The department of revenue (dor) is rolling out a new tax filing system, masstaxconnect, which replaced the current webfile for business system on nov. Select the individual payment type radio button.

2

From the masstaxconnect homepage, select the make a payment hyperlink in the quick links section.

Mass tax connect estimated tax payment. When and where do i file estimated tax payments? The system defaults to a 2017 payment but provides a checkbox to choose a 2018 payment instead. If you're making estimated tax payments, be sure to include an estimated tax payment voucher.

Jump to sections of this page That’s $289 million or 13.6% more than the actual tax collections in november 2020 — and $192 million or 8.7% more than predictions for the month. Go to masstax connect at www.mass.gov/masstaxconnect for more information.

This is a meaningful sum, but it’s well shy of the nearly $2 trillion in proposed additional spending over 10 years being negotiated right now. Visa or mastercard debit card. Masstaxconnect makes it easy, convenient, and secure for you to make payments.

Getting to know dor’s new, modernized filing system as you may have heard, the massachusetts department of revenue is revamping the way the business taxpayers can file taxes in the commonwealth. Masstaxconnect (mtc) can now accept estimated payments from individual taxpayers for 2018. Select individual for making personal income tax payments or quarterly estimated income tax payments.

Contact for create your masstaxconnect individual account. You can find your payment voucher attached to your tax bill. 30%, 25%, 25% and 20%.

The top ten benefits of “masstaxconnect” for business taxpayers posted on jul 30. If you owe any payment to massachusetts for income taxes, you need to. You do no need an account.

30, 2015, and will replace the individual tax income service, webfile for income, in 2017. Many corporations are required to pay electronically via masstaxconnect. Boston (ap) — massachusetts tax collections totaled $2.41 billion in november.

Use this link to log into mass department of revenue's site. To make personal income estimated tax payments, send to: Masstaxconnect has replaced webfile for business, offering all the benefits the old system offered, along with a host of new functionalities that will make paying and filing taxes in massachusetts easier, simpler, and more efficient than ever before.

Under quick links select make a payment (in yellow below). Masstaxconnect gives you the option to pay by eft debit. Most corporations must make estimated payments electronically.

15th day of 12th month. You can use #masstaxconnect to pay your #estimatedtaxes without logging in. It is not an option if logged in to mtc.

The correct mailing address will be printed on your payment voucher. The agency's new online portal to manage accounts for taxpayers, tax professionals, and other dra customers! Individual taxpayers can make bill, estimated, extension, or return payments on masstaxconnect without logging in.

Myconnect is the new connecticut department of revenue services’ (drs) online portal to file tax returns, make payments, and view your filing history. Users can access masstaxconnect at the following url: Freelancers, contractors, and any professional who doesn’t have taxes withheld from paychecks may be required to make an estimated tax payment at the end of each quarter in massachusetts.

Online mass dor tax payment process. New corporations in their first full taxable year with less than 10 employees have different estimated payment percentages: Who must pay estimated taxes?

The basics of masstaxconnect posted on oct 15. You may pay with your: Who must pay estimated taxes?

There are different massachusetts tax forms mailing addresses for each of the various excise tax documents corporations must file. Visa, mastercard or discover credit card or ; In general, estimated payments for calendar year filers are due on april 15, june 15, september 15, and january 15 (the due dates for fiscal year filers are adjusted based upon their fiscal year).

Freelancers, contractors, and any professional who doesn’t have taxes withheld from paychecks may be required to make an estimated tax payment at the end of each quarter in massachusetts. Estimated tax can be paid in full on or. The department of revenue (dor) has guidelines to determine if you are someone who must pay estimated taxes.

The department of revenue (dor) has guidelines to determine if you are someone who must pay estimated taxes. Corporations may also pay excise tax online through masstaxconnect. All estimated excise payments made by a combined filing group should be reported under the principal reporting entity’s tax account.

Generally, your estimated tax must be paid in full on or before april 15, 2020, or in equal installments on or before april 15, 2020; Visit mass.gov/masstaxconnect and choose make a payment in the. The payments can only be made from the mtc login page;

There is a convenience fee of 2.35% of your payment amount charged by the third party that provides this service. The portal allows users to file and amend returns, view balances, make payments, view correspondence, register new accounts, update information,. If the corporate excise tax exceeds $1,000, your corporation is required to pay estimated tax payments on expected income.

