The unemployment benefits were given to workers who'd been laid. That brings the total count to.

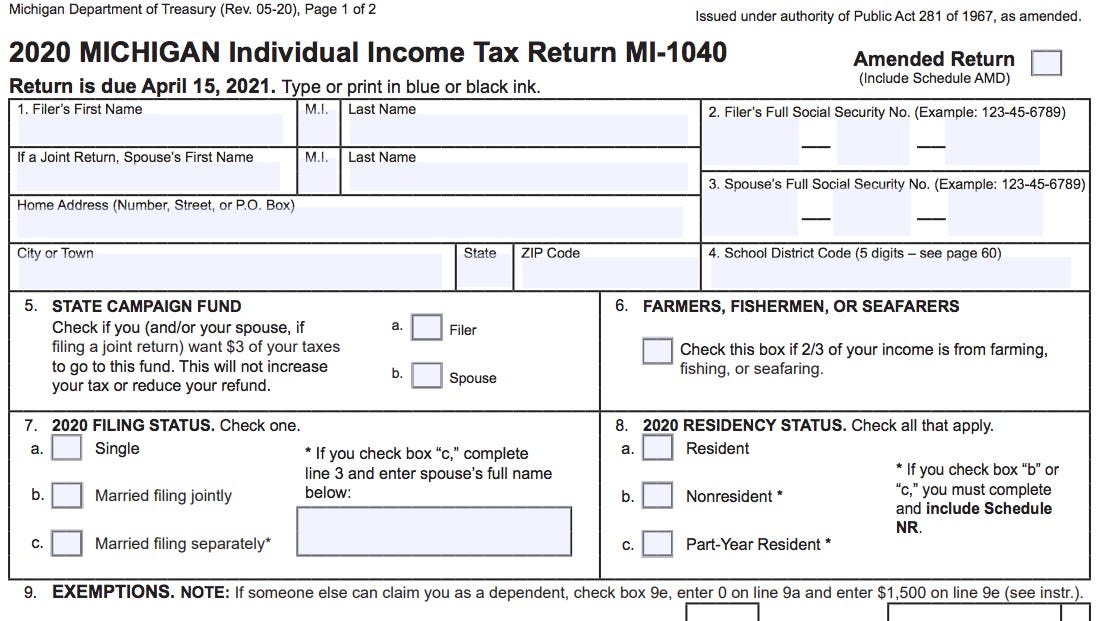

Michigan Department Of Treasury Dont Wait To File Your Individual Income Tax Returns

When you create a milogin account, you.

Michigan unemployment income tax refund. If you filed your state tax return before april 27, 2021, you may have paid taxes on the benefits that you can now ask to be refunded. There are two options to access your account information. But the bill also forgave taxes on the first $10,200 in unemployment funds taxpayers received in 2020.

However, you don't pay tax in michigan on unemployment if you no longer live in michigan. Typically, unemployment benefits are counted as. It applied to individuals and married couples.

Michigan has an income tax rate of 4.25%. June 1, 2019 2:36 pm. Account services or guest services.

Realizing the hardship this was causing, as part of the government’s efforts to stabilize the economy and more basically, help the unemployed pay their bills, congress included a provision in the american rescue plan act (arpa) which exempts unemployment benefits received in 2020 from income tax, up to a maximum of $10,200 ($20,400 for a married couple) in total benefits for households with. The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. Being exempt means that you do not have to pay tax on that income.

Michigan cities were already not allowed to collect local taxes on unemployment. On march 11, 2021, the american rescue plan act included a provision to exclude $10,200 of unemployment compensation from taxable income if the taxpayer's modified agi was $150,000 or less. The average refund for those who overpaid taxes on unemployment compensation was $1,265 earlier this year.

Up to $10,200 in unemployment benefits is exempt from state and federal income tax for taxpayers within some income brackets. The state of michigan announced friday it is extending its april 15 state income tax deadline to may 17, following a similar move for federal returns announced wednesday by. The refunds are only for people with a gross income under $150,000 and only counts toward the first $10,200 of unemployment earnings in 2020.

