Mississippi’s state income tax is fairly straightforward. There is no tax schedule for mississippi income taxes.

Utah Income Tax Rate And Brackets 2019

Employees who earn more than $10,000 a year will hit the top bracket.

Mississippi income tax calculator. How to calculate 2018 mississippi state income tax by using state income tax table. You can learn more about how the mississippi income tax compares. Mississippi income tax brackets and other information.

There are no city or local income taxes in mississippi. 5% on all taxable income over $10,000. Our mississippi state tax calculator will display a detailed graphical breakdown of the percentage, and amounts, which will be taken from your $55,000.

2021 mississippi tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. Your average tax rate is 21.2% and your marginal tax rate is 34.7%.this marginal tax rate means that your immediate additional income will be taxed at this rate. The mississippi salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2022 and mississippi state income tax rates and thresholds in 2022.

The mississippi tax calculator is designed to provide a simple illlustration of the state income tax due in mississippi, to view a comprehensive tax illustration which includes federal tax, medicare, state tax, standard/itemised deductions (and more), please use the main 2021/22 tax reform calculator. This page has the latest mississippi brackets and tax rates, plus a mississippi income tax calculator. Overall, mississippi has a relatively low tax burden.

The mississippi income tax calculator is designed to provide a salary example with salary deductions made in. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Income tax tables and other tax information is sourced from the mississippi department of revenue.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. To use our mississippi salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. These types of capital gains are taxed at 28%, 28% and 25% respectively (unless your ordinary income tax bracket is a lower rate).

Let’s take a look at an example provided by the mississippi department of revenue. Its income tax system has a top rate of just 5.00%. All other income tax returns p.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. 3% on the next $2,000 of taxable income. If you make $55,000 a year living in the region of mississippi, usa, you will be taxed $11,660.that means that your net pay will be $43,340 per year, or $3,612 per month.

If filing a combined return (both spouses work), each spouse can calculate their tax liability. Unlike the federal income tax, mississippi's state income tax does not provide couples filing jointly with expanded income tax brackets. Mississippi's 2021 income tax ranges from 3% to 5%.

Calculate your net income after taxes in mississippi. The ms tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in mss. 0% on the first $3,000 of taxable income.

Details of the personal income tax rates used in the 2022 mississippi state calculator are published below the. If you are receiving a refund p.o. 4% on the next $5,000 of taxable income.

The mississippi tax calculator is updated for the 2021/22 tax year. Find your pretax deductions, including 401k, flexible account contributions. Mississippi state income taxes are calculated on an individual basis, so if you’re married filing jointly, you’ll first calculate your tax liabilities separately and then add the totals together.

The taxes that are taken into account in the calculation consist of your federal tax, mississippi state tax, social security, and medicare costs, that you will be paying when earning $55,000.00. Free federal and mississippi paycheck withholding calculator. The graduated income tax rate is:

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Notably, mississippi has the highest maximum marginal tax bracket in the united states. This tool was created by 1984 network.

Mississippi collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. There are just three income tax brackets, and the tax rates range from 3% to 5%. If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213.that means that your net pay will be $42,787 per year, or $3,566 per month.

Your average tax rate is 22.2% and your marginal tax rate is 36.1%.this marginal tax rate means that your immediate additional income will be taxed at this rate. If you would like to help us out, donate a little ether (cryptocurrency. No cities within mississippi charge any additional municipal income taxes, so it’s pretty simple to calculate this part of your.

The state income tax system in mississippi is a progressive tax system. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. This mississippi hourly paycheck calculator is perfect for those who are paid on.

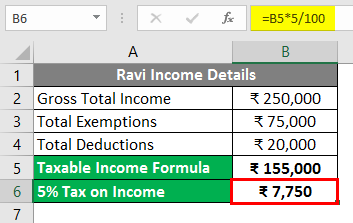

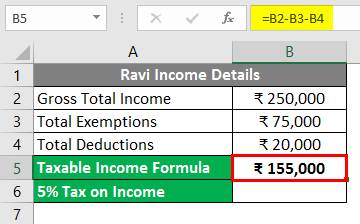

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Sales Tax On Grocery Items – Taxjar

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How High Are Capital Gains Taxes In Your State Tax Foundation

Mississippi State Income Tax Ms Tax Calculator Community Tax

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

Mississippi Income Tax Calculator – Smartasset

Mississippi Income Tax Calculator – Smartasset

Income Tax Calculator App – Concept Calculator App Tax App Discount Calculator

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

Pin On Finance

Mississippi State Tax Refund – Ms State Tax Brackets Taxact Blog

Find Out Which Red Flags Might Increase Your Chances Of Being Audited And Learn What You Can Do To Avoid The Dr Income Tax Return Federal Income Tax Income Tax

Taxation Of Social Security Benefits – Mn House Research

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Mississippi State Income Tax Ms Tax Calculator Community Tax

25 Percent Corporate Income Tax Rate Details Analysis

How To Profit From Dividends On Etoro Daily Using Dividend Calendar And Leverage Steemit Dividend Finances Money Profit