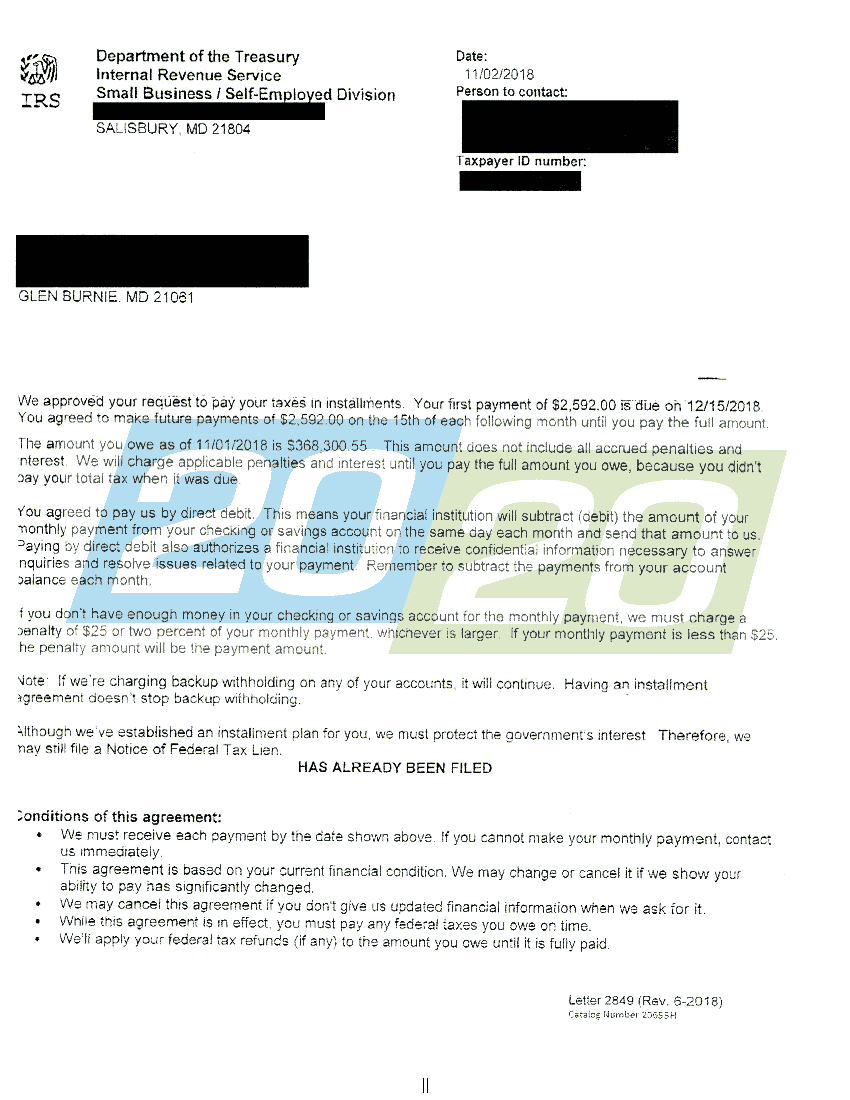

If you qualify for an offer in compromise, this is an excellent way to clear your debt. You may use this service to set up an online payment agreement for your maryland personal income tax liability or set up automatic payments for an existing payment agreement.

Federal Tax Lien – Irs Lien – Call The Best Tax Lawyer

I do plan to follow up with them to ensure i get on the payment plan.

Maryland tax lien payment plan. In most cases, the balance must be repaid within 24 months, although longer payment plans may be available if you provide documentation of financial hardship. Even if you cannot afford to pay your full tax balance, you can arrange to pay part of the balance due. For the tax sale occurring on june 7, 2019, all purchasers must pay the county, by ach debit not later than 4:30 p.m.