In the latest batch of refunds, however, the average was $1,189. The federal american rescue plan act excludes unemployment. The internal revenue service is issuing more than a total of $510 million in refunds to taxpayers to adjust unemployment compensation from previously filed income tax returns.

The internal revenue service said it sent refunds to about 430,000 people who paid taxes on unemployment benefits that were excluded from taxable income in 2020. If you use account services, select my return status once you have logged in. The tax agency recently issued about 430,000 more refunds (totaling more than $510 million) averaging about $1,189 each.

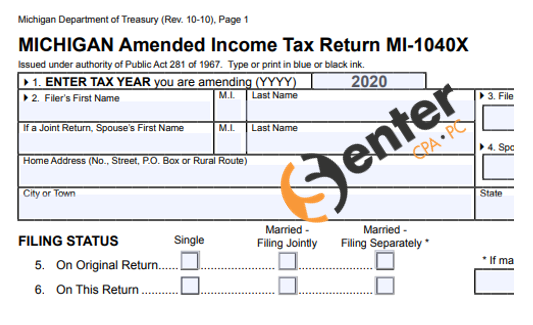

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original michigan return and taxpayers who paid any tax due with the filing of that original return. Luscombe noted that it's important to remember that many states, including michigan, also tax unemployment benefits.

If michigan tax was withheld, you would have to file a michigan return to get a refund of the michigan withholdings. The state of michigan has been unable to provide an automated mechanism and is advising taxpayers to proceed with filing an amended return. This round of refunds totaled more than $510 million and went to 430,000 workers with an average refund of $1,189.

Michigan taxpayers who have not filed a state income tax return and collected unemployment benefits can file their returns as soon as possible,. The federal american rescue plan act excludes unemployment benefits up to $10,200 from income for tax year 2020 for those within certain income brackets , providing tax relief on both federal and state income taxes. These taxpayers should file an amended michigan income tax return to claim that refund.

Michigan State Veteran Benefits Militarycom

Michigan Mistake Means Up To 650000 Could Be Forced To Repay Unemployment Benefits – Mlivecom

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Wheres My Refund Michigan Hr Block

Top Flights Travel Infographic Traveling By Yourself Route

Michigan Families Need Unemployment Benefits And A Functional System

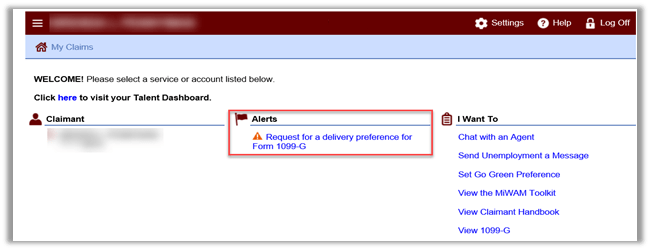

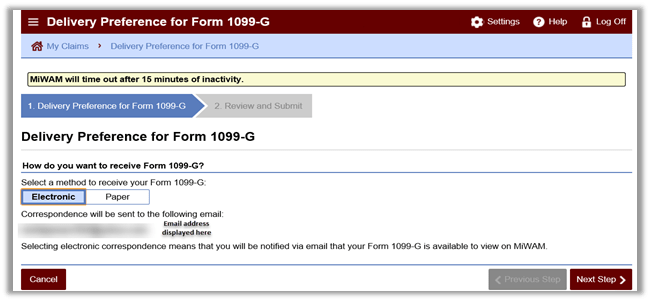

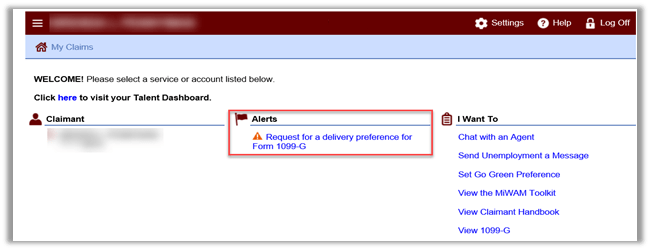

Labor And Economic Opportunity – How To Request Your 1099-g

Michigans Embattled Unemployment Agency Gets Third Director In 11 Months Bridge Michigan