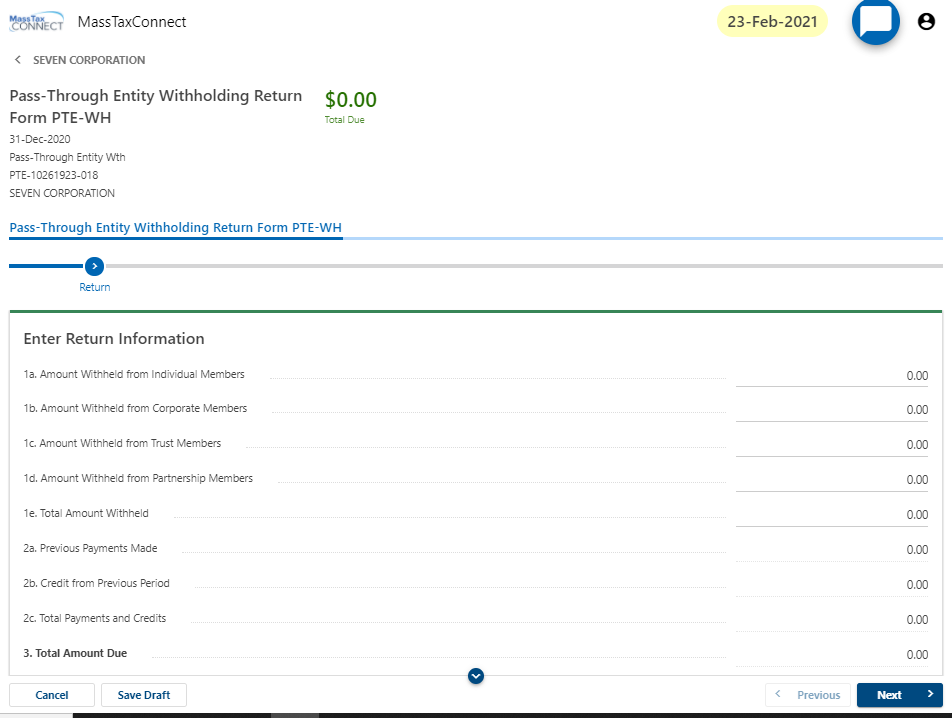

Estimated tax payments in any amount can be made electronically on masstaxconnect at mass.gov/masstaxconnect. Estimated payments are due for a taxable year even though the chapter 63d election for the taxable year cannot be made until the return is filed.

Massachusetts Sales Tax – Taxjar

Corporate Excise Tax Massgov

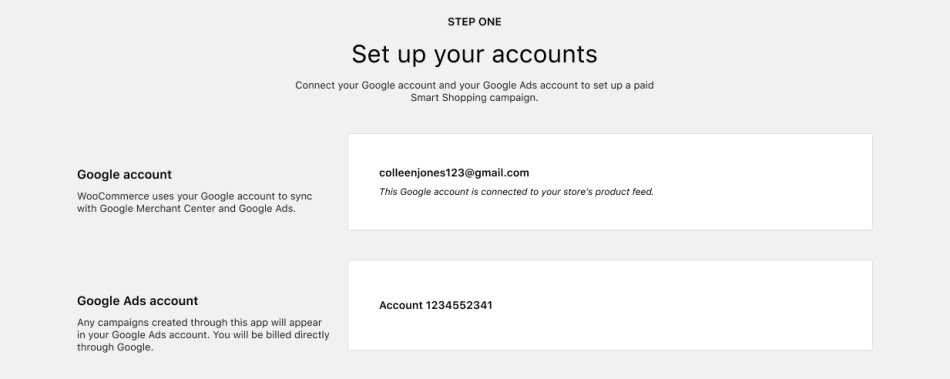

Google Listings Ads – Woocommerce

2

Implementation Of Non-communicable Disease Policies From 2015 To 2020 A Geopolitical Analysis Of 194 Countries – The Lancet Global Health