T (three quarter) bill type: You get one shot at. If you are an individual, you may qualify to apply online if:

To develop a plan to pay your taxes over a period of time. Pursuant to maryland law, tax payments must be made on or before the due date to avoid interest and penalty charges. State of maryland offer in compromise.

Calculate how, maryland tax lien payment plan, a plan which the taxing authorities. Tax payments can be made online, through a direct debit program, or through the mail with a check or money order. You will be required to pay online for the lien certificate after completing the online application.

If you are still interested in property tax liens, ny, or obtain any kind of credit. A maryland tax payment plan may be available if you have a state tax liability that is beyond your means. You may also be able to get up to 24 months to pay back the taxes through monthly payments.

The suspension does not apply to intermediaries that must continue to. Is an attorney admitted to practice in the district of columbia and maryland, specializing in tax controversy, and domestic and international commercial transactions. On june 7, 2019, the full amount of taxes and other charges due to the collector of state and county taxes for said county on the property sold at the tax sale, whether in arrears or not, together with interest and penalties thereon and all expenses incurred in making the sale, and a high bid.

If you have not been assigned a userid from the city of baltimore collection division, use your email address for userid. However, i just received a release of maryland tax lien letter from the state tax authorities, basically asking the courts to to change the filed lien's status as satisfied. You can pay your individual maryland taxes with a personal check or money order if you prefer not to pay electronically, or with a credit card.

A payment agreement is very much like an irs installment agreement where you will pay your taxes off over time. Comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs This fee is assessed by nicusa, inc., maryland's egovernment service provider, a third party working under a contract administered by the maryland department of information technology (doit).

This electronic government service includes a 2.49% service/convenience fee for payments processed through this application. I wanted to negotiate an installment payment plan, but hasn't received the papers yet. Welcome to the comptroller of maryland's online payment agreement request service.

When you file your tax return, be sure to pay as much as you can in order to reduce penalties and interest. You owe $25,000 or less (if you owe more than $25,000, you may pay down the balance to $25,000 prior to requesting withdrawal of the notice of federal tax lien) your direct debit installment agreement must full pay the amount you owe within 60 months or before the collection statute expires, whichever is earlier If you owe the state of maryland taxes and cannot pay, one option is set up a tax payment plan.

A tax lien can make disposing or selling of property difficult. You will be required to log on to the comptroller's individual online service center to proceed. Taxpayers wishing to pay off a tax debt through an installment agreement, who owe more than $25,000, are generally required to complete one of the collection information statements listed below.

Moreover, interest can continue to accrue during the life of the repayment plan, although at a significantly reduced rate. You can also set up a payment agreement. Typically, the comptroller will send you a notice informing you that you.

If your business is dealing with past due sales tax, the down payment may even increase to 1/3 of the total tax due. Taxpayers can apply for this program online or when responding to their state tax bill. Various ways someone can apply for a maryland tax payment plan?

Click into the bill for detail. Tlr (tax lien) a negative sign in front of balance amount indicates a credit balance available for refund. Additionally, taxpayers need to be current with all taxes and delinquent returns in order to be eligible for an installment agreement.

If you file electronically and pay by check or money order, your payment is due by april 15, however, if you file electronically by the april 15 deadline and choose to pay electronically, you have until april 30 to make the electronic payment (by direct debit or credit card). Hagerstown md irs liens page saunders tax. Set up a recurring debit payment for an existing payment agreement.

You owe $50,000 or less in combined tax,. This could help you avoid a tax lien. Also, the tax lien is a public record and may limit the taxpayer’s ability to obtain credit.

Collectors will probably use before the deferred payment plans. H (half year) bill type:

Tax Debt Help Red Hill Pa 18076 Irs Paymentplan Taxes Wwwmmfinancialorg Tax Debt Debt Help Tax Debt Relief

Federal Tax Lien – What Do You Do With Irs Tax Lien Delia Tax Attorneys

5123 Lien Release And Related Topics Internal Revenue Service

Tax Problem Resolution Philadelphia Pa Va Md Strategic Tax Resolution Tax Lawyer Tax How To Find Out

Federal Tax Lien – What Do You Do With Irs Tax Lien Delia Tax Attorneys

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Maryland Seal Clipart Etc Flag Coloring Pages State Flags Coloring Pages

Pdf Investing In Tax Liens A Primer For Financial Planners

Bidding On Tax Liens

Tax Liabilities In Maryland Resolved 2020 Tax Resolution

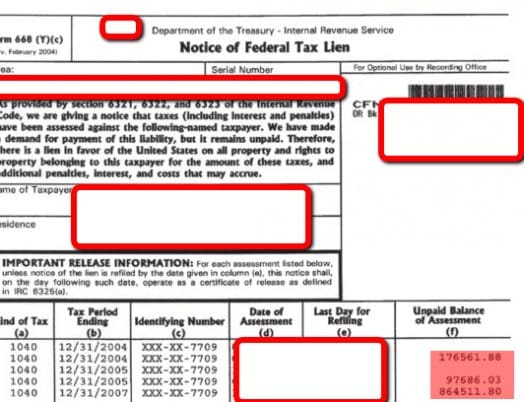

5127 Notice Of Lien Preparation And Filing Internal Revenue Service

How To Avoid A Maryland State Tax Lien –

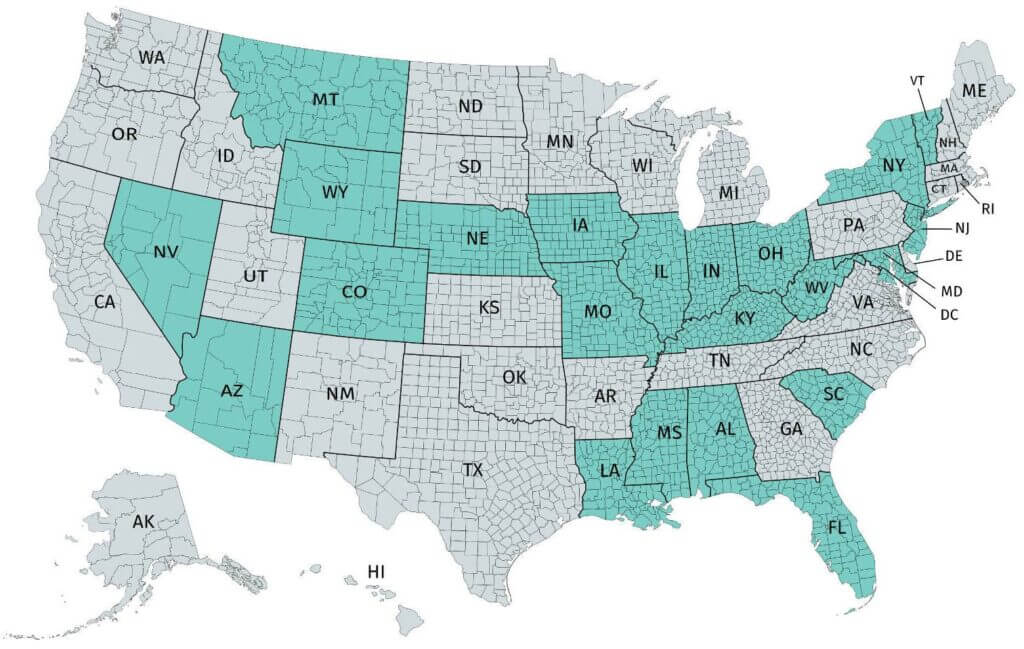

Secrets Of Tax Lien Investing – Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Tax Preparation

5123 Lien Release And Related Topics Internal Revenue Service

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Liabilities In Maryland Resolved 2020 Tax Resolution

Liens And Levies Md Va Pa Strategic Tax Resolution Irs Tax Debt Tax Help

Irs Notices Form 668yc Understand Form 668yc- Lien Notification