax is the business equivalent of the nevada personal income tax, and is based on a bracketed tax system.

All monthly tax returns due on or before june 30, 2020; How do i pay bond contributions? The default dates for this are april 30, july 31, october 31, and january 31.

If you received email confirmation from taxextension.com that your federal tax extension was approved by the irs, there is nothing else you have to do. Any unused credit may not be carried forward beyond the fourth calendar quarter immediately following the end of the taxable year for which the commerce tax was paid. The profile option is also listed on every page of your nevada tax account.

This means that nevada taxpayers do not need to request a state tax extension for filing a business tax return. Tax calculated for modified business tax for that quarter. All quarterly tax returns due on or before april 30, 2020;

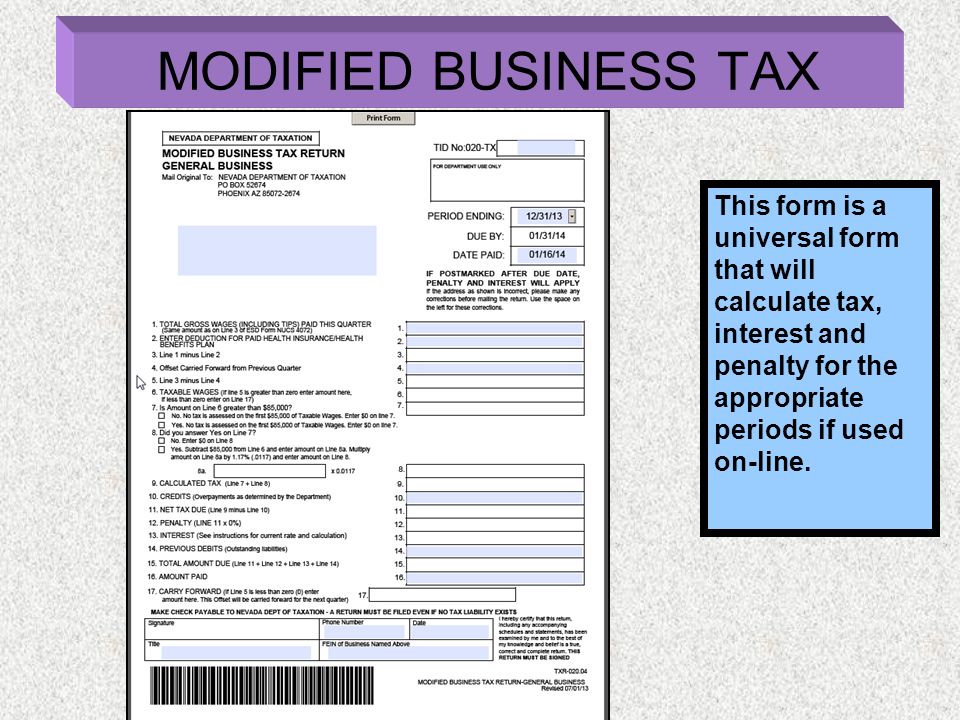

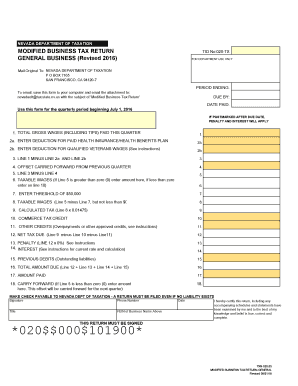

Forms and payments have to be mailed or hand delivered to one of the four district offices of the nevada department of taxation. Responding to the $10,000 cap on the federal individual income tax deduction for state and local taxes that was enacted in the 2017 federal tax overhaul legislation known as the tax cuts and jobs act (i.e., p.l. Tax for each calendar quarter is due on the last day of the quarter and is to be paid on or before the last day of the month following the quarter.

The commerce tax return is due 45 days following the end of the fiscal year. Nevada's corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in nevada. All annual tax returns due on or before january 31, 2020;

The initial corporation franchise tax is $110. The default dates for submission are april 30, july 31, october 31, and january 31. The state's modified business tax applies to all businesses paying at least $50,000 in wages quarterly.

The tax was due and payable on or before 6/30/2020, which includes: Come july, life will get more taxing for nevada business. For additional questions about the nevada modified business tax, see the following page from the state of nevada's department of taxation.

In addition, as of july 2015 nevada imposes a commerce tax on gross revenue. Any due date for the payment of sales tax or individual income tax withholding that falls on or after august 27, 2020, but before october 1, 2020, shall be extended until october 31, 2020, for a business that is a bar or other alcohol establishment in black hawk, dallas, johnson, linn, polk, or story county ordered to close to the general public pursuant to the governor’s. Read through this page to explore everything related to the state of nevada's registration and reinstatement process of charity organizations.

The state of nevada is one of seven u.s. The delinquent tax amount is paid in full for the period. Nevada nonprofits state tax overview.

If the credit amount is higher than the mbt tax owed it may be carried forward up to the fourth quarter immediately following the end of the commerce tax year for which commerce tax is paid. In other words, most nevada businesses with employees are subject to the mbt. Click 'update' once your new information is added.

When are the forms and tax payments due? There is no refund to the taxpayer for any unused credit. Sb483, 2015 legislative session, effective 7/1/2015

If the due date falls on a weekend or holiday, the return is due on the next business day. Meanwhile, nevada's commerce tax applies to all businesses with gross annual revenue exceeding $4,000,000. All forms and contribution payments are due no later than the last day of the month following the end of the quarter.

The modified business tax and commerce tax will be based on the total income of the series llc. To offer a comprehensive understanding, we have listed the filing methods the nevada state accepts, details. Generally, the due date is august 14.

Minimum business tax, franchise tax or privilege tax. Forms and payments must be mailed to the address below: Click on the option to change your username or password, and update your contact information.

The due dates are april 30, july 31, october 31, and january 31. Bond contributions are considered separate from unemployment insurance taxes and cannot be paid electronically. More particularly, any businesses that have employees and report gross wages to the nevada employment security division (esd) are subject to the state's modified business tax (mbt).

The initial tax reports are due on the 45th day following the end of the tax year. For example, the tax return and remittance for october 1, 2006 through december 31, 2006 was due on or before january 31, 2007.

2

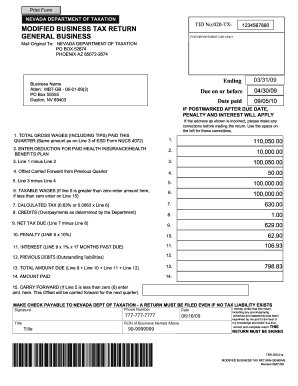

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Sends Out First Round Of Business Tax Refunds Klas

How To File And Pay Sales Tax In Nevada Taxvalet

2

2

2

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation – Ppt Download

Corporate Tax Return Due Date 2019

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation – Ppt Download

2

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation – Ppt Download

2

2

2

How To File And Pay Sales Tax In Nevada Taxvalet

Ms Form Ui 3 – Fill Online Printable Fillable Blank Pdffiller

2