2

Taxation Of Your Benefit – Mtrs

Tax Guide For Pass-through Entities Massgov

2

2

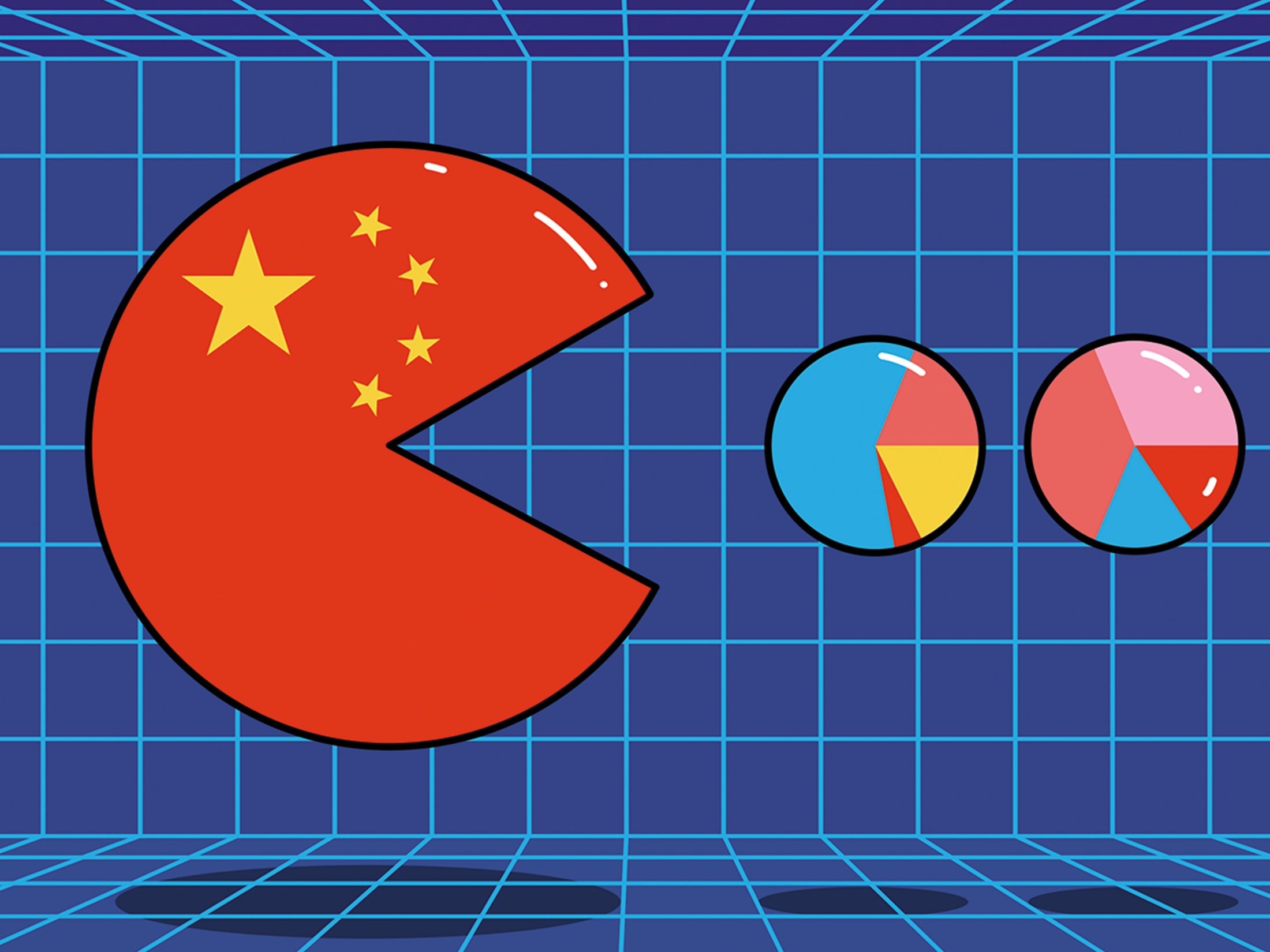

How Xi And The Ccp Turned On Jack Ma Ant And Chinas Fintech Companies – Bloomberg

Massachusetts Income Tax Hr Block

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

2

2

2

2

Prepare And E-file Your 2021 2022 Ma Income Tax Return

2