Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. 27 earned income credit allowable for the taxable year under § 32 of the internal revenue 28 code that is attributable to maryland, determined by multiplying the federal earned 29 income credit by a fraction:

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

53 rows nationwide during 2019, 25 million eligible workers and families received about.

Maryland earned income tax credit 2019. The state eitc reduces the amount of maryland tax you owe. 30 ][(1) (i) the numerator of which is the maryland adjusted gross income of 31 the individual; I have a client whose domicile is state of md, but he has resided and worked in foreign country from 2019.

Yes (if earning $25,000 or less) 50 percent of federal cdctc if income is $25,000 or. Health disparities persist in birth outcomes by mother's income, education, and race in the united states. This temporary relief is provided through the taxpayer certainty and disaster tax relief act of 2020.

Some part of his wages can be excluded by foreign earned income exclusion (form 2555) on federal return. If you qualify for the federal earned income tax credit and claim it on your federal return, you may be entitled to a maryland earned income tax credit on the state return equal to 50% of the federal tax credit. The credit is equal to 50% of the federal tax credit.

The maryland earned income tax credit (eitc) will either reduce or eliminate the amount of the state and. 25% of the federal credit. Does maryland offer a state earned income tax credit?

The earned income tax credit (eitc) is a refundable tax credit for people who worked in 2020. To figure the credit, see publication 596, earned income credit. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

The average amount of eitc received nationwide was about $2,461. If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your eitc for 2020. State poverty level credit — if your maryland state tax is more than 50% of your federal earned income credit, and both your earned income and federal adjusted gross income are below the poverty level for the number of people in your family, you may be able to claim a nonrefundable credit of 5% of your earned income.

She qualifies for something called the earned income tax credit or as some call it, the working americans credit. The credit lifts over 6 million people (including over 3 million children) out of poverty each year. State number of eitc claims1 total eitc amount1 average eitc amount1

12.5% of the federal credit; The federal credit ranges from $2 to $6,660. The state eitc reduces the amount of maryland tax you owe.

The relief act also enhances the earned income tax credit for these same 400,000 marylanders by an estimated $478 million over the next three tax years. Earned income tax credit (eitc) relief. If you earn less than $57,000 per year, you can get free help preparing your maryland income tax return through the cash campaign.

In 2019, 86,000 maryland workers paid taxes this way and 60,000 of them had incomes low enough that they would have qualified for the tax credit if allowed. Check how to qualify for the child tax relief program with our guide. The earned income tax credit (eitc) is a benefit for working people with low to moderate income.

The state eitc reduces the amount of maryland tax you owe. Eligibility and credit amount depends on your income, family size, and other factors. Disadvantaged mothers may experience benefit from supplements to family income, such as the earned income tax credit (eitc).

If you qualify for the federal earned income tax credit also qualify for the maryland earned income tax credit. The 2019 earned income tax credit will reduce the taxes you owe and will even be refunded to you if you do not owe taxes on your return. 20 percent of federal cdctc:

The state of maryland offers an earned income tax credit, matched by montgomery county's working families income supplement. But what is the working americans credit? Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

The state percentage for calculating reic for tax year 2020 increased from 28 percent to 45 percent when have qualifying child. Nationwide as of december 2020, about 25 million eligible workers and families received about $62 billion in eitc. In addition, the legislation increases the refundable earned income tax credit to 45% for families and 100% for individuals.

Does state of maryland also allow the foreign earned income exclusion? 2019 maryland earned income tax credit (eitc) maryland’s eitc is a credit for certain taxpayers who have income and have worked. 2019 maryland earned income tax credit (eitc) maryland's eitc is a credit for certain taxpayers who have income and have worked.

2019 maryland earned income tax credit (eitc) maryland’s eitc is a credit for certain taxpayers who have income and have worked. 18.75% of the federal credit; Ad review the guidelines and steps to apply for the child tax relief program with our guide.

