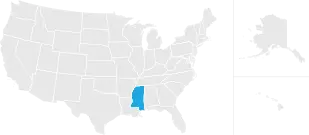

Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as married filing jointly or head of household. Mississippi has three marginal tax brackets, ranging from 3% (the lowest mississippi tax bracket) to 5% (the highest mississippi tax bracket).

Pin On Market Analysis

A state commission endorsed the recommendation, but the state struggled with the fact that the tax brings in $260 million a year.

Mississippi income tax rate 2020. However, if you owe taxes and don't pay on time, you might face late tax payment penalties. Mississippi’s state income tax is fairly straightforward. There are just three income tax brackets, and the tax rates range from 3% to 5%.

How does tax filing status affect your federal income tax bill? The income thresholds for each rate are: Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5.000%, spread across three tax brackets.

Mississippi’s income tax currently has three marginal rates of 3 percent, 4 percent, and 5 percent. This is because the single filing type does not enjoy the tax benefits associated with joint filing or having dependants. The mississippi income tax has three tax brackets, with a maximum marginal income tax of 5.00% as of 2021.

2020 mississippi state sales tax rates. If you are still working in some capacity in your retirement, the state income tax is fairly low. In 2020, mississippi governor tate reeves announced a plan to phase out the state’s individual income tax by 2030 (reeves 2020).

On the first 5,000 next 15,000. Mississippi income tax rate(s) the state has a simple progressive tax rate, with only three tax brackets for all taxpayers: • mississippi continued phasing out its 3 percent corporate income tax bracket by exempting the first $3,000 of income this year.

There is no percentage method available to determine mississippi withholding; Tax year 2020 first $3,000 @ 0% and the next $2,000 @ 3% first $4,000 @ 0% and the next $1,000 @ 3% tax year 2022 first $5,000 @ 0% $2.50 per $1,000 of capital in excess of $100,000 tax year 2019 $2.25 per $1,000 of capital in excess of $100,000 tax year 2020 $2.00 per $1,000 of capital in excess of $100,000 tax year 2021 Mississippi federal and state income tax rate, mississippi tax rate, mississippi tax tables, mississippi tax withholding, mississippi tax tables 2020

Beginning in 2018, the franchise tax rate of $2.50 per $1,000 of capital value will begin to drop. Employees who earn more than $10,000 a year will hit the top bracket. Mississippi governor tate reeves (r), in his budget proposal for fiscal year (fy) 2022, has announced his goal of phasing out the state’s income tax by 2030.

These rates are the same for all filing statuses, as well as for businesses. The list below details the localities in mississippi with differing sales tax rates, click on the location to access a supporting sales tax calculator. Each marginal rate only applies to earnings within the applicable marginal tax bracket , which are the same in.

The 2021 mississippi state income tax return forms for tax year 2021 (jan. The magnolia state’s tax system is progressive, so taxpayers who earn more can expect to pay higher marginal rates of their income. Mississippi has 3 state income tax rates:

You will be taxed 3% on any earnings between $2,001 and $5,000, 4% on the next $5,000 (up to $10,000) and 5% on income over $10,000. Mississippi's maximum marginal corporate income tax rate is the 3rd lowest in the united states, ranking directly below north dakota's 5.200%. The state does not tax social security benefits, income from public or private pensions or withdrawals from retirement accounts, including ira and 401(k) plans.

However, the department does provide a computer payroll flowchart. Residents of mississippi are also subject to federal income tax rates, and must generally file a federal income tax return by april 15, 2021. Rates range from 3% to 5%.

Back to mississippi income tax brackets page. The mississippi state state tax calculator is updated to include the latest state tax rates for 2021/2022 tax year and will be update to the 2022/2023 state tax tables once fully published as published by the various states. No cities within mississippi charge any additional municipal income taxes, so it’s pretty simple to calculate this part of your employees’ withholding.

Income below $2,000 is not taxed at the state level. The 4 and 5 percent brackets remain in place.8 • missouri lowered its corporate income tax rate from 6.25 to 4 percent, paying down this Read the mississippi income tax tables for married filing jointly filers published inside the.

Mississippi Income Tax Calculator – Smartasset

Top States To Buy Real Estate In The New Decade – Financial Samurai Real Estate Buying Real Estate Real Estate Prices

Pin On Taxes

Pin On Dashboards

California May Be The Dumbest State – The California Retort Dumb And Dumber Graphing California

See How Your States Average Teacher Salary Compares Teacher Salary Salary Teacher

Pin On Stocks To Watch

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

Mississippi Tax Rate Hr Block

Understanding The Connections Food Insecurity And Obesity Understanding Food Insecurity Connection

Pin On Only For Me

Coursera Honor Code Answers To Homework Honor Code Coding

State Corporate Income Tax Rates And Brackets Tax Foundation

Best Down Payment Assistance Program 2020 – List For Every State Includes Home Buyer Grants – Youtube First Time Home Buyers Down Payment Grants

Pin On Fascinating Facts

Pin On Ganancias Ambito 2020

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

The Minimum Income It Takes To Live In Each State In 2021 Life Map Retirement Financial Literacy Lessons

Pin On Al