Parson vetting gas tax hike approved by missouri lawmakers. 1, until the tax hits 29.5 cents per gallon in july 2025.

Parson Signs Off On Missouri Gas Tax Hike Ksdkcom

Patrick mckenna, missouri department of.

Missouri gas tax hike. The proposal raised the tax by 2.5 cents a year through 2025. It is part of the gas tax bill lawmakers passed and governor mike parson approved on july 13. Missouri’s gas tax will increase for the first time in 25 years, but missourians who don’t want to pay the increase have an option.

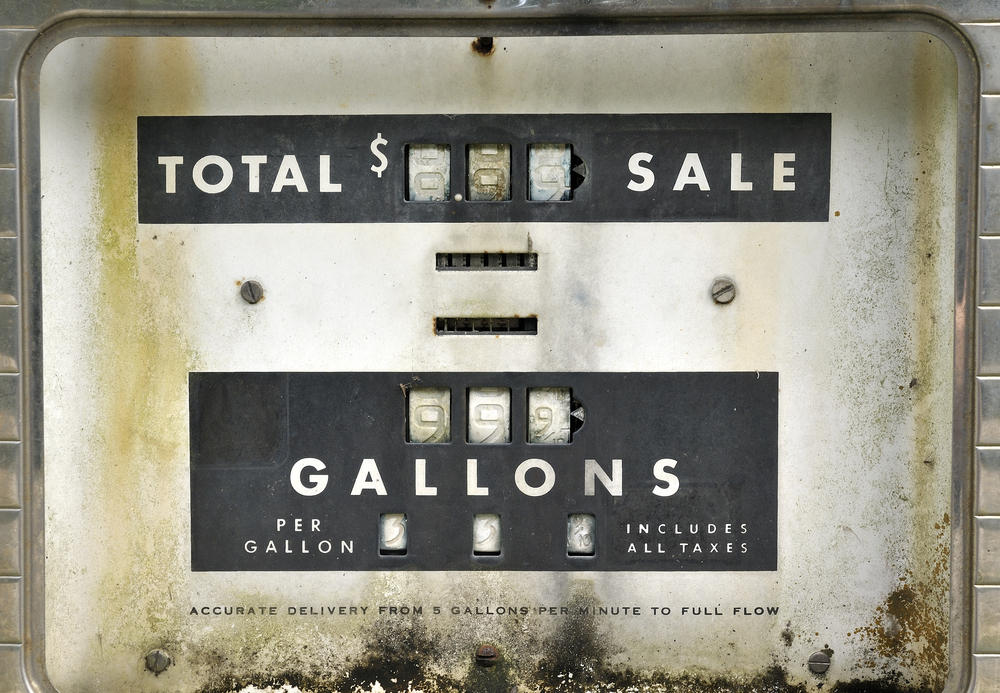

Missouri has one of the lowest gas tax rates in the country at just 17 cents per gallon. Missouri gas tax hike is now official jul 13, 2021 @ 5:36pm (jefferson city) governor mike parson signed into law today a boost in the state’s gas tax for the first time in about 25 years. 1, drivers filling up in missouri will pay an additional 2.5 cents per gallon of gas.

M issouri lawmakers agreed to raise the state’s gas tax for the first time in 25 years during their 2021 session, but gov. Governor parson signed this into law back in may as a way to pay to fix some of the roads and bridges in missouri. The tax is set to increase by the same amount yearly between 2021 and 2025.

That would make missouri’s rate closer to the national average for states. According to a release from district 39 state representative peggy mcgaugh, the tax will increase by 2.5 cents october 1, with more incremental increases every july 1 until it reaches a total increase of 12.5 cents in 2025. With $6.5 billion on the way from the federal infrastructure bill and a newly increased gas tax, missouri is ready to take a big bite out of $4.5 billion in unfunded highway needs, patrick mckenna.

The tax increase could raise about $500. By jeff long ~ southeast missourian. A conservative advocacy group’s missouri chapter launched an effort to put the gas tax hike to a public vote just days after lawmakers passed it.

Missouri’s fuel tax rate is 17 cents a gallon for all motor fuel, including gasoline, diesel, kerosene, gasohol, ethanol blended with gasoline, biodiesel (b100) blended with clear diesel fuel. On the heels of the covid shutdown and with the biden administration’s goal of $7.50 gasoline by july 4, the tax will compound the financial hardship missourians will face. Tax increases are widely unpopular among missouri voters.

On october 1, missourians will see a price increase of 2.5 cents per gallon. In that time period, the tax rate has remained stagnant, causing the quality of missouri’s roads and bridges to flounder as inflation torpedoed the purchasing power of the tax revenue. The first hike happened in october.

It was the first gas tax increase in 25 years in missouri. At the end of 2025, the state's tax rate will sit at 29.5 cents per gallon. Daniel mehan with the missouri chamber of commerce said.

Missouri lawmakers approved the bipartisan gasoline tax increase in may: Walsh supported an amendment during the debate to place the fuel tax on a statewide ballot. But that doesn’t mean the state is ready to tackle its biggest projects, like.

In october, the state tax on a gallon of gasoline increased by 2.5 cents under sb262.the tax will increase 2.5 cents per gallon in each fiscal year until it reaches 29 cents per gallon on july 1, 2025, a 73% increase from the previous rate of 17 cents per gallon, the second lowest in the nation. Motorists give mixed reaction to refund plan for missouri fuel tax hike first state tax increase since 1996 adds 2.5 cents to the price of gasoline and diesel by: With $6.5 billion on the way from the federal infrastructure bill and a newly increased gas tax, missouri is ready to take a big bite out of $4.5 billion in unfunded highway needs, patrick mckenna, director of the missouri department of transportation, said this week.

Missouri gas tax hike to fund modot road projects, cape girardeau hearing told. Gas tax hike hits as gas prices soar the timing of the tax increase could not have been more insulting to missouri residents.

Gas Tax Hike Taking Effect Dailyjournalonlinecom

Motorists Give Mixed Reaction To Refund Plan For Missouri Fuel Tax Hike

Gas Tax Hike Taking Effect Dailyjournalonlinecom

Missouri Gas Tax To Rise In October After Parson Puts Signature On New Law Politics Stltodaycom

Missouris First Gas Tax Increase Since The 1990s Goes Into Effect Friday Fox 2

Gas Tax Brass Tacks What Drove Missouris First Fuel Tax Increase In 25 Years News Columbiamissouriancom

Motorists Give Mixed Reaction To Refund Plan For Missouri Fuel Tax Hike

Missouri Voters Rejects Legislative Gas Tax Increase Planetizen News

Mo House Committee Unanimously Recommends Gas-tax Increase

Billions Headed To Missouri Transportation Fund From Gas Tax Hike Infrastructure Bill Missouri Independent

With Gas Tax Hike In Place Missouri Transportation Officials Request Approval For Raises Politics Stltodaycom

Gas Tax Increase With Rebate Option Slams Into Wall Of Opposition In Missouri Senate Politics Stltodaycom

Missouri Gov Parson Signs Off On First Missouri Gas Tax Hike In Decades

Schatzs Gas Tax Increase Passed By Senate – The Missouri Times

Parson Greenlights Gas Tax Increase – The Missouri Times

Gas Tax Hike And Medicaid Expansion Two Policies Democrats Backed Taking Effect In Red Missouri Politics Stltodaycom

Missouris Gas Tax Is Going Up How Much And When The Kansas City Star

Gas Tax Hike Taking Effect Dailyjournalonlinecom

Missouri Fuel Tax Increase Goes Into Effect On October 1