More support for unemployed marylanders

2

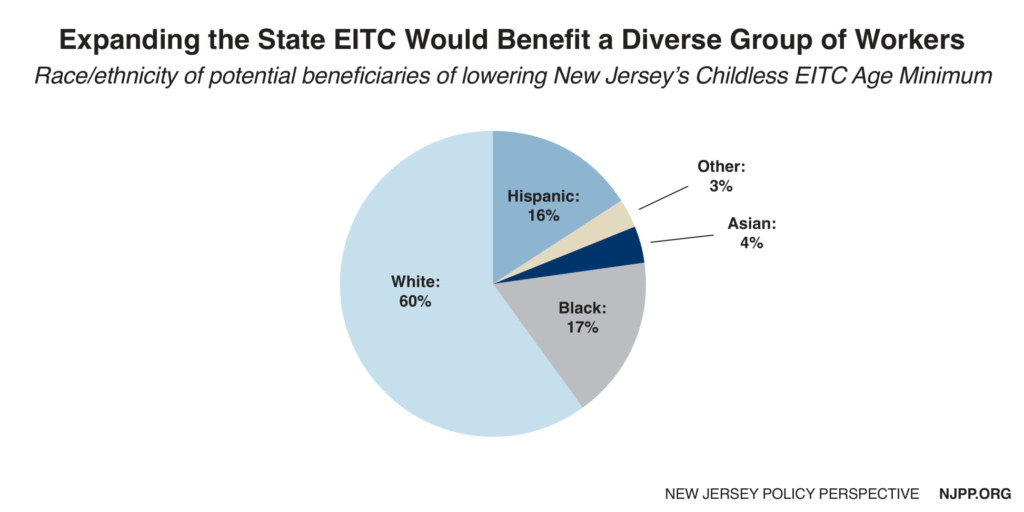

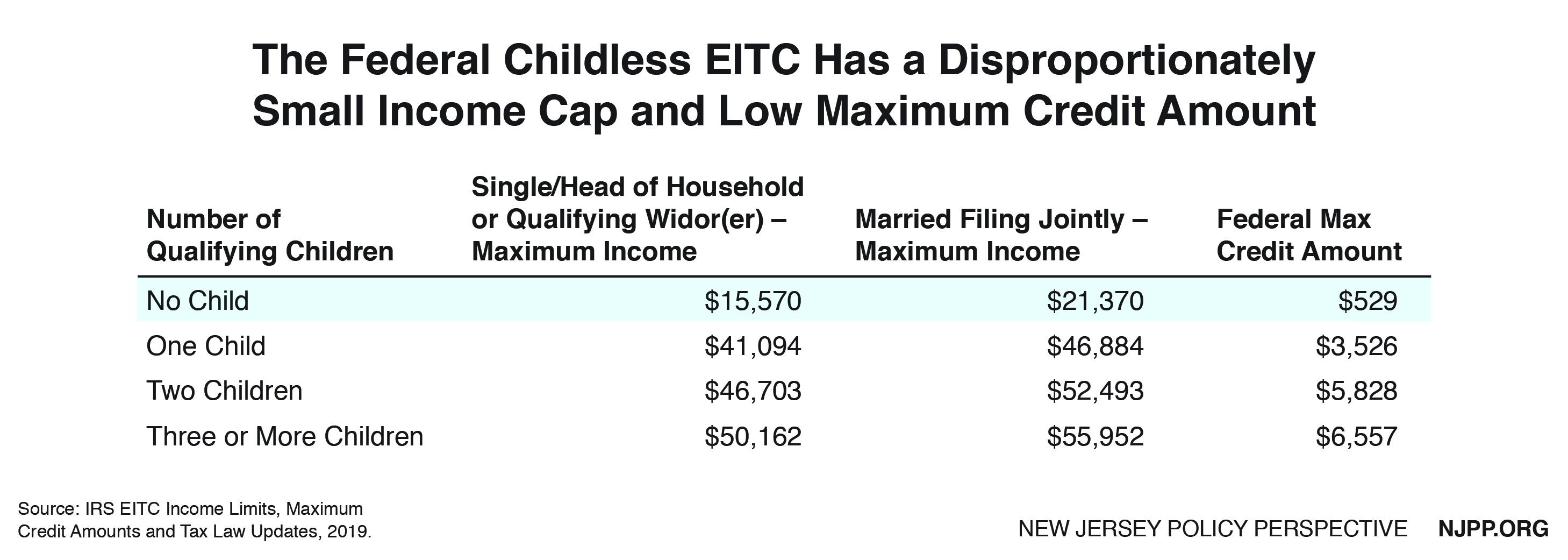

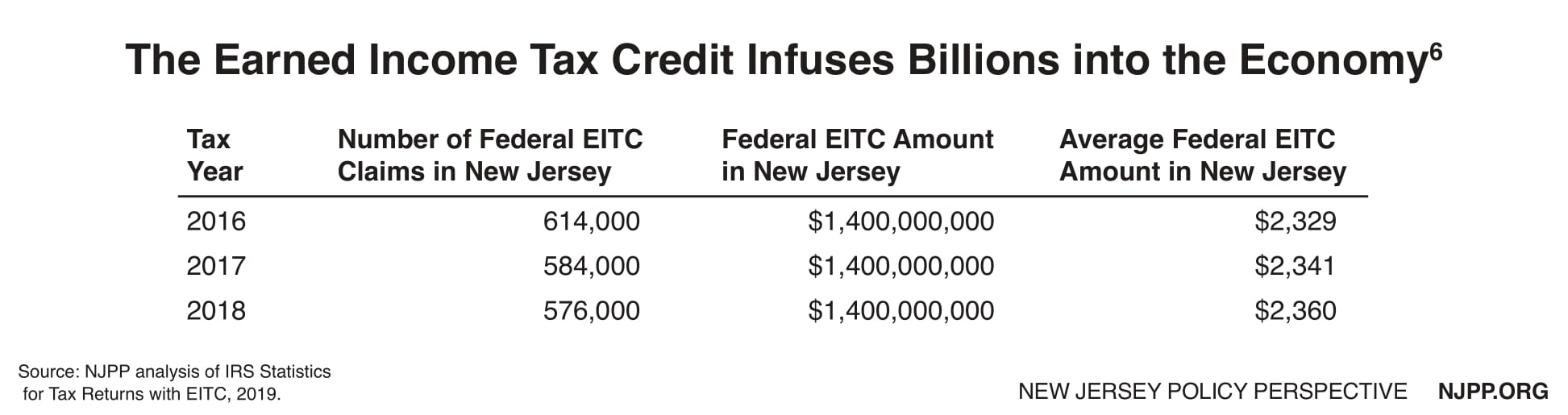

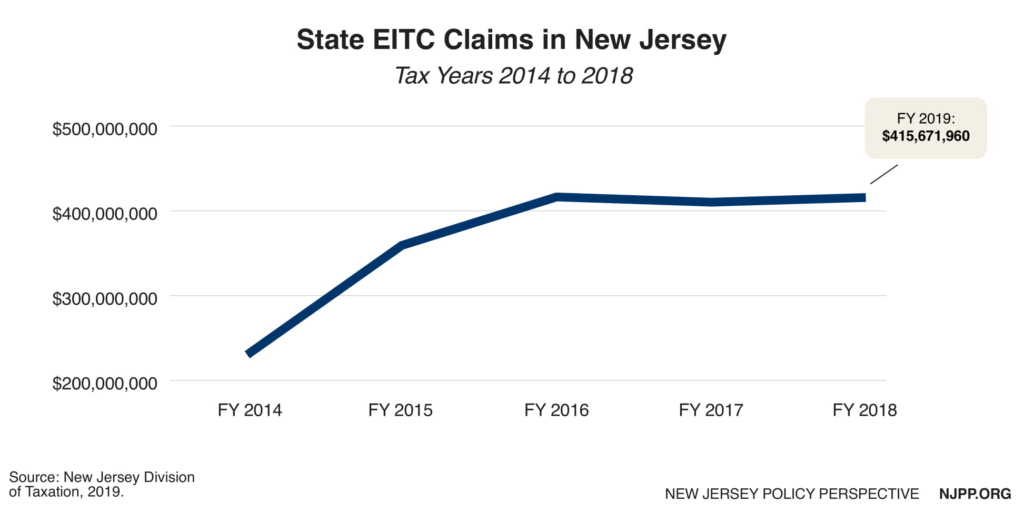