Michigan Department Of Treasury Dont Wait To File Your Individual Income Tax Returns

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

Labor And Economic Opportunity – How To Request Your 1099-g

Michigan Taxpayers Reporting Unemployment Compensation Exclusion Recommended To File Amended Returns Doeren Mayhew Cpas

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion – Senter Cpa Pc

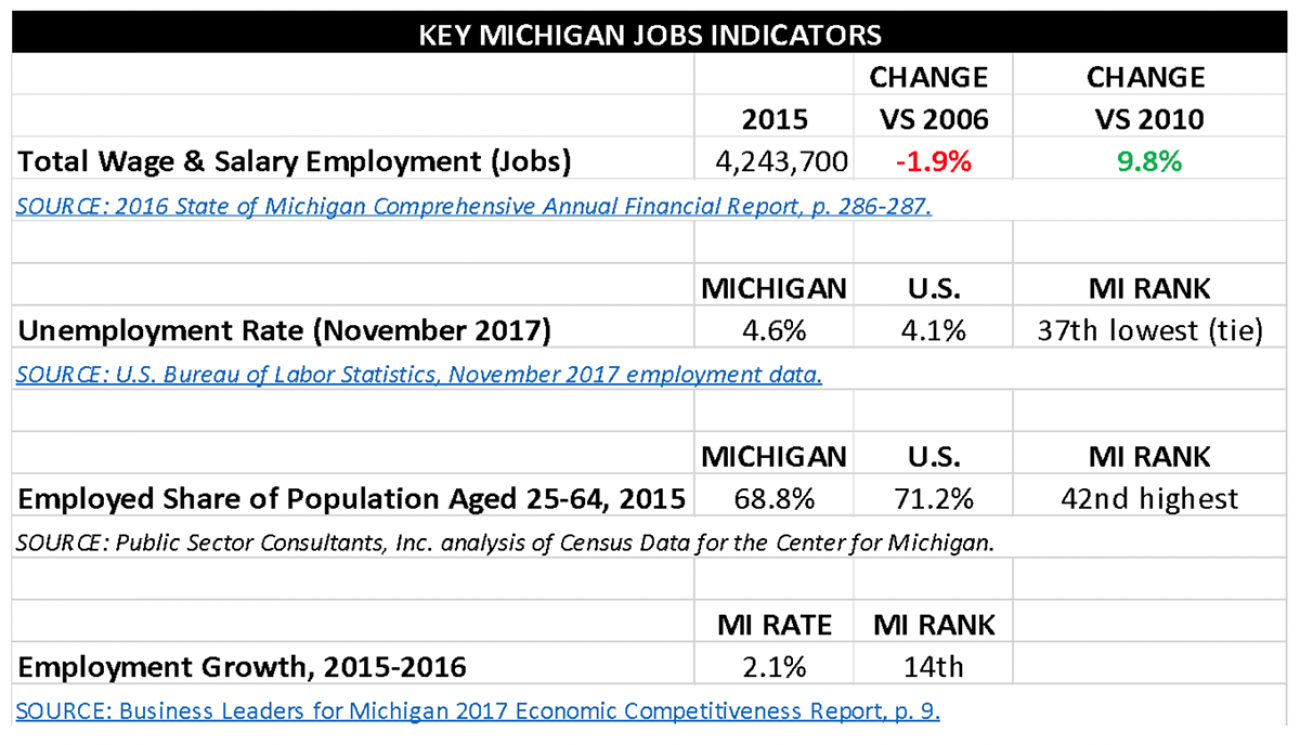

Demand For Michigan Workers Is Very High But Many Have Given Up Looking Bridge Michigan

Applying For Pandemic Unemployment Assistance Pua In Michigan Detroitisit

Labor And Economic Opportunity – Michigan Employer Advisor – October 2021

2

State Of Michigan Taxes Hr Block