The online property inquiry tool updates every hour to reflect the most recent payments. Mail your tax bill payment to:

Tuition And Financial Aid – Marian Catholic Central

The median property tax on a $249,700.00 house is $4,319.81 in illinois.

Mchenry county illinois property tax due dates 2021. January 1, 2021, you — used. The mchenry county sales tax is collected by the merchant on all qualifying sales made within mchenry county Woodstock, il 60098 (located at the southeast corner of rt.

Payments can be made with cash, check or credit cards. Springfield & des plaines, illinois pursuant to section 7(e) of the open meetings act (5 ilcs 120/7(e)), the property tax appeal board will be conducting this meeting by audio and/or video conference. Mchenry township assessor mary mahady, ciao 3703 n.

•your total household income in 2020 was $65,000 or less. Seminary ave in woodstock in our drive up facility. In illinois, mchenry county is ranked 90th of 102 counties in assessor offices per capita, and 8th of 102 counties in assessor offices per square mile.

Richmond road johnsburg, il 60051 815‐385‐0175 815‐322‐5150 (fax) website: Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. New jersey’s property taxes as a percentage of home values totaled 2.13 percent while illinois’ was 1.97 percent.

•on january 1, 2020, and. Property owners in mchenry county have 90 additional days to make tax payments without incurring interest or late fees. Wisconsin (1.53%), iowa (1.43%), missouri (0.96%), indiana (0.81%), and kentucky (0.78%).

Under illinois law, areas under a disaster declaration can waive fees and change due dates on property taxes. All 102 counties in illinois are. The median property tax on a $249,700.00 house is $2,621.85 in the united states.

Woodstock, il 60098 or use the envelope provided. Mchenry county collector 2200 n. Payments can be in person at our office at 2100 n.

Property tax relief 2021 distributed as a public service for property owners by: The ordinance only delays late fees on the first installment and does not apply to property taxes paid through escrow. There are 6 assessor offices in mchenry county, illinois, serving a population of 308,043 people in an area of 604 square miles.there is 1 assessor office per 51,340 people, and 1 assessor office per 100 square miles.

Grundy county collects, on average, 1.9% of a property's assessed fair market value as property tax. Grundy county has one of the highest median property taxes in the united states, and is ranked 93rd of the 3143 counties in order of. Mchenry county treasurer office 2100 n.

Mchenry county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. Woodstock, il 60098 (located at the southeast corner of rt. Mail your tax bill payment to:

Qualifications for the 2021 tax year (for the property taxes you will pay in 2022), are listed below. Mchenry county treasurer office 2100 n. The median property tax on a $249,700.00 house is $5,218.73 in mchenry county.

17, as part of a continuing. 19 rows september 15, 2021: Woodstock, il 60098 or use the envelope provided.

Due dates are june 7 and september 7, 2021. Mailing address is po box 458, crystal lake, il 60039; The median property tax (also known as real estate tax) in mchenry county is $5,226.00 per year, based on a median home value of $249,700.00 and a median effective property tax rate of 2.09% of property value.

Options for paying your property tax bill: N eastwood dr woodstock, il 60098. Mchenry county collector 2200 n.

The public may access this meeting via webex: This calculator can only provide you with a rough estimate of your tax liabilities based on the. Illinois’ neighboring states had far lower rates:

The mchenry county, illinois sales tax is 7.00%, consisting of 6.25% illinois state sales tax and 0.75% mchenry county local sales taxes.the local sales tax consists of a 0.75% special district sales tax (used to fund transportation districts, local attractions, etc). • •you will be 65 or older during 2021. The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00.

If the tax bills are mailed late (after may 1), the first installment is. The median property tax in grundy county, illinois is $3,666 per year for a home worth the median value of $193,300. Map more homes in hebron.

In most counties, property taxes are paid in two installments, usually june 1 and september 1. Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes.

Chicagoland Il – Area Counties 2020- 2nd Installment Property Tax Due Dates Chicagoland Mchenry Dekalb County

2020 Mchenry County Tax Bills Are Out Now What – Mchenry County Lawyers Law Firm Attorneys In Woodstock Illinois

What Is Tax Increment Financing

Illinois Doubled Gas Tax Grows A Little More July 1

2

Cook-county Property Tax Records – Cook-county Property Taxes Il

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

2

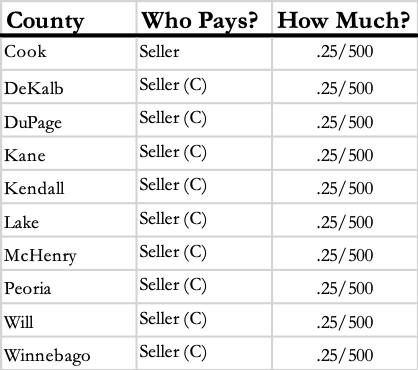

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Cook County Property Tax Bills In The Mail This Week

2

Summer Housing Market Speeds Up In June As Prices Rise And Inventory Thins – Illinois Realtors

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Get Free Tax Estimate With Global Prime Taxation Llc In 2021 Filing Taxes How To Plan Global

Taxes Fees Long Grove Illinois

Tax Lien Registry – Tax Lien Registry

Bank Guarantee For Trade Finance Or For Import Export – Magazine With 5 Pages Bank Guarantees Play A Vital Role In Trade Finance Project Finance Finance

2

The Best School Districts In Illinois In 2014 As Ranked By Schooldigger Httpwwwdisclosurenewsonlinecom20150125th School Fun School District Illinois