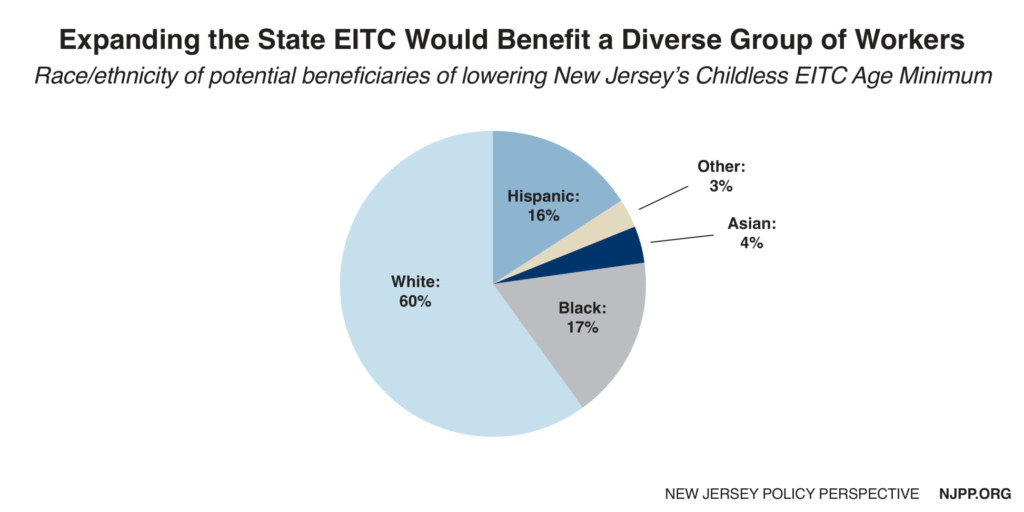

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers – New Jersey Policy Perspective

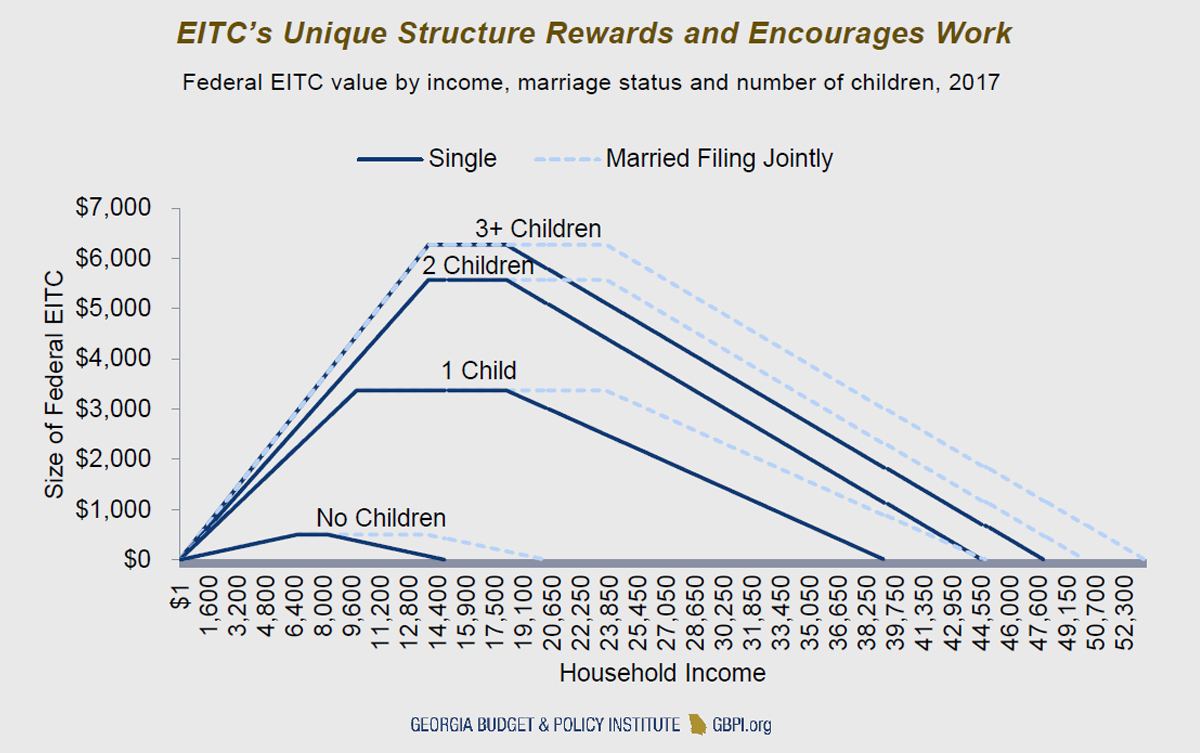

The Earned Income Tax Credit And Young Adult Workers – Georgia Budget And Policy Institute

2

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Maryland Income Tax Brackets 2020

What Are The Tax Brackets Hr Block

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers – New Jersey Policy Perspective

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Why We Should Expand The Earned Income Tax Credit Prosperity Now

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers – New Jersey Policy Perspective

Maryland Relief Act What You Need To Know – Mvls

Filing Maryland State Taxes Things To Know Credit Karma Tax

Prosperity For All Expanding The Earned Income Tax Credit For Childless Workers – New Jersey Policy Perspective

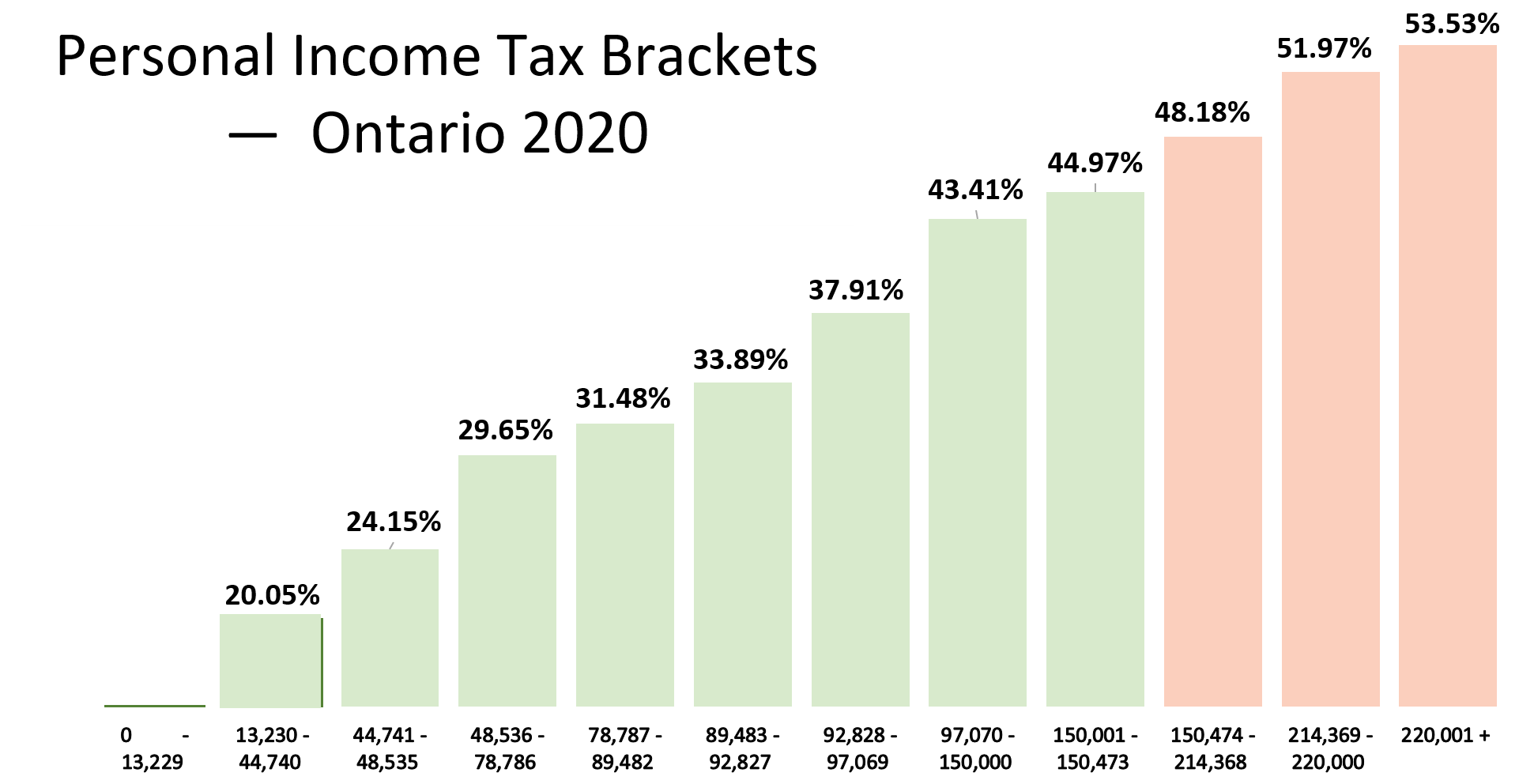

Personal Income Tax Brackets Ontario 2020 – Md Tax

Free Income Tax Prep United Way Of Frederick County

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow